Trump’s policies, the main question mark surrounding the global economic outlook

We are therefore heading towards a context with higher tariffs and in which, most likely, there will be some reconfiguration of global value chains in an attempt to compensate, insofar as possible, for the loss of attractiveness of the US market. Consequently, we are moving towards a world with greater fragmentation, lower economic growth and the risk of higher inflation.

Developing forecast scenarios in economics is far from an exact science and the forecasts that are produced are always subject to a certain margin of error. However, the current context is especially challenging, as Trump’s second term seems more unpredictable, generating more economic uncertainty and financial volatility. In fact, in less than a month, Trump has signed more than 60 executive orders, three times the number signed in the first 100 days of his first term and almost twice as many as Biden in the same time interval. These measures have focused, above all, on controlling immigration and raising tariffs.

Trump uses tariffs as a negotiating tool, following a pattern similar to during his first term: he announces strong measures, signs the executive order, and then postpones its application in order to open negotiations, which in some cases can lead to the initial tariff being reduced or even eliminated. Thus, at the close of this report, we have on the table 20 additional pps to be imposed on products originating in China (China has responded with a tariff of 10%-15% on energy products, cars and various agricultural products); an increase of 25 pps in the tariff on imports from Mexico and Canada and of 10 pps on Canadian energy; 25% on steel and aluminium, and reciprocal tariffs on the EU and other economies currently being studied (a tariff of 25% «generally speaking» has been mentioned in the case of the EU); and a tariff on all agricultural imports from 2 April has been announced. He also announced that the customs exemption for all shipments from China with a value of less than 800 dollars will remain in place until appropriate systems for processing and collecting tariff revenues are developed.

We are therefore heading towards a context with higher tariffs and in which, most likely, there will be some reconfiguration of global value chains in an attempt to compensate, insofar as possible, for the loss of attractiveness of the US market. Consequently, we are moving towards a world with greater fragmentation, lower economic growth and the risk of higher inflation. In elaborating the new forecast scenarios, we have assumed a situation with a contained trade war in which there is no escalation and in which the new rules of the game are established by the middle of the year.

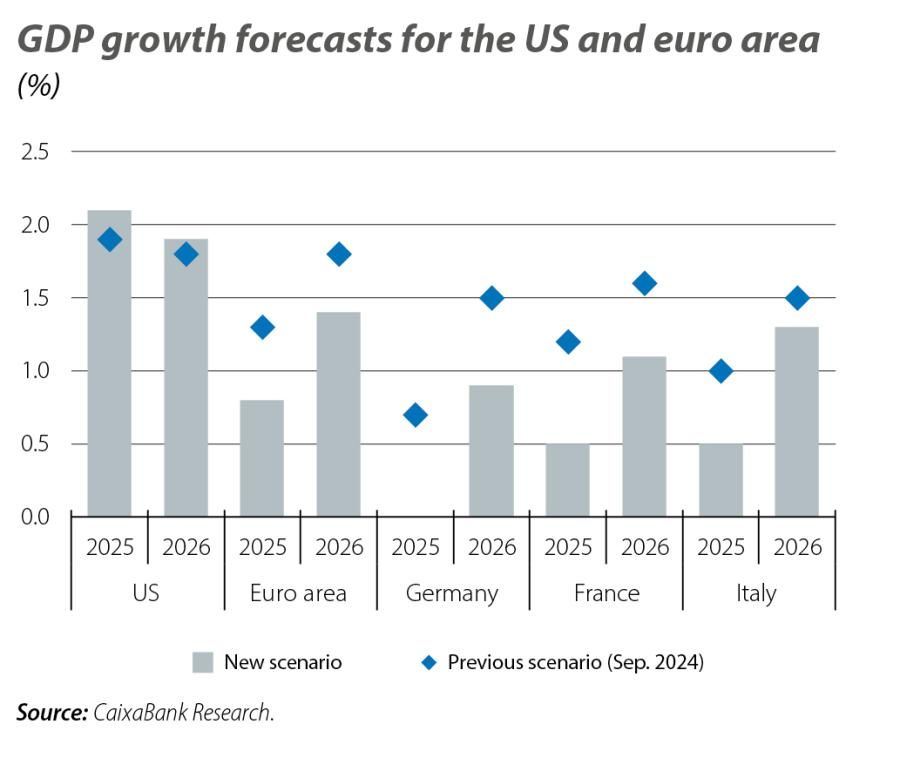

The euro area closed 2024 practically stagnant (0.1% quarter-on-quarter in Q4 2024), with Germany and France recording negative GDP growth. The first indicators of 2025 point to a certain stabilisation of activity, but we cannot expect to see any significant upturn in the short term (see the International Economy - Economic Outlook section of this same report). Therefore, the euro area is in a rather weak starting position to overcome the significant challenges it faces, which are not just limited to the impact of a tariff hike by the US. There are also domestic factors which could impair activity growth in the region’s large economies during the first half of the year. On the one hand, the political instability in France still persists and the possibility of new elections this summer cannot be ruled out. On the other hand, in Germany, the elections held on 23 February handed victory to the CDU/CSU with 28.5% of the votes and they could form a coalition government with the SPD (16.4%). However, the strong performance of the AfD (21%) and of the radical left party Die Linke (9%) gives them enough seats to block changes to the «debt brake», which requires the approval of two-thirds of the House. All this is taking place while progress is being made in the sphere of fiscal consolidation, on the objectives of the so-called Competitiveness Compass presented in February by the European Commission and on the recommendations of the Draghi report, and also while the need to substantially boost defence spending is being addressed, now that it is clear that Europe cannot rely solely on NATO to guarantee its security. Consequently, growth for 2025 is estimated at 0.8% and for 2026 at 1.4%, 0.5 pps and 0.4 pps, respectively, lower than the previous forecasts. We will have to wait to see if there is any response on the fiscal side that can stimulate activity in the coming quarters.

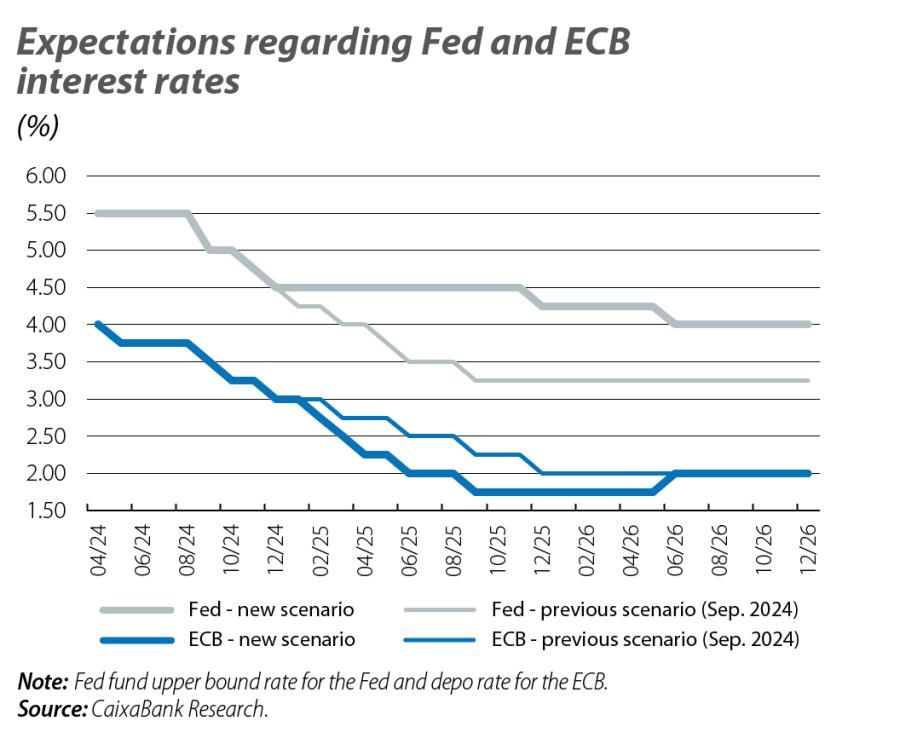

The impact on inflation, meanwhile, is not so clear. The imposition of reciprocal tariffs on the US represents an upside risk for prices, which could be offset by weak domestic demand, the limited ability of companies to translate the tariff hikes to final prices and the potential redirection of trade flows from China to the euro area. Therefore, we have kept the inflation scenario virtually unchanged, which also limits the modest adjustments in our expectations for the ECB’s interest rates. Thus, after the 25-bp cut already approved in January, we expect the depo rate to be in the lower end (1.75%) of the range considered neutral, before returning to 2% in 2026.

The US economy has been performing better than expected in the past two years, but this could change going forward. The Trump administration’s agenda, designed to Make America Great Again, could have the opposite effect. The attempt to cut the size of the public sector considerably could lead to a certain demand shock due to job losses, reduced public spending and increased uncertainty linked to cuts in social programmes. Coupled with the supply shock that could be triggered by the restrictive immigration measures and the tariff hikes, this will have a negative impact on growth and increase the risk of higher inflation. However, the positive inertia of the economy will persist during the first half of the year and it will not be until the second half of 2025 and early 2026 that the impact of the measures on growth will be felt more intensely. This explains why we anticipate GDP growth of 2.1% in 2025 and of 1.9% in 2026, slightly above the previous forecasts. However, this good outlook masks the fact that, in the absence of Trump’s measures, average growth in both years could have been around 0.5 pps higher. Regarding headline inflation, we estimate that it will reach 3.1% this year and 2.7% in 2026, which would be around 0.2 and 0.4 pps higher, respectively, than without the Trump agenda.

This higher inflation, in a context of relative buoyancy in the economy, explains the substantial adjustment we have made to expectations for the Fed’s interest rates, with a much less aggressive and more gradual pattern of rate cuts than had been expected up until now. Thus, we anticipate a single rate cut at the end of the year of 25 bps, which would place the upper band of the Fed Funds rate at 4.25%. We then expect it to remain at that level until around mid-2026, when another 25-bp cut could bring it down to 4.0%, where it would remain for the rest of the year.

La economía china logró cumplir por la mínima, en 2024, el objetivo de un crecimiento del 5,0%, pero las expectativas para este año son algo más pesimistas. La nueva Administración Trump tiene como uno de sus objetivos reducir el déficit comercial con China y, para ello, ya ha iniciado un ciclo de subidas de aranceles sobre sus importaciones como el que prometió en campaña electoral. En respuesta al renovado proteccionismo de EE. UU., China ha aprobado ya aranceles sobre determinados productos, siendo el sector automotriz y el energético los más afectados, así como restricciones a las exportaciones de minerales críticos. Además, las autoridades chinas han iniciado una investigación antimonopolio contra Google y añadieron empresas estadounidenses a su lista de entidades no confiables, lo que sugiere que se preparan para tomar nuevas represalias si las próximas negociaciones bilaterales en materia de aranceles fracasan. Ante la debilidad que presentará su demanda externa, las autoridades chinas ya han mostrado su compromiso para continuar apoyando el crecimiento este año. En este sentido, todavía hay mucha incertidumbre acerca de la magnitud del estímulo fiscal y habrá que esperar a la conclusión de las «Dos Sesiones» de comienzo de marzo para conocer más detalles, pero todo apunta a que dependerá de cómo evolucionen las negociaciones con EE. UU.

Lo que parece claro es que el impacto de la guerra comercial en curso provocará una desaceleración de la economía y anticipamos un crecimiento del 4,2% en 2025 y del 3,9% en 2026, lo que implica un crecimiento casi 0,5 p. p. inferior de media al que hubiera alcanzado en ausencia de este recrudecimiento del proteccionismo global.