Widespread growth across virtually all sectors after overcoming the shocks of recent years

Our Sectoral Indicator reflects a widespread improvement across the various sectors in 2024, particularly in some branches of manufacturing, such as the chemicals, pharmaceutical and paper industries, which have benefited from lower energy costs and an improvement in exports. By contrast, the automotive sector has slowed sharply over the course of this year, following the recovery experienced in 2023.

The Spanish economy has once again beaten expectations in 2024. In fact, the CaixaBank Research Sectoral Indicator shows an acceleration of economic activity towards rates of around 3.0% year-on-year in the final stretch of the year. The improvement is fairly widespread across the various sectors, but it has been particularly pronounced in some branches of manufacturing, such as the chemicals, pharmaceutical and paper industries, which have benefited from lower energy costs and an improvement in exports. By contrast, the automotive sector has slowed sharply over the course of this year, following the recovery experienced in 2023. Within services, those related to tourism continue to enjoy strong growth, albeit at a slower rate than in 2023 due to the normalisation of growth rates after overcoming the effects of the pandemic. Real estate activities have also recorded rapid growth and lead the sector ranking thanks to the strength of housing demand. On balance, the Spanish economy has shown strong growth, with a reduction in the number of sectors in a situation of weakness and an increase in those in expansion.

The Spanish economy beats expectations once again in 2024

As we approach the end of 2024, we can safely say that this has been a good year for the Spanish economy. This is largely thanks to the fact that inflation and interest rates – although still high – have steadily declined, as well as thanks to the good performance of the foreign sector, driven by tourism and non-tourism services.1 Spain’s GDP has recorded very buoyant growth rates, exceeding 3.0% year-on-year in Q2 and Q3, compared to rates closer to 2.0% observed in mid-2023. The indicators available for Q4 suggest that this buoyancy has continued in the final stretch of the year, as reflected by the CaixaBank Research Sectoral Indicator.2,3 According to the latest CaixaBank Research forecast scenario, the Spanish economy as a whole will grow by around 2.8% in 2024, 1 point more than was expected at the beginning of the year.4

- 1See «New economic outlook: upward revision of Spain’s GDP growth forecast» in the Monthly Report of October 2024.

- 2The CaixaBank Research Sectoral Indicator is a tool that combines information from various economic activity indicators, the labour market and the foreign sector, allowing us to analyse the evolution of the economy from a sector-based perspective. For a closer look at how this indicator is built and which sectors are included, see «Methodology note: CaixaBank Research Sectoral Indicator» published in the Sectoral Observatory of May 2024.

- 3It should be recalled that our Sectoral Indicator does not cover the financial sector, general government, education or health. Excluding these sectors, the economy would have accelerated from 2.0% in Q3 2023 to the 3.5% recorded in Q3 2024.

- 4Following the publication of the GDP data for Q3 2024 (growth of 0.8% quarter-on-quarter, higher than our forecast), there are upside risks to both the 2024 and the 2025 growth forecasts

The CaixaBank Research Sectoral Indicator shows an acceleration of economic activity in the second half of 2024 toward rates around 3.0% year-on-year

How rapidly are Spain’s various economic sectors growing?

The sectoral traffic light chart provides a graphical summary of the rate of growth (or contraction) of the various sectors that make up the Spanish economy.5 From the chart below, several conclusions can be drawn about the current state of the economy.

- 5In particular, a sector is considered to be in a position of «significant weakness» if the value taken by the sectoral indicator lies below the 15th percentile (P15) of that indicator’s historical distribution; a position of «weakness» when it takes a value between P15 and P40; «stability» between P40 and P60; «expansion» between P60 and P85, and «significant expansion» when the indicator lies above P85.

Firstly, we note that the number of sectors facing difficulties is gradually decreasing: whereas in the second half of 2023 over 55% of the sectors considered showed signs of weakness, at the end of 2024 only 36% of them are in a situation of weakness. Moreover, there are no sectors suffering significant weakness.

Secondly, there is an increase in the number of sectors in a stationary or stable situation. At the end of 2024, 50% were in the «stability» category, whereas in the second half of 2023 only 1 in 4 sectors were at that point of the cycle.

Thirdly, there is a reappearance of sectors in significant expansion, indicating that some sectors have seen a marked improvement in their cyclical position during 2024. Next, we will look at which sectors correspond to each of these dynamics.

CaixaBank Research sectoral clock: at what point in the cycle does each sector currently lie?

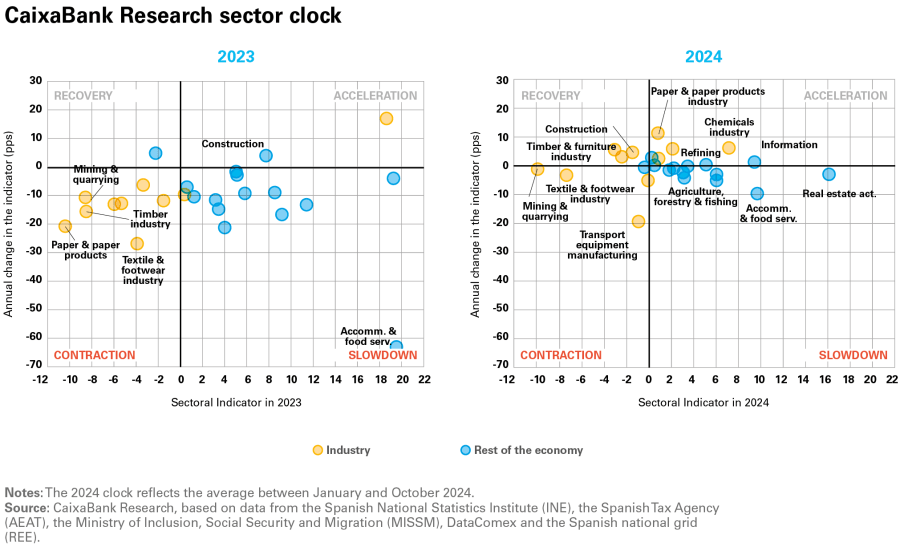

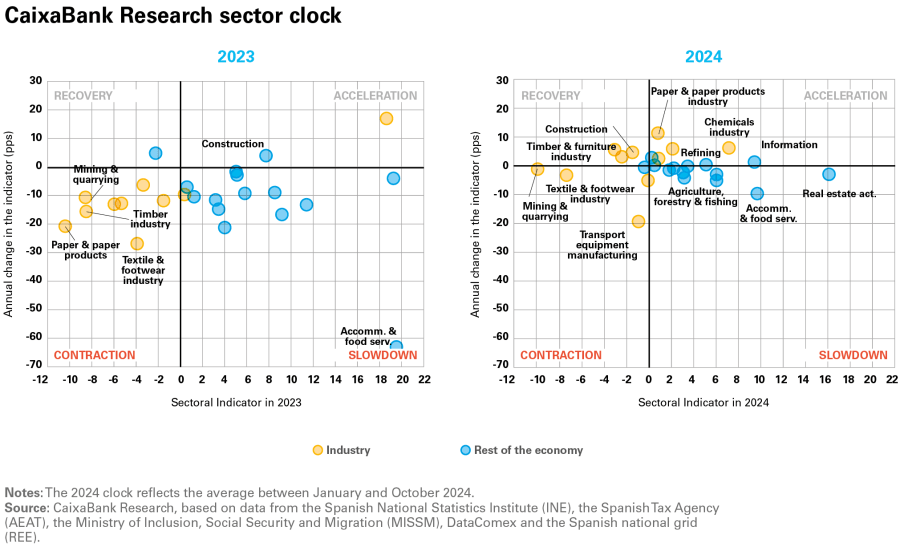

In order to analyse which sectors have driven the growth of the Spanish economy during 2024, and which ones have faced the greatest challenges, we refer to the CaixaBank Research sector clock and we compare the situation in 2023 with that of 2024 to date (with data up until October at the closure of this report).

The first point to note is that there are no major annual swings so far in 2024; rather, most sectors are gradually converging towards the Sectoral Clock’s horizontal axis, with much smoother movements than those noted during 2023. This reflects the fact that, now that the multiple shocks that have been affecting the Spanish economy since the pandemic have been largely absorbed, the big «step effects» have also steadily faded and the variations in activity at the sector level over the course of the year have been more moderate.

Secondly, the improvement compared to 2023 is clear: only 3 sectors (transport equipment manufacturing, textiles, and mining and quarrying) are in contraction, compared to 8 sectors in 2023 (1 in 3). In addition, there are 7 sectors that are currently in a state of expansion, compared to just 2 in 2023 (construction and transport equipment manufacturing).

The manufacturing sectors registered the greatest improvements, particularly the chemicals, pharmaceutical and paper industries

Broadly speaking, the greatest improvements in the indicator are to be found in the manufacturing sectors, particularly in the case of the chemicals and pharmaceutical industry (the sector with the second highest growth according to our indicator, behind only real estate activities) and the paper industry (which benefited from the reduction in costs and increased demand for more sustainable packaging materials). On the other hand, the textile industry and transport equipment manufacturing, together with the mining and quarrying industry, are the sectors in a state of contraction. The pattern followed by the automotive sector is particularly alarming: it enjoyed a strong recovery in 2023, after the severe blow dealt by the pandemic and the multiple factors that held it back thereafter, so there is a slight step effect which explains part of the weakness we now see.6

The construction sector continues to enjoy strong growth and shows some improvement in the second half of 2024 thanks to the stabilisation of production costs and the reduction of financing costs, which are supporting a certain revival of the housing supply, as shown in the number of new construction permits being granted (+14.6% year-on-year between January and July 2024).

The services sectors generally show positive signs in our indicator (i.e. they are growing), although their growth rate is moderating following the rapid expansion recorded in 2023. The clearest example of this is the accommodation and food services sector, which recovered significantly during 2022, and above all in 2023. Today it remains one of the Spanish economy’s most buoyant sectors, although its growth rates have normalised in 2024 as the post-pandemic momentum has gradually dissipated.

- 6In this Sectoral Observatory we dedicate the article «The automotive sector in Spain: the challenge of remaining competitive in the new global ecosystem» to taking a closer look at the current state of the sector, as well as the challenges it faces in the coming years.

What factors explain the behaviour of the various sectors?

In order to understand the economy’s behaviour on the supply side, we must first recall the factors that have held back the various economic sectors in recent years: the deterioration of global supply chains (in 2021 and in certain periods of 2022, particularly affecting the automotive sector), the energy crisis (triggered by the war in Ukraine, affecting the most energy-intensive branches of manufacturing), the drought (which severely affected agricultural production), and the tightening of financial conditions (the interest rate hikes in 2022-2023 by the ECB, which particularly affected the most credit-dependent sectors, such as construction and real estate activities, as well as the sectors that are the most intensive in investment in equipment). Currently, all these factors have been gradually dissipating, so their impact is beginning to have an opposite effect. In other words, the sectors that suffered the most are now the ones which, generally speaking, are growing the fastest.

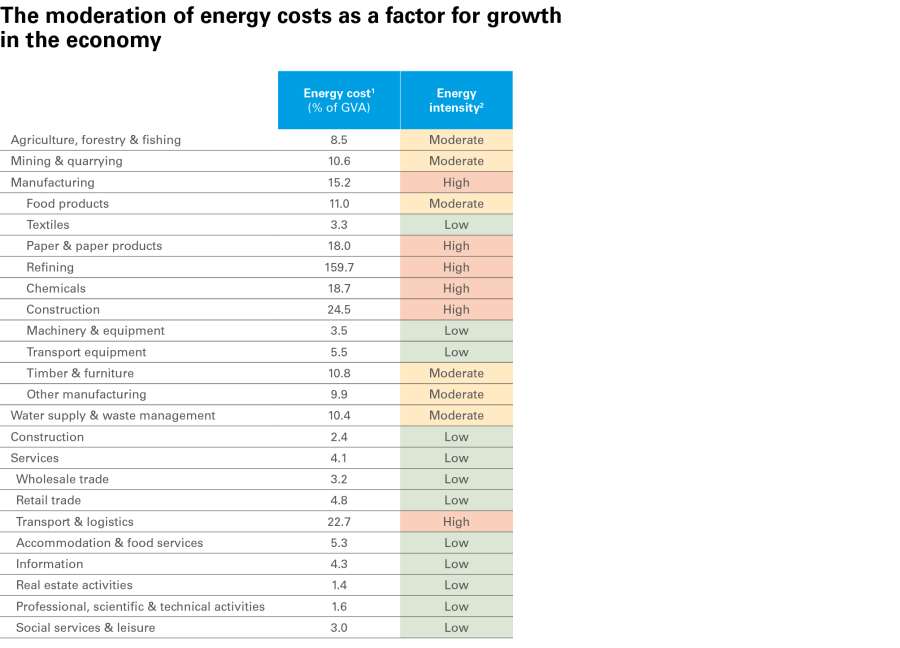

A key factor in explaining the good performance of the Spanish economy is the moderation of energy costs relative to the peaks reached in the summer of 2022: of the 16 sectors that have seen an increase in their year-on-year growth rates in the last 12 months, 12 are energy-intensive.7 As summarised in the chart below, for the most energy-intensive sectors, the sectoral indicator increased by around 6 pps over the last 12 months. On the contrary, the indicator decreased by just over 1 pp in the less energy-intensive sectors.

- 7We define energy intensity as the amount of expenditure on energy consumption as a percentage of the sector’s GVA. In this case, energy-intensive sectors are considered to be those that lie above the 50th percentile of the distribution for all sectors of the Spanish economy.

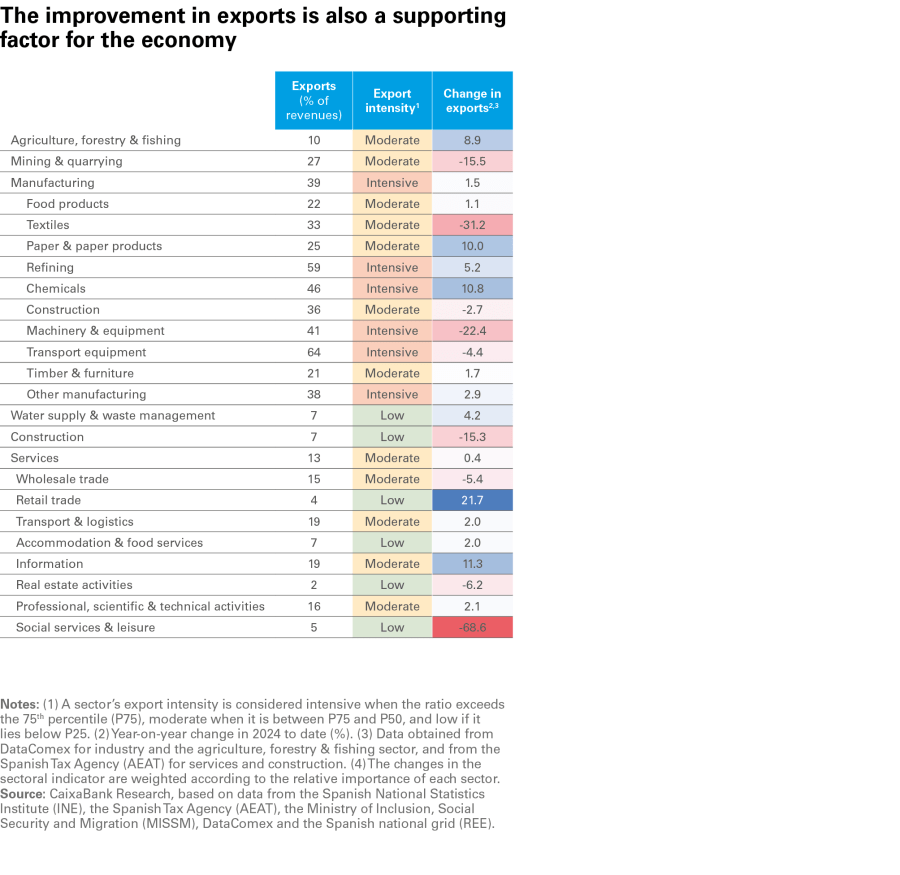

Another factor that could be driving certain sectors of the Spanish economy is the recent good performance of exports of goods and services: in fact, the 16 sectors that have seen an increase in their year-on-year rate in the sectoral indicator over the past 12 months are particularly dependent on export earnings.8 It should be noted that most of the sectors that are dependent on foreign sales have seen an increase in their exports in the current year to date, with the exception of the mining and quarrying industry, and the machinery and transport equipment manufacturing sectors, which are precisely the manufacturing sectors that have been performing the worst in recent months. The following chart, meanwhile, shows how the sectors that are most dependent on foreign sales have generally seen a greater improvement in their exports over the last 12 months. In contrast, the indicator fell in the branches of the economy that are less dependent on foreign sales.9

- 8We define a sector’s export intensity as the value of foreign sales as a percentage of total sales in the sector. In this case, export-dependent sectors are considered to be those that lie above the 50th percentile of the distribution for all sectors of the Spanish economy.

- 9It should be noted that the transport equipment manufacturing sector has been excluded from this analysis as it distorts the conclusions: it is the most export-intensive branch of manufacturing in the case of the Spanish economy and it is going through a particularly difficult time due to supply problems, increased costs, changes in demand and new environmental regulations, among other factors, which have forced the sector to undertake a profound shift in its business model.

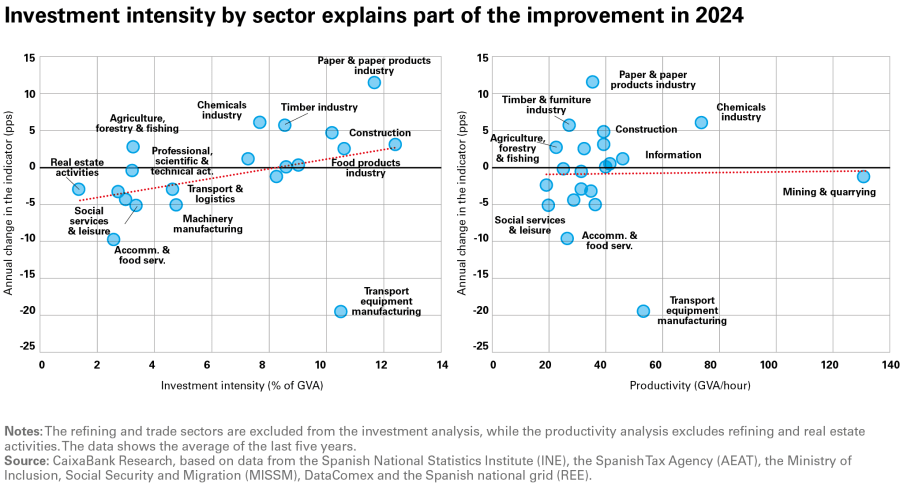

The impact which the monetary tightening process – implemented through the aggressive interest rate hikes between 2022 and 2023 – had on the various sectors of the Spanish economy could be established through the sectors that are the most intensive in terms of investment in equipment. Today, the most investment-intensive sectors (according to the value of investment in equipment as a percentage of GVA for each sector), such as the food products industry, paper and paper products and construction, are some of the branches of industry that have improved the most so far this year (the only big exception is the transport equipment manufacturing sector). In the case of services, transport and logistics stands out as the most capital-intensive branch, and it is also among the sectors with the highest scores in our indicator thanks to the positive secular trends it is currently enjoying (benefiting from the boost provided by e-commerce).10

There is also, to some extent, a positive relationship between the sectors that are showing more buoyancy and those that are most productive. As can be seen in the chart below, there are sectors that have improved significantly of late and which also have above-average productivity (the chemicals and pharmaceutical industry is a prime example). However, there are also other sectors which have high productivity but have seen their position deteriorate (again, transport equipment manufacturing stands out). In services, information and telecommunications is the most productive sector, but it has hardly improved in the last 12 months, although it continues to score well in the indicator thanks to new digitalisation trends.11

- 10The refining and wholesale and retail trade sectors are excluded from the investment intensity analysis, in all cases due to a lack of data.

- 11The productivity analysis excludes the refining sector, due to a lack of data, and real estate activities, since it includes attributed rents which significantly distort the data.

This robust growth across virtually all economic sectors in 2024 places them on a good footing as we move into next year. For 2025, the Spanish economy is expected to continue to enjoy buoyant growth, albeit at a more moderate pace compared to previous years and with differences between sectors, as we will discover in the next article of this Sectoral Observatory.