Foreigners’ appetite for homes in Spain since the pandemic

Foreign demand is a fundamental pillar in explaining the strength of housing demand in the current expansionary cycle. Much of this demand comes from foreigners who reside in Spain – a group that has been on the rise in recent years with the recent influx of immigrants into our country.

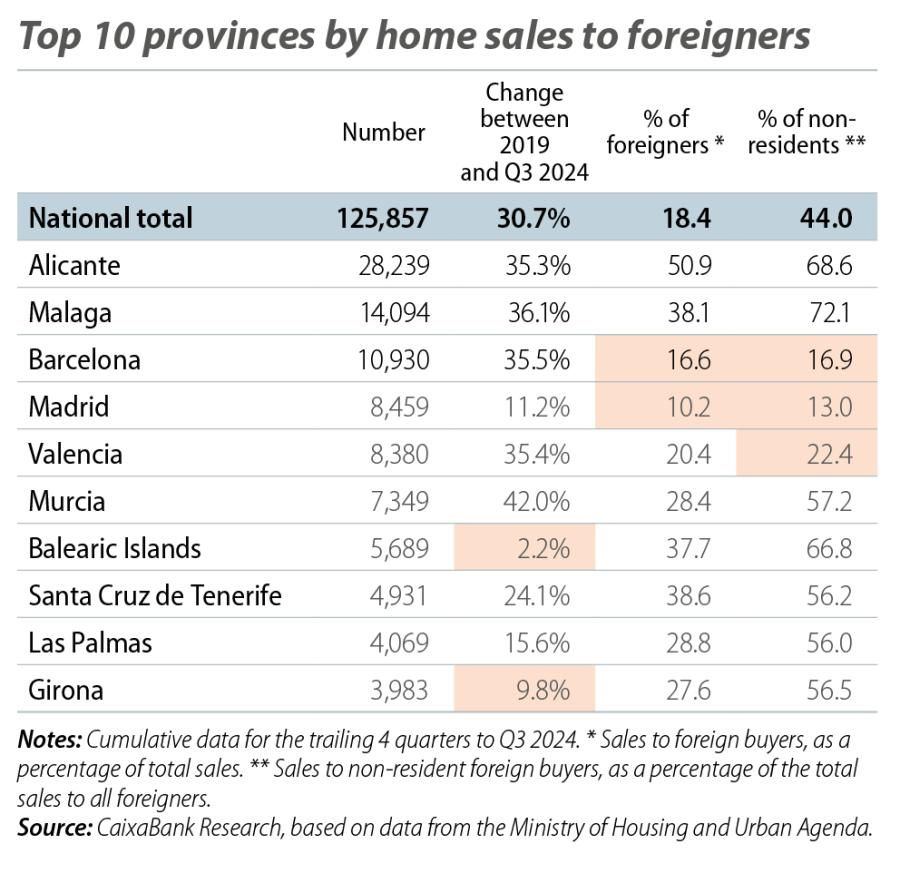

The demand among foreigners for housing in Spain has grown sharply since the pandemic. According to data on real estate transactions published by the Ministry of Housing and Urban Agenda (MIVAU), foreigners bought 125,857 homes in the trailing 12 months to Q3 2024, representing 18.4% of the total and 30.7% more transactions than in 2019.1In comparison, sales to Spanish buyers were 17.7% above the level of 2019. There is no doubt that foreign demand is a fundamental pillar in explaining the strength of housing demand in the current expansionary cycle. As we shall see, much of this demand comes from foreigners who reside in Spain – a group that has been on the rise in recent years with the recent influx of immigrants into our country.

- 1According to the Spanish Association of Property Registrars (Colegio de Registradores), sales to foreign buyers accounted for 14.9% of the total, at around 87,600 sales, in the trailing four quarters to Q3 2024. In this article, we use the data from the Ministry of Housing and Urban Agenda (MIVAU, obtained from Notariado), as they allow us to distinguish between resident and non-resident foreigners.

Differences between resident and non-resident foreign buyers

Among foreign buyers, there is a different pattern of behaviour between those who live in Spain and those who do not. Generally speaking, these two groups have different purchasing motives: non-residents tend to buy homes in Spain as a place to spend their holidays and have a preference for tourist areas, whereas residents usually do so for reasons related to work or education and it is more common for them to buy in more urban areas.2 There are also differences in terms of the average price per square metre of the homes purchased: non-residents purchase higher-priced homes per square metre (€2,895/m2 in S1 2024) than residents (€1,734/m2) and nationals (€1,659/m2).3 In terms of nationalities, the main non-resident buyers come from European countries, with the British, German, Dutch, Belgian and French topping the list (48.5% of the total). Among foreign residents, Moroccans were the main buyers in the first half of 2024, followed by Romanians and Italians. These nationalities lead the rankings in terms of share of sales in most autonomous community regions, with the exception of Galicia and Madrid, where the Portuguese and the Chinese, respectively, made the most purchases.

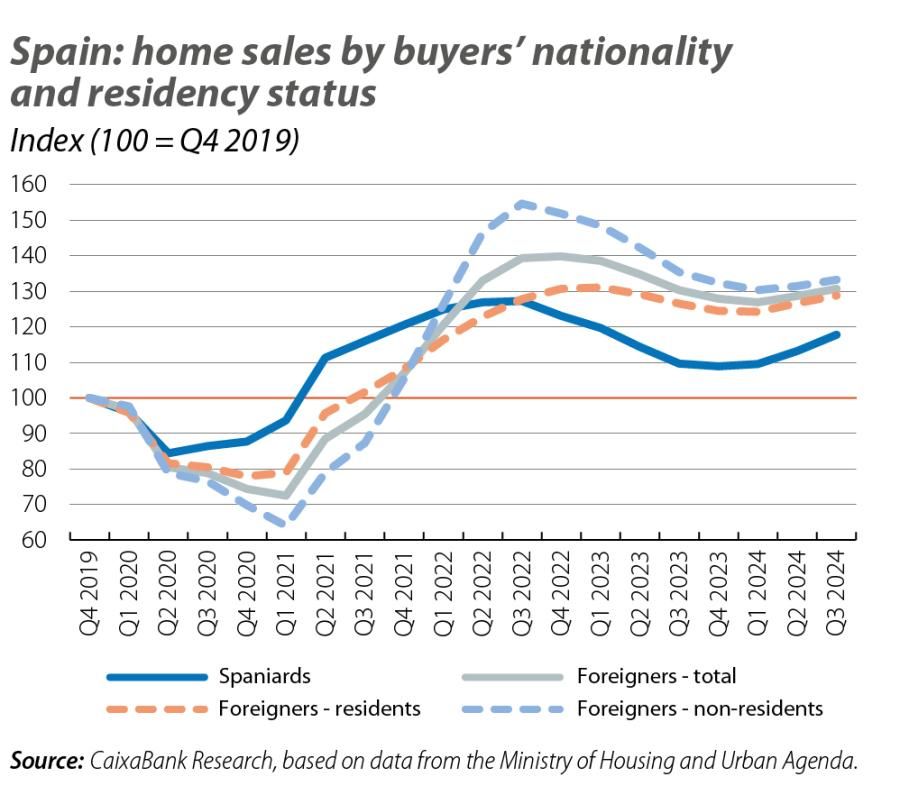

In the chart we can see that, during the pandemic, sales to non-resident foreigners fell the most (–30.2% compared to –22.1% among resident foreigners and –12.2% among Spaniards in 2020), as a result of the restrictions on international mobility at that time. However, acquisitions by non-residents experienced a strong rebound in 2021, and especially in 2022, which far surpassed that of residents and Spaniards.

With the rise in interest rates, sales declined for all categories of buyer in 2023. Nevertheless, the decline was more moderate among resident foreigners (–4.7%) than for non-resident foreigners (–12.9%) and Spaniards (–11.6%), as the rise in interest rates coincided with a significant wave of migration,4 which is driving up sales to resident foreigners.5

Regional differences: foreigners choose tourist and urban areas

The boom in the sale of homes to foreigners has not affected the whole country equally, as they are concentrated in tourist areas (the islands and the Mediterranean arc) and urban areas (especially Barcelona and Madrid). The table shows the 10 provinces with the highest number of sales to foreign buyers in Q3 2024 (trailing four-quarter cumulative total). These provinces account for 76% of the total sales to foreigners, 90% of the sales to non-residents, but only 66% of those to resident buyers, demonstrating the greater geographical dispersion of the latter.

Alicante is the province with the most foreign buyers, where they represent approximately half of all sales, with a significant presence of non-residents (68.6% of the total number of foreigners). Other tourist provinces, such as Malaga and the Balearic Islands, also have a large proportion of non-resident foreign buyers. On the other hand, resident foreigners predominate in Barcelona, Madrid and Valencia.

The end of Golden Visas will have a limited impact

In 2013, Act 14/2013 was passed, which allowed non-EU residents to obtain residence permits in Spain in exchange for making significant investments in the country, such as the purchase of property valued at over 500,000 euros. According to government data, between the time this law was passed and October 2024, 15,149 Golden Visas were granted in connection with investments in real estate, most of them to citizens of China, Russia, the United Kingdom, the USA, Ukraine, Iran, Venezuela and Mexico. The main provinces for these investments are Barcelona, Madrid, Malaga, Alicante, the Balearic Islands and Valencia, which account for as much as 90% of the authorisations granted nationwide.6

The European Commission has repeatedly expressed its concern about such programmes offering residency in exchange for investment, as they could expose the EU to security risks, money laundering and tax evasion, a concern which has intensified in the wake of the war in Ukraine. Several countries are withdrawing such schemes.7 In Spain, the law ending Golden Visas has been passed in January 2025 and will come into force in April. However, the impact on the property market of this abolition ought to be limited, as they represent a very small fraction of total sales.

- 6Organic Law 1/2025, of 2 January, on measures related to the efficiency of the Public Justice Service, cancels articles 63 to 67 of Act 14/2013, which established the conditions required to qualify for the Golden Visa.

- 7Ireland abolished its Golden Visa programme in February 2023, Portugal discontinued its real estate investment visa in 2023 and the Netherlands abolished its scheme in January 2024. Albania planned to introduce a Golden Visa scheme in 2022, but the European Commission urged it to abstain.