The rise in savings: magnitude, distribution and the importance of demographics

The savings rate of Spanish households remains very high, but it can vary substantially depending on income level, so it is important to analyse how it is distributed according to income level and age. We dedicate this article to such an analysis, using anonymised internal data and big data techniques.

The latest data reaffirm the high savings

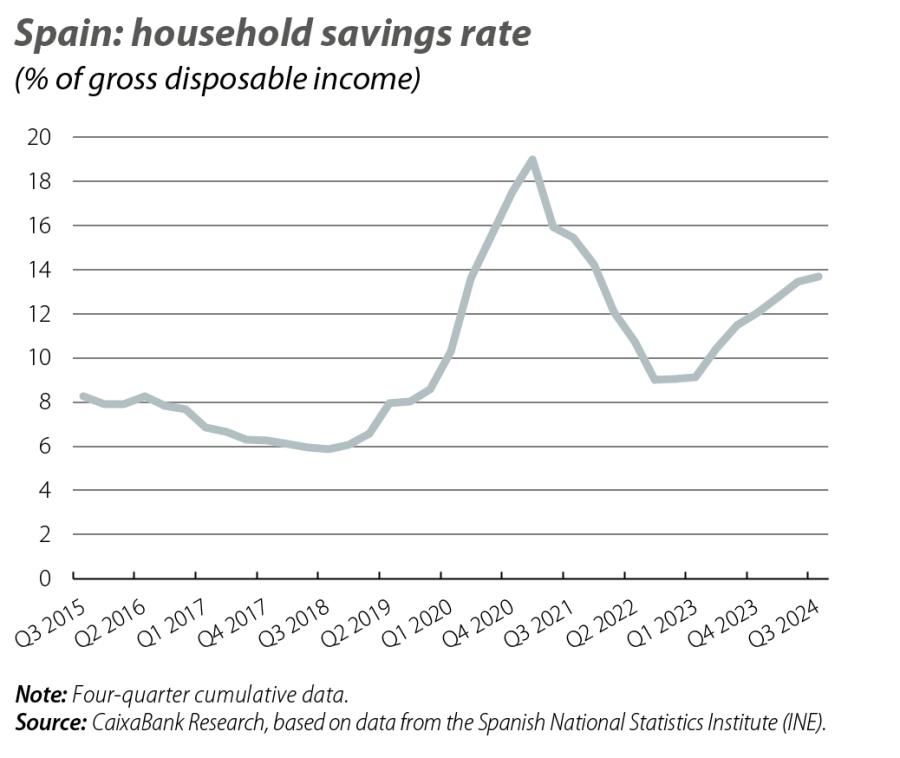

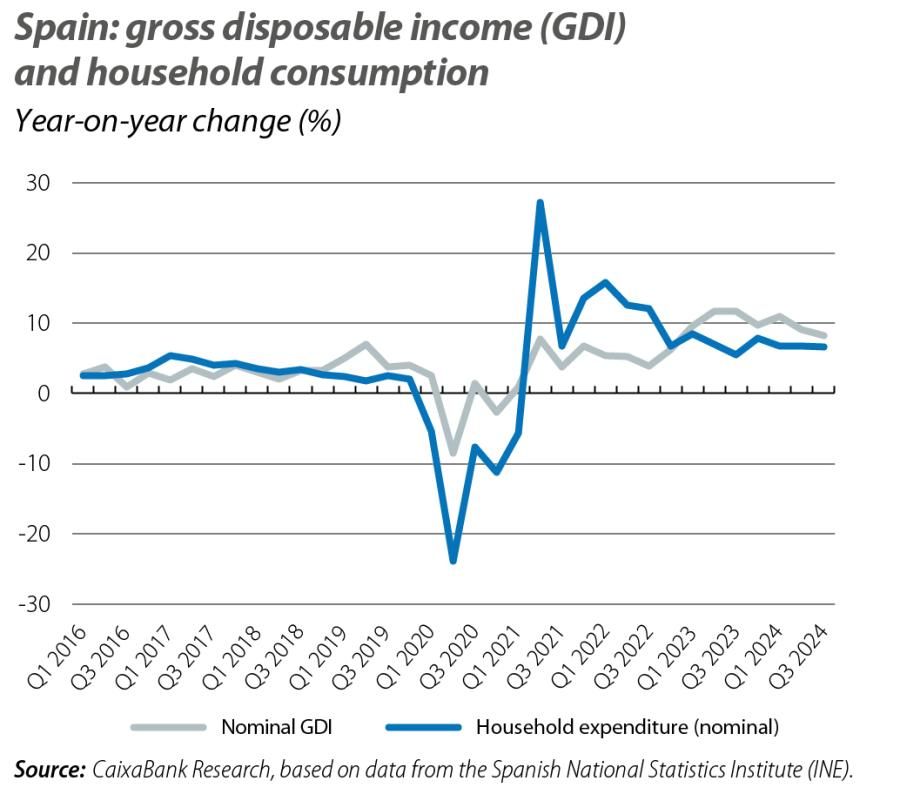

The data from the Q3 non-financial accounts confirm that the savings rate of Spanish households remains very high: in the cumulative total of the last four quarters it has reached 13.7% of gross disposable income (GDI). This is a notable increase, both with respect to a year ago (11.5%) and with respect to the historical average of 7.3% in 2015-2019. This is the result of highly dynamic growth in households’ (nominal) GDI in the first three quarters of 2024, at 9.4% year-on-year, which exceeded that of their (nominal) expenditure, at +6.7%. Thus, in the last year and a half the savings rate has rebounded by 4.6 points and by 5.1 points since the end of 2019.

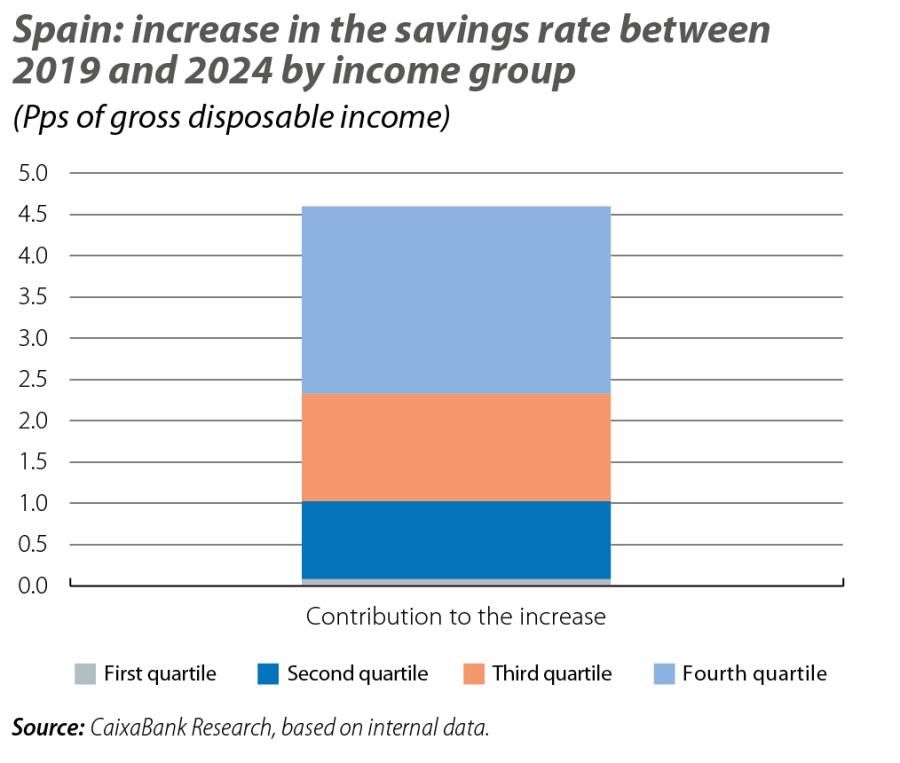

However, this increase in the savings rate can vary substantially depending on household incomes, so it is important to analyse how it is distributed according to income level. Using internal and duly anonymised CaixaBank data, we observe an increase in the savings rate of 4.6 points between the end of 2019 and Q2 2024, which is very similar to the 4.8-point increase observed in the non-financial accounts over the same period. Less than 2% of this increase is attributable to households in the first income quartile, 21% is attributable to households in the second quartile, 28% to those in the third quartile and a significant 49% to households in the fourth income quartile (see third chart). The substantial weight of the contribution from the fourth quartile, which is the one with the greatest savings capacity, is similar in magnitude to that estimated by the Bank of Spain in its September macroeconomic projections.

Are there structural factors behind the increase in savings? An analysis by age

The strength of savings in 2024 reflects a myriad of factors, some of which are short-term in nature and others more structural. The short-term factors include the high interest rates, which incentivise financial savings through higher yields; indeed, in Q2 households acquired financial assets worth around 53.5 billion euros, almost double the second-quarter average during the period 2014-2019 (27.65 billion). Other reasons behind the higher savings may also include an intention to use them to pay off debts, below-average confidence levels and perhaps even greater prudence on the part of households in the wake of recent shocks (COVID, and energy and food prices).

The savings rate will steadily decline over the coming years thanks to the improvement in cyclical factors, as interest rates come down and confidence levels increase. However, there is significant uncertainty about the speed at which this decline will take place. If the rebound in savings we are witnessing also responds to structural factors, then the decline in the savings rate over the coming years could be relatively smooth and gradual.

Among the structural factors, the one that has stood out the most in the public debate from a theoretical perspective has been the ageing of the population.1 This could be due to the fact that, with longer life expectancies, these households believe that they now need to save more in order to cover healthcare costs in the years ahead. In this second part of the article, we use internal and anonymised CaixaBank data to conduct an empirical analysis of whether or not ageing can actually explain some of this increase in the aggregate savings rate.

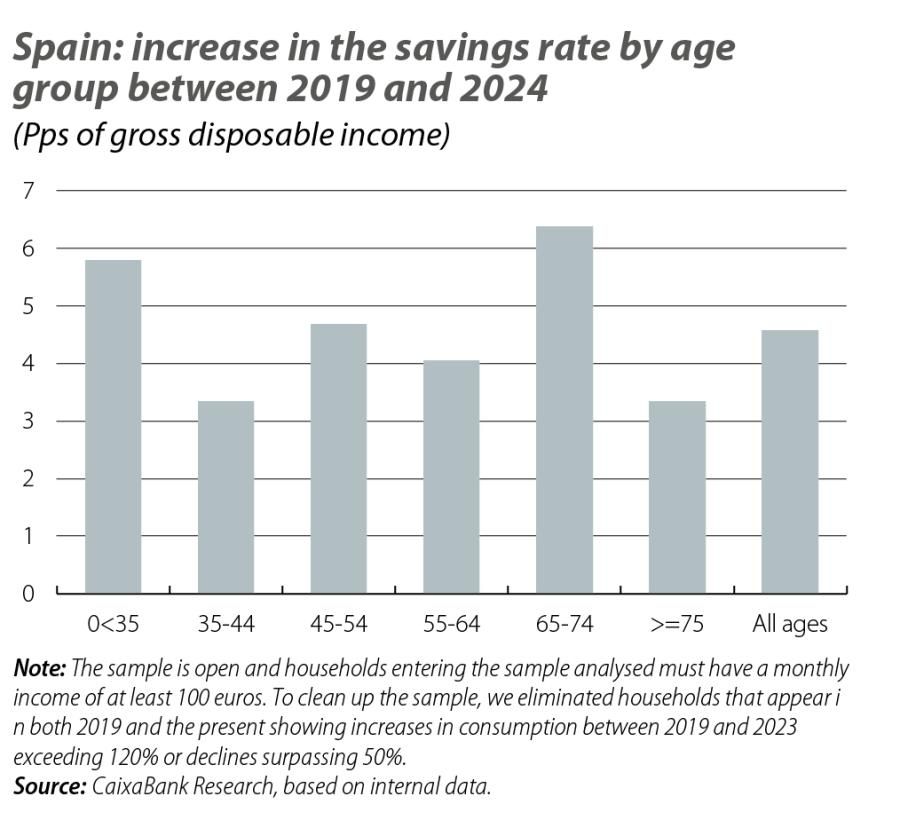

The result of this analysis is that, according to our internal data, it is precisely the generations between 65 and 74 years of age2 that have increased their savings rate the most between July 2023 and June 2024 compared to 2019, as shown in the fourth chart.3 The rebound in the savings rate of working-age households, meanwhile, is lower than average (and slightly higher among the self-employed than for employees). Specifically, the rebound in the savings rate for the cohorts between 65 and 74 years of age is 32% higher than the average for the entire sample, which is 4.6 pps. This suggests that structural factors may be playing an important role in explaining the increase in savings, such that they may dampen the speed at which the savings rate of Spanish households will decline on aggregate.

- 1AIReF also finds that it is older generations that have increased their savings the most. See Box 2 of the «Report on Budgetary Execution, Public Debt and the Expenditure Rule 2024» published last July.

- 2In households made up of more than one person, we take the age of the highest-earning member of the household.

- 3The savings rate is the sum of all income minus all expenses in the numerator and the sum of all income in the denominator. We have aggregated these concepts between July 2023 and June 2024 and compared them with the year 2019 in order to obtain the increase in the savings rate between these two periods. For incomes, we have taken into consideration the main sources: payroll, unemployment benefits, public pensions and public aid. We have not included rental incomes or payments. As for consumption, we have examined card movements and cash withdrawals from ATMs and we have also included direct debit payments and transfers from individuals to legal entities.