How is climate change impacting the Spanish real estate sector?

Climate change represents a key challenge for the real estate sector and for the entire Spanish economy. In this article, we analyse the risks associated with extreme weather events and the transition risks which the sector must address, as well as the role of public policies.

Climate change poses risks for the real estate sector that constitute a crucial challenge not only to the sector itself, but to the whole of the Spanish economy. Risks associated with extreme weather events can have an impact on property values and home insurance premiums, as is already happening in certain regions. Furthermore, the sector will have to adapt to stricter regulations that will allow it to become carbon neutral by 2050. To address the magnitude of the challenges associated with climate change, public policies must act in a variety of areas. These could range from improving the information available for economic agents to make informed decisions, to facilitating the conversion of the housing stock to cut greenhouse gas emissions, and encouraging the investments needed to mitigate the impact of physical risks. It is also imperative that these transitional measures be accompanied by mechanisms to mitigate their impact on the most vulnerable households, ensuring an efficient and fair climate transition.

Climate change poses significant risks to the real estate sector, in the form of both physical and transition risks. These risks are a crucial challenge not only for the real estate sector, but also for the entire Spanish economy, given the important role that real estate assets play in households’ wealth and on financial institutions’ balance sheets.23 Understanding and managing these risks will be essential for achieving a successful climate transition in the sector, as well as for minimising the costs and risks to financial stability and to the wider economy.

- 23. 75.7% of Spanish households’ total wealth is held in real estate (based on data from Q4 2023), and the outstanding balance of mortgage loans represented 31.2% of GDP in Q1 2024, according to the Bank of Spain (Summary Indicators).

The physical risks associated with climate change refer to the economic costs and financial losses resulting from the increasing severity and frequency of climate or weather events related to climate change.24 They are considered to be acute when triggered by extreme weather events such as heat waves, landslides, floods, wildfires and storms; and chronic when they arise from more gradual and long-term climate changes, such as variations in precipitation levels, ocean acidification, or rising sea levels and average temperatures.

- 24. Definition according to the Basel Committee on Banking Supervision (BCBS), which coincides with that of the Task Force for Climate Related Financial Disclosures (TCFD).

Extreme climate events are usually associated with a decrease in the value of the homes affected by such events

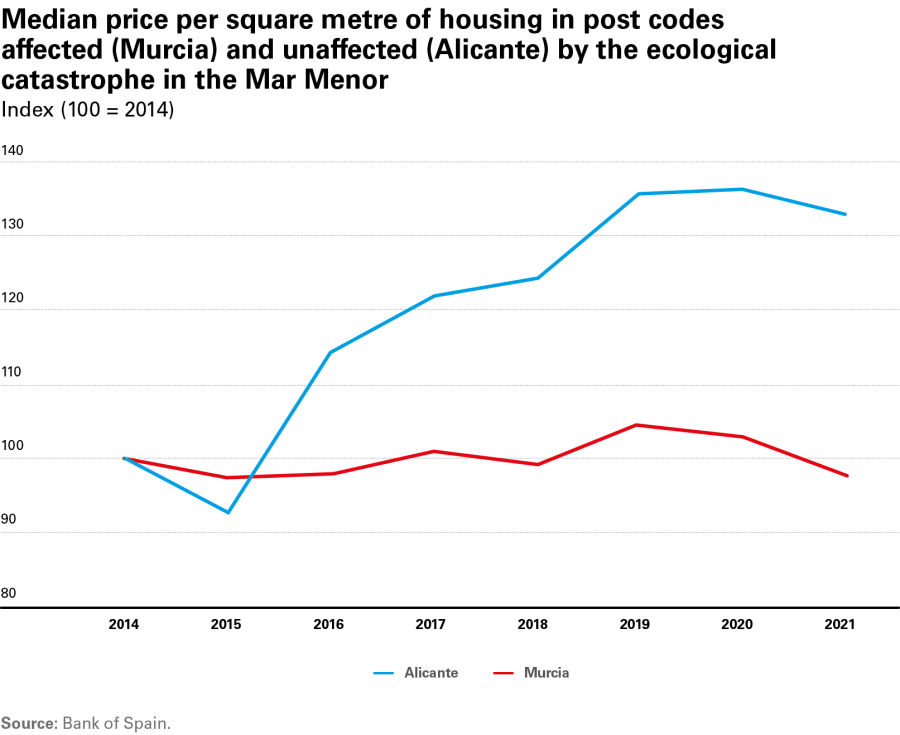

Several studies show that the materialisation of physical risks can significantly reduce the value of homes, either because of direct damage or due to the emigration of the population from the affected areas after an event. In Spain, recent reports have analysed the economic impact of the ecological degradation of the lagoon known as the Mar Menor in the Murcia region,25 which according to the Bank of Spain has caused losses in the value of the homes in the affected area amounting to 4.15 billion euros over a period of six years (2016-2021).26 As can be seen in the chart, since 2016 there has been a negative impact on the change in prices per square metre of homes sold in the vicinity of the Mar Menor in relation to unaffected areas in southern Alicante, which equates to a 45% loss of increase in value in the affected area.

- 25. Although the ecological degradation of the Mar Menor cannot be considered a direct consequence of climate change, analysing the economic impact of environmental disasters is a useful way to approximate the potential impact that extreme weather events can have.

- 26. M. Lamas Rodríguez, M.L. García Lorenzo, M. Medina Magro et al. «Impact of climate risk materialization and ecological deterioration on house prices in Mar Menor, Spain». Sci Rep 13, 11772 (2023).

In the home insurance market, the risks posed by climate change are beginning to materialise

Although the materialisation of physical risks can significantly reduce the value of homes, the literature suggests that these risks are not fully reflected in market prices prior to their occurrence.27 This market failure can lead to sub-optimal decisions, such as encouraging investment in areas with a high exposure to climate risks (areas susceptible to flooding, developments close to large forest masses, etc.), which could amplify the economic value of such losses. In this regard, public policies ought to be directed towards generating high-quality and highly granular information on the climate risks affecting each area,28 thus allowing agents involved in the housing market to make more informed decisions and to manage these risks more efficiently. Increasing the quantity and improving the quality of information is particularly important in this area due to cognitive biases related to climate events. In particular, individuals tend to underestimate low-probability, high-impact events, and this can lead to suboptimal decision-making when it comes to buying or valuing properties.29

Increased physical risks can also lead to higher home insurance premiums. In more extreme cases, there are even areas where homes have become uninsurable. A prime example is that of the US, where in states such as California and Florida a growing number of homes cannot get insurance in the private market, leading the government to intervene as a last-resort last-resort insurer. In these two states as a whole, the value of the homes insured by the public sector has increased from 160 billion to 633 billion between 2017 and 2024.30 Although home insurance is crucial for ensuring that households are resilient to climate risks, this policy of providing public insurance in areas that are highly exposed to climate change not only burdens governments with significant risks, but it could also push households to assume more climate-related risks than if they were to internalise the costs involved. In this regard, it is very important that public sector interventions are geared towards mitigating climate risks and that incentives which can lead to excessive risk-taking are avoided.

- 27. Gourevitch et al. «Unpriced climate risk and the potential consequences of overvaluation in US housing markets». Nature Climate Change, 2023.

- 28. For example, creating accessible and up-to-date databases on climate risks by region or adapting the regulations on property appraisals so that climate risks can be taken into account more explicitly when making valuations.

- 29. See Haines et al. «Explaining the description-experience gap in risky decision-making: learning and memory retention during experience as causal mechanisms», Cognitive, Affective, & Behavioral Neuroscience, 2023, and Barron and Ursino «Underweighting rare events in experience based decisions: Beyond sample error», Journal of Economic Psychology, 2013.

- 30. Sum of the assets insured by Citizens Property Insurance Corporation and the California FAIR plan in early 2024. See «The next housing disaster», The Economist, April 2024.

Spain’s housing stock is not energy efficient and housing refurbishments have not taken off

Transition risks relate to the costs associated with adapting to a low-carbon economy. They range from regulatory, legal and technological risks (a new technology displaces old technology, causing disruptions) to market risks (changes in the supply and demand of commodities, etc.) and reputational risks. For the housing market, the most relevant transition risks are the implementation of stricter regulations aimed at reducing greenhouse gas emissions and the need to adapt homes to new energy standards.

In 2023, the European Commission approved a revised Energy Performance of Buildings Directive (EPBD) with the aim of ensuring that the housing sector contributes to achieving climate neutrality by 2050 and to cutting CO2 emissions by 55% by 2030. The housing sector is key to reducing emissions, since, according to the same directive, European buildings consume 40% of all energy in the EU and produce 36% of the bloc’s emissions. This directive requires the primary energy consumption of residential buildings to be reduced by at least 16% by 2030 and by between 20% and 22% at least by 2035. Meeting these goals will require both renovating the existing housing stock and ensuring the energy efficiency of newly built housing, which according to the same directive will have to be entirely zero emissions by 2030. Although the directive does not specify sanctions, it is the responsibility of each Member State to take actions in order to achieve the objectives that have been set.

Complying with this directive will require a major effort, as the current housing stock has a very low level of energy efficiency. Today, 25.6% of dwellings have an F or G rating for emissions, and only 19% have a D rating or higher. Despite the imperative need to renovate the housing stock in Spain, this process is currently stagnant at around 25,000 homes per year, according to the home refurbishment permits granted by the Ministry of Housing and Urban Agenda (MIVAU). In this regard, the disbursement of NGEU funds available for the economic and social recovery programme in residential settings ought to be accelerated. According to the AIReF31 Recovery, Transformation and Resilience Plan (RTRP) Observatory, only 18% of the 6.187 billion euros allocated to renovations and urban regeneration (component 2 of the RTRP) had been formalised by April 2024.32

- 31. AIReF, RTRP Observatory.

- 32. According to the General Comptroller of the State Administration (IGAE), payments made under the category «C02.I01 Renovation and economic and social recovery of residential environments» amount to 676.6 million euros in 2022, 384.3 million in 2023 and 150 million in January-April 2024.

The climate transition in the real estate sector must be managed taking into account the significant wealth distributional implications that it entails: the most humble households are the ones most vulnerable to climate change

It is important to note that low-income households are more affected by the risks posed by climate change. On the one hand, housing accounts for a higher percentage of their gross wealth: 83.5% of their gross wealth is held in real estate assets, compared to 58.7% among households in the top income decile. On the other hand, as stated in Directive 2024/1275 on the energy efficiency of buildings, the most modest households tend to live in homes that are in poorer condition and have lower energy performance ratings.

From an economic policy perspective, subsidising investments for adapting to climate change is desirable for two key reasons. The first is that increasing a home’s energy efficiency has positive effects for wider society. The second is that investments to improve energy efficiency can be unaffordable for households on more modest incomes. Therefore, transitional measures should be accompanied by a mechanism of grants or subsidies that facilitates them and mitigates their impact on the most vulnerable households.

- 23. 75.7% of Spanish households’ total wealth is held in real estate (based on data from Q4 2023), and the outstanding balance of mortgage loans represented 31.2% of GDP in Q1 2024, according to the Bank of Spain (Summary Indicators).

- 24. Definition according to the Basel Committee on Banking Supervision (BCBS), which coincides with that of the Task Force for Climate Related Financial Disclosures (TCFD).

- 25. Although the ecological degradation of the Mar Menor cannot be considered a direct consequence of climate change, analysing the economic impact of environmental disasters is a useful way to approximate the potential impact that extreme weather events can have.

- 26. M. Lamas Rodríguez, M.L. García Lorenzo, M. Medina Magro et al. «Impact of climate risk materialization and ecological deterioration on house prices in Mar Menor, Spain». Sci Rep 13, 11772 (2023).

- 27. Gourevitch et al. «Unpriced climate risk and the potential consequences of overvaluation in US housing markets». Nature Climate Change, 2023.

- 28. For example, creating accessible and up-to-date databases on climate risks by region or adapting the regulations on property appraisals so that climate risks can be taken into account more explicitly when making valuations.

- 29. See Haines et al. «Explaining the description-experience gap in risky decision-making: learning and memory retention during experience as causal mechanisms», Cognitive, Affective, & Behavioral Neuroscience, 2023, and Barron and Ursino «Underweighting rare events in experience based decisions: Beyond sample error», Journal of Economic Psychology, 2013.

- 30. Sum of the assets insured by Citizens Property Insurance Corporation and the California FAIR plan in early 2024. See «The next housing disaster», The Economist, April 2024.

- 31. AIReF, RTRP Observatory.

- 32. According to the General Comptroller of the State Administration (IGAE), payments made under the category «C02.I01 Renovation and economic and social recovery of residential environments» amount to 676.6 million euros in 2022, 384.3 million in 2023 and 150 million in January-April 2024.