The Spanish economy ends 2024 among the top of the class

Spain’s GDP continued to record dynamic growth in Q3 2024 and the main indicators suggest this trend will continue in Q4. The strength of the labour market is boosting household incomes and inflation remains contained, despite the ongoing rebound.

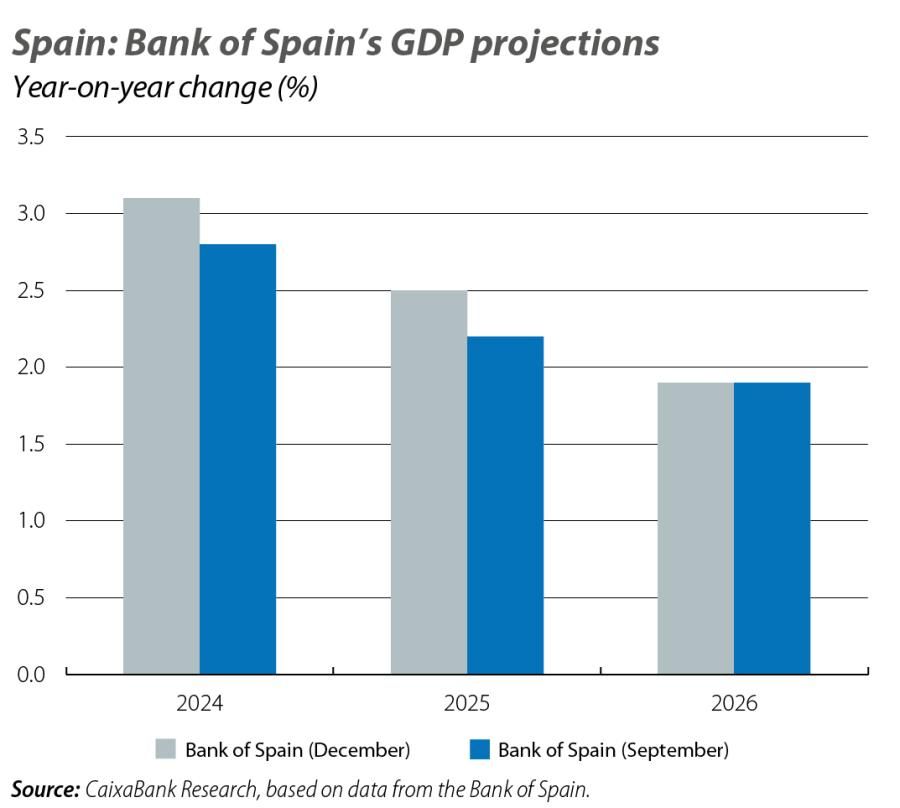

2024 was a year of positive surprises. In January, the analyst consensus published by Funcas placed the GDP growth forecast for the year as a whole at 1.6%. In November, this figure practically doubled to 3.0%, slightly above the 2.8% estimated in September here by CaixaBank Research. Similarly, Bank of Spain revised upwards its GDP growth forecast in December, to 3.1% for 2024 and to 2.5% for 2025 (0.3 pps more than in its previous forecasts in both cases). As for inflation, the institution has left its forecasts practically unchanged, with a small upward adjustment of 0.1 pp in 2026, bringing the figure to 1.8%.

At the end of last year, we were anticipating a change in the growth pattern in favour of a greater role of domestic demand, after two years in which foreign demand was the main driver of growth. The normalisation of the touristic sector and the exhaustion of the pent-up savings from the pandemic led us to believe that this change in the production pattern would be accompanied by a slight slowdown. However, exports, especially those of services (both tourism and non-tourism), have continued to break records, while household consumption has been more dynamic than expected, which explains the steady trickle of upward revisions throughout the year. The main indicators suggest that the economy’s good performance continued during Q4 2024. For 2025, we expect growth to remain buoyant, albeit probably less so than in 2024.

GDP continued to record dynamic growth in Q3 2024

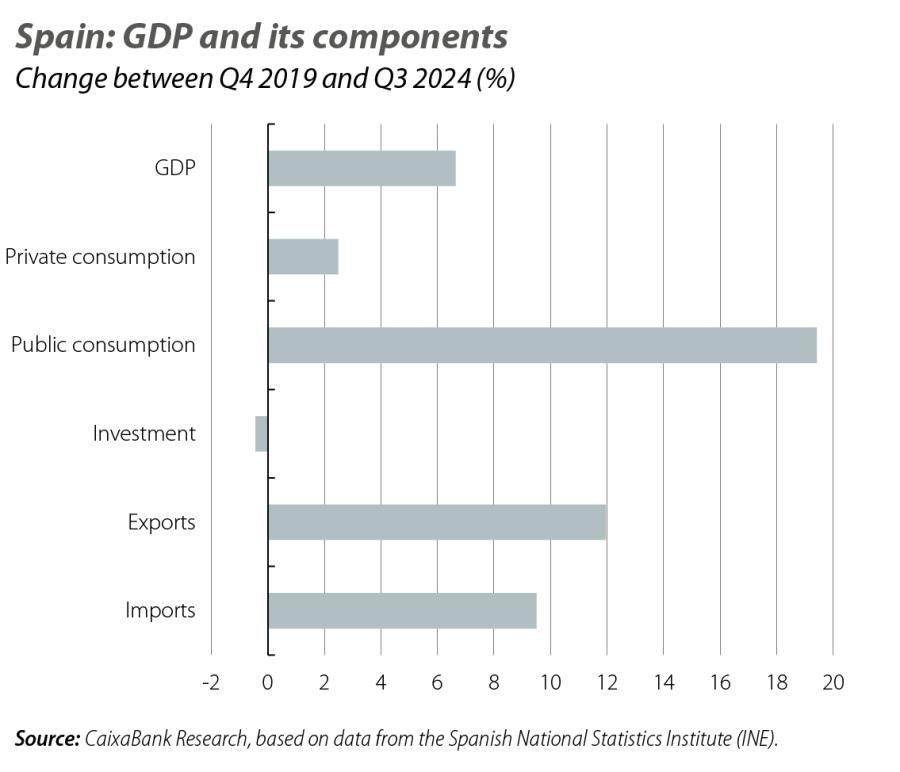

In its second estimate of GDP for Q3, the National Statistics Institute confirmed that the economy’s growth stood at 0.8% quarter-on-quarter, a rate similar to that of Q2 and 6.6% above the level of Q4 2019. The change in the growth pattern was reaffirmed by the increases recorded in both household and public consumption, of 1.2% and 2.5% respectively, marking the highest growth rate of the last two years. Conversely, investment fell 1.3% and remains 0.5% below the level of Q4 2019. Finally, exports continued to grow at a fairly dynamic rate, but the greater growth of imports led to a negative contribution from external demand of 0.2 pps to quarter-on-quarter growth.

The main indicators predict strong growth for Q4

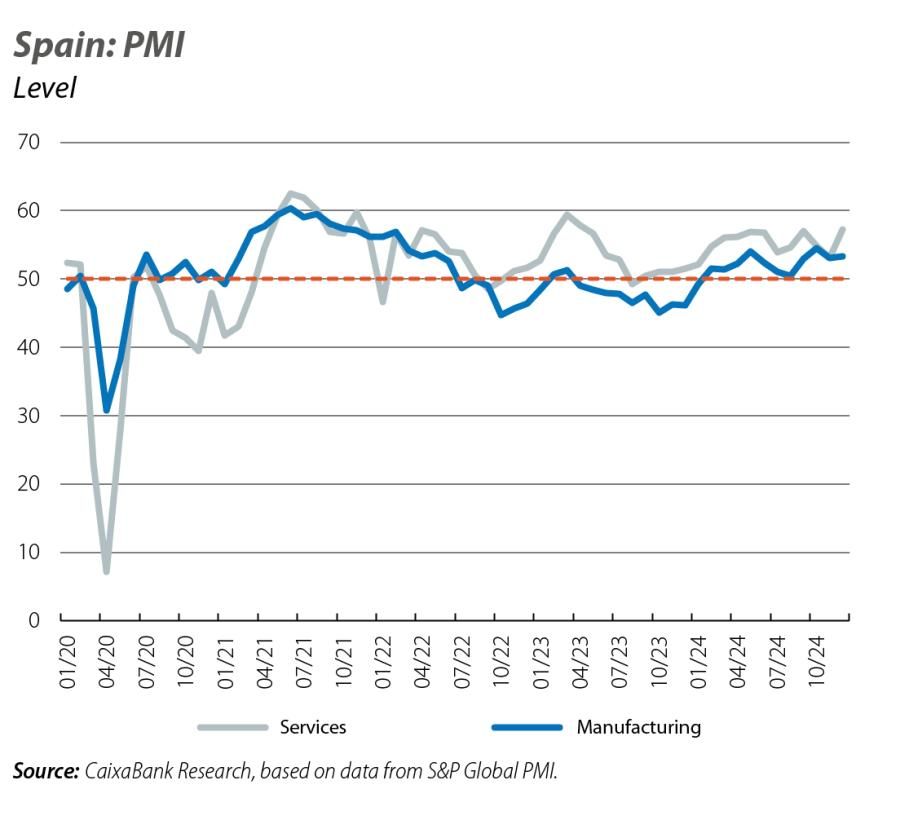

While we await the publication of the growth figure for the last quarter of the year, in December the main activity indicators maintained the good figures of the rest of the quarter. The CaixaBank Research consumption indicator rose 3.2% year-on-year in December and closed the best quarter of the year with an increase of 4.0%. Thus, the consumption of Spaniards grew by 3.5% year-on-year on average in 2024 (4.8% in 2023), while inflation moderated to 2.8% on average (3.5% in 2023). On the other hand, business confidence indices remain comfortably in expansive territory, above 50 points: the PMI for the services sector rose sharply in December to 57.3 points (53.1 in November), while the manufacturing index remained at a similar level to the previous month (53.3 in December vs. 53.1 in November).

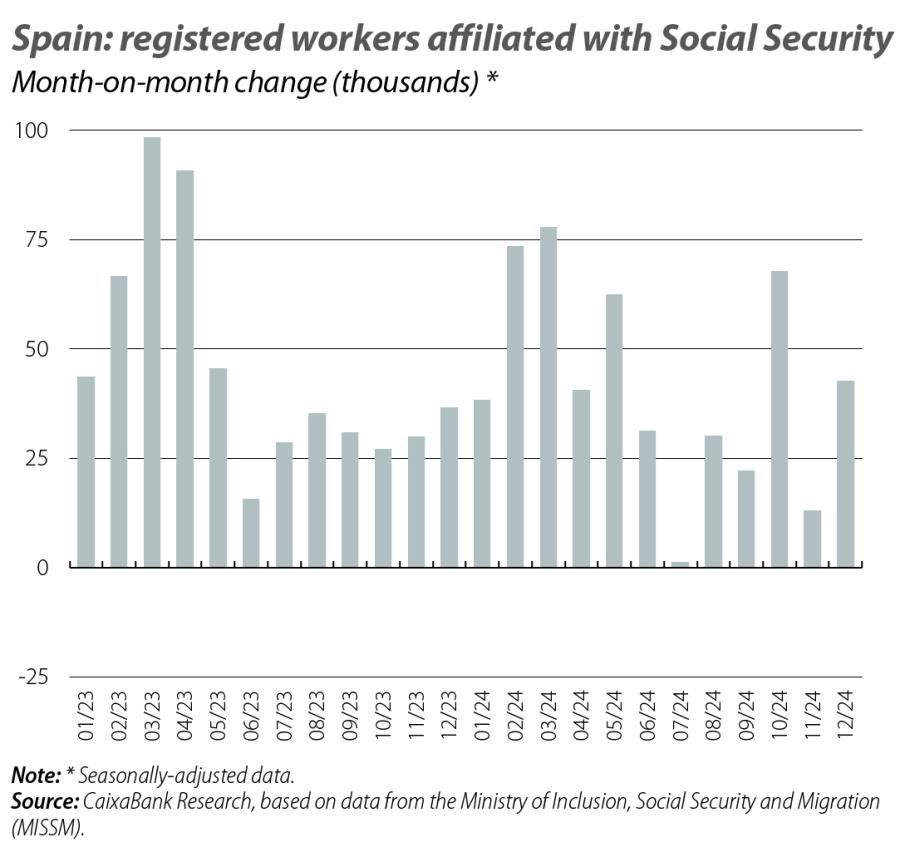

A good year for employment

Job creation, which is key to understanding the economy’s good performance throughout 2024, accelerated yet again in December, adding 35,500 new registered workers, up from the 29,900 recorded in the same month of 2023. Thus, the Spanish labour market closed the year with an increase of over 500,000 new registered workers, placing the total number of Social Security affiliates at 21,337,962. In seasonally adjusted terms, the increase was 42,700 new affiliates, such that the quarter-on-quarter growth in Q4 accelerated to 0.5%, compared to 0.3% in the previous quarter. Finally, the number of unemployed persons fell by 25,300, placing the total at 2.56 million, the lowest figure since December 2007.

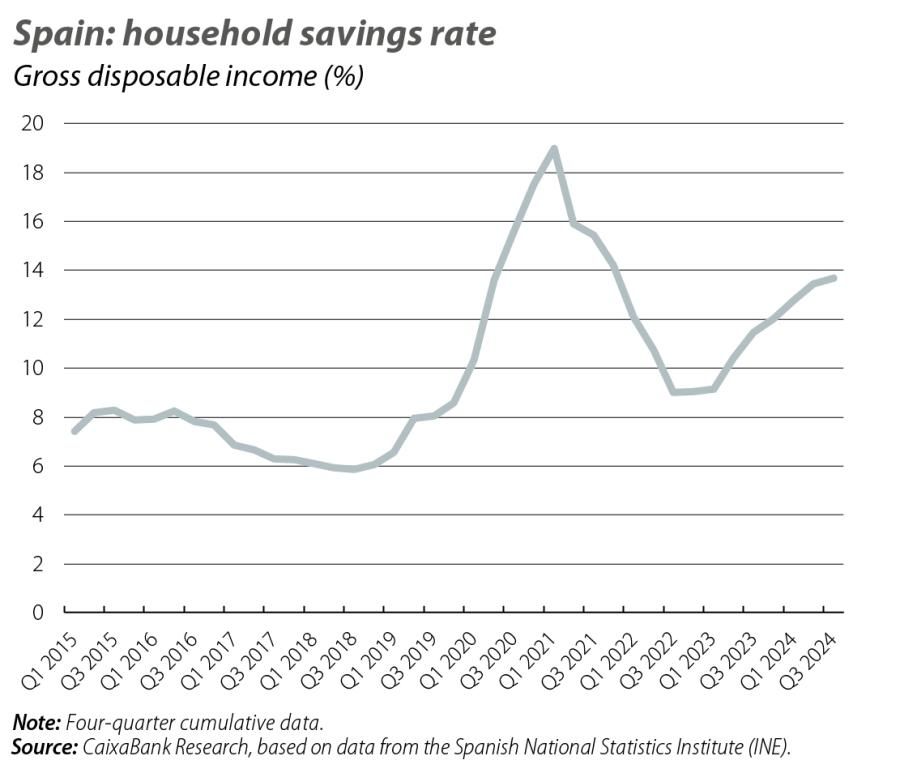

The strength of the labour market boosts household incomes

Household gross disposable income (GDI) grew by 8.2% year-on-year in Q3. The main factor behind this increase was the strength of the labour market, which boosted wage growth to 7.4%, while social benefits grew at a more modest rate of 5.8%. Given that the increase in final consumption expenditure was 6.6% (below that of GDI), the savings rate increased. Specifically, the cumulative four-quarter savings rate rose 0.3 pps to 13.7%.

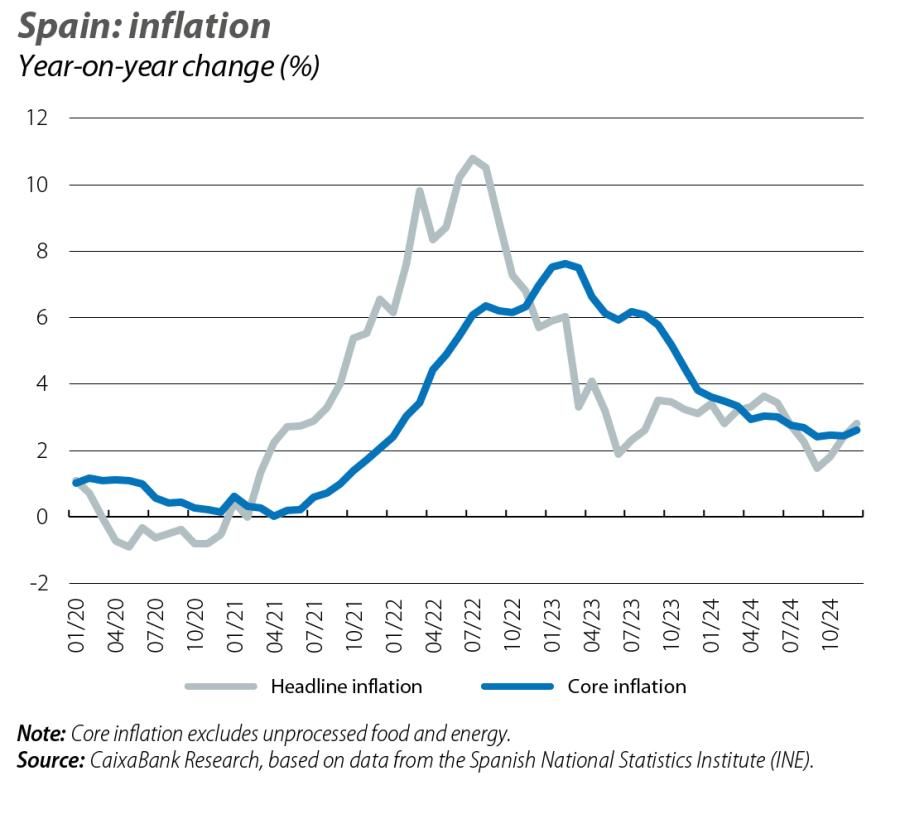

The rebound in inflation continues, but remains contained

Inflation has been on the rise during Q4, after falling in September to its lowest level since the beginning of 2021. Specifically, according to the initial estimates provided by the National Statistics Institute, inflation rose for the third consecutive month in December to 2.8%, 0.4 pps more than in November, driven mainly by fuel prices and, to a lesser extent, those of services related to leisure and culture. Core inflation, meanwhile, rebounded 0.2 pps to 2.6%. Both the headline and core inflation statistics were below the range anticipated by CaixaBank Research in our current forecast scenario, which was developed in September, largely because energy prices have remained more contained than expected. If these figures are confirmed, average headline inflation in 2024 would be 2.8% year-on-year (3.5% in 2023) and average core inflation, 2.9% (6.0% in 2023).