The Portuguese economy gains strength in Q4 2024

GDP beat expectations in Q4 2024 with a quarter-on-quarter increase of 1.5%, placing growth for the year as a whole at 1.9%. The good performance in the final stretch of 2024 introduces upside risks into CaixaBank Research’s current forecast for 2025 (2.3%), due to the knock-on effect.

GDP beat expectations in Q4 2024

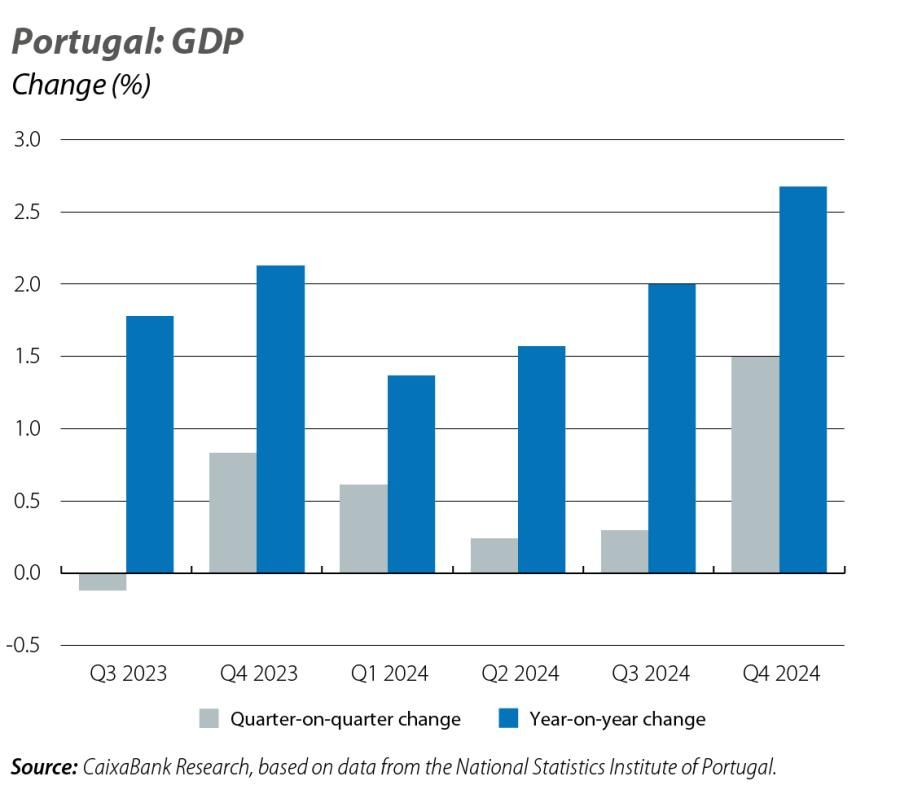

GDP beat expectations in Q4 2024 with a quarter-on-quarter increase of 1.5% (2.7% year-on-year). This placed growth for the year as a whole at 1.9%, surpassing the forecasts of CaixaBank Research (1.7%) and the analyst consensus. The good performance in the final stretch of 2024 introduces upside risks into CaixaBank Research’s current forecast for 2025 (2.3%), due to the knock-on effect.

By component, investment ought to recover, given the anticipated acceleration in the execution of NGEU funds, which are entering their penultimate year, in an environment with less restrictive financing conditions. Private consumption will also remain highly buoyant, thanks to the strength of the labour market and the growth of households’ real disposable income. We believe that foreign demand will have a slight negative contribution to GDP growth, stemming from an acceleration in imports together with the fact that exports will be adversely affected by an international context still marked by uncertainty regarding the US’ more protectionist policies.

Inflation falls in January

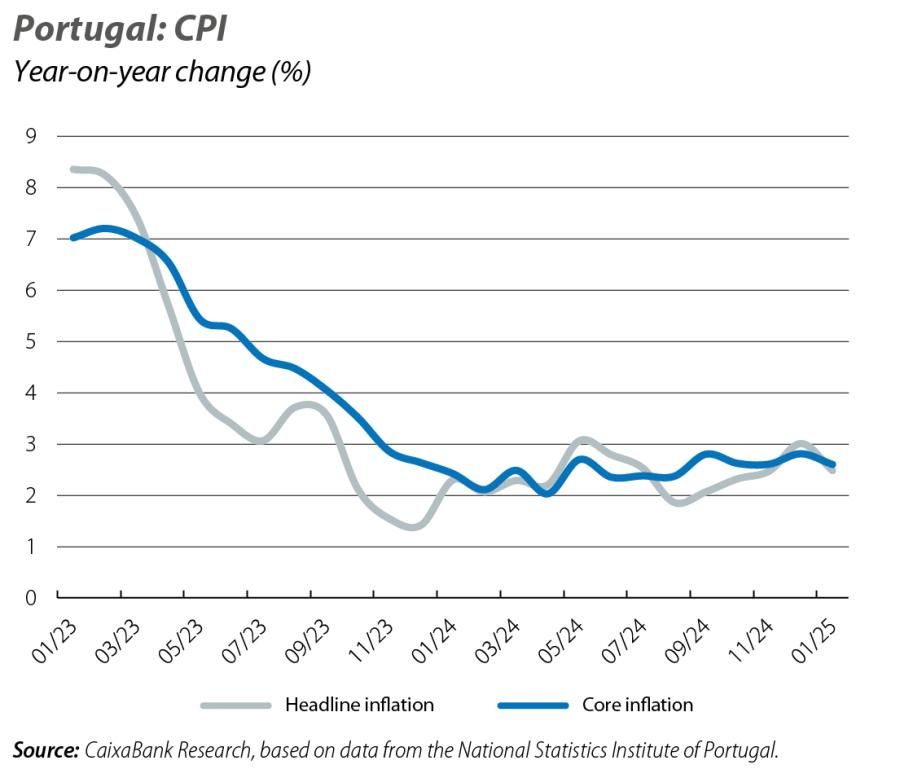

The headline CPI fell to 2.5% in January, compared to 3.0% in the previous month, while the core index went from 2.8% to 2.6%. This correction is partly explained by a base effect associated both with the end of the VAT exemption on a series of essential food products and with the increase in electricity prices, which took place in January 2024. However, the data for January are higher than the figures from a year ago (2.3% for the headline rate and 2.4%, the core rate), reflecting the downward resistance of inflation in the last mile to the 2% target.

2024 was a new record year for the tourism sector

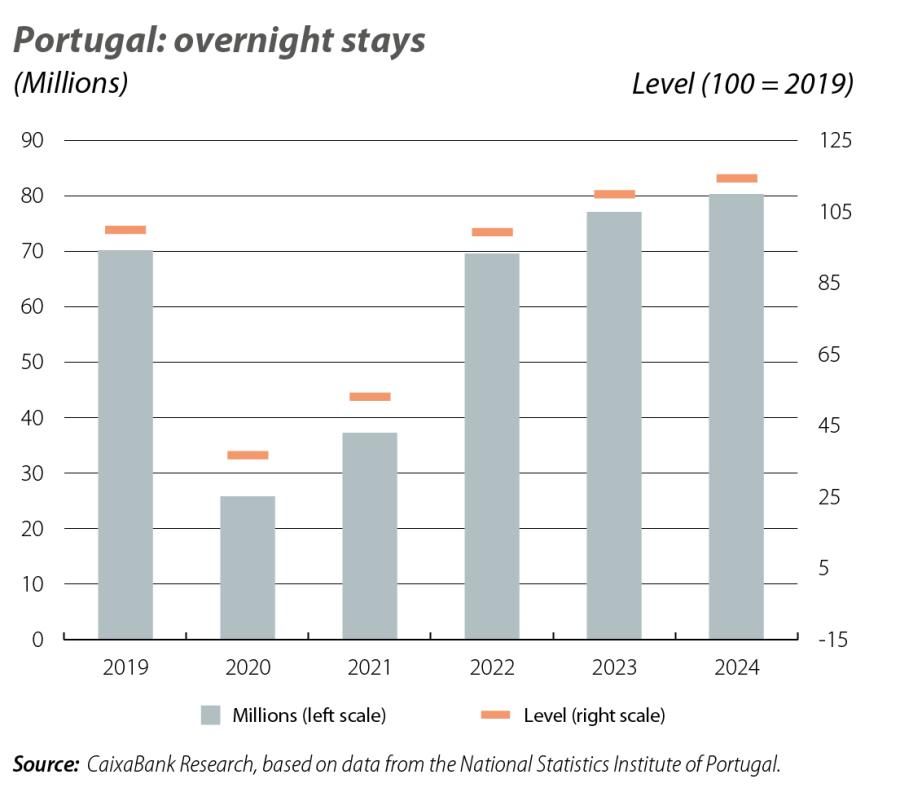

2024 was a new record year for the tourism sector, with 31.6 million tourist arrivals and 80.3 million overnight stays, representing growth of 5.2% and 4.0%, respectively. The increase in overnight stays was higher among foreigners (+4.8% vs. 2.4% among residents). Among the source markets, the United Kingdom remains the leader, although the most pronounced growth in overnight stays is found among tourists from Canada and the US (+17.1% and +12.1%, respectively). The outlook for 2025 remains very positive, as a result of the recovery of purchasing power and expectations that the dollar will remain strong.

The public accounts end 2024 in positive territory for the second consecutive year

The budget balance (in cash terms) stood at 0.1% of GDP for the year as a whole, compared to 1.7% in 2023 (excluding the impact of the transfer of the CGD pension fund to CGA). The lower surplus is explained by the sharp growth in expenditure (9.2%, compared to 5.1% in the case of revenues). In any event, the slight positive balance is an improvement on the government’s own estimate (–0.4% of GDP). Based on this result, we estimate that in national accounting terms the surplus has been around 1.0% of GDP, which, if confirmed, would far exceed the estimates of both the government (0.4%) and CaixaBank Research (0.5%).