House prices in Europe reactivate with the shift in monetary policy

The initiation of the ECB’s monetary policy normalisation process has led to an acceleration in house prices, especially in markets with a significant mismatch between insufficient supply and dynamic demand. The economies in which real prices have increased the most in the last year and a half, and where the residential markets are showing signs of more significant overvaluation, include Portugal, Bulgaria, Hungary, the Netherlands and Estonia. In contrast, the markets of large economies such as Germany, Sweden, France and Luxembourg remain overvalued, but have corrected the strong price growth they experienced in the decades leading up to the pandemic, reducing signs of overheating.

House prices return to growth in real terms in the EU

Price houses across the EU in the last five years have been conditioned by monetary policy. After emerging from the most restrictive phases of the pandemic in 2020, house prices began to climb rapidly, driven by pent-up demand, forced savings, the population’s new housing needs and the low interest rates. As a result, in the early months of 2022 the year-on-year growth in the price of housing reached 6% in real terms. From July 2022, the aggressive cycle of interest rate hikes pursued by the ECB and other central banks in the region to tackle the inflation rally triggered a significant correction in house prices in the EU in real terms (see the chart on page 19).

The aggressive cycle of interest rate hikes pursued by the ECB and other central banks beginning in July 2022 to tackle the inflation rally triggered a significant correction in house prices in the EU

With the beginning of the normalisation of interest rates during 2024,9 the demand for housing was reactivated and house prices picked up again. Thus, in Q2 2024, slightly positive year-on-year growth rates were recorded in real terms. Looking at the period 2020-2024, house prices for the EU as a whole are only 2.0% above the level of Q4 2019 in real terms, but 26% higher in nominal terms, reflecting the high inflation experienced during this period.

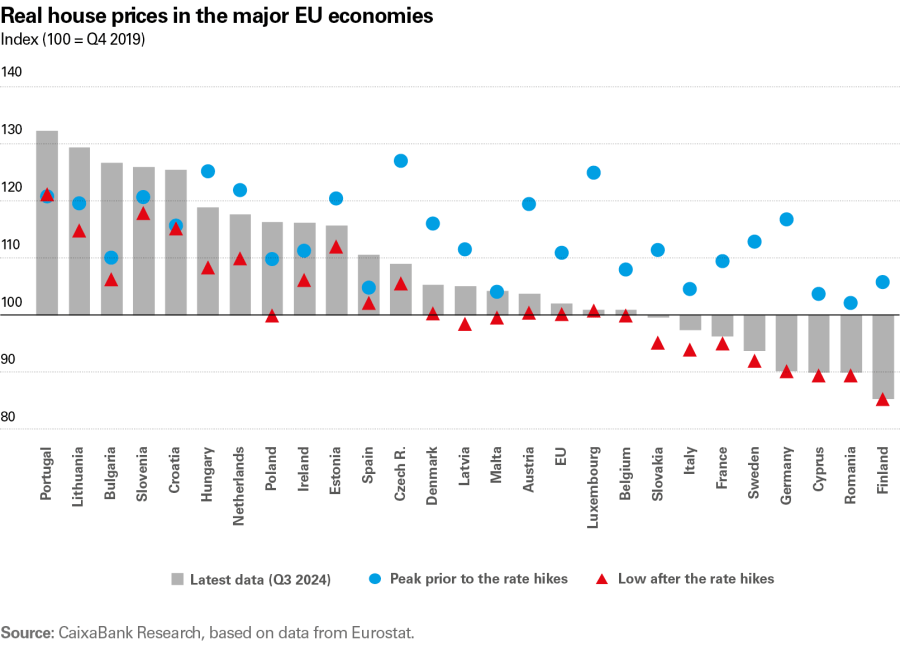

It should be noted that there is a significant disparity between countries. In the chart of the following page we compare the evolution of real house prices relative to Q4 2019 by country (grey bar), showing the rebound in prices after the pandemic (blue circle) and the low reached in response to the interest rate hikes beginning in the second half of 2022 (red triangle). The countries are ordered according to the cumulative increase since Q4 2019 (the latest available data is for Q3 2024). Through this analysis, we can identify three major groups of countries according to the pattern of their real prices.

- 9The ECB has cut interest rates on six occasions since 2024, such that the depo benchmark rate at the close of this report stands at 2.50%, compared to 4.0% at the 2023 year end. For a more in-depth analysis of our outlook for monetary policy in the region in the coming months, see the Central Banks Observatory.

With the beginning of the normalisation of interest rates during 2024, the demand for housing was reactivated and house prices picked up again

House prices reactivate following the ECB’s rate cuts

Firstly, on the left of the chart we can distinguish a group of countries in which house prices have risen more sharply since Q4 2019, in many cases exceeding the peaks reached prior to the interest rate hikes. They include Portugal, Lithuania, Bulgaria, Slovenia and Croatia, with a cumulative growth in real house prices between Q4 2019 and Q3 2024 in excess of 25%.

Portugal, Lithuania, Bulgaria, Slovenia and Croatia are the economies that have experienced the sharpest growth in house prices since the pandemic

At the opposite end of the spectrum we find a second group of countries, represented further to the right of the chart, which include Finland, Germany, Sweden, France and Italy, with much larger residential markets that are relevant for the region as a whole. In these economies, prices remain around the lows recorded following the cycle of interest rate hikes in 2022-2023. Excluding the case of Italy, these are markets in which house prices had risen significantly during the decade prior to the pandemic and had experienced a major correction as a result of the rate hikes in 2022. Consequently, the state of alarm due to the significant increase in house prices is moderating. A clear example is that of Germany, where real house prices registered an increase of 17% in two years (between Q4 2019 and Q4 2021), but then dropped 23% by Q3 2024. In the five-year period as a whole, real house prices in Germany have fallen by around 10%.

Finally, the bulk of EU economies (including Spain) are somewhere in the middle, with prices rising rapidly following the easing of monetary conditions, but with a moderate cumulative increase since Q4 2019. In this intermediate group there are also some residential markets that have undergone a significant correction following the sharp rally in house prices in previous periods, including the Czech Republic, Estonia, Austria and Luxembourg, where prices had risen 20%-30% since 2019. Even so, as we will see below, the ECB notes that over three-quarters of the EU’s residential markets are overvalued.

The ECB notes that 80% of EU residential markets are overvalued

The ECB publishes quarterly estimates on the overvaluation and undervaluation of residential prices in EU economies, based on four different valuation methods: price-to-rent ratio, price-to-income ratio and two model-based techniques.10

According to these estimates, over 80% of the region’s economies currently have an overvalued residential market. Following the real estate boom of the mid-2000s, first the global financial crisis and then the sovereign debt crisis in Europe drastically reduced the proportion of residential markets that were overvalued to just 20-30%. However, since 2018, the region’s markets have once again recorded sharp price increases. Excluding the unusual rebound in 2020, influenced by the effects of the pandemic, the number of overvalued residential markets has once again reached levels similar to those of the mid-2000s.

Luxembourg, Estonia, Greece and Portugal are the economies with the most overvalued residential markets (between 20% and 30%). On the other hand, Romania, Finland, Italy, Cyprus and Ireland are the only markets that are currently undervalued, according to the ECB’s estimates.

- 10To carry out the analyses of this article, we have chosen to take the average valuation of these four methods. For further details on the ECB’s estimates of over/undervaluation, see Box 3 in the ECB’s Financial Stability Review of June 2011 and/or Box 3 in the ECB’s Financial Stability Review of November 2015.

Luxembourg, Estonia, Greece and Portugal are the region’s residential markets showing the most signs of overheating today, according to the ECB

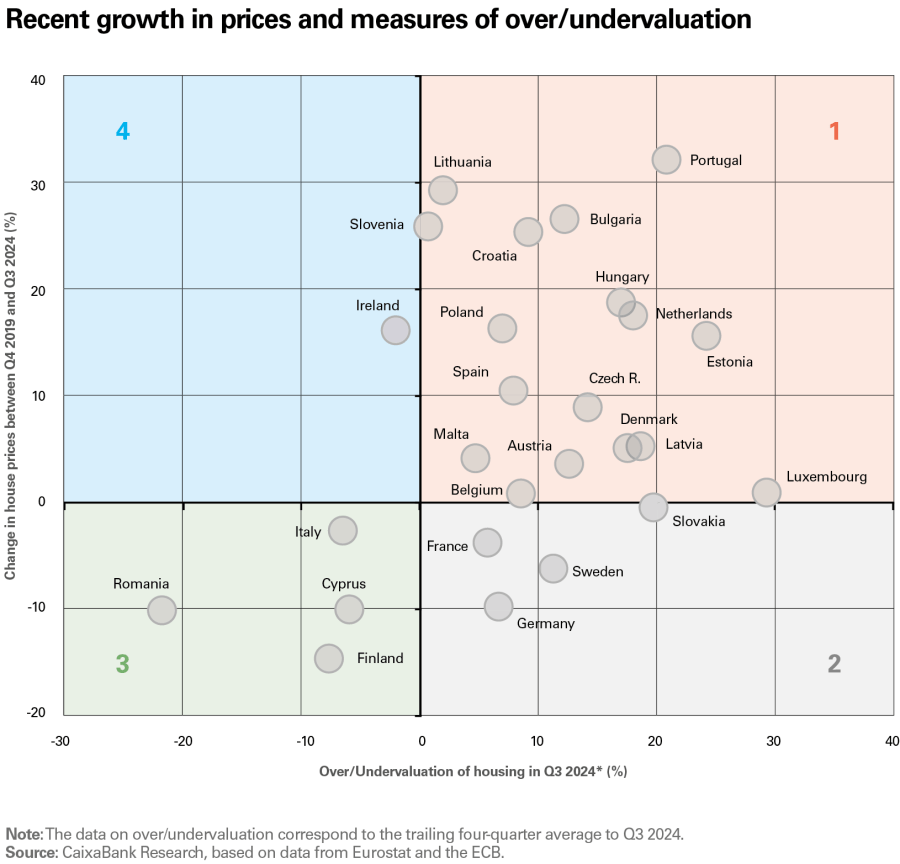

If we compare these measures of overvaluation or undervaluation with the recent pattern in house prices, we can draw important conclusions about the current state of the residential markets. The following chart summarises this information and allows us to identify four major groups of countries.

Quadrant 1 encompasses the residential markets with the biggest price increases since

Q4 2019, as well as those that are most overvalued according to the ECB’s metrics. The cases of Portugal, Bulgaria, Hungary, the Netherlands and Estonia are particularly clear cases. In this group we also find the Spanish market, although neither its price growth nor its degree of overvaluation stand out, since it is closer to the centre of the chart’s coordinates.

At the opposite end of the spectrum, quadrant 3 encompasses the countries in which house prices have declined since the start of the pandemic and which, according to the ECB’s estimates, have undervalued markets. In this group we find Finland, Romania, Cyprus and Italy.

In an intermediate position are the countries located in the other two quadrants. Quadrant 2 includes Germany, Sweden, France and Luxembourg,11 markets where prices increased significantly in the pre-pandemic period and which, according to the ECB, are overvalued. However, their prices have recently been corrected and now lie below Q4 2019 levels. Finally, quadrant 4 contains only Ireland, a country where prices are growing rapidly, although the ECB considers that its market is still undervalued.

- 11Although Luxembourg appears in quadrant 1, it is also included in this group: it is the most overvalued residential market in the EU, but prices have been correcting significantly in recent years and, since Q4 2019, they have grown by just 0.5% in real terms.

Which European economies present a systemic risk associated with their residential market?

Having looked at the recent pattern of prices and the valuation metrics, a final analysis is needed in order to distinguish which economies have recently received systemic risk alerts due to the behaviour of their residential market and to assess whether the macroprudential policies implemented to date have had any effect.

The overvaluation of certain European residential markets in recent years has triggered some alerts. In Europe, the European Systemic Risk Board (ESRB) has been in charge of macroprudential supervision in the region since the financial crisis of 2008.12 This body not only monitors trends in house prices, but it also takes into account household borrowing, households’ ability to cover their mortgage payments, credit growth and the relaxation of lending standards.

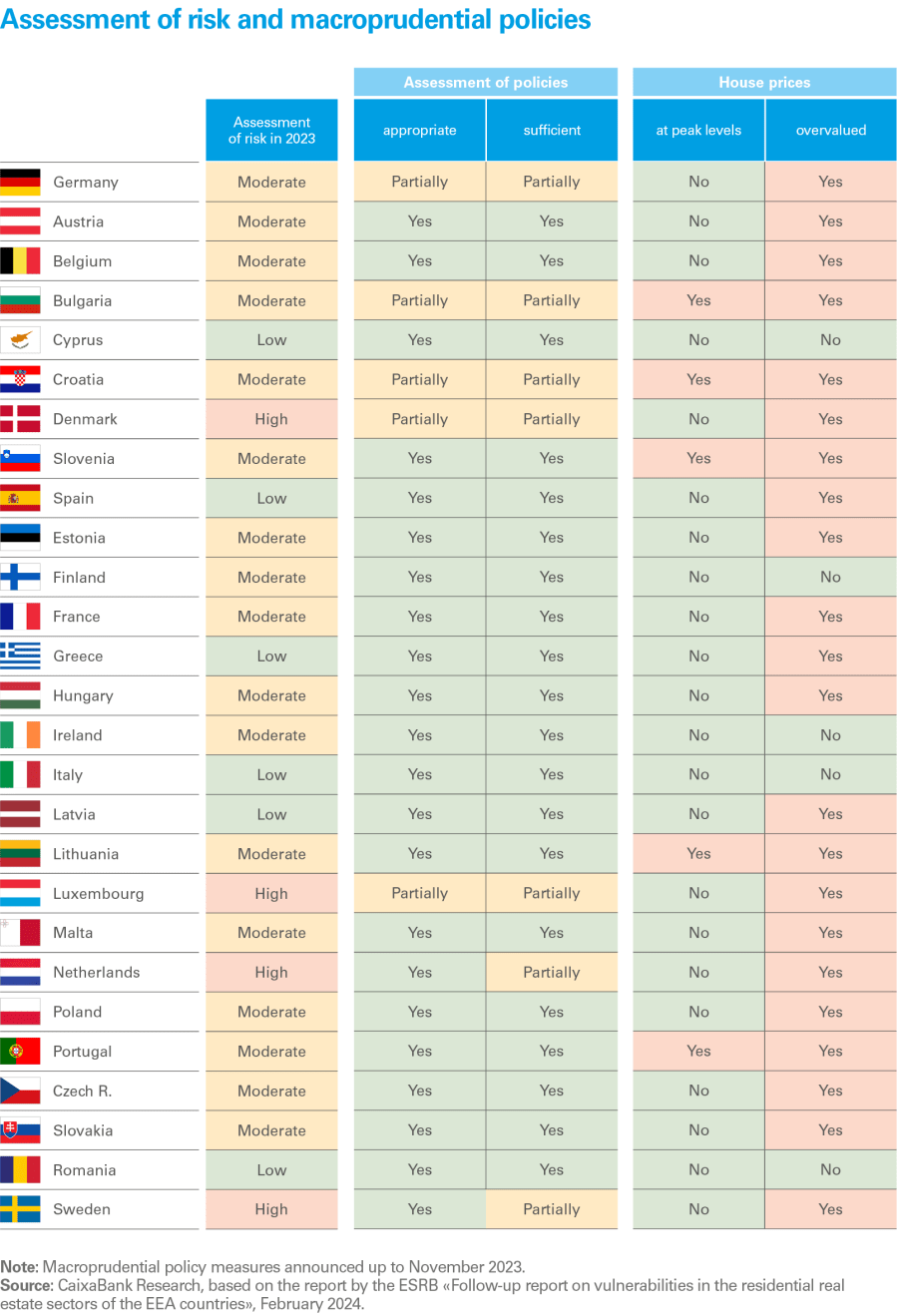

The table on page 25 seeks to summarise the ESRB’s assessment of systemic risk, the suitability of the macroprudential policies implemented by these countries to date and, finally, how prices are currently behaving.

- 12The ESRB is an EU institution responsible for the macroprudential supervision of the financial system in the EU. It was created in 2010 following the 2008 financial crisis to identify and mitigate systemic risks that could affect financial stability in Europe. To this end, the ESRB monitors and evaluates risks in the financial system; it issues warnings and recommendations to governments, central banks and national regulators; and it proposes measures to strengthen financial stability in the EU. The ESRB has no coercive power, but its warnings and recommendations have a strong influence on economic and regulatory policy in the EU.

Denmark, Luxembourg, the Netherlands and Sweden are the economies in the region with the highest systemic risk associated with their residential market according to the ESRB

In its last assessment in 2023, the ESRB identified Denmark, Luxembourg, the Netherlands and Sweden as the economies with the highest systemic risk in the region. In fact, the body had already issued an alert for these countries back in 2016. Among them, the most worrying case is that of the Netherlands, due to the significant recent growth in its prices (+17% since Q4 2019, although they remain below their peak) and its position as one of the most overvalued markets in the region (by 18%). In addition, the ESRB considers the macroprudential measures that the country has implemented to date to be inadequate. In contrast, the rest of the countries under alert do not currently show any significant increase in their real house prices or any excessive overvaluation of their markets, suggesting that they have already begun to correct their imbalances.

At the other end of the spectrum are economies such as Cyprus, Greece, Italy, Latvia, Romania and Spain, where the ESRB considers the systemic risk to be low and the macroprudential policies – in those cases where they have been implemented – to be adequate and sufficient. Furthermore, none of these countries show a particularly significant acceleration in their house prices, nor do they have especially overvalued residential markets.

Portugal, Bulgaria, Hungary and Estonia have not yet been the subject of alerts, but the current behaviour of their residential markets warrants close monitoring

Finally, there are some economies in the region that will need to be closely monitored in the coming years. Portugal, Bulgaria, Hungary and Estonia are considered by the ESRB to be economies with a moderate systemic risk and with macroprudential policies that have, so far, been adequate and sufficient. However, in recent quarters the growth of their house prices has accelerated and their residential markets are now considered to be particularly overvalued according to the ECB’s estimates.