The Spanish real estate market in 2024-2025: in expansive mode

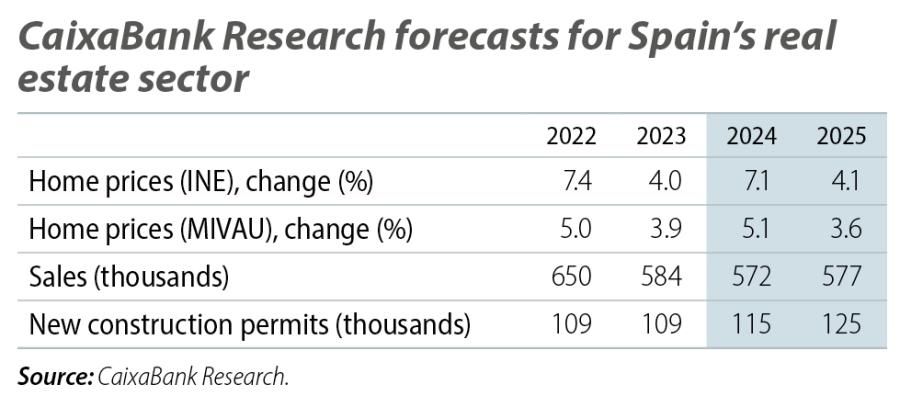

The current state of Spain’s real estate market is characterised, broadly speaking, by the strength of demand and the scarcity of supply. As a result of this mismatch between supply and demand, home prices have accelerated, especially in the case of new-builds. Here at CaixaBank Research we already predicted that the upward trend in the real estate market would take hold in 2024, but the published data have proved to be more bullish than expected, and this, together with the improvement in the economic outlook, has led us to revise upwards our real estate sector forecasts for 2024-2025.

Strength of housing demand

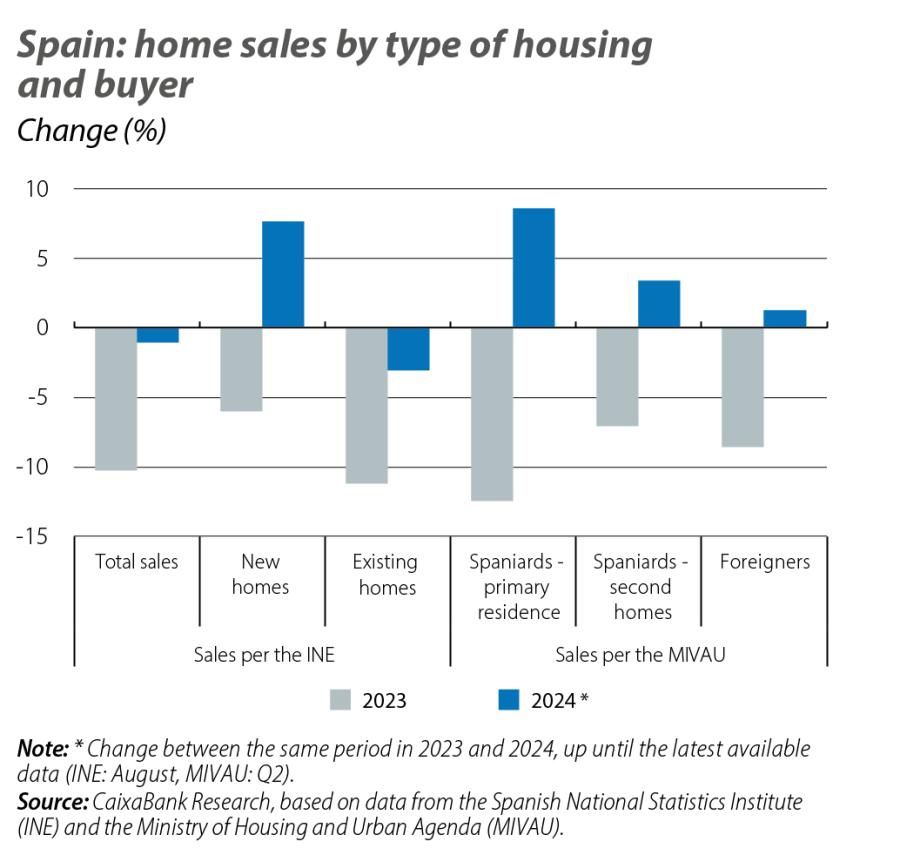

After peaking in 2022 with 650,000 home sales according to the National Statistics Institute (INE), the number of transactions dropped sharply in 2023 (–10 2%) due to the rise in interest rates and the fading of the temporary factors that had driven up the demand for housing in the aftermath of the pandemic. Between January and August 2024, the number of sales has remained practically stable at around 578,000, which is a significant figure from a historical perspective (450,000 on average during the period 2015-2019). By type of housing, a change in pattern is beginning to emerge, with sales of new homes recording rapid growth (+7.7% year-on-year in the eight-month period from January to August) while those of existing homes have declined (–3.1%). That said, new home sales account for just 20.3% of the total (+1.5 pps compared to 2023).

According to type of buyer, sales to Spaniards buying a primary residence grew the most (+8.6% year-on-year in the first half of 2024), after registering a sharp decline in 2023 (–12.4%), reflecting the fact that this category of buyer is the most sensitive to changes in interest rates.1 On the other hand, the number of sales to foreign buyers, which withstood the increase in financing costs much better, showed the most moderate growth in the first half of 2024 (1.3%), although it remained high from a historical perspective (some 87,600 sales in the trailing four quarters to Q3 2024, representing 14.7% of the total according to the Association of Registrars). Finally, sales to Spanish buyers for second homes grew by 3.4% in the first half of 2024 and represent around 13% of total sales.

Looking ahead to 2025, we expect that the factors supporting housing demand will remain present: net job creation (around 400,000 more people in employment), wage growth above inflation, dynamic migration flows (albeit below those of 2022-2023), strong foreign demand, and healthy household finances (household debt represented 45.4% of GDP in Q2 2024, below the euro area average of 52.4%). This is coupled with the easing of financial conditions thanks to the ECB’s lowering of interest rates. At its October meeting, the central bank cut interest rates by 25 bps for the third time since June and lowered the depo rate to 3.25%. Following this meeting, the markets assigned a 100% probability to another 25-bp cut in December, while for 2025 market prices pointed to approximately four additional interest rate cuts by the end of that year.

- 1For the breakdown by type of buyer, we use data from the Ministry of Housing and Urban Agenda (MIVAU). We consider a sale to be a second home when the province in which the buyer resides differs from the one where the home is located.

Shortage of supply, but with signs of improvement

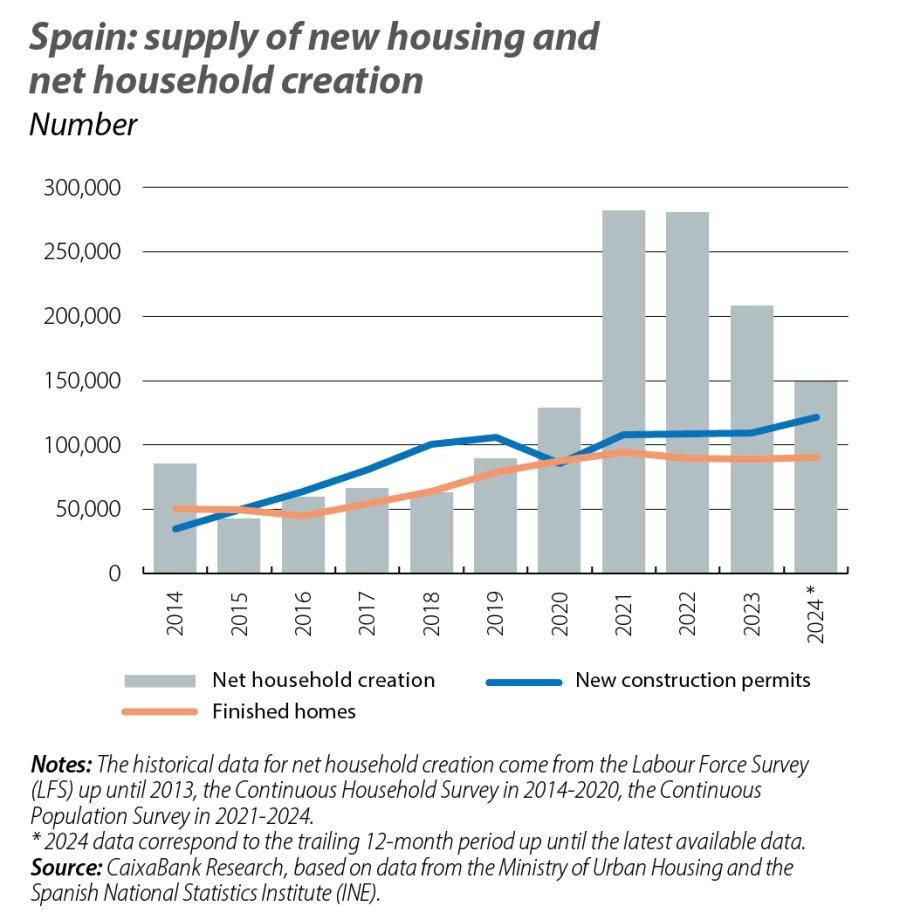

The main imbalance in the real estate market today is the lack of housing supply, especially affordable housing. According to the Spanish National Statistics Institute’s Continuous Population Statistics, between 2021 and 2023 some 777,000 net households were created (about 260,000 per year), while the number of homes completed in this same three-year period amounted to 273,000 (about 90,000 per year) and the number of new construction permits was about 110,000 per year. It is clear that the number of new homes being built falls far short of demand.

The latest data show that this gap has narrowed (with an increase in net households of around 150,000 up until Q3 2024 according to the Labour Force Survey, compared to some 121,000 new construction permits granted in the 12 month to August). In any case, the gap accumulated in previous years is wide and continues to determine developments in the market. On the other hand, we cannot rule out the possibility that the reduced dynamism in net household creation could be a consequence of the increasing difficulty in affording a home, whether as a buyer or as a renter.

While the major players in Spain’s real estate market share this diagnosis, there are multiple factors that are limiting housing production, including the shortage of land earmarked for development, the labour shortage, high construction costs (although the current increases are moderate in year-on-year terms, they are still 30% above 2019 levels) and regulatory changes. It should also be noted that the construction sector has a productivity problem which goes back decades: whereas real GDP per hour worked grew by 19.4% between 1995 and 2023 for the economy as a whole, and by 56.5% for the manufacturing industry, in the case of construction it fell 27.7%.

Home prices in Spain accelerate supported by falling interest rates

The imbalance between housing supply and demand, the improvement in the economic outlook and the decline in interest rates have supported the growth of home prices, which in the first half of 2024 rose by 7.1% year-on-year, according to the Spanish National Statistics Institute. New homes recorded the sharpest price growth (+10.7% year-on-year in the first half of 2024), although existing home prices are also increasing rapidly (+6.5%).

We expect this rally in home prices to continue in 2025, with nominal growth expected to be around 4%, well above inflation. It should be noted that, given the current boom in the real estate market and the good performance of the Spanish economy as a whole, the risks of home prices rising more quickly than anticipated in our baseline scenario are far from negligible. On the contrary, the high prices that have already been reached in certain areas mean that the difficulties people have in affording a home could end up becoming a limiting factor for the growth of demand and prices.

Finally, it should be noted that the affordability problems associated with the rise in home prices, in both the sales and the rental markets, could end up generating adverse economic and social effects in the medium and long term. Notably, the struggle to afford a home can affect vital decisions and trends such as birth rates, workers’ geographical mobility and the accumulation of human capital, among others. On the other hand, there are companies that point to the high cost of housing as a limiting factor for hiring labour in certain sectors and locations. There is no simple solution to this situation, but we hope that the supply of housing in general, and of affordable housing in particular, will gain traction and that this will help to redirect the situation.2

- 2

See the article «The challenge of increasing the supply of affordable housing in Spain» in the Real Estate Sector Report S2 2024.