Deficit and debt on the rise: the future of the US’ public finances

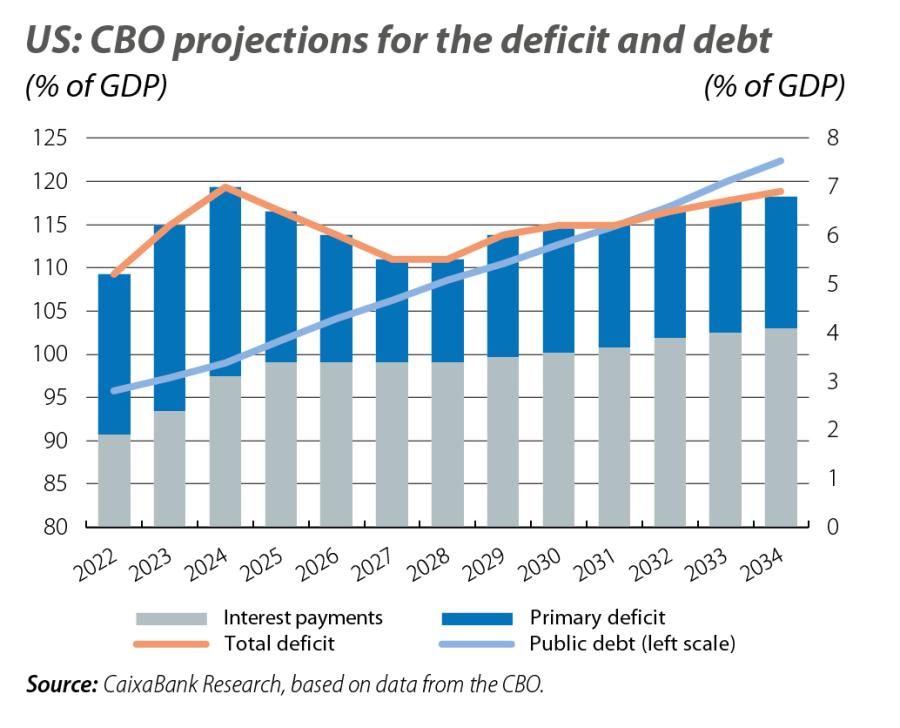

The CBO’s report published in June reveals that, in the absence of any substantial changes in fiscal policy, the US’ public accounts are set to deteriorate significantly over the coming decade: by 2034 the deficit would represent 7% of GDP, well above the historical level of 3.7%, while public debt would continue to climb to new highs, reaching 122% of GDP.

Ever year, the US Congressional Budget Office (CBO) publishes a report with 10-year projections for public revenues and expenditure, the resulting surpluses or deficits, and the public debt required to finance the federal government. These projections are prepared on the assumption that, over the next decade, both revenues and expenditure will follow current policy trends and that inflation and GDP will grow at an average rate of 2.0% and 1.8%, respectively. As with all exercises of this nature, the projections published by the CBO are not intended to offer a precise measure of where the public accounts will stand in the future (no one can predict a change of legislation or an economic shock). They do, however, provide a clear picture of the current fiscal situation and how it might evolve under different assumptions.

With these considerations in mind, the report published in June by the CBO reveals that, in the absence of any substantial changes in the current fiscal policies, the public accounts would deteriorate significantly over the coming decade: by 2034 the deficit would represent 7% of GDP, well above the historical level of 3.7%, while public debt would continue to climb to new highs, reaching 122% of GDP.

Spending on debt interest and social programmes will increase total public spending

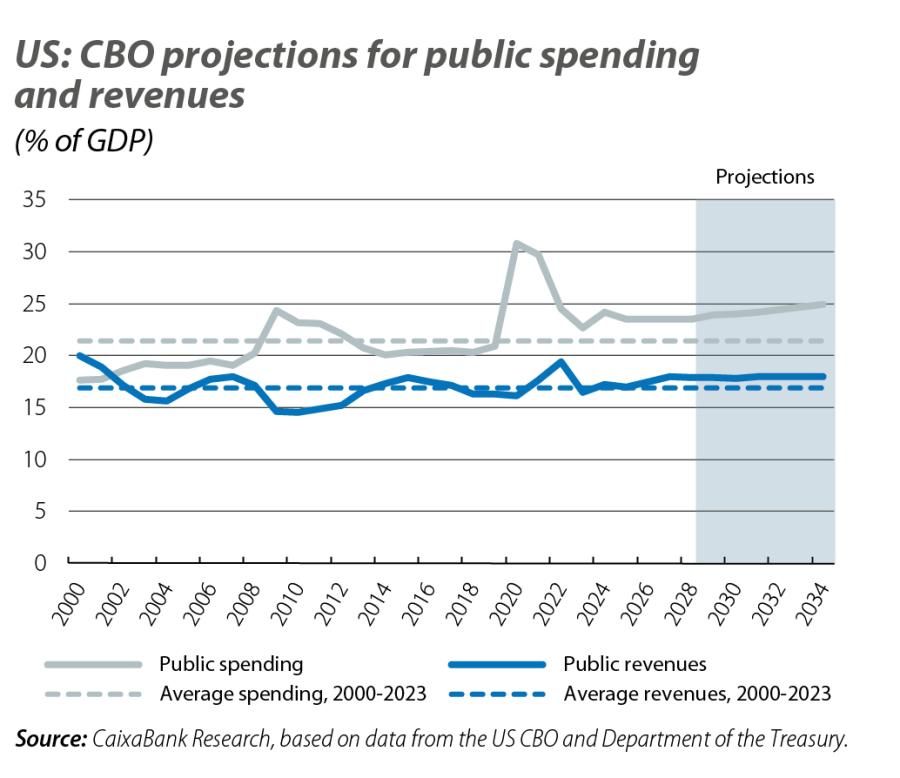

In 2024, public spending is estimated to reach 6.8 trillion dollars, while by 2034 it will reach 10.3 trillion. These sums represent 24% and 25% of GDP, respectively, compared to a historical average of 21%. This increase will be driven primarily by mandatory items, as well as by an increase in interest expenditures. Mandatory expenditures, which include commitments such as social security and healthcare, will be pushed up mainly by an ageing population and rising health costs.1 In fact, by 2034, health expenditure as a proportion of GDP is expected to reach double the average of the last 50 years. Interest payments will also increase, going from 2.4% of GDP in 2024 to 4.1% in 10 years time. This will be this component’s highest level since 1940 and places it at the same level as spending on Medicare,2 primarily due to the rise in debt (the projected average 10-year treasury rate is 3.80%, which is similar to the average for the past 20 years). On the other hand, discretionary spending, which is approved annually by Congress and includes items such as defence, transportation and education, is set to fall over the coming decade, reaching an all-time low of 5.5% of GDP by 2034 (6.3% in 2024).

- 1The CBO estimates that the number of Social Security beneficiaries is growing faster than the total population, and that the cost of healthcare per beneficiary is growing faster than GDP per capita.

- 2Medicare is the healthcare programme for people over the age of 65 and people with certain disabilities.

Revenues will increase if the tax cuts are not extended

In 2024, it is estimated that the government will record revenues totalling some 4.9 trillion dollars, or 17% of GDP, and that this figure will steadily increase to reach 7.5 trillion by 2034, which is 18% of GDP. This is slightly above the average of 17% of GDP of the last 20 years, given the expiry in late 2025 of the tax cuts introduced in 2017 under Trump’s presidency.3 Thus, revenues from corporate taxes, personal income taxes and social security contributions, which account for over three quarters of all federal government resources, will increase from 15.5% to 16.7% of GDP. The other revenue components will remain fairly stable in GDP terms in the coming years.

- 3The Tax Cuts and Jobs Act cut corporation tax from 35% to 21% and reduced the maximum rates of each bracket of personal income tax.

The deficit and public debt will reach historic highs

According to the CBO’s projections, the fiscal deficit in 2024 will stand at 1.9 trillion dollars, or 7% of GDP, and by 2034 it will rise to 2.8 trillion, or 6.9% of GDP. This means that by the end of the projected period, the deficit in GDP terms will still be twice the average level recorded during the five years immediately prior to the pandemic. In addition, it will be the first time since 1930 that the deficit will exceed 5.5% of GDP for more than five consecutive years. The primary deficit, which excludes interest payments on debt, will fall from 3.9% of GDP to 2.8%, placing it even below the 4.1% average of the last decade. However, this will be insufficient to offset the aforementioned increase in interest spending. Consequently, these larger deficits will be financed by the issuance of greater sums of public debt, which is forecast to rise from 28.2 trillion dollars (99% of GDP) to 50.6 trillion (122% of GDP) in 2024.

What could change?

Beyond any unexpected economic shocks that could significantly alter the growth, inflation and interest rate forecasts of the CBO’s baseline scenario, the main factor that will determine the future evolution of the public finances will be what form of fiscal policy is implemented by the upcoming administration. However, the economic proposals from both candidates thus far appear likely to aggravate the already deteriorated fiscal landscape: from the expansion of spending on social programmes, to further tax cuts for both corporations and individuals. A priori, it does not appear that either of the two major political parties intend to adopt policies aimed at reducing the public deficit, although this may be an electoral strategy.

But promises made during an election campaign are one thing, and the reality that follows is another. In fact, the Federal Reserve and various institutions have issued warnings about the path that debt is on, as they consider it to be unsustainable. Even the rating agency Moody’s downgraded its outlook for the US’ credit rating from stable to negative last November. For now, the financial markets have not been too concerned about the US’ fiscal sustainability. However, history (events such as the «Truss effect» in the UK) warns us that the sensitivity of «bond vigilantes» can spike in the event of a deterioration in the fiscal outlook, and the lack of clarity in the fiscal plans remains a risk for the financial markets.