Housing credit in Portugal: from the pandemic, to regulation and rate hikes

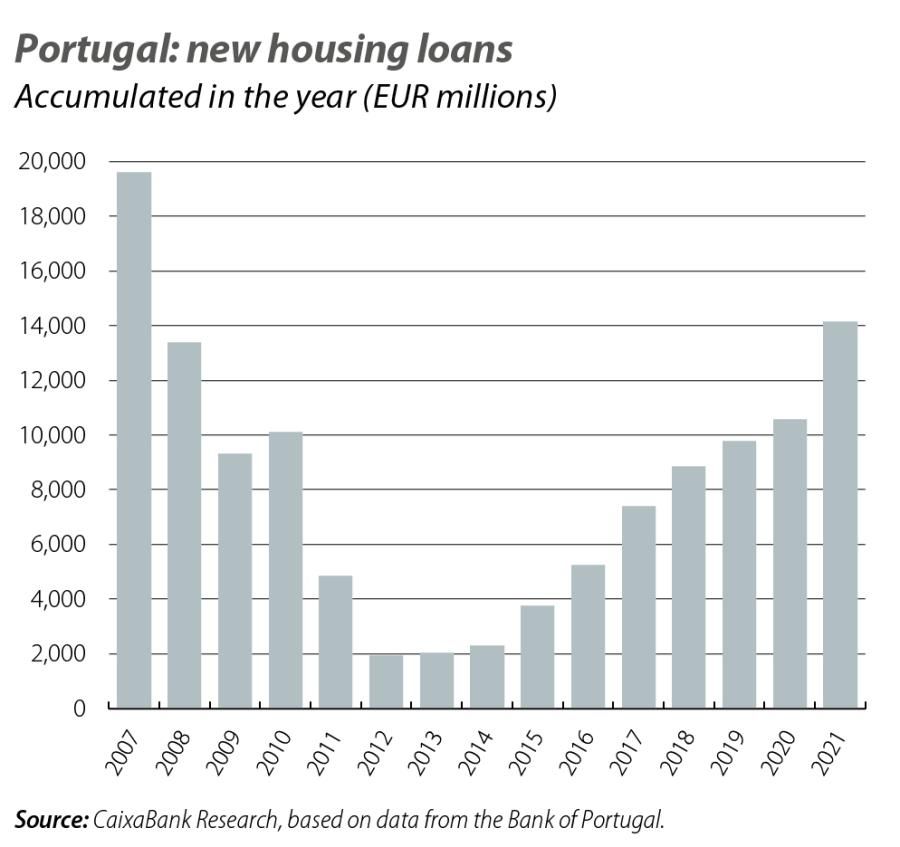

New lending for housing in Portugal has been very buoyant in these last two years marked by the COVID-19 pandemic. Specifically, after registering an increase of 8.1% in 2020, it grew by 34% in 2021, ending the year almost 45% above the level of 2019. What is behind this buoyancy in housing credit and how is it expected to evolve in the near future?

This buoyancy in credit has gone hand-in-hand with the behaviour of the residential real estate market, both in terms of prices and sale transactions, which in 2021 grew by 9.4% and 20.5%, respectively, pushing home values to their highest in the historical series. In particular, the average purchase price exceeded 179,000 euros at the end of the year, the highest level since such records began (in 2009), which helps to explain the growth in new lending for housing. However, the purchase of housing through credit has represented only around 50% of the total amount of the purchases completed in 2021.

The context has been particularly favourable for home buyers for various reasons. Firstly, interest rates have been low, while significant savings having been accumulated during the pandemic, thus boosting the demand for housing for both residential and investment purposes.1 In fact, the interest rate on new loans went from 1.10% at the end of 2019 to 0.83% at the end of 2021. At the same time, the pandemic has brought about considerable changes in the labour market as a result of teleworking and expectations that it will be maintained, in a hybrid format, after the pandemic. This possibility led households to place more emphasis on their homes and to seek properties with more outdoor space or areas for remote working.

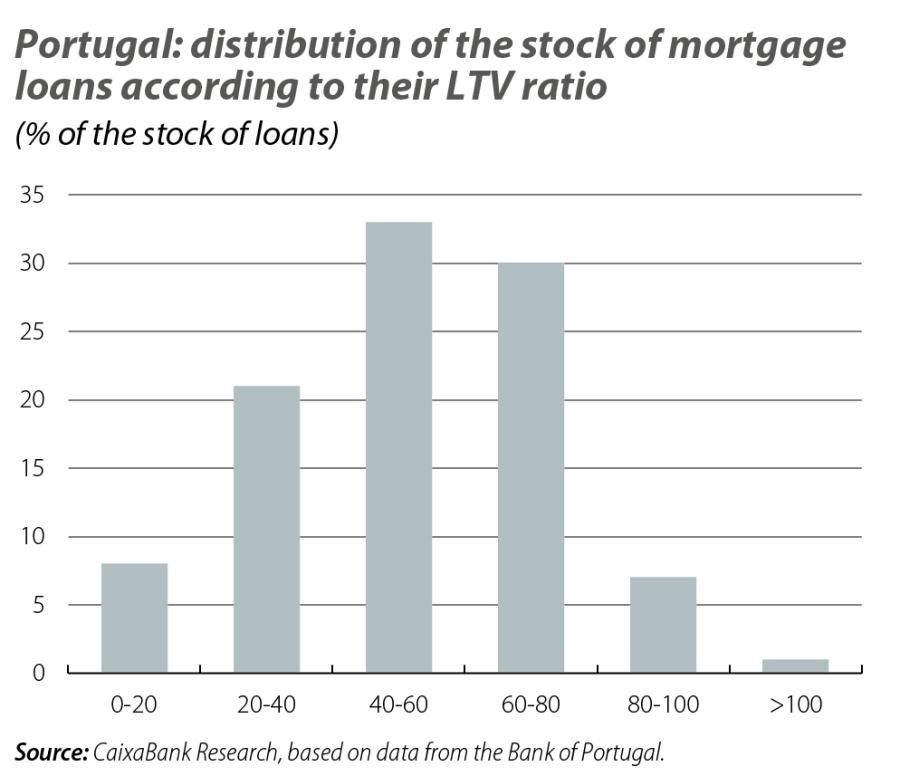

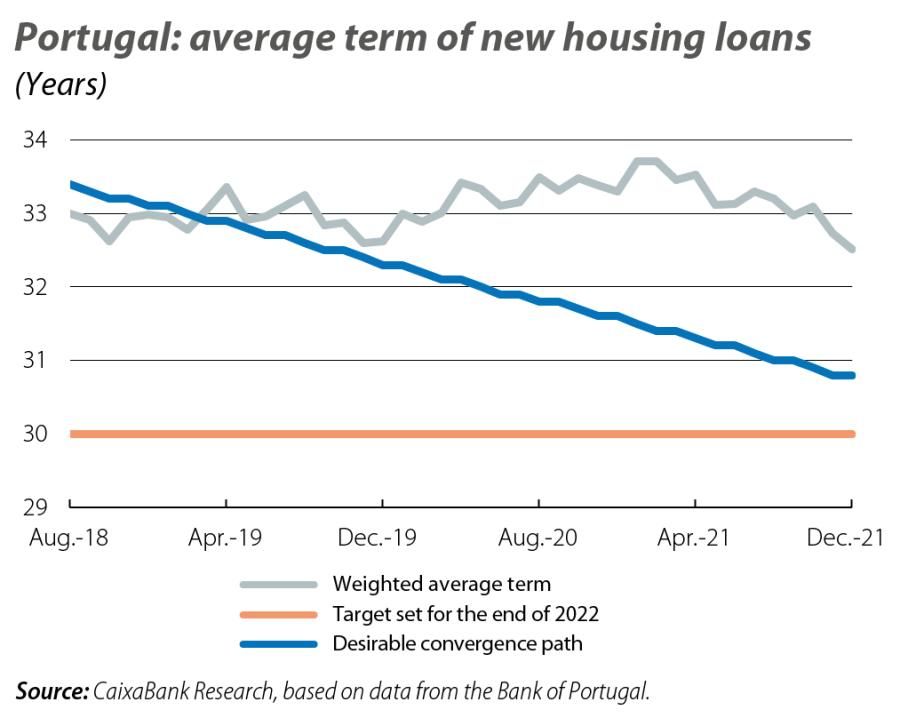

Faced with such significant growth in the housing market, in a context in which interest rates are expected to rise in the euro area, and with the challenges that households are currently facing as a result of the sharp rise in inflation triggered by the war in Ukraine, there is renewed concern over the potential impacts this situation could have on the Portuguese financial system. In this regard, as early as 2018 the Bank of Portugal (BoP) had envisaged a set of macro-prudential measures aimed at preventing the accumulation of excessive risk in banks’ balance sheets and ensuring that households obtained sustainable financing in order to minimise the risk of default. These measures2 include the following key components: (i) a requirement that the loan-to-value (LTV) ratio, or the percentage of the value of the home that is financed through loans, be equal to or less than 90% in the case of a household’s permanent and primary residence; (ii) a limit set for the debt service-to-income (DSTI) ratio,3 which should be equal to or less than 50%, and (iii) limits on the loan term, with a view to reducing the average repayment period to 30 years by the end of 2022. More recently, and in light of evidence indicating that loan terms are not converging to the target, the central bank has recommended linking loan repayment terms to the age of the borrower.4 Specifically, the maximum repayment term for borrowers up to 30 years of age is set at 40 years, and it is reduced to 37 years for those between 30 and 35 years of age. The term falls to 35 years for people over 35 years of age.

- 1We estimate that, in the first year of the pandemic, the savings accumulated due to the impossibility to consume certain goods or services, or for precautionary reasons, amounted to around 8 billion euros (almost 4% of 2019 GDP), while in 2021 they amounted to 5.6 billion (2.6% of GDP).

- 2For further information, visit the Bank of Portugal website: https://www.bportugal.pt/page/limites-ao-racio-ltv-ao-dsti-e-maturidade.

- 3Represents the proportion of monthly income (net of taxes and social security contributions) that is used to pay all the monthly instalments of all the loans held by the borrower. For this purposes, the impact of a potential increase in interest rates and of a reduction in income if the borrower will be over 70 years of age at the end of the loan term should also be considered.

- 4See the communiqué issued by the Bank of Portugal, at https://www.bportugal.pt/comunicado/comunicado-do-banco-de-portugal-sobre-implementacao-da-recomendacao-macroprudencial-em-2-0.

Let us take a look at where these indicators stand today. With regard to the LTV ratio, in 2021 the vast majority of new loan contracts complied with the BoP’s recommendation, and around half of them had an LTV ratio below 80%. As for the stock of all outstanding loans, 92% had a ratio of 80% or less, and 62% had an LTV ratio of 60% or less. Similarly, around 94% of new housing loans registered a DSTI ratio of 50% or less.5

On the other hand, the average maturity of new housing loans at the end of 2021 was 32.5 years, still above the desirable level in order to converge on the 30-year target by the end of 2022.5 This led to the BoP’s recommendation mentioned above. In fact, the vast majority of new housing loans have an average repayment term of between 30 and 40 years (representing 63% of new loans at the end of 2021), and almost half are between 35 and 40 years. These values stand in contrast with much lower average maturity in other European countries such as Spain or France (23 and 21.1 years, respectively, in 2020).5 In fact, such long repayment terms mean that in many cases they could outlast the borrower’s working life (in 63% of the total stock of outstanding housing credit, the borrowers will have 70 years old at the end of the loan term; more specifically, for around 25% of the stock, the borrowers will be 75 or 76 years of age at the end of the loan term if no early repayments are made).5

If we weigh all these factors, we believe that the rate of new lending for housing will slow, opening the door to a period of deleveraging in a context in which household debt remains high. In addition, we must take into consideration the impact on demand of a climate of greater uncertainty and lower household confidence,6 whether because of concerns over the effect that the Russia-Ukraine conflict could have on their employment, or due to the uncertainty as to the indirect impact it will have on the price of goods, especially food and energy. In this regard, there is a possibility that the savings accumulated during the pandemic could be used to counteract the rise in prices, leading more permanent investment decisions such as the purchase of a home to be postponed. In addition, the BoP’s recommendation, implemented in early April, is likely to encourage greater prudence when it comes to taking out housing loans, while the prospect of rising interest rates could also affect home purchase decisions.7

- 6Consumer confidence fell sharply in March to levels close to those recorded at the beginning of the pandemic, with the outlook for prices being a particular source of concern.

- 7For example, for a 35-year loan of 120,000 euros, a rise in interest rates of around 1 pp would result in the monthly payment increasing by some 60 euros. This is particularly relevant if we consider that around 20% of households’ monthly outgoings are related to housing (also including water, electricity, gas and other fuel costs).