New outlook for the Spanish real estate sector: slowdown in the housing market

We summarise the current state and future outlook of Spain’s real estate sector, in this preview of the CaixaBank Research Real Estate Sector Report 2S 2023.

The Spanish real estate market began to slow down in mid-2022 with the shift of direction of monetary policy. Although the ECB has raised benchmark interest rates by 4 pps for the moment, the pace of the slowdown has been gentler than anticipated, leading us to improve the sector’s outlook for 2023. Nevertheless, we continue to expect a significant slowdown in the Spanish real estate market over the coming quarters, although a sharp market correction like the one experienced in 2008-2013 is unlikely.

A more moderate than expected decline in sales

In the current year to date, home sales have fallen by 3.4% year-on-year to 642,000 in April (trailing 12-month cumulative figure). The decrease is apparent in both the new-build segment (–4.0%) and in that of existing homes (–3.3%). Despite this decline compared to the exceptional levels reached in 2022 (650,000 sales), sales are still 16.7% above the same period in 2019.

Analysing the breakdown by type of buyer, purchases by foreign buyers are holding up considerably better than first and second-home purchases by Spaniards.1 In particular, the number of purchases by foreigners fell by just 2.7% year-on-year in Q1 2023, compared to declines among Spanish buyers of –9.0% for second-home purchases and –12.1% for first-home purchases. In addition, this strength in sales among foreigners follows the significant rebound of 2022, when they grew by 30.7% compared to 6.4% growth for home sales as a whole. As a result, they now account for a much larger portion of total sales (19.5%, according to the Ministry of Transport, Mobility and Urban Agenda), and this is partly down to the fact that foreign buyers are less dependent on credit when purchasing property.

- 1For the breakdown by type of buyer, we use data from the Ministry of Transport, Mobility and Urban Agenda. We consider that a buyer is purchasing a second home when the province where they reside differs from the home’s location.

The housing supply struggles to take off

The housing supply remains very limited and insufficient to cover housing needs taking into account demographic trends. The number of construction permits for new homes (109,000 homes in the last 12 months to March) remains well below net household creation (241,000 in the last four quarters to Q1 2023, according to the LFS).

It should be noted that the strength of household formation reflects significant immigration flows (the increase in the foreign population was 452,000 people in the cumulative four quarters to Q1 2023, according to the LFS) and this explains the high demand for housing in the areas of greater economic buoyancy. On the other hand, a key condition for determining supply is residential construction costs, which remain high despite showing signs of moderation. In particular, according to our projections (which take into account commodity futures prices on the international markets and our oil price projections in euros), residential construction costs in Spain could begin to decline in August and fall by around 5% on average in 2024 (in the absence of new shocks). Despite this decline, costs would still consolidate well above pre-shock levels (around 16% above the January 2021 level).

Housing prices remain resilient despite rising interest rates, especially for new housing

The greater resilience of demand, especially foreign demand, as well as the shortage in the supply of new housing and the high construction costs have been supporting home prices in recent quarters, despite the sharp rise in interest rates. The price of housing (according to the appraisal value published by the Ministry of Transport, Mobility and Urban Agenda) surged in Q1 2023 (2.2% quarter-on-quarter compared to 0.5% in Q4 2022), although in year-on-year terms it continued to register a slowdown (3.1% year-on-year compared to 3.3% in Q4 2022).

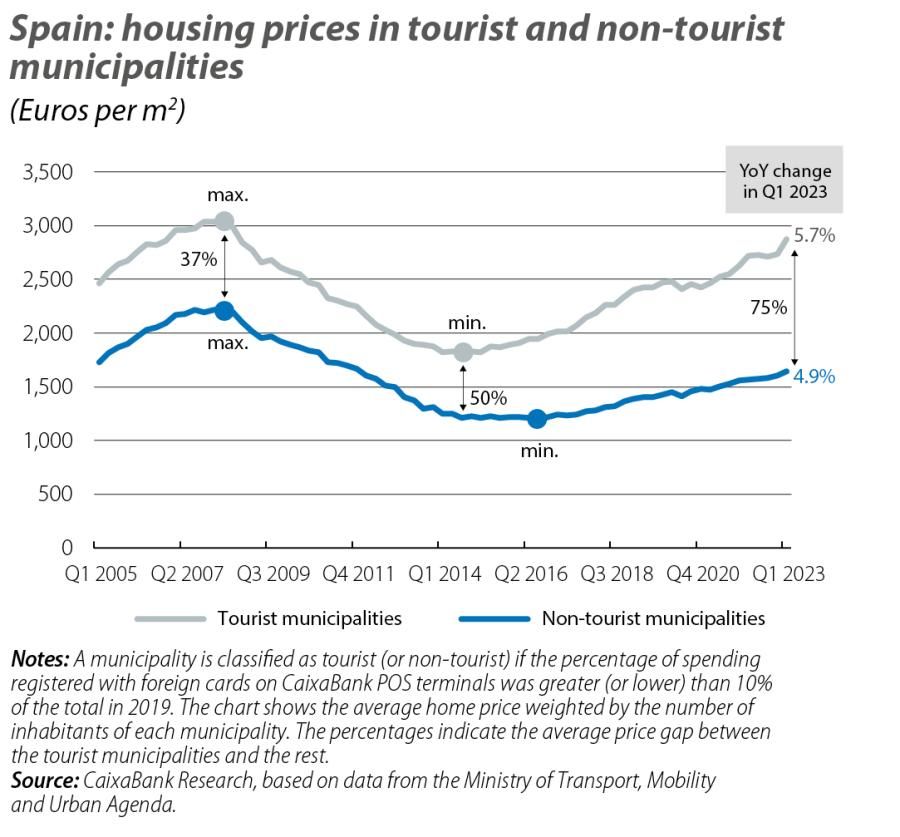

The second chart shows the evolution of housing prices in the municipalities classified as tourist and non-tourist areas based on the percentage of expenditure registered with foreign cards on CaixaBank POS terminals.2 It can be seen that the average price of housing in tourist municipalities is higher than in non-tourist areas, and this gap has expanded to reach 75% today. In fact, the latest data corresponding to Q1 2023 show that the growth rate of housing prices is higher in tourist municipalities (5.7% year-on-year) than it is in the rest (4.9%). In fact, the average price of housing in tourist municipalities is very close to reaching a level similar to the previous high recorded in mid-2008, while in non-tourist areas it is still 26% below the peak.

- 2We classify municipalities as either tourist or non-tourist according to whether the spending registered with foreign cards on CaixaBank POS terminals was greater (or lower) than 10% of the total in 2019.

Updated real estate sector forecasts for 2023 and 2024

The second half of this year will be key in determining the extent of the impact that the cumulative interest rate rises will have on the wider economy and, in particular, on the real estate sector. However, there are also several counterweight factors that will continue to support housing demand and prices, including a resilient labour market (we anticipate the creation of 390,000 jobs in 2023 and 270,000 in 2024 in terms of people in employment per the LFS), declining inflation (below 4% in 2023) and more dynamic wage growth (around 4%-5% in 2023, and around 3.5%-4% in 2024). In addition, high migration flows (the National Statistics Institute estimates that in 2023 and 2024 the foreign population will increase by some 490,000 people per year) will continue to sustain the demand for housing in areas with greater economic activity.

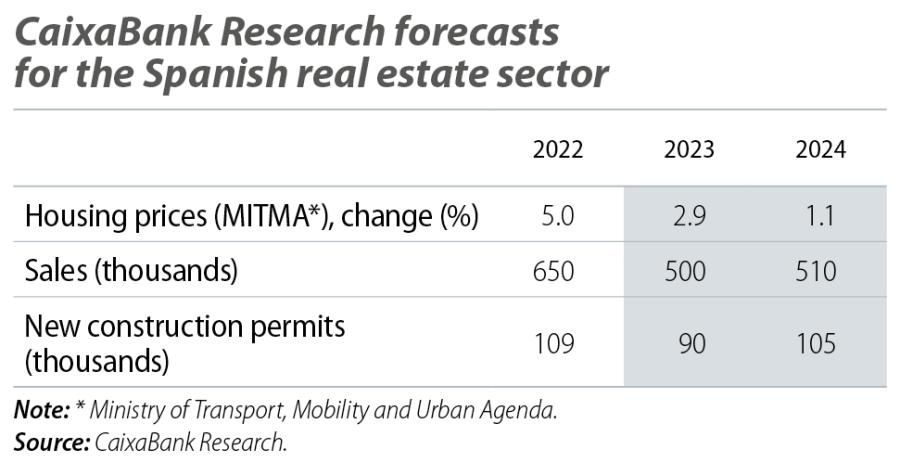

In terms of demand, we expect sales to decline considerably in the coming months, reaching around 500,000 in 2023 as a whole, a figure similar to that recorded in 2019 but 23% lower than that of 2022 (650,000). This forecast has recently been revised upwards (480,000 in the previous forecast)3 due to the smaller than expected drop in sales in the first few months of the year. By segment, the biggest adjustment is expected to occur in sales of existing homes. In contrast, the number of new home purchases will remain in a similar range to the previous year (around 110,000 homes, in line with the number of new builds started in the last 12-18 months).

Similarly, we also revised our price forecast upwards due to the good figures for Q1. Specifically, we significantly improved the annual projection for 2023, from 0.2% to 2.9% (appraisal value per the Ministry of Transport, Mobility and Urban Agenda). Despite these upward revisions, it is important to note that they are due to the good performance observed to date and the short-term rigidity of prices to declines. Looking ahead to the coming quarters, in line with the weakening of demand and of the wider economy, we continue to expect a significant slowdown, as reflected in our 2024 forecast (1.1%).

Finally, the supply of housing will remain very limited (forecast of 90,000 construction permits in 2023), well short of net household creation. Faced with this combination of factors – cooling demand, legislative developments, structural problems in the sector and construction costs that remain high despite the recent moderation – we are unlikely to see a reversal of the current lack of housing supply in the coming quarters.

- 3Forecast published in the Focus «Spanish real estate sector: 2022 recap and 2023 outlook» in the MR04/2023.