The Spanish economy, faring better than we thought

Spain’s National Statistics Institute has revised the growth of recent years upwards and the flash indicators for Q3 point to an improvement in private consumption, despite the slowdown in the labour market in the quarter. Inflation unexpectedly fell to 1.5% in September, while housing demand was higher than expected.

Spain’s National Statistics Institute revises the growth of recent years upwards

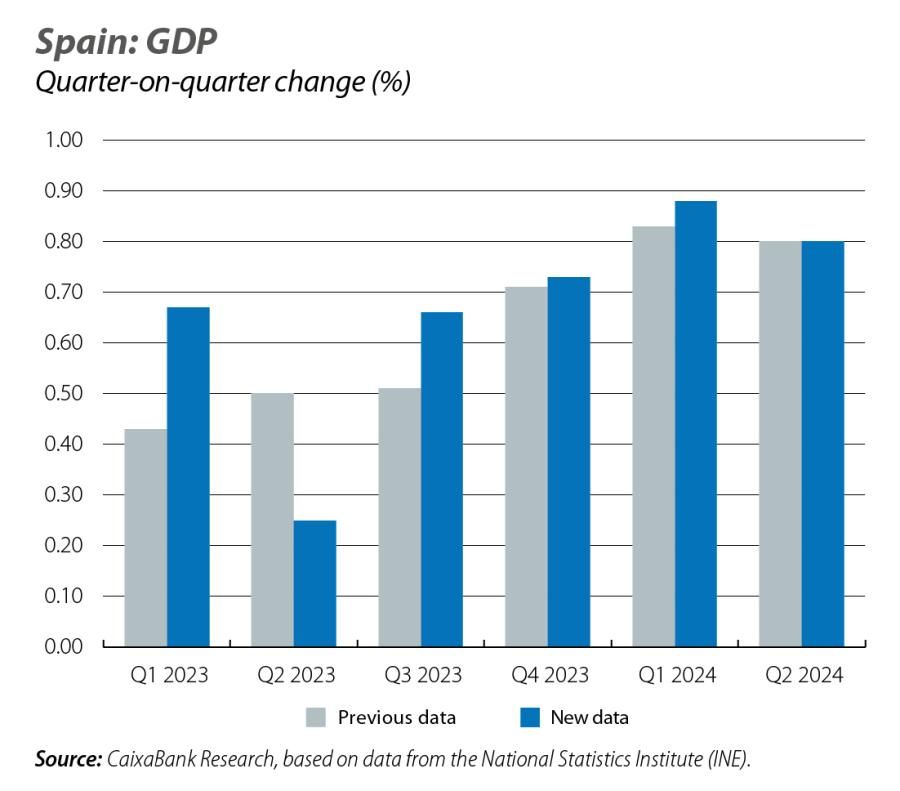

At the end of September, Spain’s National Statistics Institute (INE) revised its figure for quarter-on-quarter GDP growth in Q1 2024 upwards by 0.1 pp, to 0.9%, and maintained the growth of Q2 2024 at 0.8%. This revision confirms the Spanish economy’s good performance so far this year thanks to the buoyancy of foreign demand. In addition, INE also revised the pattern of GDP growth during the period 2020-2023. Overall, the data show that the Spanish economy’s post-pandemic recovery was more rapid than previously estimated. The review also offers a new perspective relative to the economy’s recovery following the COVID crisis. In particular, the data show that private consumption has accumulated growth of 1.4% since Q4 2019, twice the previous estimate, while investment is now 0.4% above the pre-pandemic level instead of 1.3% below. Thus, while foreign demand was the main driver of growth during the recovery, the mix of the contribution between domestic and foreign demand was actually more balanced than originally estimated.

In this context, growth forecasts for the Spanish economy of various organisations and analysts are being revised upwards. Bank of Spain, for instance, has raised its GDP growth forecasts for 2024 by 0.5 pps, to 2.8%. For the following two years, the central bank revised its growth forecast upwards to 2.2% and 1.9%, respectively. During the same month, the government also improved its forecast for 2024 by 0.3 pps, to 2.7%, and its forecast for 2025 and 2026 by 0.2 pps, to 2.4% and 2.2%, respectively. These forecasts are in line with the upward revision of growth to 2.8% in our new scenario (see the Focus «New economic outlook: upward revision of Spain’s GDP growth forecast» in this same report).

Flash indicators for Q3 point to an improvement in private consumption

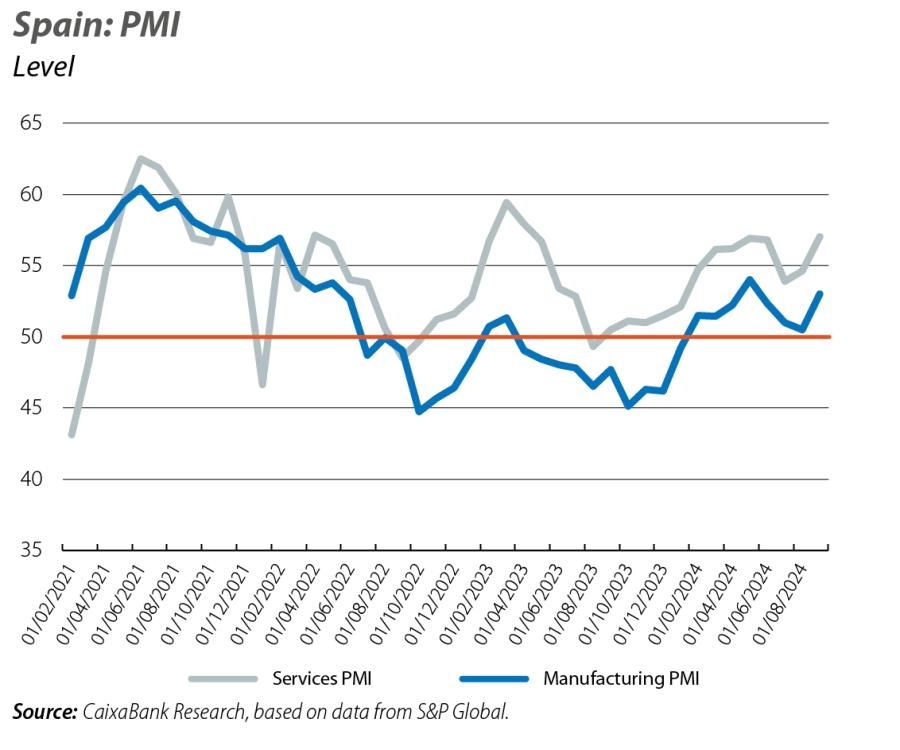

With data available up until the third week of September, CaixaBank Research's consumption indicator points to an improvement in household consumption, growing by 4.0% year-on-year (3.5% in Q2), thanks to the 0.7-pp increase in in-person consumption to 1.8%. The increase in consumption is particularly notable in expenditure on essential goods (5.6% year-on-year vs. 5.0% in Q2), while the growth of expenditure on transport and at petrol stations moderated significantly (0.5% year-on-year vs. 5.1% in Q2) in line with the declines in the price of petrol. On the supply side, the Purchasing Managers’ Index (PMI) for the manufacturing sector reversed three months of setbacks in September by climbing to 53 points, the highest record since May. Similarly, the services PMI rebounded to 57 points, the best figure since April 2023.

Labour market slows in Q3

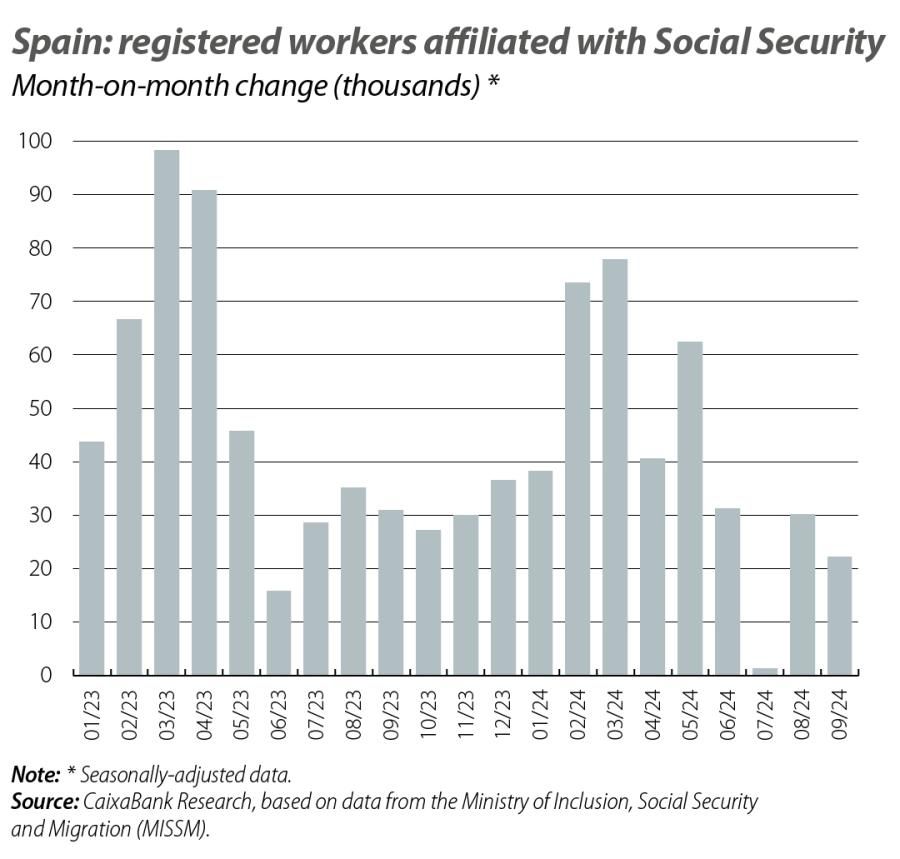

In September, the number of registered workers increased by 22,220 in seasonally adjusted terms, closing Q3 with a quarter-on-quarter growth of 0.3%, 0.5 pps below that of Q2. Thus, the labour market began to show signs of moderation, after accelerating in Q2 and having sustained the growth of Spain’s economic activity during the first two quarters of the year. The temporary employment rate fell again after three months of slight rebounds: of the total number of workers registered under the general social security scheme in September, 13.1% are on temporary contracts, which is 1.1 point less than the previous month and 0.9 points less than in September last year.

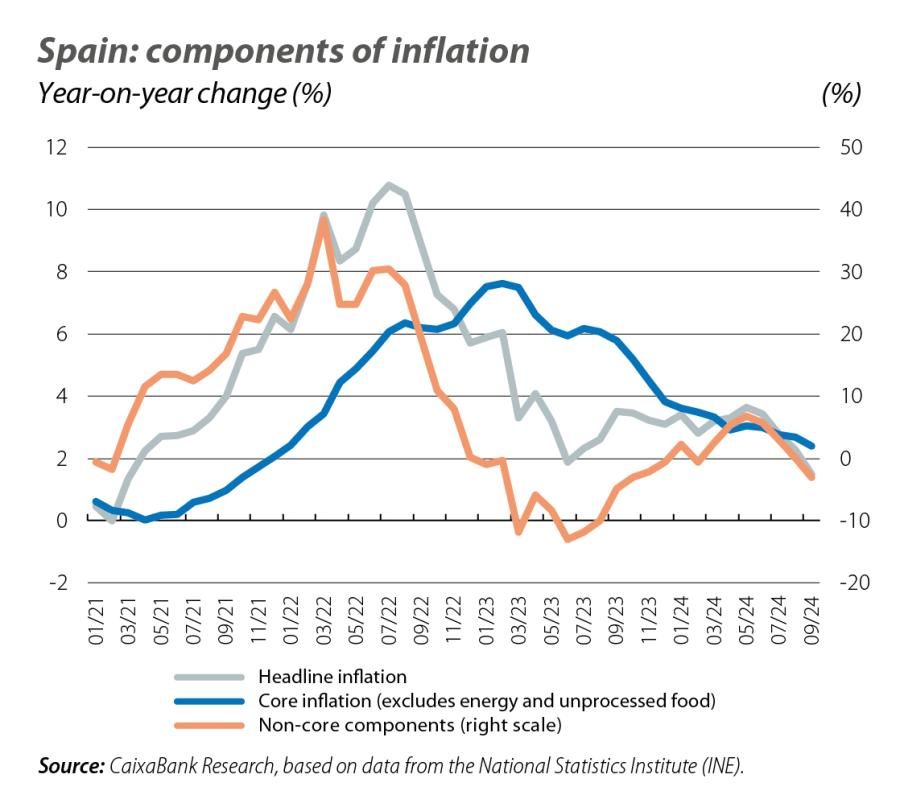

Inflation unexpectedly falls to 1.5% in September

According to the CPI flash indicator published by the INE, headline inflation fell 0.8 pps in September to 1.5% due to the decrease in fuel prices and, to a lesser extent, food and electricity prices. On the other hand, core inflation, which excludes energy and unprocessed food, fell 0.3 pps to 2.4% in September. Both headline and core inflation data have been lower than expected and hint at a further decline in food inflation, thus continuing the moderation of recent months. On the other hand, we will have to wait for the breakdown by component in mid-October to see whether there has been a fall in services inflation, which has remained above 3.5% so far this year.

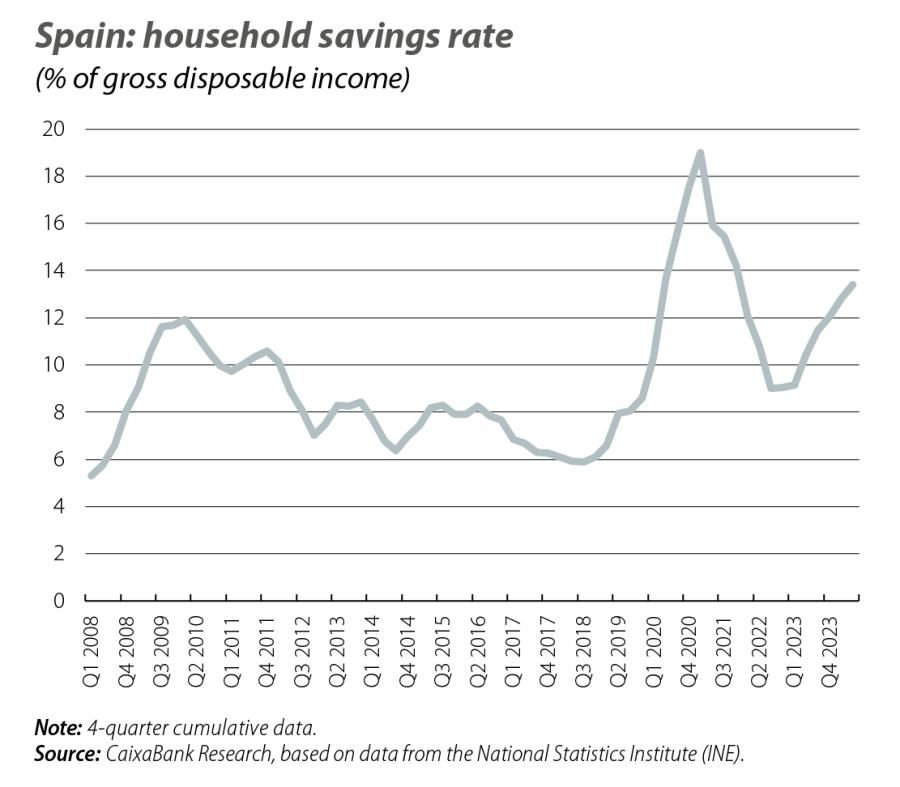

Household savings remain high

During Q2, household gross disposable income rose 8.7% compared to the same quarter last year. This increase was bigger than expected and is 2 points above the increase in household spending (6.7%). Thus, the household savings rate reached a new peak in the post-pandemic period, standing at 13.4% of gross disposable income, well above the 2015-2019 average of 7.2%. This higher figure for Q2 is explained by the good performance of the labour market, which entailed a 7.4% increase in the total wage mass. In addition, in the context of the revision of the historical series, the INE also revised upwards the 2023 household savings rate by 0.3 pps, placing it at 12%.

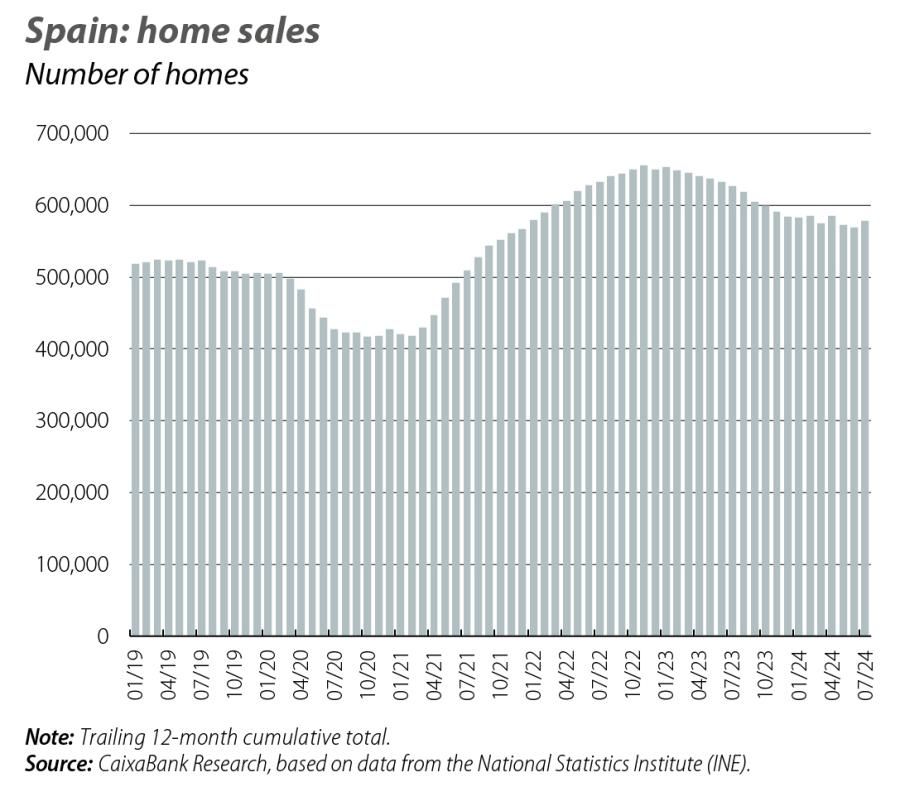

Housing demand is higher than expected

Sales rose sharply again in July, up 19% year-on-year, after two consecutive months of declines. The balance for the year to date shows a 1.3% decrease in the number of sales up to July, although this is a small reduction compared to the 6.1% slump recorded in the same period last year. The increase in July was widespread across both housing types (39% in new housing and 15.5% in the case of existing housing) and between autonomous communities (only the Balearic Islands and Melilla registered a decrease). On balance, in a context in which interest rates remain high, demand continues to be somewhat more robust than expected (some 579,000 sales have been closed in the last 12 months), and this is translating to prices. The main home price indicators show an acceleration during Q2, including both the appraisal value of unsubsidised housing published by the Ministry of Housing and Urban Agenda (MIVAU, 1.6% quarter-on-quarter vs. 1.3% in Q1) and the price of housing by INE (3.6% quarter-on-quarter vs. 2.6% in Q1).