Spain: a complex environment, with good and bad news

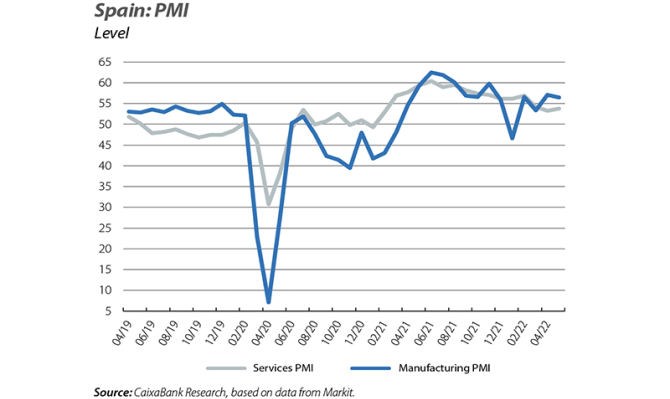

Three months have passed since the outbreak of the war and we now have a considerable amount of post-invasion data with which to make an assessment of the impact of the conflict on our economy. The shock of the war is filtering asymmetrically through the economy. On the supply side, the services sector, led by the sectors linked to tourism, continues to benefit from the fading of the pandemic and is enjoying a rapid recovery. In contrast, the agricultural sector and various branches of the industrial sector – those most exposed to the rises in energy, food and metal prices – are feeling the effects of the conflict to a greater degree. The manufacturing and services PMIs reflect these asymmetries: in May, the PMI for the services sector stood at 56.5 points, well above the 52.2-point average in Q1 2022, while the counterpart index for the manufacturing sector remained at a contained 53.8 points (55.8 in Q1 2022). On the demand side, there is growing concern about the rise in inflation and the impact it could have on private consumption. That said, the indicator scoreboard shows that the Spanish economy is currently weathering the storm successfully. Following the deterioration of the indicators in March, in April most have either stabilised, as is the case with the consumer confidence indicator published by the European Commission, or have rallied, as is the case with retail sales, which grew by 5.3% in April after falling 4.3% month-on-month in March. However, it should be noted that the balance of risks is clearly skewed to the downside. At the current juncture marked by the war, the risks in the geopolitical sphere have increased, and the consequences they could have for economic activity are potentially high.

The high level of inflation is one of the more concerning developments in the current environment. Having peaked at 9.8% in March, headline inflation moderated to 8.3% in April, but rose again to 8.7% in May. Inflation could remain below the March peak in the coming months as the electricity component, one of the main drivers of the inflation rally in 2021, will push inflation down: over the next few months the price of electricity will be compared with the months of 2021 when the price of electricity had already begun to climb. However, despite the gradual fading of the impact of higher electricity prices, the increase in energy costs is beginning to filter through to the rest of the components. In addition to this contagion effect, food prices are also being driven up as a result of the war. Thus, while headline inflation has moderated, core inflation, which excludes energy and unprocessed food, has risen by 1.5 pps in just two months

to 4.9% in May, its highest level since 1995.

Despite the difficulties affecting the agrifood and industrial sectors in the current environment, job creation remains highly buoyant thanks to the recovery of the services sector. In May, Social Security affiliation grew by 33,366 workers in seasonally adjusted terms, the same as the previous month, bringing employment to 2.8% above the pre-pandemic level of February 2020. Recruitment on permanent contracts, meanwhile, is also on the rise and in May accounted for 44.5% of all contracts registered in the month. This increase in permanent hiring reflects the conversion of temporary jobs into permanent-discontinuous jobs induced by the recent labour reform. This process is already reflected in the Social Security affiliation figures: whereas the percentage of temporary workers traditionally fluctuated at around 30% of the total number of registered workers, this percentage now stands at around 22%. However, it should be recalled that in order to make a comprehensive assessment of the impact of the reform we must take into account not only the temporary employment rate, but also the impact on job creation.

In April, around 6.1 million tourists arrived and spent 6.9 billion euros. These figures mark a sharp acceleration in the pace of recovery: tourist arrivals stood 14.6% below the same month in 2019, compared to 28.6% below the pre-pandemic level in the previous month; and for the first time spending was very close to the pre-pandemic level, at just 2.2% below April 2019 (−16.0% in the previous month). A good tourist season will be key to cementing the recovery of the Spanish economy in 2022.

The valuation price of unsubsidised housing rose by a significant 2.4% quarter-on-quarter in Q1 2022 (6.7% year-on-year). This rally is occurring against a backdrop of a marked rise in construction costs (18.9% year-on-year in February) and a continued surge in demand, while supply is increasing more gradually. This price trend can be seen in other indicators too, such as those published by real estate portals and the repeated home sale index published by the Spanish Association of Registrars (Colegio de Registradores), which increased 10.6% year-on-year in Q1.

The Stability Plan for 2022-2025 foresees a deficit of 5.0% in 2022 and a gradual reduction to 2.9% by 2025. This reduction would be driven by the economic recovery that is expected to occur during this period and does not include any significant measures for reducing the structural deficit, which is expected to stand above 3%.