Uncertain times in the international economy

Stable economic outlook but with increasing risks: geopolitical instability, uncertainty and a lack of confidence.

Stable economic outlook but with growing risks

In its autumn report, the IMF has highlighted an environment of continuing growth, in which the imbalances between supply and demand are fading, enabling a gradual decline in inflation without triggering a sharp correction in economic activity or employment. In this favourable economic context, there are significant differences in growth between regions and a considerable risk map, skewed to the downside. On the one hand, the persistent strength of the US economy and the good performance of the emerging Asian economies (excluding China) contrasts with the weakness shown by China, the large European economies and those most dependent on oil exports. On the other hand, as the main sources of danger the Fund identifies as key threats the possibility of new episodes of volatility in the financial markets, resistance in the disinflationary process, the increase in social tensions, and the rise of protectionism (a risk which is accentuated by the economic agenda proposed by the US president-elect Donald Trump). In particular, the IMF estimates that a scenario with widespread tariff increases, greater uncertainty and lower migration flows could subtract around 1% from world GDP between 2025 and 2026.

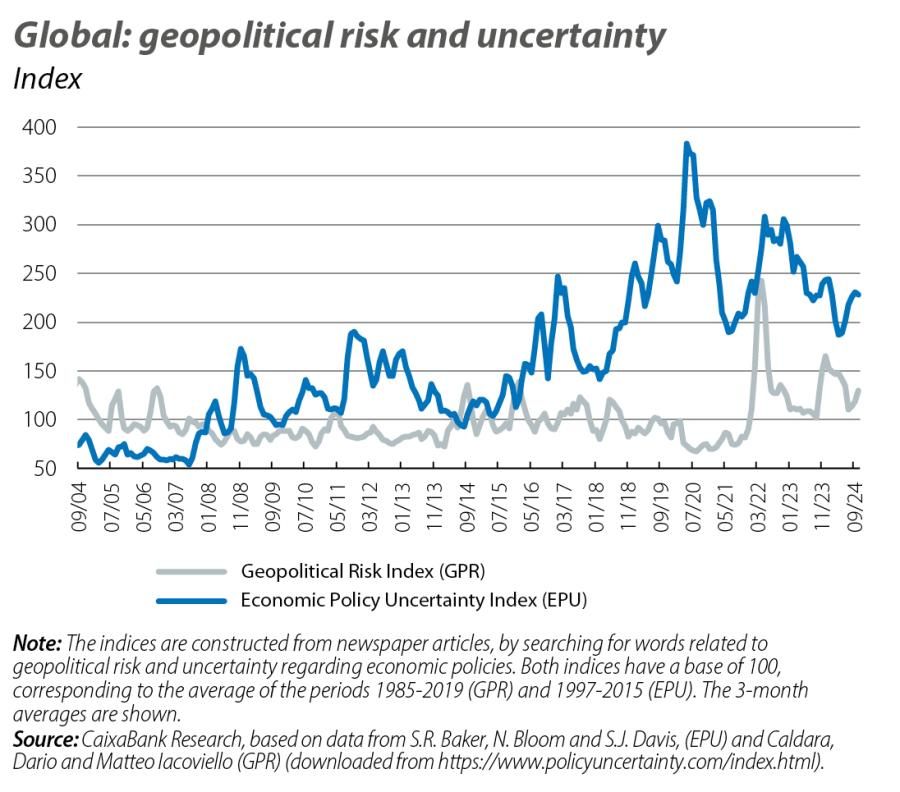

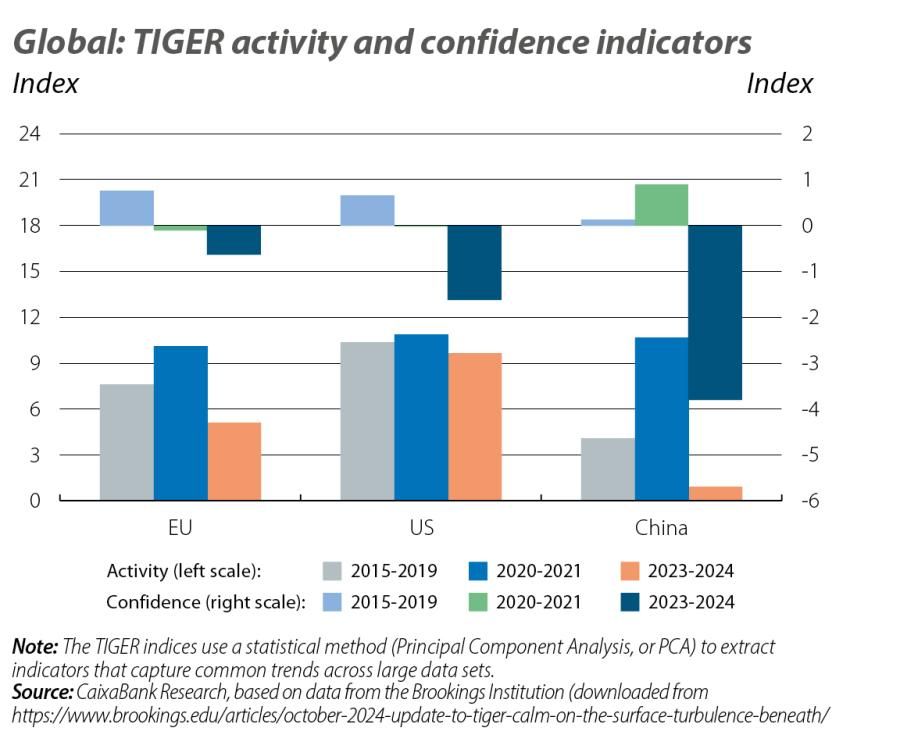

Geopolitical risk, uncertainty and lack of confidence

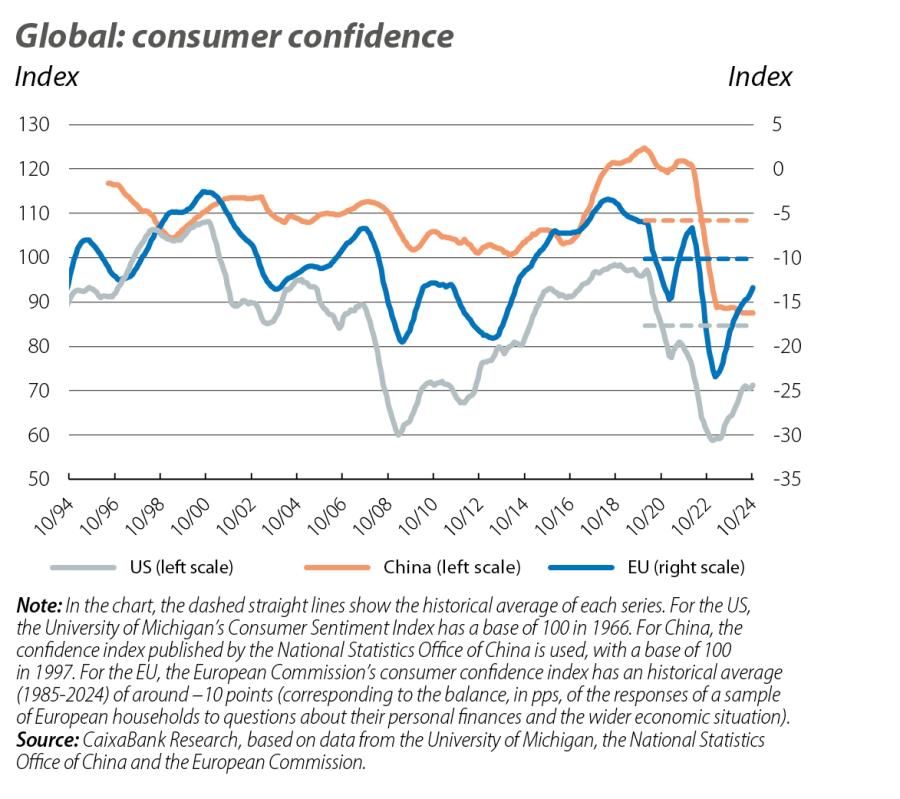

In an environment marked by high geopolitical risk, as well as uncertainty regarding the direction of global economic policy, confidence remains the Achilles’ heel in the largest economies. In the European economy and in China, the deterioration of the confidence indicators is taking place amid a slowdown in economic activity. The case of the US, meanwhile, provides a clear example of how (a lack of) confidence at the global level can have a more fundamental root – and can eventually curb the economy – as long as perceived risk and uncertainty remain high. In addition, the IMF’s Global Financial Stability Report identified the environment of high uncertainty as an additional risk to macrofinancial stability and a factor that could delay consumption and investment decisions. In this regard, in the US, the confidence indicator published by the University of Michigan has shown an improvement in recent months and stood at 70.5 points in October, although it still lies well below its historical average (around 85 points). In the case of China, consumer confidence remains close to record lows (85 points, compared to an all-time average of 108 points). In the euro area, the consumer confidence index stood at –11.2 points in October, confirming the improving trend of previous months, although it remains below its historical average (around –10 points). Meanwhile, the ESI sentiment indicator published by the European Commission fell again in October (to 95.6 points) and has also remained below its historical average since July 2022.

Q3 on the radar: no landing in the US while the euro area and China are still struggling to take off

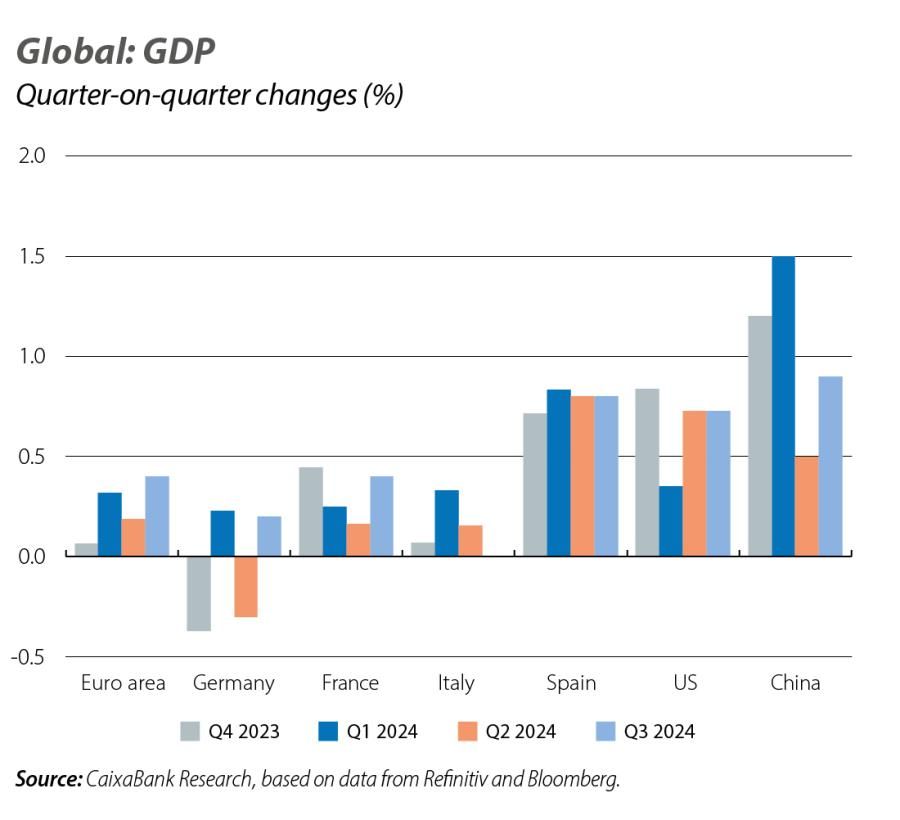

In Q3, the publication of the GDP figures brought upside surprises in the largest economies. The euro area economy beat expectations by growing 0.4% quarter-on-quarter, after recording a modest growth of 0.2% in Q2. However, with the exception of Spain, which registered a significant growth of 0.8% quarter-on-quarter, the underlying picture is one of practical stagnation among the major European economies. Germany exceeded expectations by growing 0.2% quarter-on-quarter (but it contracted 0.3% in Q2, revised 0.2 pps down from the initial estimate). France grew 0.4% quarter-on-quarter (versus 0.2% quarter-on-quarter in Q2), a result that can be explained by the effect of the Paris Olympic Games. For its part, Italy disappointed by stagnating in Q3. The figures for the euro area were also affected by the volatility of Ireland’s data, which showed growth of 2.0% quarter-on-quarter (vs. –1.0% quarter-on-quarter in Q2). Across the Atlantic, the US economy maintained robust growth in Q3 (0.7% quarter-on-quarter, the same as in Q3), driven by strong private consumption, while investment slowed, weighed down by a decline in the residential sector. The Chinese economy, for its part, registered quarter-on-quarter growth of 0.9% in Q3 (vs. 0.5% in Q2). Despite this acceleration, the year-on-year rate observed in Q3 (4.6% vs. 4.7% previously) is the lowest since the beginning of 2023. In an environment in which the disinflationary pressures are accumulating and domestic demand is showing signs of weakness, the fiscal stimulus recently announced by the Chinese authorities may provide some cyclical support, but it does not substantially alter the underlying economic outlook.

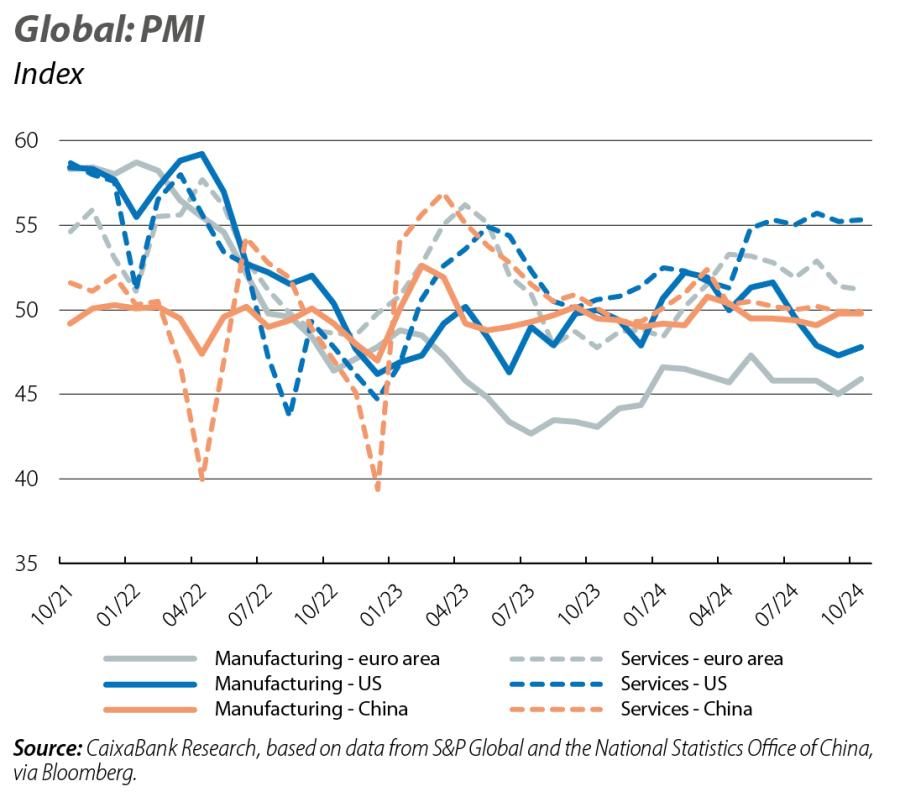

The strength of services continues, but with no signs of recovery in manufacturing

At the start of Q4, the business sentiment indicators continue to reflect a clear disparity between the euro area and the US, as well as between the weakness of the global manufacturing sector and a more resilient services sector. October’s composite PMI for the euro area stood at 50.0 points (49.6 in September), indicating a stagnation in activity. In the US, the composite index rose to 54.3 points (54.0 in September), placing it in expansive territory and offering a further sign of the buoyancy of the US economy. On both sides of the Atlantic, the manufacturing sector remains somewhat sluggish. In the euro area, the manufacturing PMI reached 46.0 points in October (45.0 previously), while US manufacturing, despite some improvement (47.8 vs. 47.3) remains far from the growth threshold. On the services side, the sector remains in expansive territory, although in the euro area it has lost some momentum (51.6 vs. 51.4) and in the US the index continues to show more vitality (55.3 vs. 55.2).

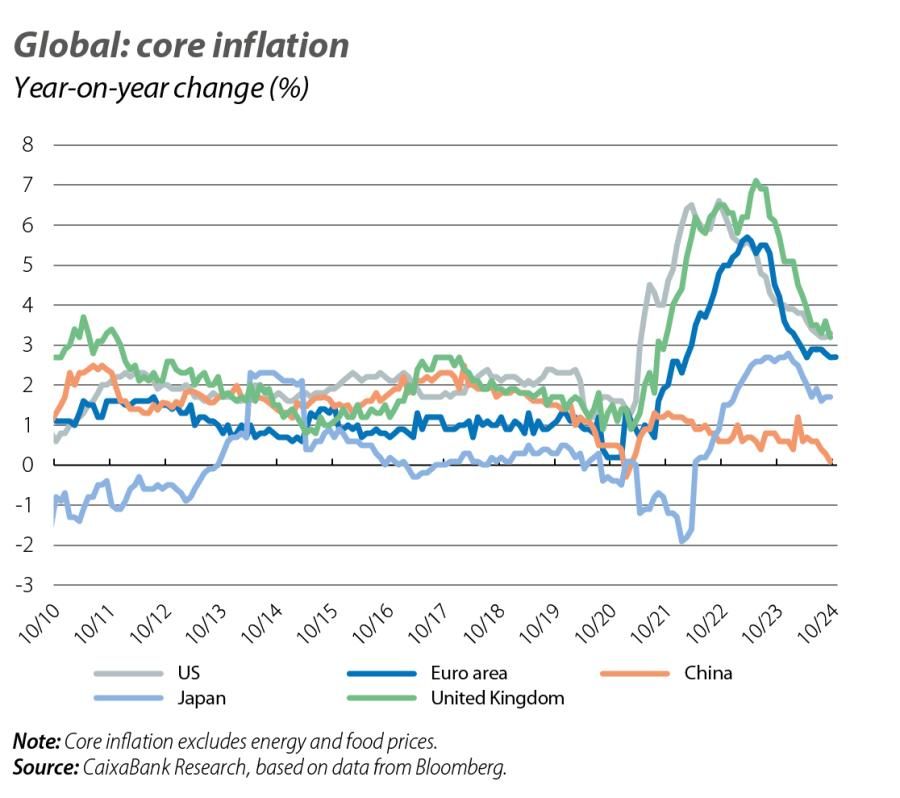

With inflation close to central bank targets, the global economy «pivots» towards old problems

In the euro area, headline inflation reached 2.0% year-on-year in October (vs. 1.7% in September), while the core index remained stable at 2.7%. This rebound is mainly explained by the rise in prices in more volatile components, such as energy and food, and does not contradict the underlying disinflationary dynamics. In the US, headline inflation fell 0.1 pp to 2.4% in September, while core inflation accelerated to 3.3% (vs. 3.2%), pressured by the persistence of prices in services. In particular, inflation in medical and transport services picked up again after several months of moderation, while the shelter component, which accounts for over 30% of the index, has moderated but remains high (4.9% in September vs. 5.2%). Faced with a return to normality in the main macroeconomic variables, the IMF suggests the need for a «triple pivot» in economic policy. Monetary policy must shift from being restrictive to neutral, fiscal consolidation must control debt dynamics and rebuild «buffers», while reforms are needed to improve growth and boost productivity.