The Portuguese economy kicked off 2024 stronger than expected

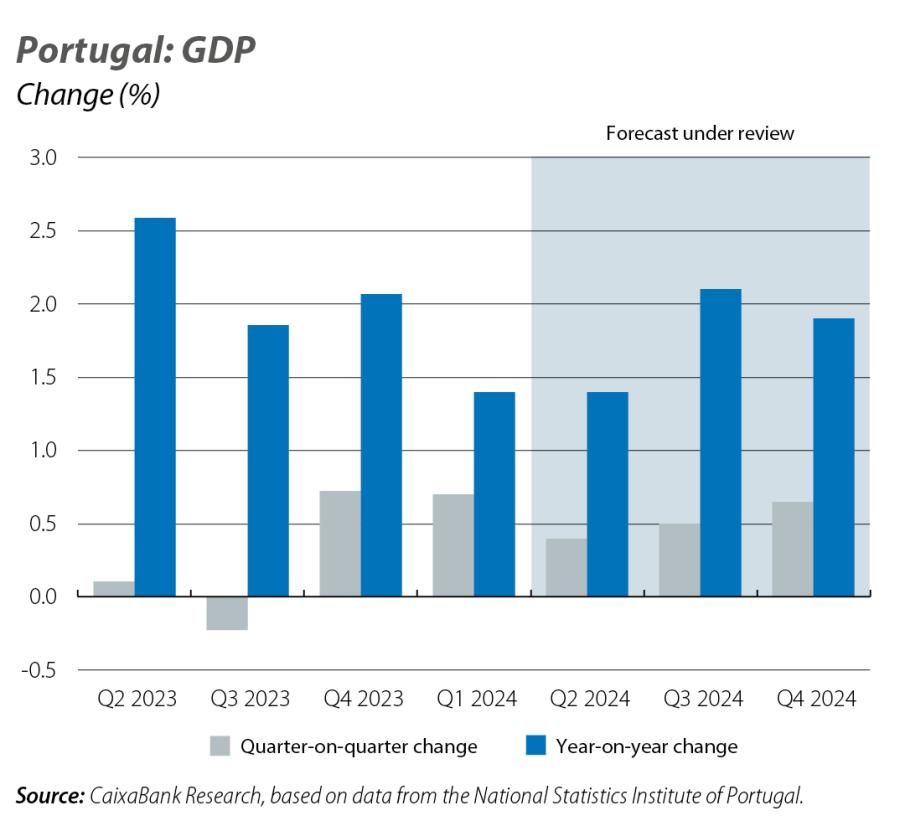

GDP provides a positive surprise in Q1, with quarter-on-quarter growth of 0.7%, according to the first provisional estimate published by the country’s National Statistics Institute.This exceeds our forecast of 0.4% and, therefore, introduces upward risks to our forecast for the year as a whole, which until now has stood at 1.6%.

GDP provides a positive surprise in Q1, with quarter-on-quarter growth of 0.7%, according to the first provisional estimate published by the country’s National Statistics Institute. This exceeds our forecast of 0.4% and, therefore, introduces upward risks to our forecast for the year as a whole, which until now has stood at 1.6%. This performance was driven by foreign demand making a positive contribution to the quarterly growth, while domestic demand was impacted by the fall in investment, although private consumption recorded an acceleration.

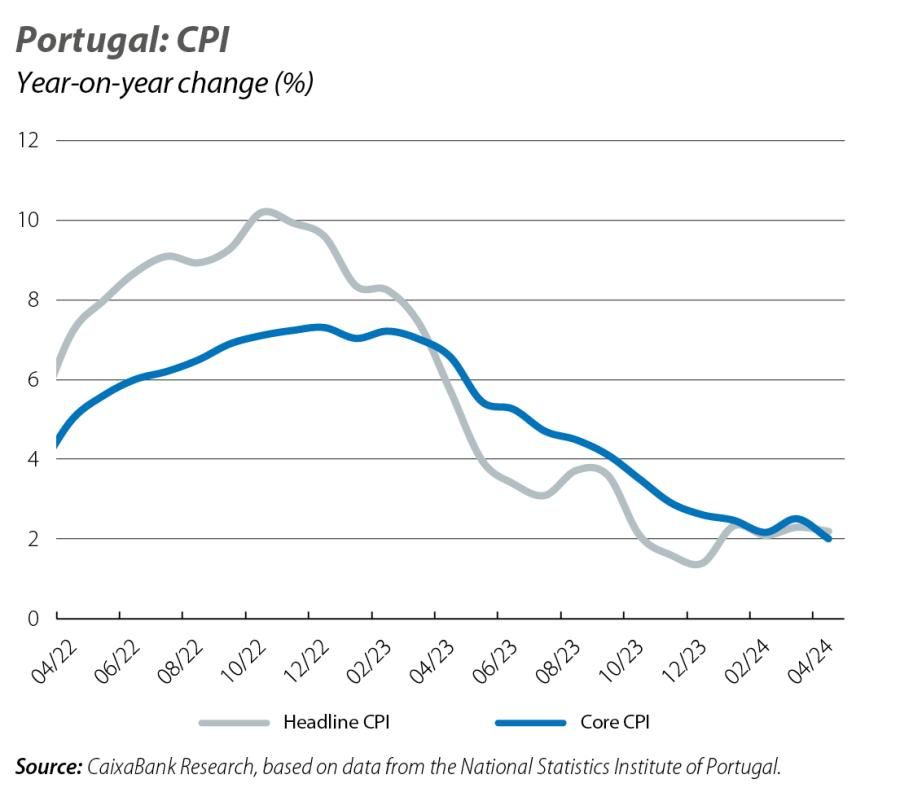

Headline inflation moderated 10 percentage points to 2.2% in April, while core inflation dropped to 2.0%, from 2.5% in March. However, the monthly dynamics of core inflation remain higher than the pre-pandemic average, which may be linked to the persistence of high inflation in the services component. Looking ahead to the next few months, we do not rule out the possibility of another uptick in inflation. In fact, it is expected that in May the base effects will also be felt in the inflation of unprocessed food and energy products (in May 2023 they fell at a monthly rate of 2.3% and 1.7%, respectively).

Employment continues to perform well with growth rates of around 2% year-on-year. The unemployment rate, meanwhile, stabilised at 6.5% in March, for the fifth consecutive month, and registered unemployment fell in March for the second consecutive month. On the downside, job offers, despite recovering in the first three months of the year, remain at very low levels.

The publication of the estimate of exports and imports of goods in Q1 suggests that, in nominal terms, the trade deficit has decreased by 12% year-on-year and has reached around 5.8 billion euros. This pattern has been due to the notable weakness of imports, which have been held back primarily by the correction of energy prices, while exports of goods will have contracted.

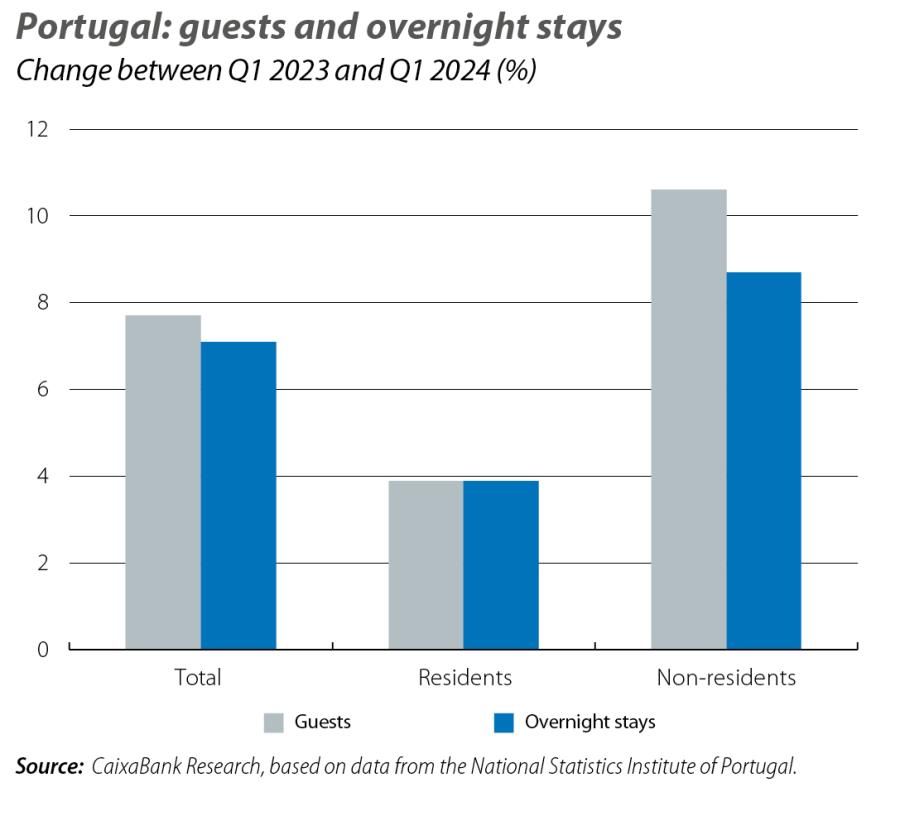

In the first three months of the year there were 5.5 million guests and 13.4 million overnight stays in tourist accommodation establishments, representing an increase of 7.7% and 7.1% compared to the same period of 2023, respectively. This good performance was influenced in part by the calendar effect, since this year the Easter holiday period fell in late March, whereas last year it was in April. The growth was higher among non-residents (+8.7% in the case of overnight stays) than among residents (+3.9% in overnight stays). Among non-residents, the British were the main source market, accounting for 16% of overnight stays, although North Americans recorded one of the highest growth rates (+18% compared to Q1 2023).