Outlook for the Spanish economy and its sectors in 2024-2025

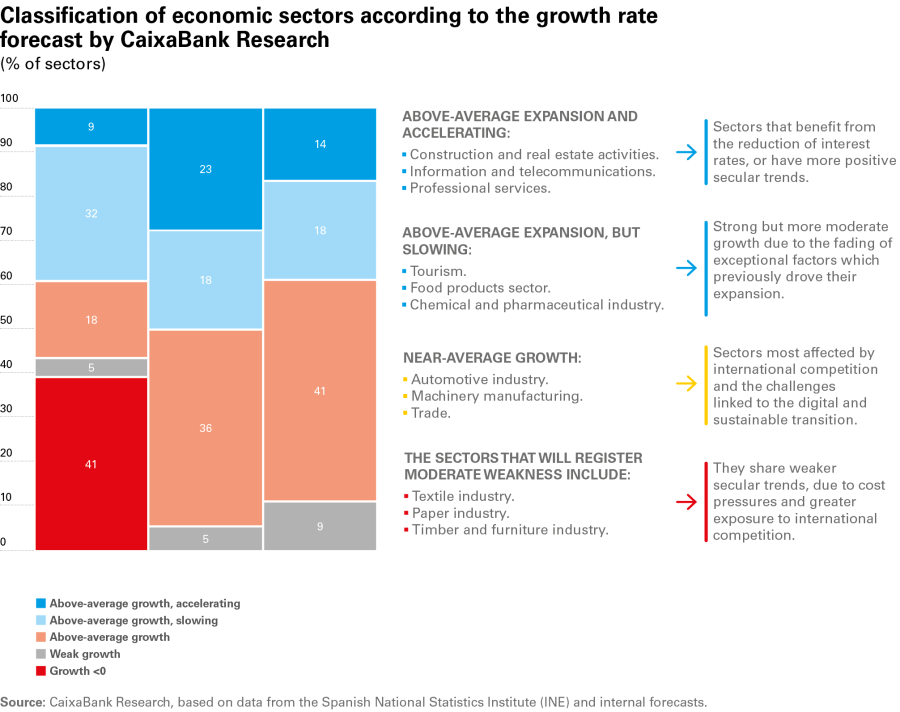

In 2025, we expect that the primary, manufacturing and tourism sectors will continue to grow, albeit at a more moderate rate than in 2024, and that the ICT, professional services, pharmaceutical, construction and real estate industries will gain strength. Some branches of industry such as textiles and paper could see their growth rates slow.

In 2024, the Spanish economy has experienced widespread growth across its sectors – a positive trend that we expect to continue throughout 2025. This year, the sectors that have performed particularly well are those that have been recovering from the various shocks of prior years: the agriculture, forestry and fishing sector, which has recovered from the drought; manufacturing, from the energy crisis, and tourism, converging on its pre-COVID trend. For 2025, while we anticipate continued strength in these sectors, we expect a slight slowdown in their growth rates as the effects of these shocks dissipate. On the other hand, sectors with more positive secular trends, such as information and communication technologies, professional services and the pharmaceutical industry, will strengthen, as will those that have a higher sensitivity to lower interest rates, such as construction and real estate. Although the economy is broadly strong, there are some branches of industry, such as textiles and paper, in which cost pressures and fierce international competition could lead to slow growth.

Sectoral trends in Spain: recent developments and future outlook

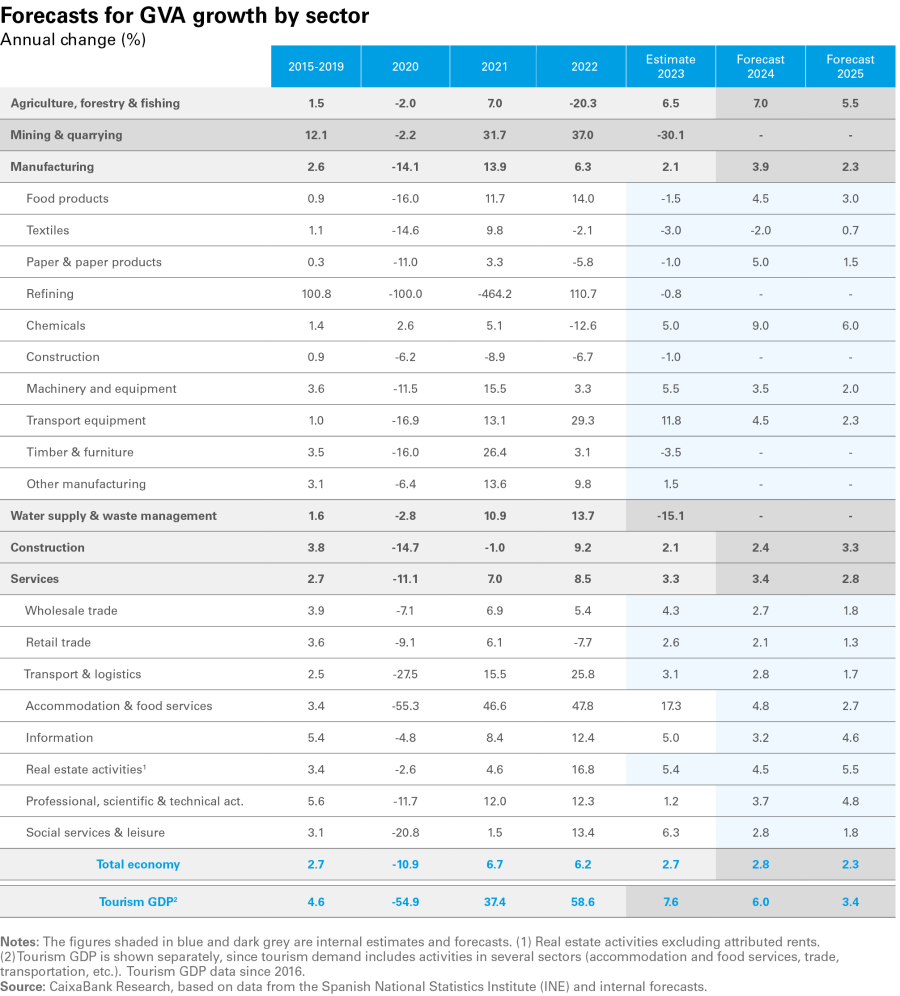

In 2024, CaixaBank Research expects the Spanish economy to grow by 2.8%. This is a solid rate of growth and slightly higher than that recorded in 2023 (+2.7%). If we look at the breakdown of this growth by sector, we see widespread momentum and a particularly strong performance from sectors that have endured shocks in recent years, as discussed in the first article of this report. For 2024 as a whole, the tourism sector looks set to top the ranking with an expected growth rate of 6%, as it continues its path of recovery and approaches its pre-COVID trend. The manufacturing industry also stands out, with a solid growth of 3.9%, driven by the strong performance of industries that were particularly affected by the blow dealt by the pandemic, such as transport equipment manufacturing (+4.5%), and some of those hardest hit by the energy shock, such as the paper industry and the chemicals and pharmaceutical sector. In addition, the GVA of the agriculture, forestry & fishing sector is expected to increase by 7.0% in 2024, consolidating its recovery following the sharp decline it recorded in 2022 (–20.3%), thanks to the improvement in the climatic conditions and the reduction of production costs. On the other hand, the sectors with weaker growth are those feeling the effects of less positive long-term trends, such as the textile industry (–2.0%), or which saw their growth rates slowed by their sensitivity to high interest rates, as in the case of the construction sector (+2.4%).

The outlook for the Spanish economy in 2025 is positive, although we anticipate a slight moderation in GDP growth. Specifically, it is expected to slow from +2.8% in 2024 to +2.3% in 2025, according to CaixaBank Research’s latest forecasts. In this scenario, while we expect to see continued strength in the sectors with the highest growth in 2024, such as the agriculture, forestry & fishing sector (+5.5% in 2025), manufacturing (+2.3%) and tourism (+3.4%), these growth rates reflect a certain slowdown as the effects of the previous shocks finish dissipating. On the other hand, sectors with more positive secular trends, such as information and communication technologies (+4.6%) and professional and administrative activities (+4.8%), will gain strength. Moreover, sectors that are more sensitive to the reduction in interest rates, such as construction (+3.3%) and real estate activities (+5.5%), will accelerate, driven by increased investment activity and improved financing conditions. Although the economy is looking strong across the board, some branches of industry, such as textiles and the mining and quarrying industry, could see their growth rates curbed by cost pressures and fierce international competition. Overall, we do not expect to see negative GVA growth in any of the sectors analysed in 2025.

According to the growth rate anticipated for the period 2024-2025, we classify the various sectors into four main groups: 1) sectors with high and accelerating growth, 2) sectors with high but slowing growth, 3) sectors with near-average growth and 4) sectors with weaker growth.

The rate cuts and the fading of shocks will be the key determining factors for the performance of Spain's economic sectors

1) Sectors that have high growth and are accelerating

These sectors have high growth potential, with positive secular trends, or are particularly sensitive to interest rates and thus will benefit from their decline. These include:

Information and communication technologies (ICT): with a boost provided by digitalisation and the adoption of new technologies, the ICT sector is benefiting from solid structural growth (+5.4% on average between 2015 and 2019). In 2024, this sector’s growth (+3.2%) has been below its historical average, but we expect that it will approach its long-term growth rate in 2025, reaching +4.6%.

Professional and administrative activities: the growing complexity of businesses and the need for specialised services are driving demand in this sector. Consulting, advisory and administrative services have a positive secular trend, and after recording growth of 3.7% in 2024, we expect them to accelerate to 4.8% in 2025.

Construction: in 2023, the construction sector grew by 2.1%, falling short of the growth rate of the economy as a whole. Despite the significant mismatch between supply (around 110,000 units per year) and demand (the creation of 265,400 net households in 2023, according to the Labour Force Survey, due to the significant increase in migration flows), the sector was weighed down by increased financing and construction costs. With the fall in rates, the sector will receive a boost from the lower financing costs and we expect it to accelerate to 2.4% in 2024 and to 3.3% in 2025. Even so, we expect that the mismatch between supply and demand will persist, mainly because of factors restricting supply, such as the lack of available land. The deployment of NGEU funds will help provide a boost to the sector, although according to the Independent Authority for Fiscal Responsibility (AIReF), the volume of contracts in urban refurbishment projects is lagging, with only 23% of contracts formalised and grants awarded. This stands in stark contrast with the execution of grants for sustainable mobility infrastructure, which stands between 72 and 92%.

Real estate activities: following a buoyant 2022 (16.2%), the real estate sector experienced a sharp slowdown in 2023 (5.4%) as a result of the rate hikes. With the start of the rate cuts, 2024 has been a year of transition for the sector and we expect it to have grown by 4.5%. As rates continue to decline in 2025, we expect the sector to accelerate to 5.5%, outpacing the Spanish economy as a whole.

2) Sectors that have high growth but are slowing

These sectors continue to show robust growth, although the pace of that growth is moderating as the exceptional factors which previously drove their expansion steadily fade:

Agriculture, forestry and fishing: following a slump in 2022 (–20.3%), the sector is experiencing a rapid recovery driven by the improvement in climatic conditions and the reduction of production costs. In 2023, the sector recovered by 6.5% and for 2024 we expect growth of 7.0%. This will be followed by a slight slowdown in 2025, at 5.5%, as the momentum provided by the end of the drought dissipates. The food products industry will continue to enjoy a recovery, in line with production in the agriculture, forestry and fishing sector and the decline in its input prices. In the medium term, the sector’s outlook will be highly dependent on its capacity to adapt to climate change.

Manufacturing industry: the manufacturing industry recorded moderate growth in 2023 (+2.1%), held back by the rise in energy costs that followed Russia’s invasion of Ukraine, as well as by the rise in rates. In 2024, the sector has enjoyed a recovery and we expect it to grow by 3.9%, driven by the improved competitiveness of Spain’s industry relative to that of the rest of Europe Compared to the situation prior to 2022, energy costs in Spain have been at a lower level relative to that of our European competitors. This is due to the country’s lower exposure to Russian gas and the significant role of renewables in Spain’s electricity generation. For 2025, we forecast growth of 2.3% in the GVA of manufacturing, which is similar to that of the Spanish economy as a whole.

Within manufacturing, of particular note is the growth of the chemicals industry, which is benefiting from the competitive advantage in energy inputs, and the pharmaceutical industry, which has positive secular trends and a high degree of international competitiveness and specialisation. We expect the pharmaceutical industry will continue to see its role in the economy grow in the medium and long term, and that it will be a driver of exports and of investment in R&D.

Manufacturing is growing steadily thanks to the improvement in energy input prices relative to the main European competitors

Tourism and accommodation and food services: the tourism sector has been a key driver in the post-COVID 19 recovery and now lies well above its pre-pandemic levels. In 2024 we expect it to grow by 6.0%, placing it 11.5% above its level of 2019. For 2025, we expect to see a moderation of the growth rate to 3.4% as the sector converges towards its historical trend and the factors related to the post-COVID recovery lose steam. Still, it will continue to outpace the economy as a whole. The key factor behind this strength is the recovery of purchasing power in the main source countries for tourists visiting Spain, thanks to a decline in inflation and a moderate increase in wages. Moreover, Spain’s greater geopolitical stability relative to that of competing countries will also continue to play in the sector’s favour.

3) Sectors with near-average growth

These sectors show a similar rate of growth to the economy as a whole. Among others, they include:

Wholesale trade: supported by a favourable consumption outlook due to the decline in inflation, rising incomes and job creation, we expect the sector to grow by 2.7% in 2024 and by 1.8% in 2025. Real private consumption is showing encouraging signs, supporting the sector’s growth. Thus, we expect it to grow by 2.5% in both 2024 and 2025, up from the 1.7% recorded in 2023. These favourable dynamics will support the trade sector, for which we anticipate positive growth rates, slightly below the average for the economy as a whole.

Manufacture of machinery and equipment: the sector suffered a major decline during the pandemic due to the disruption of global supply chains and, subsequently, the rise in production costs. In 2023, the sector enjoyed rapid growth (+5.5%). We expect it to continue to grow (+3.5% in 2024 and +2.0% in 2025), although the increased global competition will push it towards growth rates closer to that of the economy as a whole.

Automotive industry: between 2021 and 2023 the automotive industry experienced solid growth rates, following a slump in 2020. Although there are factors that will support demand (and which we examine in the third article of this report, such as the ageing of the existing car fleet and the high level of automation in Spain, second in Europe after Germany), the sector is also facing major challenges. In the context of the transition to electric vehicles, the sector faces fierce international competition, particularly from China. The balance of these factors will result in the sector growing at around the same rate as the economy as a whole. It is crucial that the sector adapts to these changes and that a high-value-added position is achieved in the electric vehicle production ecosystem. To improve the outlook, it will be key to deploy the charging infrastructure and to stimulate Spain’s presence throughout the value chain through the Strategic Project for Economic Recovery and Transformation (PERTE) related to the Electric and Connected Vehicle (ECV).

4) Sectors with weaker growth

Although in our baseline scenario we do not forecast a sharp decline in any of the sectors considered, there are sectors for which we expect growth to be significantly below the average for the economy as a whole. On the manufacturing side, the relatively weaker sectors include branches of industry such as textiles and paper, which present negative secular trends due to significant international competition and the pressure of structural costs related to these competitors. These branches of industry remain substantially below the activity levels they recorded in 2019. In the case of the textile industry, we expect negative growth in 2024, followed by growth close to zero in 2025. In the case of the paper industry, after declines were recorded in 2022 and 2023, we anticipate a revival in 2024 linked to energy prices, which will steadily dissipate in 2025.

On the services side, retail trade is facing significant challenges despite the general economic expansion. Fierce competition from e-commerce and changes in consumer habits, accelerated by the pandemic, represent a headwind for the sector. With growth of 2.1% in 2024 and of 1.3% in 2025, we expect it to be the component of the services sector with the weakest growth.

Fierce competition from e-commerce and changes in consumer habits represent a headwind for the retail sector

The sectoral perspective and the Draghi report

In broad terms, the Draghi plan analyzes the situation of key sectors of the European economy —such as the automotive and pharmaceutical industries, and within the technological sphere, green technologies— in the context of the challenge to maintain competitiveness in the 21st century. Draghi highlights the difficulties posed by dependence on fossil fuels, generally imported, and the fragmentation of capital markets in Europe. He underscores the necessity for the continent to bolster its competitiveness through the integration of capital markets, higher levels of public investment on a European scale, and an acceleration of the climate transition.

A sectoral examination of the state of the Spanish economy reveals that, although Spain shares many of the challenges outlined by Draghi—particularly regarding the automotive sector and the fragmentation of capital markets—the country is in a relatively better position concerning the energy challenge. According to Draghi, one source of the recent stagnation in the European economy, especially in manufacturing, is the high energy costs. In this realm, Spain sets itself apart, enjoying low energy costs compared to its European competitors, which is boosting manufacturing. However, this should not lead to complacency: it is crucial that Spain continues investing in renewable energies, a sector where favorable climatic conditions grant it a competitive advantage, also potentially paving the way for a new export industry.

The Draghi report highlights the challenge of boosting competitiveness and the need for investment in order to adapt key sectors of the economy

One of the most significant challenges highlighted by the Draghi report, and which affects the Spanish economy, is that of the automotive industry. While it has shown signs of recovery in the wake of the energy shock and the supply crisis, it faces increasing pressure amid the transition to electric mobility and fierce competition from other major producers such as China. The Draghi plan emphasises that, in order for the European and Spanish automotive sectors to be competitive globally, it is essential to address this transition. This will require not only greater investment in R&D, but also a regulatory framework that simultaneously promotes innovation and competitiveness.