New forecasts for the Spanish real estate sector: the expansionary cycle takes hold in 2025

In 2024, Spain’s real estate market enjoyed a remarkable recovery, with a significant increase in both house prices and sales. Factors such as the growth of gross disposable income, foreign demand and falling rates drove this trend. In this article, we unveil our forecasts for 2025 and explain why we expect this boom to continue.

The housing market entered expansive mode in 2024

2024 marked a change of trend for the real estate market. Whereas in 2023 the increase in interest rates led to a slowdown in house prices and a drop in demand (sales fell by 10.2%), in 2024 prices accelerated significantly. Specifically, the growth of house prices rose from 3.9% in 2023 to 6.0% year-on-year in Q3 2024 according to the Ministry of Housing and Urban Agenda (MIVAU), based on appraisal values. The acceleration is even more evident in the index produced by the National Statistics Institute (INE), which is based on transaction prices: the growth rate went from 4.0% in 2023 to 8.2% year-on-year in Q3 2024.

This acceleration in prices has occurred in a context in which housing demand has remained very strong. The number of sales transactions rose by 8.1% year-on-year in January-November of 2024 (628,000 units in the trailing 12 months to November, 24% more than in 2019). This growth is attributable to a series of factors that are driving demand: growth in gross disposable income, increasing foreign demand, positive migration flows, favourable household finances, lower interest rates and an expectation that house prices will continue to rise.

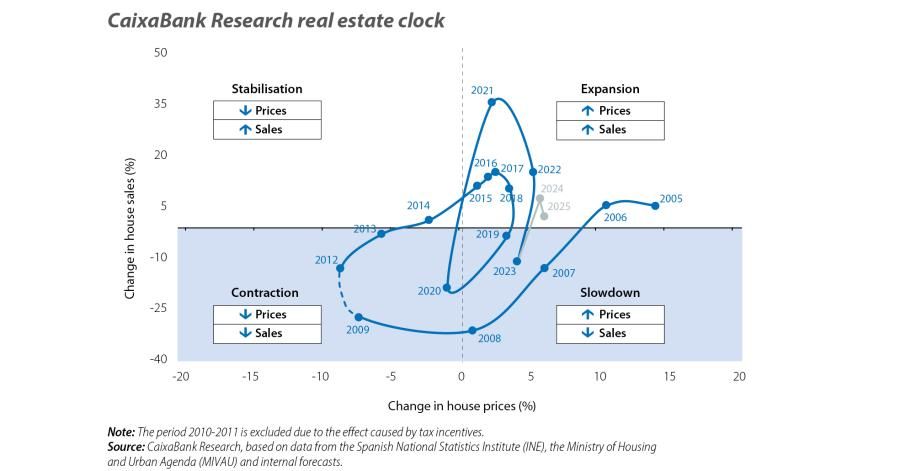

The CaixaBank Research real estate clock reflects this movement: after spending 2023 in the slowdown zone (with a decline in sales, but not in prices), in 2024 it entered the expansion zone (increase in both sales and prices).1

- 1For a description of the movements of the real estate clock in recent years, see the Focus «The CaixaBank Research real estate clock: slowdown in sight», in the MR09/2022. The latest update of the clock was published in the MR03/2024: «The CaixaBank Research real estate clock: from slowdown to expansion».

The upward trend will continue in 2025

For 2025, we believe that the housing market will remain in this expansive zone. On the one hand, the various factors that have driven demand will remain present. The ECB will continue to lower interest rates, household incomes are expected to continue to regain purchasing power, and the population is also expected to continue to grow. Thus, we expect that the number of sales transactions will reach around 650,000, equalling the figure for 2022. On the other hand, we expect that the housing supply will continue to gradually increase: we have raised our forecast for new construction permits from 125,000 to 135,000 in 2025, after they gained traction in 2024 (+16.5% year-on-year in January-October of 2024, reaching around 125,000 permits in the trailing 12 months). However, the supply of new housing is likely to remain below the rate at which new households are being created, so house prices are likely to grow at rates similar to those observed in 2024. Specifically, we expect the housing price index according to the MIVAU (based on appraisal values) to grow by 5.6% and 5.9% in 2024 and 2025, respectively (+0.5 pps and +2.3 pps compared to the previous forecast). In the case of the INE’s index (using transaction prices), the upward revision is +1.3 pps and +3.1 pps, respectively, brining the figure to 8.5% in 2024 and to 7.2% for 2025.

According to these new forecasts, house price growth will slightly outpace that of disposable income per household. This will cause the affordability ratio2 to increase slightly at the aggregate level, going from 7.2 in 2024 to 7.5 in 2025 and placing it a level similar to that of 2022, albeit well below the peak of 9.4 reached in 2007. In this way, the strength of household incomes ought to prevent the emergence of significant imbalances in prices at the aggregate level in the short term, although in the large cities there is a clear affordability problem. In any event, the pattern of house prices will continue to be largely conditioned by the mismatch between supply and demand. In this regard, a lower-than-expected revival of supply could put more pressure than expected on house prices and, depending on the response of demand, could exacerbate the affordability problems.3