The tone of the Portuguese economy improves in the last quarter of 2024

The economic indicators point to an acceleration of activity in Q4

The Bank of Portugal’s composite indicators, with data to November, suggest an acceleration in the growth of overall economic activity to 1.3% in Q4 (1.2% in Q3) and of private consumption to 2.8% (vs. 2.4%). This trend is also confirmed by other indicators, such as retail sales, card spending and car sales, which rose by 11.9% year-on-year in Q4. The economic climate indicator, meanwhile, gained strength in Q4, with improvements across all sectors, especially in services.

The outlook for 2025 remains positive, supported by the resilience of consumption, thanks to the strength of the labour market and the recovery of real disposable income, driven both by wage increases and by the containment of inflation. An acceleration in investment also seems plausible, both due to the reduction in financing costs and because we are entering the penultimate year of execution of NGEU funds. In short, the domestic factors reveal a sound economy, although they could be counteracted by external factors related, for example, to the rise in protectionism or the impact that a potential aggravation of geopolitical factors could have on key commodity prices.

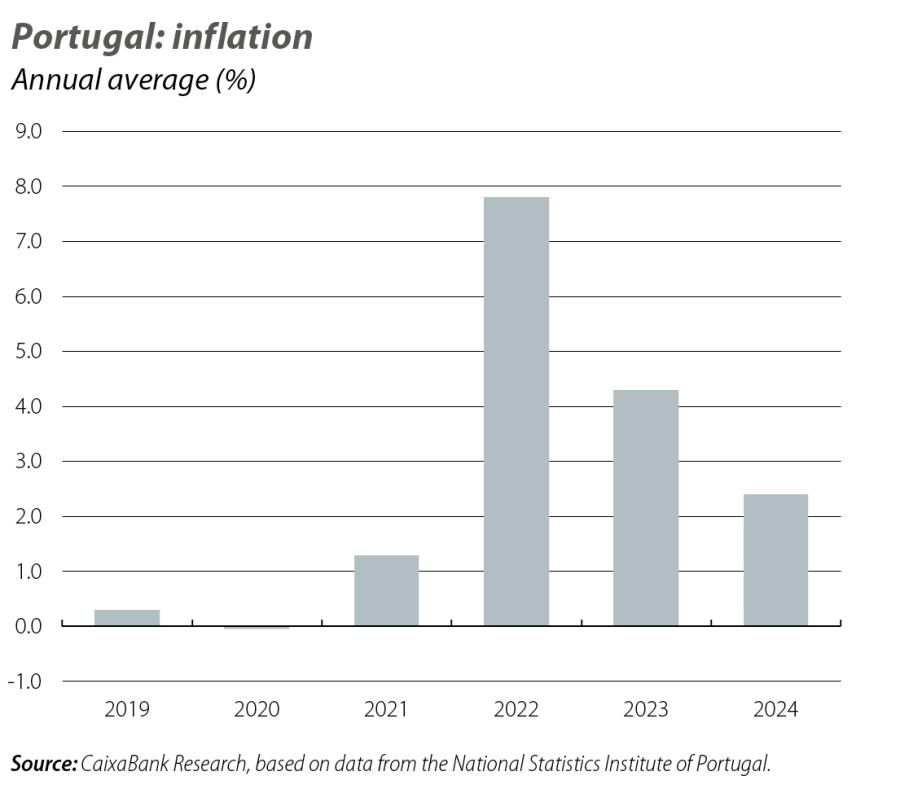

Inflation closed 2024 with an annual average of 2.4%

In December, headline inflation rebounded to 3.0% (2.5% in November) and core inflation to 2.8% (vs. 2.6%), placing the average inflation rate for 2024 at 2.4%, compared to 4.3% in 2023. For 2025, our current forecast for average inflation stands at 2.1%, a figure that would definitively mark the end of the inflationary cycle of recent years. The price outlook looks favourable: on the one hand, the futures markets for the main agricultural products point to prices closer to those that existed before the war in Ukraine; as for services, in telecommunications, for example, increased competition and the announcement by some operators that they will keep prices unchanged suggest that inflation will remain contained in this category.

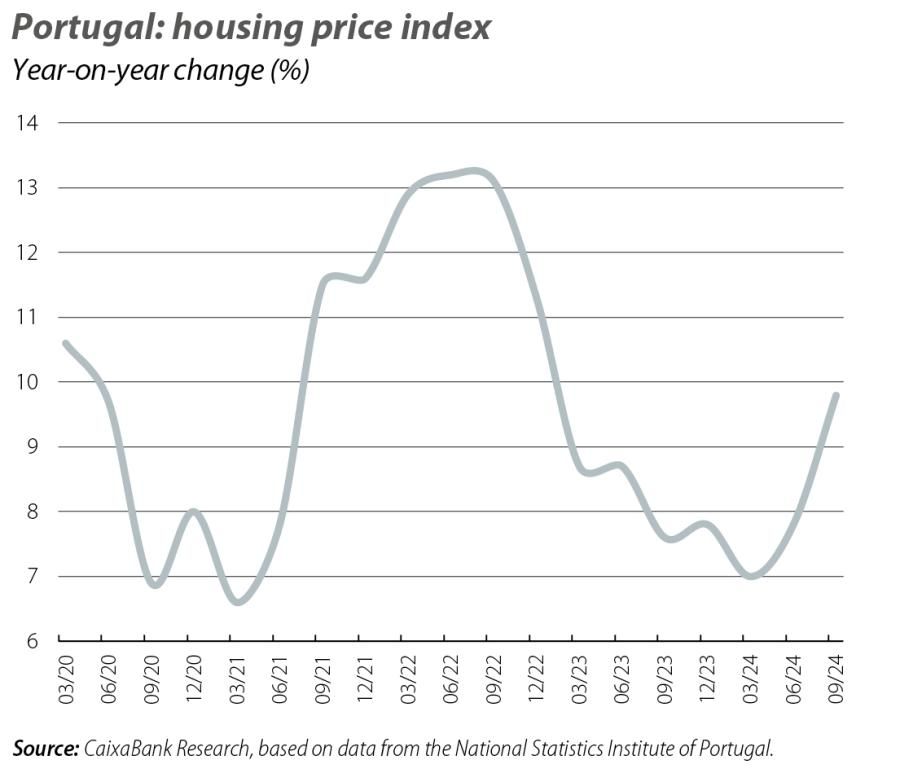

The housing market goes from strength to strength

The Housing Price Index for Q3, published at the end of December, reveals a rapid rate of growth: +3.7% quarterly (+3.9% in Q2) and +9.8% year-on-year (vs. +7.8%). In Q3, 40,909 homes were sold, 19.4% more than in Q3 2023 and 10.2% more than in the previous quarter. The average price of the homes sold rose to 221,300 euros (4.3% more than in Q2). The publication of this statistic, together with other available indicators for Q4, fuels the expectation that average price growth in 2024 will be much closer to that of 2023, so the current CaixaBank Research forecast (6.8%) is somewhat skewed to the downside.

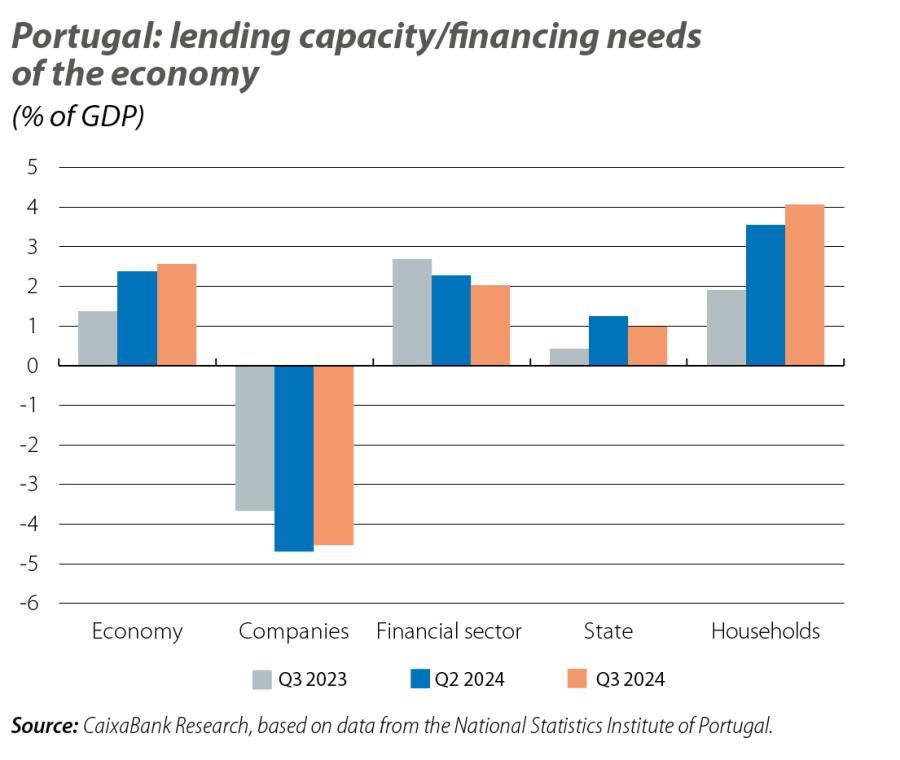

The economy’s lending capacity increases to 2.6% of GDP in Q3 2024

This essentially reflects the increase in the capacity of households (4.1% of GDP vs. 3.5% in Q2), as a result of the 8.4% increase in savings versus the previous quarter, driven by disposable income growth of 2.3%, which exceeded that of consumption (1.6%).