The real estate boom spreads across Spain

House prices and the number of sales have surged since mid-last year in Spain, although there are significant geographical differences. In 2024, house prices grew more vigorously in the most expensive areas, thus widening the price gap between municipalities and regions, and this is causing some of the demand to begin to shift towards more affordable areas. At the provincial level, temperature could be a relevant factor: sales are growing more rapidly in the cooler regions of the Northwest of the peninsula, while the traditional tourist areas are experiencing a more gradual increase in demand. In addition, the sharp rise in house prices in the major cities is causing a shift in housing demand towards more affordable peripheral areas, where house prices are expected to experience rapid growth in 2025.

Where are house prices and sales growing the most in Spain?

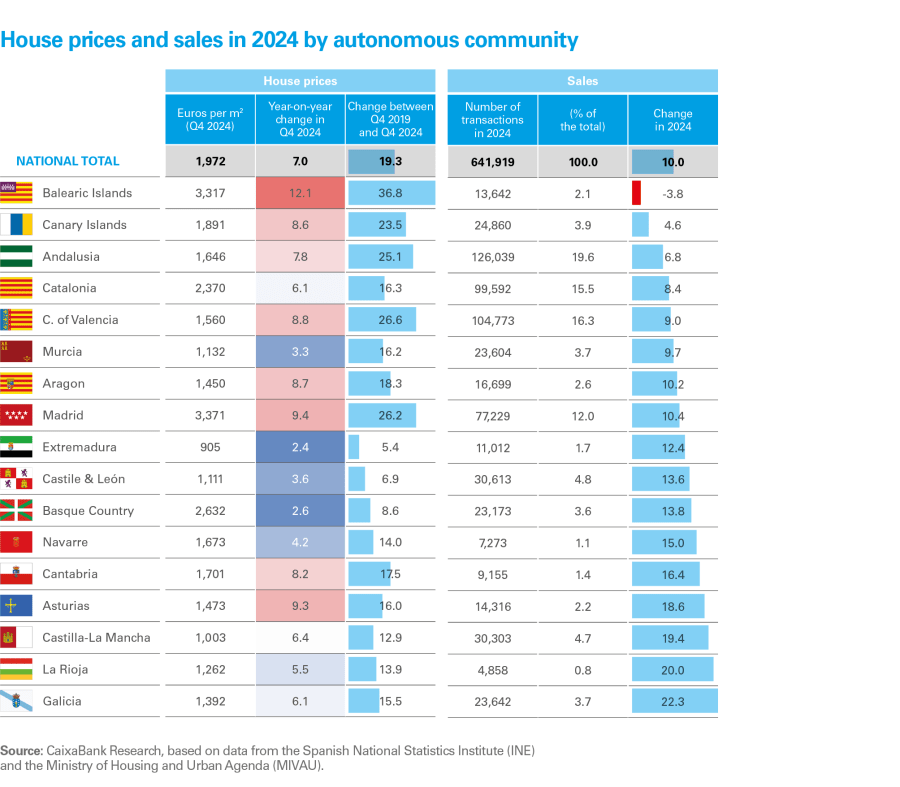

House prices grew in all autonomous community regions in 2024, although the pace of that growth varied widely.5 The biggest increase was registered in the Balearic Islands (12.1% year-on-year in Q4 2024) and in the Community of Madrid (9.4%), which are precisely the regions with the highest average price (above €3,000/m2). On the other hand, Extremadura, the Basque Country, Murcia and Castile and León showed the lowest increases in house prices (below 4% year-on-year in Q4 2024) and their starting point was an average price below the national average, with the exception of the Basque Country. As a result of this uneven rate of growth, prices between regions are diverging and the gap between the most expensive and the cheapest regions is widening.6

This sharp increase in house prices in the most expensive regions is causing a slight depletion of demand, while the buying boom is spreading to more affordable areas. For instance, the biggest increases in sales by autonomous community were registered in Galicia (22.3%), La Rioja (20.0%), Castilla-La Mancha (19.4%), Asturias (18.6%), Cantabria (16.4%), Navarre (15.0%) and the Basque Country (13.8%), most of which are located in the Northwest of the peninsula. The Balearic Islands was the only one to experience a decrease in the number of sales (–2.8% in 2024), while other tourist regions, such as the Canary Islands, Andalusia, Catalonia and the Valencian Community, recorded a modest increase in sales, below the national average, although it is true that these regions represent more than half of all sales in Spain as a whole.

- 5In this article, we focus on the appraisal value of unsubsidised housing published by the Ministry of Housing and Urban Agenda (MIVAU), since this data is published at the provincial level and for municipalities with more than 25,000 inhabitants.

- 6The standard deviation of house prices between autonomous community regions, provinces and municipalities is at an all-time high, as is the ratio between the maximum and the minimum price at each geographical level.

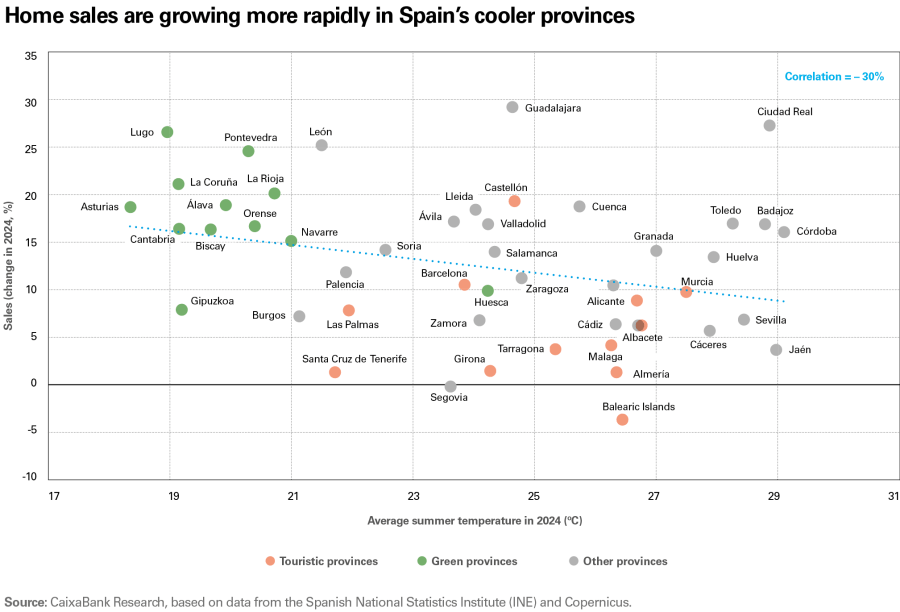

Recently, it is apparent that the average annual temperature, as well as the rise of green tourism and active tourism since the pandemic, are factors that are also fuelling sales in certain regions. To illustrate these trends, the chart on the following page places the provinces according to their average temperature in the summer of 2024 (horizontal scale) and their sales growth in 2024 (vertical scale). It can be seen that the cooler areas of Spain, marked with a green circle, are experiencing higher sales growth than the traditionally more touristic and hotter provinces (red circle) or the rest. This pattern shows the growing attraction that the Northwest of the peninsula is gaining as a tourist destination, as a result of the increase in temperatures and the heat waves of recent summers. An analysis of tourist spending, based on card payments recorded on CaixaBank POS terminals, shows that the coolest municipalities in Spain recorded the fastest growth in tourist spending between the high seasons of 2019 and 2023, highlighting the rise of green and active tourism in the more temperate areas.7

- 7See «The impact of climate change on tourism in Spain: analysis and outlook» in the Tourism Sector Report S1 2024.

This trend is translating into a greater level of interest in homes in these regions, including among foreign buyers. According to data from the Association of Registrars, the combined total home sales to foreign buyers in Galicia, Asturias, Cantabria and the Basque Country, which accounted for just 1.8% of the total in Q4 2020, reached 3.9% in Q4 2024. Among these four autonomous communities, the greatest international interest is the Principality of Asturias, where sales to foreigners represent 5.8% of the total, followed by the Basque Country (3.7%), Cantabria (3.6%) and Galicia (2.2%). It should be noted that, despite this growing interest, the percentages of sales to foreign buyers in this area of the country are well below the national average (14.6% in 2024).

The rise of green and active tourism in Spain’s more temperate municipalities highlights the attraction that these types of destinations are gaining among domestic and foreign home buyers

The growth in house prices is spreading to the periphery of Spain’s major cities

If we analyse the evolution of house prices in municipalities with more than 25,000 inhabitants, it is apparent that the rally is spreading to more and more municipalities. In particular, 47.1% of municipalities registered a year-on-year increase in excess of 10% in Q4 2024, which is 20 points more than in the previous quarter (27.1%). On the other hand, only 2.3% of municipalities experienced a drop in house prices.

CaixaBank Research’s house price forecasting models, which use big data and are based on machine learning techniques,8 indicate that this year the number of municipalities that register double-digit growth will increase. Specifically, according to our models, an appreciation of house prices in excess of 10% is anticipated in 58% of Spanish municipalities with more than 25,000 inhabitants (compared to 47% today). It should also be noted that a decrease in the price of housing is not expected in virtually any municipality (see the last column in the chart on the following page).

- 8These models use GDP forecasts by autonomous community as the main macroeconomic factor, and a large number of socio-demographic and real estate indicators (based on internal CaixaBank data and external data from corroborated sources) to capture the differential evolution of the real estate markets in each location.

The forecasts for municipalities of more than 25,000 inhabitants suggest we will see widespread growth in house prices in 2025

In 2024, the biggest house price increases were recorded in the largest municipalities and in the most touristic ones. Specifically, the price of housing grew by 9.1% on average in Spanish municipalities with over 200,000 inhabitants (7.4% in the rest) and by 10.3% in the touristic ones (6.5% in non-touristic ones). Our forecasting models suggest that in 2025 house prices will continue to grow more vigorously in touristic municipalities than in non-touristic ones. On the other hand, the differences between the municipalities with more than and less than 200,000 inhabitants will gradually narrow: the models predict similar price increases in both cases, of around 10%.

The forecasting models also reflect a certain depletion of demand in the major city centres and its displacement from the most expensive municipalities towards more affordable areas. This trend is particularly pronounced in Spain’s two biggest cities, Madrid and Barcelona, which have registered significant price increases in recent years and where the so-called «oil stain» phenomenon is the most apparent, extending from the cities themselves out towards the adjoining and peripheral towns and cities.

In the charts on the next page, we show the latest data on the growth in house prices, corresponding to Q4 2024, and the forecast for the end of this year for the cities of Barcelona and Madrid and the municipalities of their respective provinces, ordered according to their distance from each city centre.

The sharp rise in house prices in Spain's major cities is causing a certain displacement of housing demand towards more affordable peripheral areas

In the city of Barcelona, house prices grew 10.1% year-on-year in Q4 2024. The nearest municipalities (located within 17 kilometres of the city centre) registered an average growth of 6.4%; this figure was 6.7% for those located mid-distance from the city (17-24 kilometres) and it was a significant 8.1% in the case of those furthest away (more than 24 kilometres). In this latter group we find some of the municipalities that recorded the highest price increases in the province, such as Martorell (15.2% year-on-year in Q4 2024), Vilafranca del Penedès (12.4%), Manresa (12.4%) and Igualada (10.4%). Despite the sharp rise in house prices in these municipalities, their average price is approximately half that of the city of Barcelona (€1,942/m2 compared to €4,034 in Barcelona). The forecasting models suggest that these more distant municipalities with a lower average price will continue to experience above-average price growth.

In the Community of Madrid a similar phenomenon is observed, albeit perhaps less pronounced. In the group of municipalities located furthest away from Madrid’s Puerta del Sol, we find some that have registered considerable price growth in the last year, such as Galapagar (14.3% year-on-year in Q4 2024), Collado Villalba (13.0%), Torrejón de Ardoz (11.9%) and Alcalá de Henares (10.2%). However, other municipalities closer to the city have also recorded growth rates above 10%, most notably Parla (15.8%) and Alcobendas (14.7%). In any case, the forecasts for the municipalities of Madrid also indicate that the rate of growth, on average, could be somewhat more vigorous in those located furthest from Puerta del Sol, although it would not exceed the growth rate that is expected in the capital.