The US economy, the clear winner of 2024

The latest available economic indicators suggest that the trends observed for much of 2024 remain in place as the year draws to a close: buoyancy and resilience in the US, weakness in the euro area due to the delicate situation in Germany and France, and a lack of momentum in the Chinese economy in the absence of decisive economic stimuli.

The latest available economic indicators suggest that the trends observed for much of 2024 remain in place as the year draws to a close: buoyancy and resilience in the US, weakness in the euro area due to the delicate situation in Germany and France, and a lack of momentum in the Chinese economy in the absence of decisive economic stimuli.

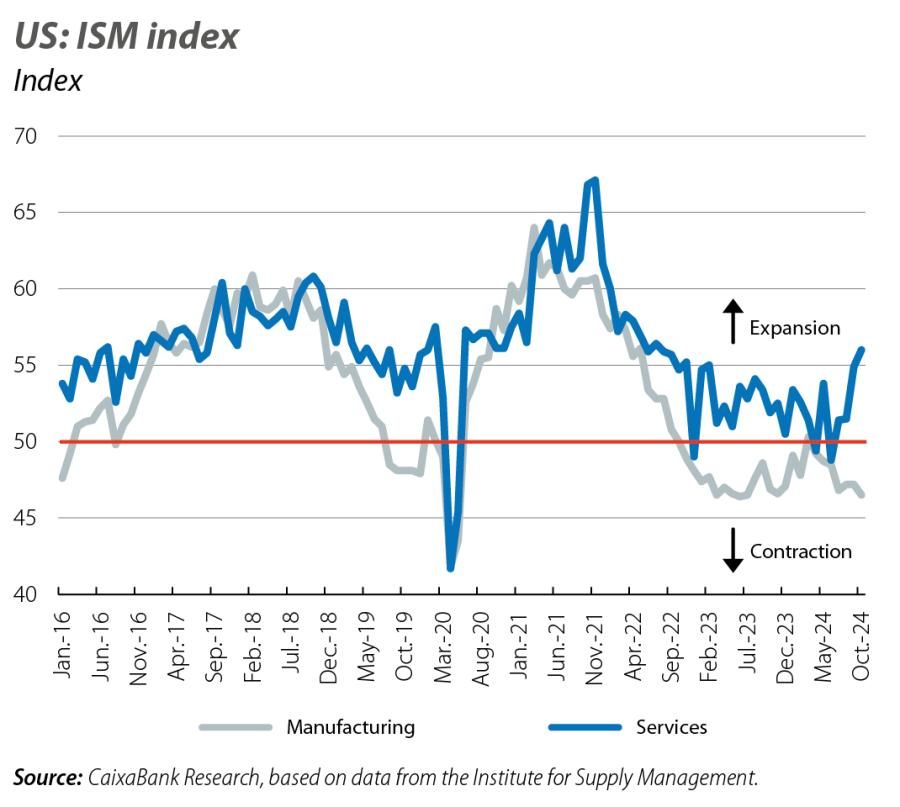

The US economy is beginning to moderate, although it continues to grow at a steady pace thanks to the strength of private consumption in a context of gradual normalisation of the labour market. In fact, both household consumption and disposable income, in real terms, exceeded in October their Q3 average by 0.5%, while the savings rate rose by 0.4 pps to 4.4%, «reinforcing» households’ buffer have as they approach the year end. In addition, the ISM services index increased in October for the fourth consecutive month, reaching its highest level in over two years (56 points, well above the 50-point threshold which separates growth from contraction). The picture in industry is somewhat less favourable: industrial production fell in October (–0.3% month-on-month vs. –0.5% previously), as did orders for capital goods, excluding those related to defence and aircraft (–0.2% vs. 0.3%), while both the ISM and the PMI for the manufacturing sector have consolidated below 50 points, indicating further declines in the sector’s activity. However, the balance for the economy as a whole is clearly positive and the trackers point to GDP growth of 0.5%-0.7% quarter-on-quarter in Q4 (0.7% in the previous two quarters). In this context, in October headline inflation rebounded 0.2 pps, to 2.6%, while the core index remained stable at 3.3%. This has contributed to the adjustment in market expectations regarding the Fed’s future movements (see the Financial Markets - Economic Outlook section).

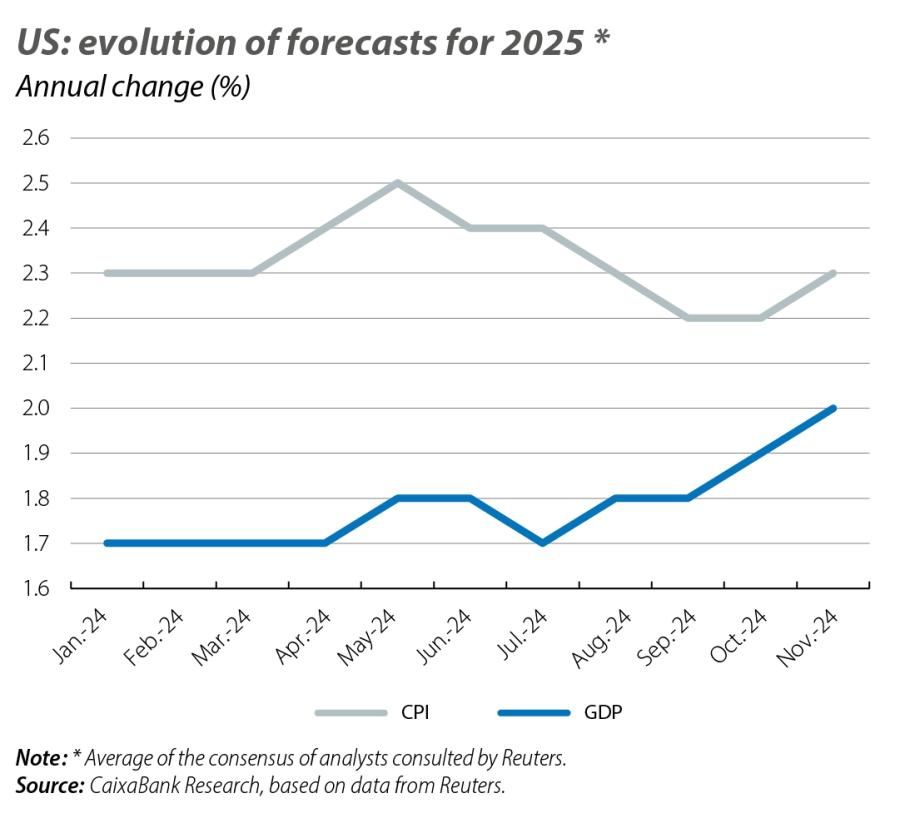

The growth outlook for 2025 is also quite optimistic, although there are questions surrounding the implementation of the new administration’s economic agenda. Trump has a Republican majority in both the Senate and the House of Representatives and, while that does not guarantee that his agenda will be fully approved, expectations of a short-term boost to growth have begun to arise due to the anticipated tax cuts. However, if the planned tariffs end up being implemented and greater limits are imposed on immigration, then growth could suffer in the medium term. There is less doubt about the inflationary nature of these measures, and since September inflation expectations for two years ahead have risen by more than 50 bps (according to the inflation swap markets).

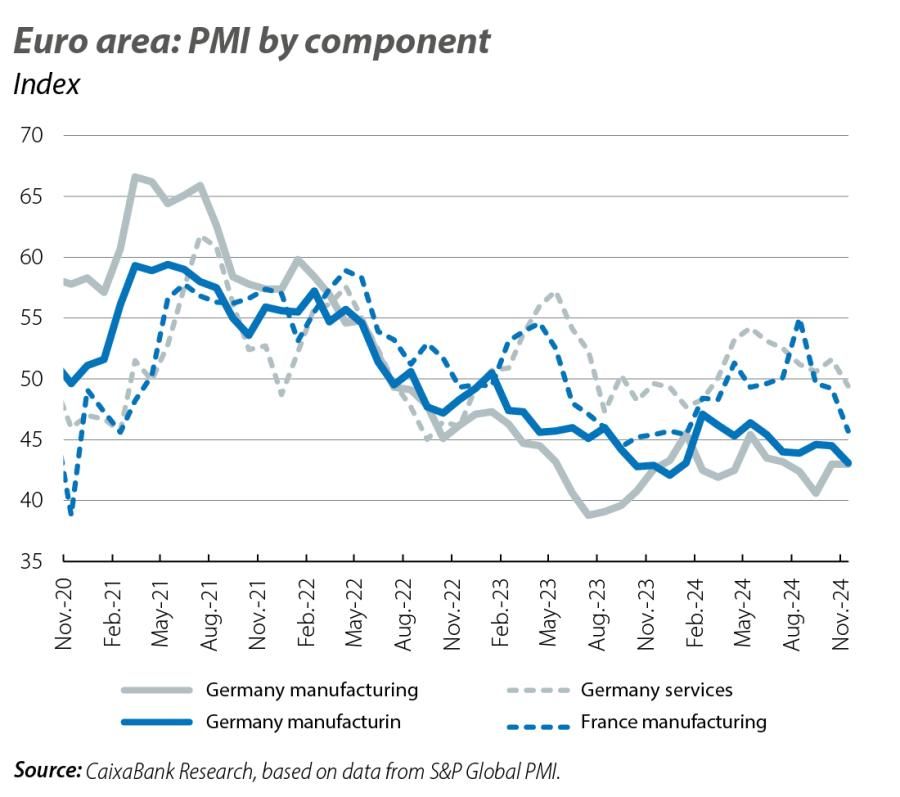

According to the latest data, the euro area is approaching the year end with increasing weakness: the main business climate and opinion indicators are prolonging their deterioration and are consolidating at levels compatible with contractions in economic activity (the composite PMI fell in November to 48.1, a 10-month low). This lack of momentum is explained by the delicate situation that the region’s two major economies are facing. On the one hand, Germany is mired in structural difficulties (GDP in Q3 is barely 0.2% above pre-COVID levels), weighed down by its industrial sector (industrial orders in September were almost 12% below their trend levels) and a service sector that lacks the necessary momentum to take the reigns. Moreover, in view of the latest data we cannot rule out a further decline in GDP at the end of the year. On the other hand, France is no longer enjoying the boost that the Paris Olympic Games provided (GDP +0.4% quarter-on-quarter in Q3) and it is now also facing a year end with a clear slowdown (in October, household consumption fell by 0.4% in the month, while the composite PMI fell below 45 points in November). Added to this economic weakness is the heightened political uncertainty: Germany is heading for early elections on 23 February, while in France, President Macron has been left without a government after losing a no-confidence vote, which also left the 2025 budgets unapproved. The Italian economy has also begun to lose steam: GDP stagnated in Q3 and November’s composite PMI was below 50 points. However, the slowdown in activity gives confidence to the fight against inflation. In November, euro area headline inflation stood at 2.3% (with a slight rebound, as expected, due to base effects in energy), while the core index remained at 2.7% and more real-time indicators (momentums) pointed to inflation rates slightly below 2%.

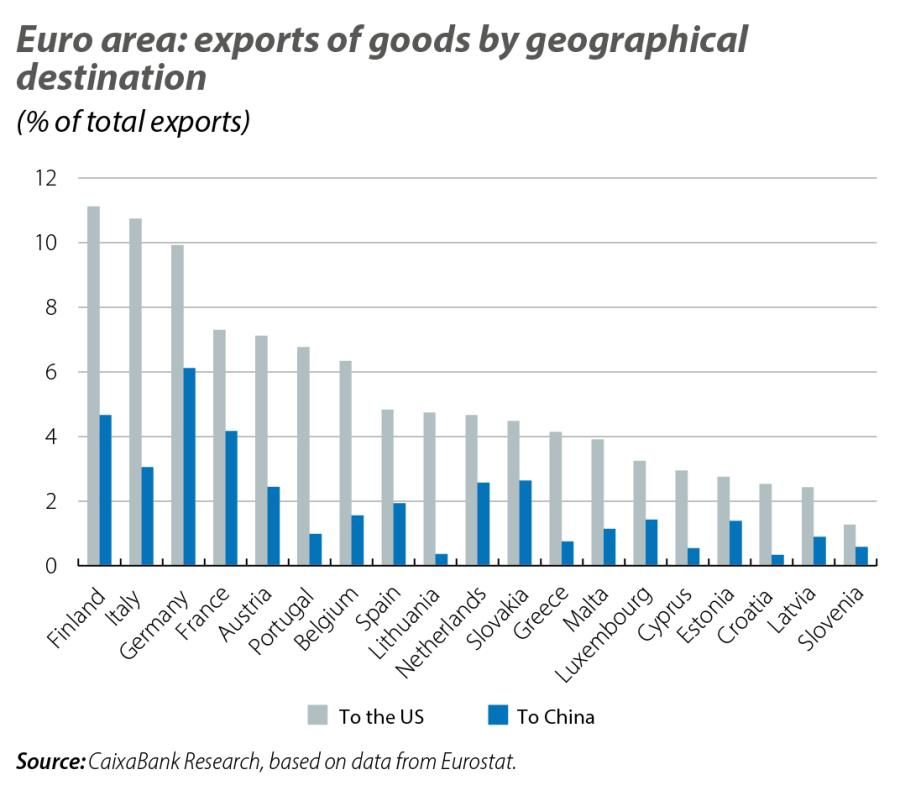

Firstly, beginning in 2025, fiscal consolidation processes must begin in a large number of the bloc’s economies, after years of highly expansionary fiscal policies intended to offset the impact of COVID and the war in Ukraine. Among others, Italy and France are currently subject to excessive deficit procedures, forcing them to implement restrictive measures and meet a schedule of targets. Secondly, a tariff hike by the US would be a burden for economic activity in the euro area, as an open economy that relies on its foreign sector, and Germany and Italy would be particularly exposed (see the Focus «Exposure of the European economy to a US tariff hike» in this same report). On the upside, the rate cuts anticipated for the ECB will translate into a weaker headwind from monetary policy.

The Chinese economy has failed to pick up in Q4 despite the government’s efforts to stimulate consumption and investment. In year-on-year terms, industrial production in October was up 5.3% and retail sales, 3.2%, far short of their pre-pandemic averages for the same month. In addition, the situation in the country’s housing sector remains rather delicate, as indicated by the sector’s confidence index in October being near its all-time low. While China is likely to end up close enough to its 5.0% GDP growth target in 2024, the outlook for 2025 is less certain. On the one hand, this is because of the risks arising from the US tariff policy (China is one of the main targets, with threats of 60% tariffs already preceded by an announcement that on 20 January, the day of Trump’s inauguration, an additional tariff of 10% will be approved by executive order). On the other hand, the economy is facing structural difficulties related to the housing crisis and the weakness of household confidence indicators. These are factors which translate into weak domestic demand and widespread «disinflation»: headline inflation is practically zero (0.3% in October) and production prices have been falling for the past two years (–2.9% year-on-year in October).