The decline in interest rates reignites investment in commercial real estate

Valuations of commercial real estate assets recovered significantly during 2024, driven by the shift in monetary policy and the reduction of market interest rates. Investment in the sector grew at an annual rate of around 20% and the living, hotel and retail segments were particularly dynamic. For 2025, it appears that most of the revaluations will have already taken place, as interest rates are already at levels close to the new equilibrium. Still, the sector will continue to attract investment opportunities. Spain is positioning itself among the most attractive destinations for international investment in commercial real estate, thanks to solid macroeconomic fundamentals that will remain attractive throughout this year.

Asset valuations in the commercial real estate market are inversely related to the evolution of market interest rates, since an increase in the latter makes this type of investment less attractive compared to other, lower-risk alternatives. In this regard, throughout 2022 and 2023 we witnessed a widespread decline in valuations and, above all, in the number of transactions in the sector.13 Following the shift in monetary policy in 2024 and the change in expectations regarding market interest rates, the sector has seen a revival of investment activity and a fairly widespread recovery of valuations among the various different asset types.

- 13For a more detailed analysis of the behaviour of valuations of commercial real estate assets, see the article «Given the economic scenario, the commercial real estate market goes into ‘wait and see’ mode» in the Real Estate Sector Report S1 2023.

Investment in commercial real estate picked up in 2024, mainly thanks to the enormous interest in the living, hotel and commercial premises segments

According to the commercial real estate price indices produced by the Bank of Spain, the clearest improvement in asset valuations has occurred in the prime real estate segment (+18% since the lows recorded in Q2 2023) and that of industrial buildings (+4% since the recent lows of Q4 2023), that is, in assets associated with the logistics sector. In terms of investment, the data offered by the main real estate consultancy firms show a rebound at an annual rate of around 10%-20% in 2024, which is roughly double that of the EU as a whole and above the average investment volumes of the last five years. Of particular note is the growing attraction of assets in the living, hotel and retail segments (the fastest growing asset types in 2024).

Valuations and investment in commercial real estate assets are reviving after the shift in monetary policy

What can we expect for Spanish commercial real estate in 2025?

The projections for 2025 indicate an expanding commercial real estate market, with rising valuations and an increase in both the number of transactions and the amount of investment. Moreover, this market will receive the support of the reduction of interest rates (although market rates have already incorporated most of the anticipated cuts), favourable economic conditions (the Spanish economy is expected to grow above potential thanks to the buoyancy of domestic demand) and sustained demand, especially in the segments with better macroeconomic fundamentals.

The living, hotel and logistics segments are the ones that have the most favourable fundamentals in the short and medium term

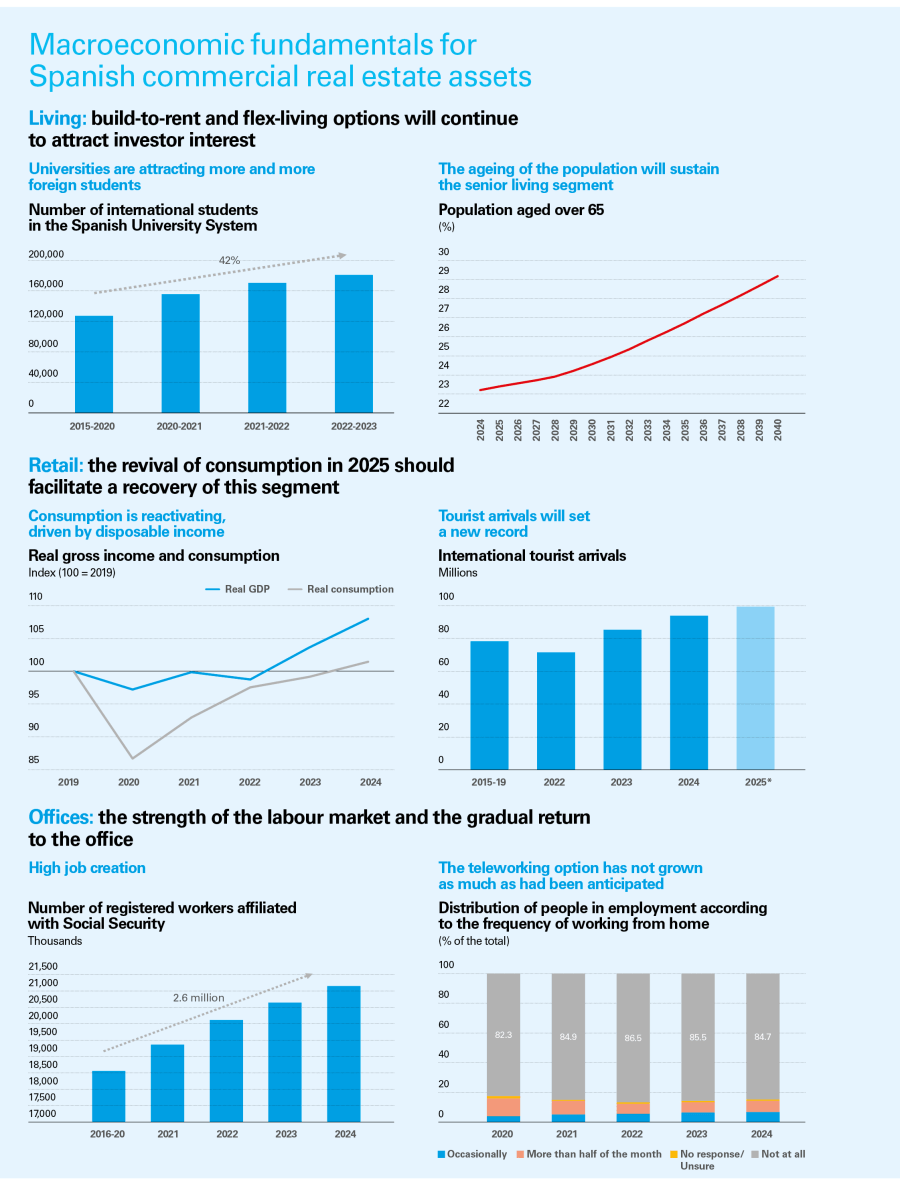

The living segment will continue to generate significant interest, driven by the demand for housing. In particular, the build-to-rent segment and new forms of flex-living (co-living, student residences and senior living, among others) have gained prominence due to the limited supply of housing in Spain and favourable market fundamentals. Factors such as rapid demographic growth (the population increased by half a million inhabitants per year on average between 2022 and 2024), the increase in international students attracted by the quality of the country’s education (40% increase versus the pre-pandemic period) and the ageing of the population (those over 65 years old will exceed 25% of Spain’s population by 2030) will support the expansion of this segment in the medium and long term.

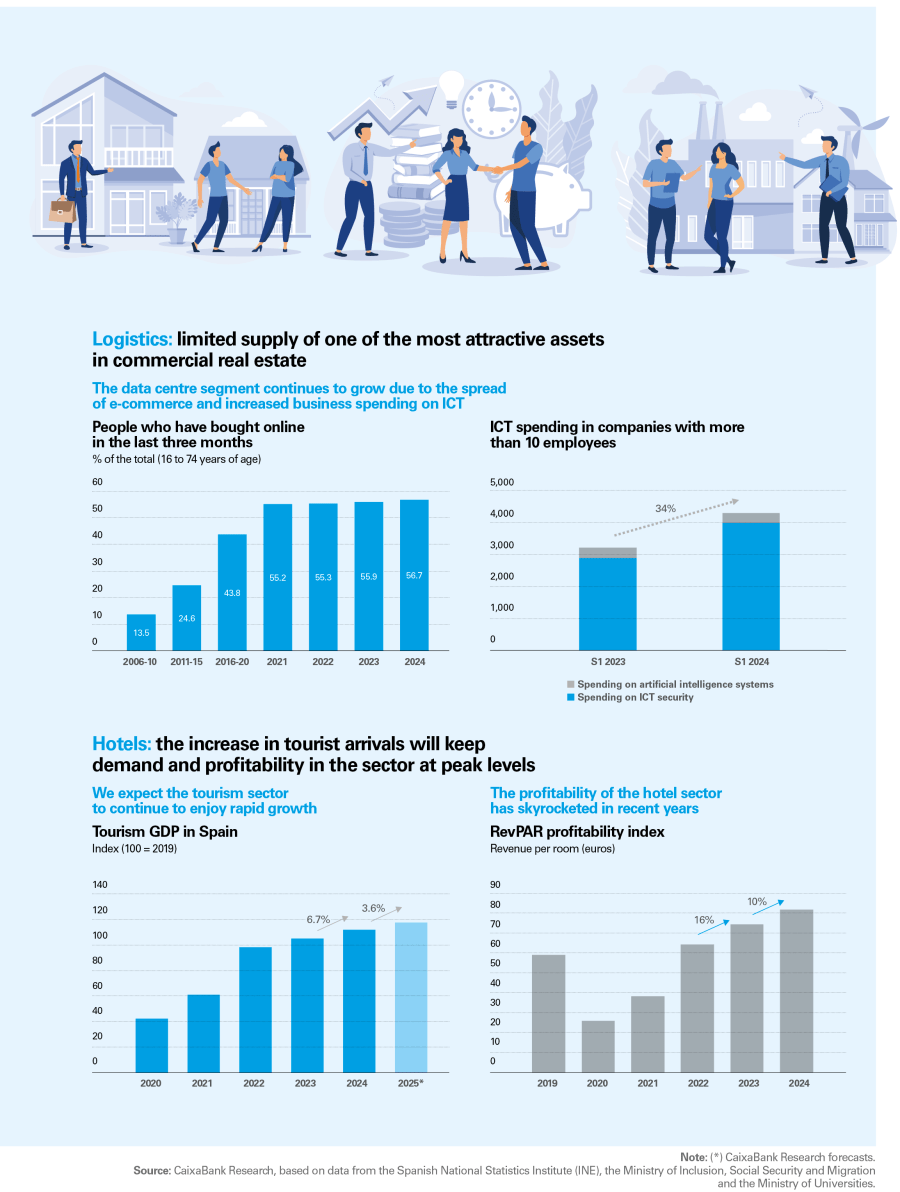

In the hotel sector, expectations of an increase in the number of international tourist arrivals (which will reach 98.5 million in 2025 according to our estimates, 5% more than in 2024) allow us to anticipate another year of peak demand for the hotel sector. In addition, the sector’s profitability has shown solid growth in recent years: the RevPAR index is registering consecutive double-digit increases, reflecting the boom which Spain’s hotel industry is currently enjoying.

The logistics segment, which encompasses industrial buildings and data centres, remains one of the most attractive assets thanks to the favourable trend in sectors related to e-commerce, logistics and investment in ICT and AI. On the one hand, the latest available surveys show that making purchases online is now common practice for over 55% of the Spanish population (between 2005 and 2015, this was the case for less than 25%).14 On the other hand, expenditure on ICT tools by companies has grown by 34% in the last year alone. On balance, the easing of monetary conditions, together with strong demand and high interest among investors, contrasts with a still limited supply in Spain, thus reinforcing its attractiveness in the medium and long term.

As for the retail segment, the fundamentals suggest that its valuations could continue to converge on pre-pandemic levels. In particular, private consumption will maintain a positive tone in the short term, favoured by declining interest rates, moderating inflation and the recovery of household disposable income. In addition, the Spanish labour market continues to show significant strength, having created more than 2.5 million jobs since the outbreak of the pandemic. In this regard, we expect that the interest in transactions and investment in shopping centres will persist, having been among the best performing assets in 2024 after several years marred by post-pandemic doubts.

Offices are another of the commercial real estate assets that have not yet recovered their pre-pandemic valuations. Moreover, this asset class could benefit from the aforementioned strength of the labour market and a lower adoption of teleworking relative to expectations in the aftermath of the health crisis. According to the Labour Force Survey (LFS), only 6.9% of people in employment worked occasionally from home in 2024 (4.0% in 2020). Moreover, 85% did not telework at all. In any case, while many companies are pushing for a return to the office, the hybrid model and the growing demand for flexibility from employees have become consolidated as the new norm and will continue to define the evolution of this segment.

Offices have not yet recovered their pre-pandemic valuations and could benefit from the strength of the labour market and a lower adoption of teleworking