The international economy, in search of an orderly landing

The resilience shown by the international economy at the aggregate level, which is quite remarkable given the significant geopolitical uncertainty and restrictive financial conditions dominating the scenario, reflects disparate dynamics among the various international economies, with each one seeking to make an orderly landing amidst their own challenges. The US is experiencing strong growth and is seeking to normalise towards more sustainable rates, while the euro area is showing signs of less apathetic growth and China maintains mixed dynamics between industry and domestic demand.

Global economic resilience, but with regional disparity

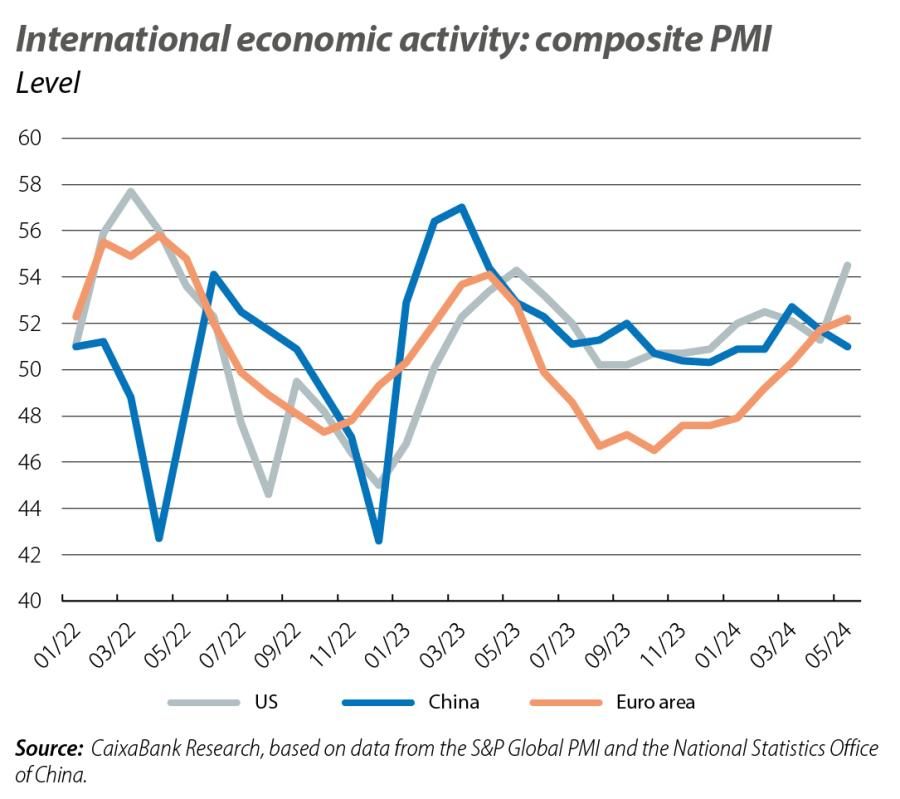

As the general elections in India and Mexico were being brought to a close at the beginning of June, the electoral year continued its course with the European Parliament elections held from 6 to 9 June. These latter elections mark the beginning of the 2024-2029 term, which will involve significant challenges, as we analyse in this month’s Dossier. With the latest data to hand, the global economy is navigating this electoral calendar with resilience: the global composite PMI accelerated steadily to 53.7 points in May, and it is expected that for 2024 as a whole global GDP will grow by just over 3% (a similar figure to 2023 but below the average of the last 20-30 years), supporting a recovery in international trade. This resilience at the aggregate level, which is quite remarkable given the significant geopolitical uncertainty and restrictive financial conditions dominating the scenario, reflects disparate dynamics among the various international economies, with each one seeking to make an orderly landing amidst their own challenges: the US is experiencing strong growth and is seeking to normalise towards more sustainable rates, while the euro area is showing signs of less apathetic growth and China maintains mixed dynamics between industry and domestic demand.

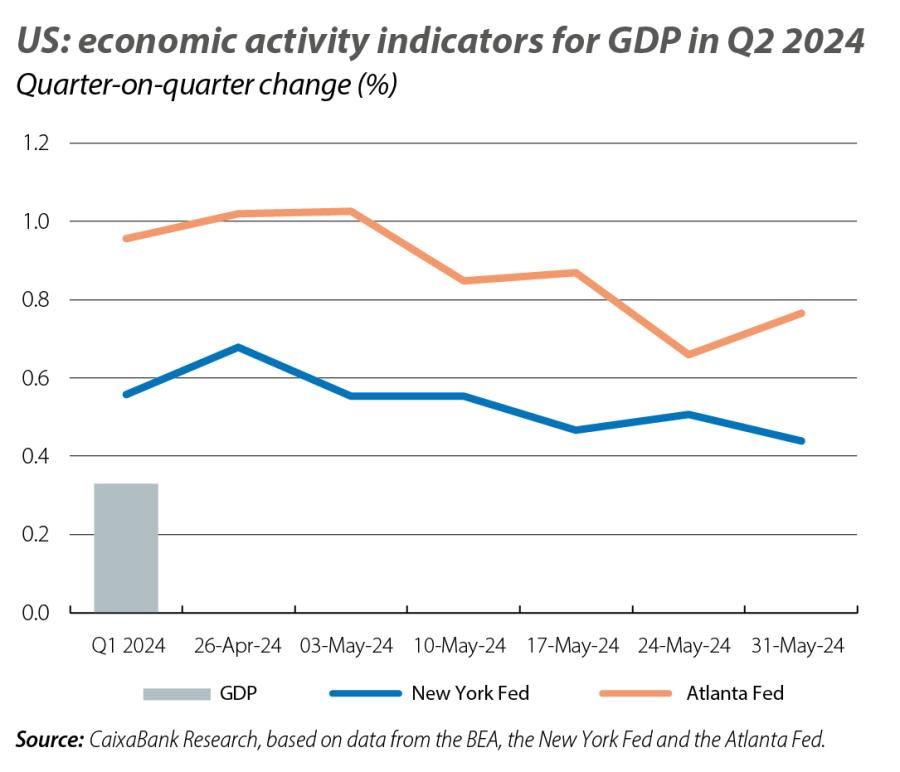

Solid economic activity in the US

On the one hand, US indicators continue to show solid economic growth, with its composite PMI standing at 54.5 points in May (54.4 in April) and trackers that point to GDP growing at rates of slightly above 0.4% quarter-on-quarter in Q2. On the other hand, there are various signs suggesting a slight moderation in growth towards more sustainable rates after a much more robust 2023 than expected. Thus, in May the quarter-on-quarter GDP growth rate for Q1 was revised downwards to 0.3% (–0.1 pp), mainly due to a slightly less dynamic private consumption than anticipated (a trend also reflected in the latest data on personal consumption, decelerating from 0.7% month-on-month in March to 0.2% in April). Also, in May the Fed’s Beige Book reported that, so far in Q2, «slight or modest» growth has been observed in most districts of the United States. Finally, these disparate signs are also reflected in the labour market, with an unemployment rate that rose to 4.0% in May (+0.3 pps year-on-year), but at the same time with dynamic job creation (+272,000).

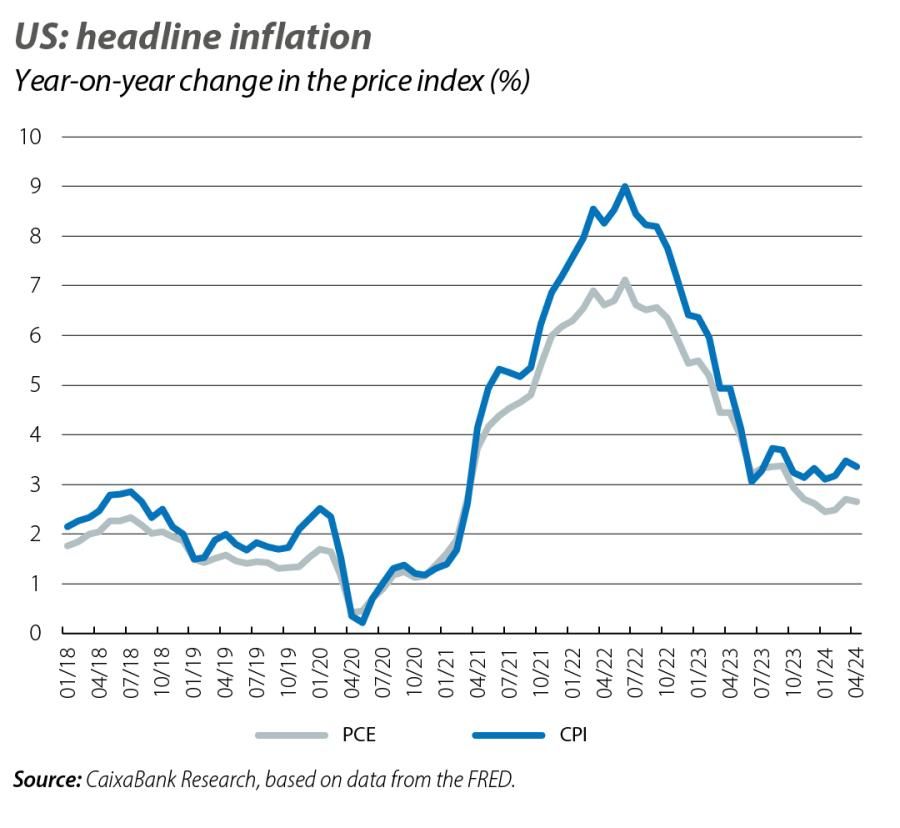

American inflation offered a respite in April

After two months on the rise, in April headline inflation fell by 0.1 pp to a year-on-year growth in the CPI of 3.4%. The 0.2-pp moderation of core inflation (3.6%) was a particularly positive development, as this indicator had been showing significant persistence since the end of 2023. However, items such as shelter (services related to housing) remain at very high levels (5.5%) and, given their weight in the CPI basket (accounting for over 35% of the index), they are preventing headline inflation from making further downward progress. Shelter accounts for a smaller portion of the PCE price index, which is why this inflation measure, which is preferred by the Fed, is lower. That said, it has also recently exhibited more inertia than expected (rising from 2.5% year-on-year in January to 2.7% in April), which supports the expectation of a more cautious Fed when it comes to implementing rate cuts.

Signs of revival in the euro area

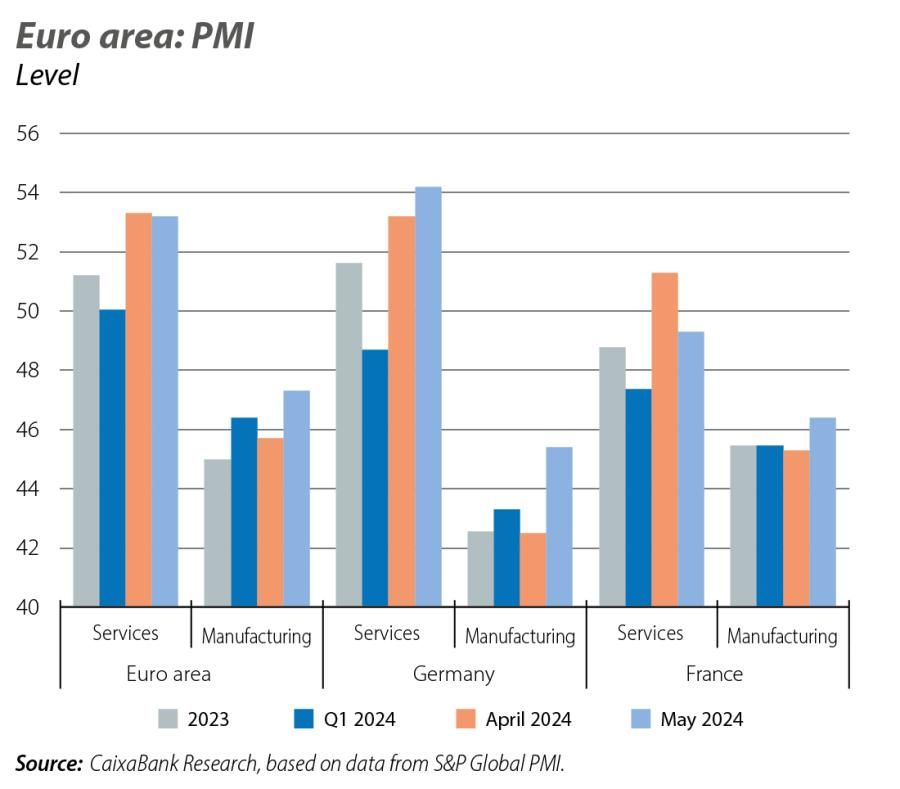

In Q1, with GDP growth of 0.3% quarter-on-quarter, the euro area managed to leave behind the ±0.1% range in which it had been stranded since Q4 2022, and it did so with a positive performance in all major economies. This dynamic is continuing in Q2, with the region’s composite PMI accelerating to 52.2 points in May (12-month high) and reflecting both an improvement in services (53.2) and signs of stabilisation in industry (47.3 points in May, which marks the best figure in the last 14 months, although it is still in slightly recessionary territory). This improvement is primarily led by the countries of the periphery, although the data also point to a certain revival in Germany, one of the economies with the most sluggish growth so far. The recovery of sentiment in the euro area as a whole is also taking place in a context of continued strength in the labour market, with an unemployment rate that fell to a low of 6.4% last April. All this gives greater confidence in the expected reinvigoration of economic activity, although we do not expect a very significant acceleration; rather, GDP is expected to maintain the growth rate of around 0.3% recorded in Q1 over the following quarters.

European disinflation shifted down a gear in May

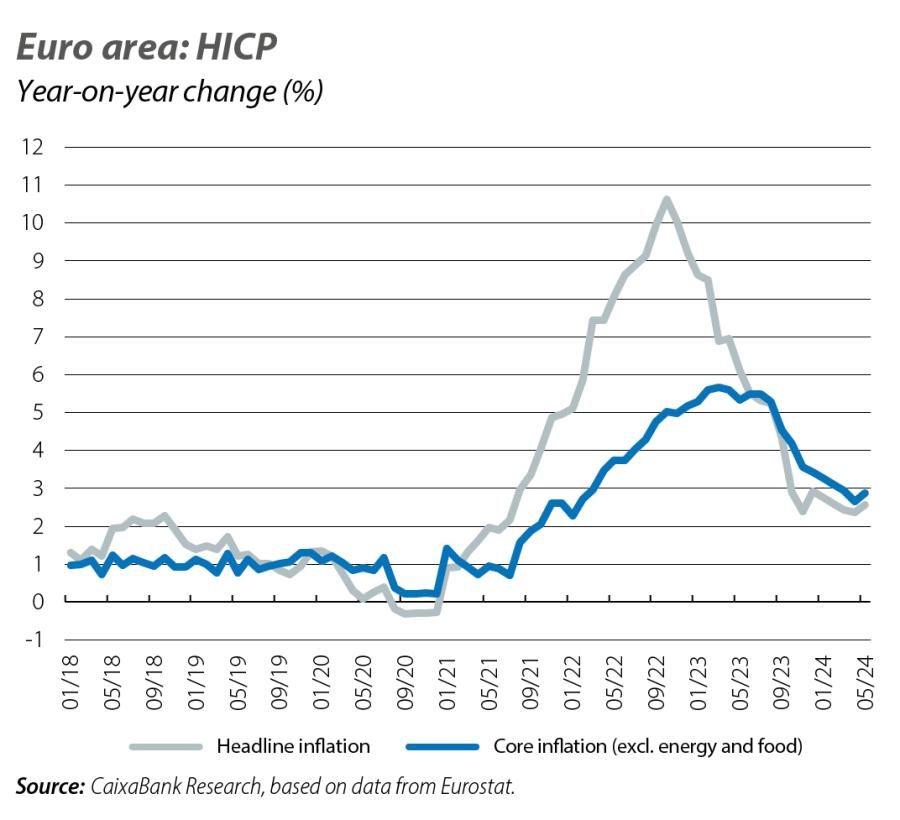

European disinflation shifted down a gear in May, with the headline HICP up 2.6% year-on-year in the euro area as a whole and an acceleration in core inflation (excluding food and energy) to 2.9% (+0.2 pps with respect to April in both cases). Although the euro area has recorded a very sharp decline in price pressures from its peak of 10.6% (in October 2022), the disinflationary process has slowed down in recent months (e.g. in December 2023 it already stood at 2.9%). This is a result of disparate dynamics between components: whereas the source of energy disinflation is now practically exhausted (+0.3% in May, marking the first positive year-on-year rate of change in a year), services are more inertial and still have a long way to go (4.1% in May). In addition to all this, base effects related to support measures introduced to tackle the energy crisis are persisting, and although they will not compromise inflation’s return to 2%, they will lead to volatility in the coming months.

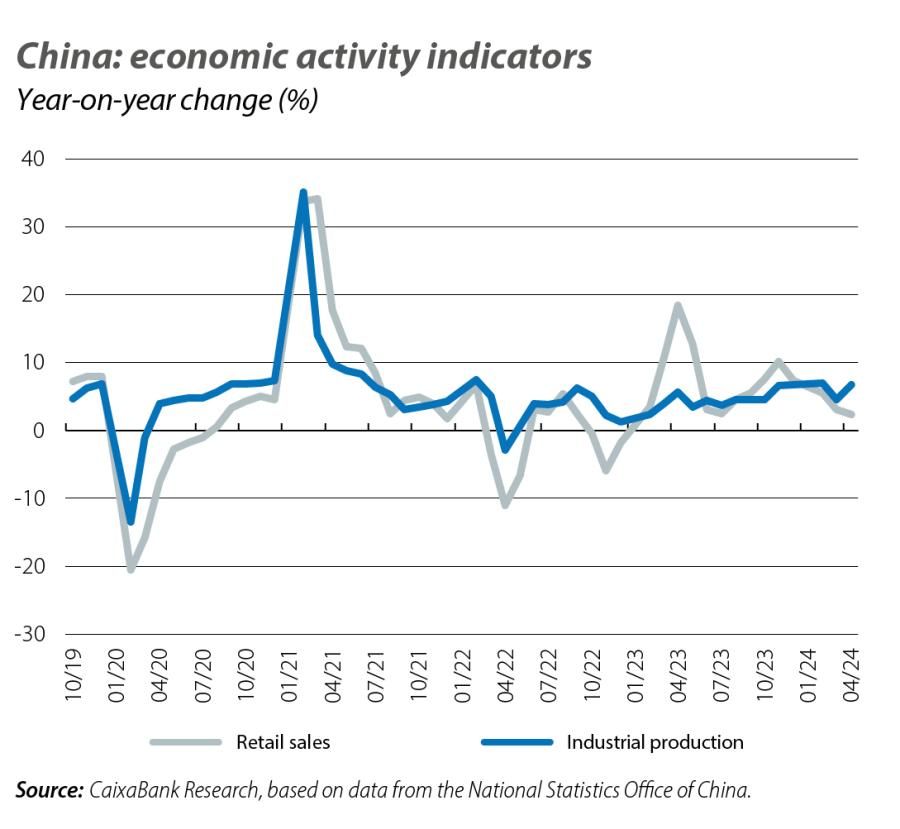

China, at two speeds

The data for Q2 continue to paint a picture of a duality in the Chinese economy, with the momentum of industry on one side and the weakness of domestic demand on the other. In April, industrial production accelerated to 6.7% year-on-year (4.5% in March), while retail sales slowed to 2.3% (3.1% in March). Adding to these mixed dynamics, in May the PMIs showed signs of a slowdown, with a decline in the manufacturing sector to 49.5 points (50.4 in April), stagnation in the services sector (50.5 points in May vs. 50.3 in April) and a drop of almost 2 points in the construction PMI, to 54.4. Overall, the composite PMI stood at 51.0 points (vs. 51.7 previously), reflecting an economy that grew with less intensity in Q2. Looking ahead over the coming months, China’s ability to revive domestic demand will remain one of the key questions while a relaxation of fiscal policy is awaited in the short term. India’s GDP, meanwhile, beat expectations once again, recording a year-on-year increase of 7.8% in Q1.