Spanish firms remain financially sound

The year-end data for 2023 confirm that, despite a fall in their revenues, businesses have continued to generate lending capacity and to reduce their levels of debt to the lowest they have been in over two decades.

Spanish businesses, on the whole, have been relatively successful in overcoming the impact of the various shocks that have shaken the economy in recent years, such as the crisis triggered by the pandemic; the increase in production costs, especially energy costs following the outbreak of the war in Ukraine, and the tightening of the ECB’s monetary policy. The year-end data for 2023 confirm that, despite a fall in their revenues, businesses have continued to generate lending capacity and to reduce their levels of debt to the lowest they have been in over two decades.

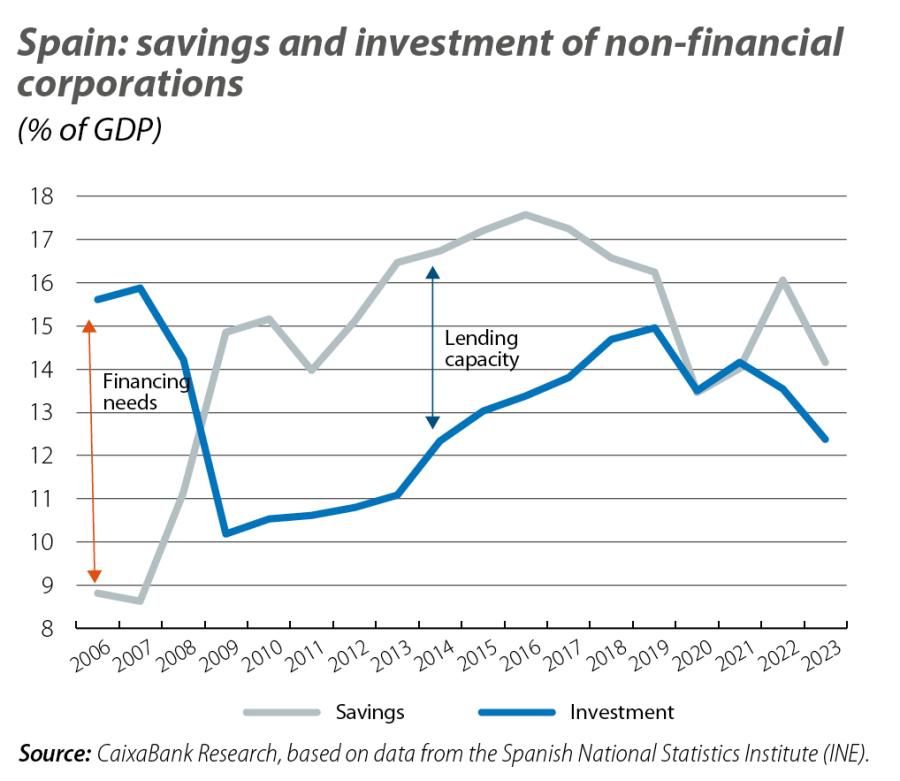

After two years of strong growth, in 2023 firms’ disposable income1 fell by 4.3% year-on-year, as the increase in operating profits2 (3.6%) was dwarfed by the rise in outflows such as corporate tax payments (up 21%) and, above all, net charges on capital payable (42.3%), due to both interest payments3 and dividends. Despite the fall in disposable income, firms continued to generate lending capacity – something that has been happening continuously since 2009 – as investment also contracted by 0.7% year-on-year, placing it at 12.4% of GDP (13.5% in 2022): this capacity amounted to 32.028 billion euros (2.2% of GDP), as can be seen in the first chart.

- 1Earnings after tax payments and the distribution of dividends, equivalent to business savings.

- 2Gross operating surplus (GOS).

- 3Although interest income grew at a faster rate, the volume of payments is greater: before financial brokerage services (SIFMI), interest received grew by 226% to 14.046 billion euros, while the amount paid was 40.178 billion. Thus, interest payments amounted to over 16% of GOS in Q4 2023, almost doubling the previous year’s figure. In any event, the adverse effects associated with higher interest costs were generally limited. See Bank of Spain (2024): Financial Stability Report, spring 2024, and Bank of Spain (2023): «The impact of interest rate hikes on firms’ financial pressure», Box 2, Report on the financial situation of households and firms, 2nd half of 2023.

How have businesses put this funding capacity to use? According to the data provided by the Bank of Spain’s financial accounts, it has been used exclusively for deleveraging and not for acquiring financial assets. Let’s take a closer look: firstly, consolidated debt (excluding corporate debt) fell in 2023 for the second consecutive year, with a reduction of 11.866 billion euros (–1.2%) which placed it at 946.529 billion. This level is equivalent to 64.7% of GDP and is 6.5 points less than the previous year. Moreover, this is the lowest ratio since 2001, it is almost 3 points below the euro area average and it is a far cry from the highs of 2009-2010, when it peaked at 120%4 (see second chart). Thus, last year the business deleveraging process, which had begun in 2010 but was abruptly interrupted in 2020 by the pandemic, continued. This was due both to the sharp rise in nominal GDP (denominator), of 8.6%, and to the decline in the debt balance (numerator). This decline of 11.866 billion in the debt balance corresponds to a negative net balance in new lending to businesses of 17.262 billion euros, which represents the largest repayment of debt since 2014. Of this amount, the majority was in the form of loans (about 70%), while the rest was in fixed-income securities (see third chart).

- 4In unconsolidated terms, the debt ratio stood at 81.7% of GDP, compared to 92.2% in 2022, 13.7 points below the euro area average.

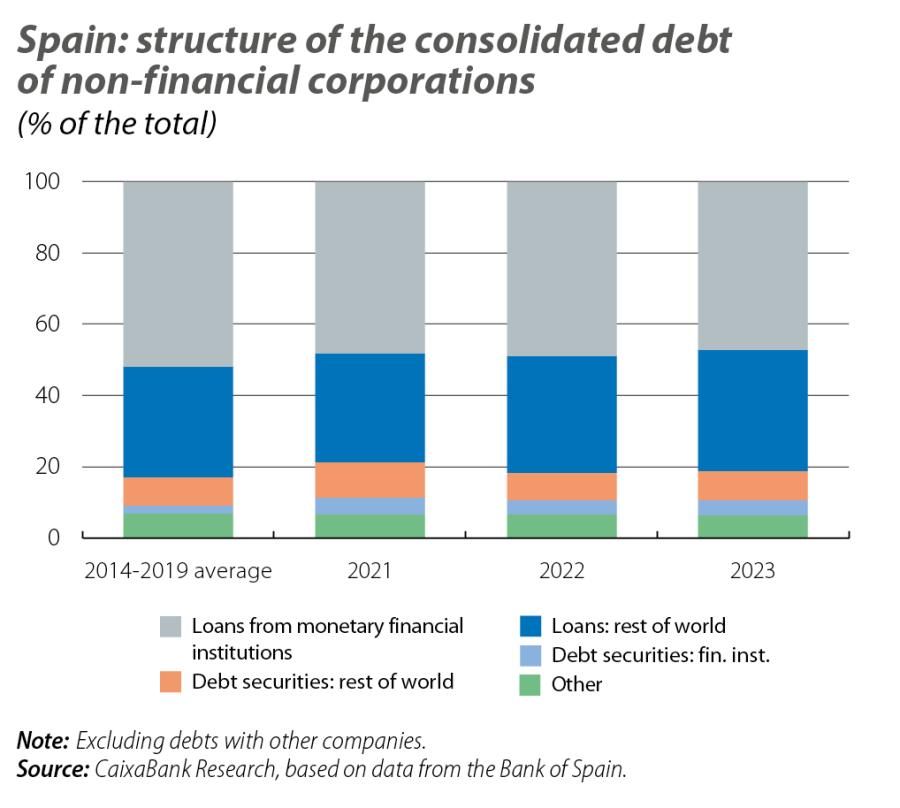

As a result, the trend observed in recent years of a declining role of bank loans – i.e. those granted by monetary financial institutions, or MFIs – in businesses’ external financing is confirmed: in 2023 they accounted for 47.3% of total consolidated debt, almost 5 points less than prior to the pandemic (see fourth chart). The use of these forms of loans is being replaced by issues of fixed-income securities, which are predominantly acquired by financial institutions and, above all, loans granted by non-residents.

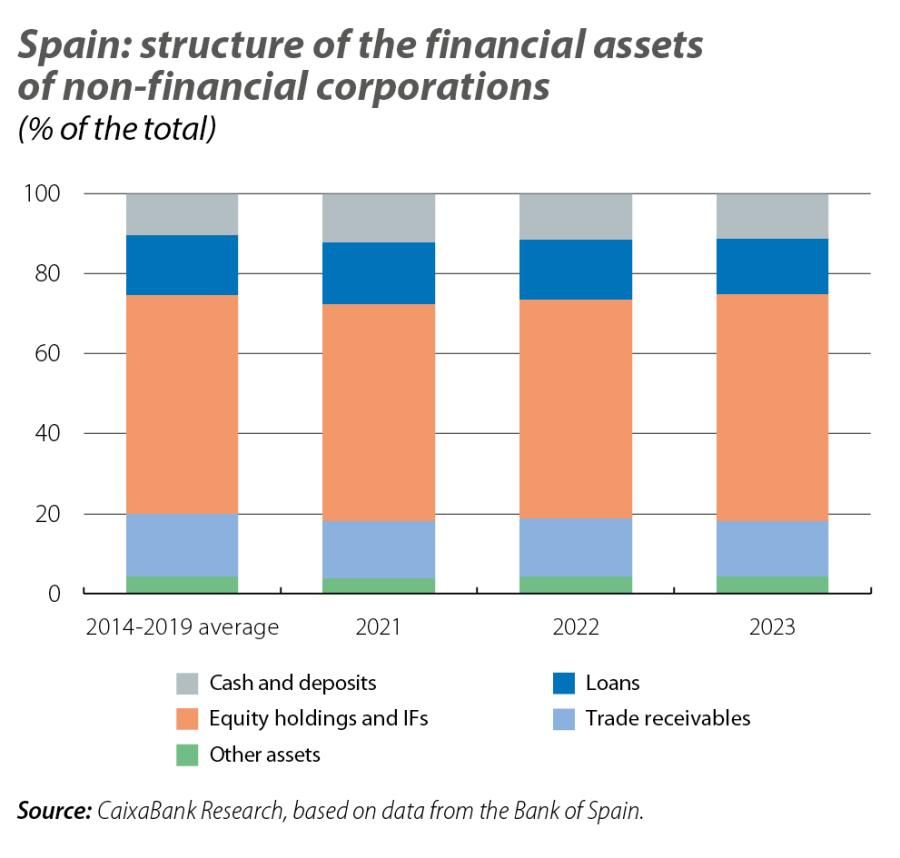

As for firms’ financial assets, they increased in 2023 by 85.759 billion euros (2.8%, reaching a total of 3.13 trillion). This increase in the balance of assets is fully explained by their significant rise in value (101.711 billion), especially in the case of shares and investment funds (IFs), in line with the increase in stock prices, given that the net acquisition of assets was negative, at –16.234 billion (see fifth chart). In other words, in a trend not seen since 2023, companies divested: they reduced their assets held in the form of shares, IFs and, most notably, loans. On the other hand, their holdings of cash, deposits and fixed-income securities increased.

In any case, firms’ financial wealth continues to be held mainly in equity holdings in other companies and in IFs. An increase is even observed in their relative weight after the pandemic, as they now account for 57% of the total, 2 points more than the average during the period 2014-2019. Cash and deposits are also increasing, albeit to a lesser extent, while the role of loans and other assets, mainly trade receivables, is diminishing (see last chart).

In short, in a context marked by the resilience of economic activity, and with an outlook in which financing conditions will gradually ease and the deployment of NGEU funds should intensify, all the indicators suggest that business’ financial position will remain strong at the aggregate level in 2024. In this regard, the percentage of firms with high levels of debt fell to 18.2% at the 2023 year end, compared to 20% the previous year. All this should facilitate the revival of investment, which is the component of demand that is lagging the most behind its pre-pandemic levels, and the definitive recovery of which is considered essential if the current expansionary cycle is to continue.