New economic outlook: Spain’s economy once again surpasses expectations

The Spanish economy has once again exceeded our expectations in the opening months of 2024. While the GDP growth figure for the final quarter of 2023 was higher than expected, that of the first quarter of this year confirms the good performance of Spain’s economy and leads us to revise our forecasts upwards. Let’s re-examine the main factors that will determine the outlook for Spain’s economy, after incorporating the latest available information.

Starting point

The performance of Spain’s economy provided a positive surprise for the second consecutive quarter, growing by 0.7% quarter-on-quarter during Q1 2024. This better-than-expected performance comes in addition to the upward revision of the figure for the final quarter of 2023, when GDP also grew by 0.7% quarter-on-quarter. Thus, the Spanish economy has managed to maintain a steady growth rate despite the multiple factors it has had to contend with, such as the weakness of the euro area economies, persistent inflation and the impact of the interest rate hikes, which were expected to peak in Q1 2024. Underlying this good performance are several key factors: the strength of the labour market, the boost provided by immigration flows, which remain dynamic, and the buoyancy of international tourism, which once again exceeded expectations and explains the strong contribution of foreign demand to growth. In contrast, domestic demand has maintained a more modest pace of progress. In the case of investment, although it rebounded significantly in Q1 2024, it remains 2.2% below the level of Q4 2019, and private consumption is just 0.4% above, despite the fact that the population has increased by 3% since 2019.

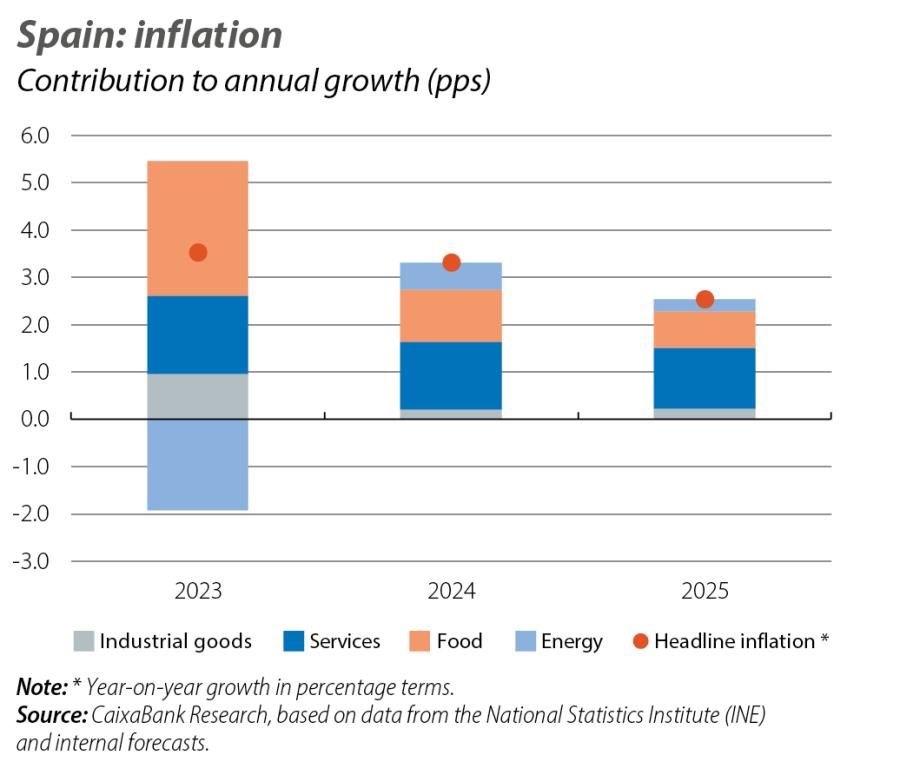

On the other hand, inflation, which has averaged 3.3% between January and May this year, has behaved in line with our expectations, albeit with some nuances when we go into the detail of the different components. In recent months, opposing dynamics between the various components of the CPI basket have been accentuated. On the one hand, core inflation, which excludes energy and food, has gradually fallen to 2.7% in May (4.4% in 2023), despite persistent inflation in services. On the other hand, the rest of the components continue to show relatively high inflation rates. The rise in energy inflation is mainly due to temporary factors: although the price of electricity in the wholesale market has remained relatively low, the final price has been affected by increases in the various taxes that apply to electricity bills. In the case of food, inflation rates are well below those of last year (4.6% year-on-year in April vs. 11.1% on average in 2023), but this decline is largely due to base effects. With month-on-month increases still above the average of the period 2015-2019, food inflation remains far from normalised.

Revision of the underlying assumptions of the scenario

In the international scenario, the main assumptions of two months ago regarding the outlook remain in place. For the euro area, where economic growth is still weak and average inflation has been 2.5% up until May, we maintain our forecast of four rate cuts in 2024 (bringing the depo rate to 3.0% in December 2024), followed by three more in 2025. As such, monetary policy will continue to favour the recovery of investment. In terms of the price of the main commodities, the upward revision of the price of Brent oil to an average of 87 dollars/barrel in 2024 (79 dollars/barrel in the previous scenario) means that fuels will no longer contribute to the decline in inflation. However, the impact of this revision is relatively moderate, as oil already experienced a peak in prices during the second half of 2023.1

- 1See the Focus «The buzzword in the new international scenario: divergence» in this same Monthly Report.

Outlook

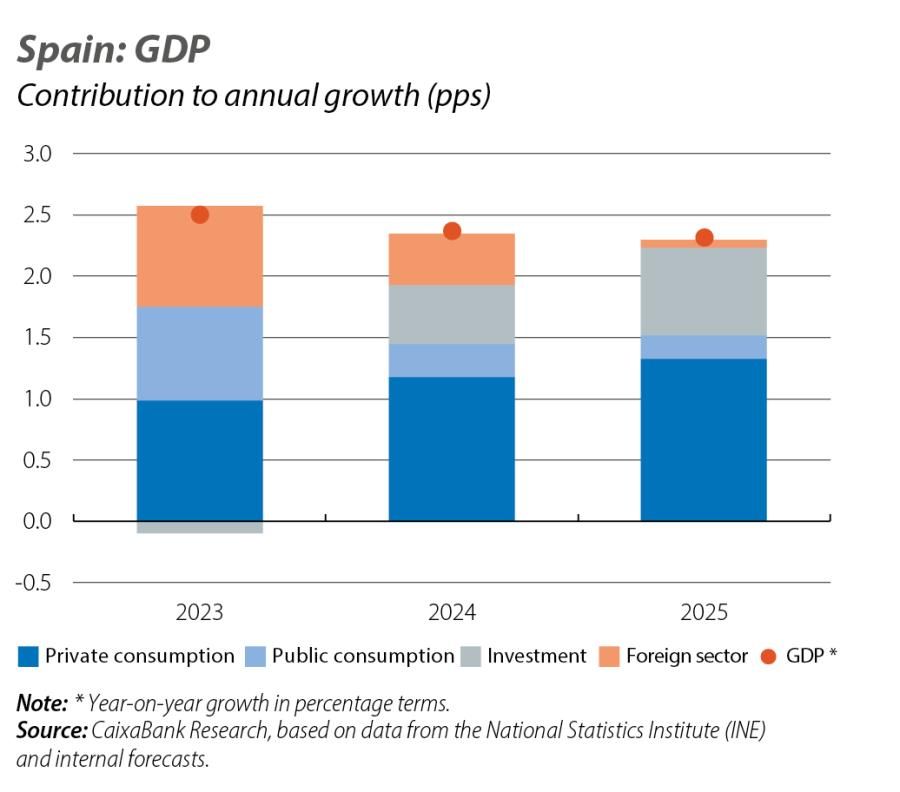

The good data for this year’s Q1, together with a somewhat more favourable global environment, lead us to revise upwards our GDP growth forecast for 2024 as a whole to 2.4% year-on-year and for 2025, to 2.3% year-on-year (0.5 and 0.1 pps more than in the previous scenario, respectively). Beyond the aggregate data, this revision is accompanied by a change in the pattern of growth. Firstly, we expect domestic demand to take over from foreign demand as the driver of growth, in light of the expected cooling of exports of goods and the anticipated normalisation of tourist flows.2 In turn, we also expect that domestic demand will be less driven by public consumption and that we will see a gradual revival of both private consumption and investment.

- 2See the article «Which of Spain’s sectors have been hardest hit by the slowdown of the country’s trading partners?» in the Sectoral Observatory.

On the private consumption side, the good data on job creation and population growth have resulted in a sharp increase in household gross disposable income (GDI), which rose by 11.0% year-on-year in 2023. This increase in GDI has placed the savings rate at 11.7%, above the historical average of 8.2%.3 Given the anticipated interest rate cuts on the part of the ECB, we expect a portion of these savings to contribute to an increase in private consumption, which would improve the growth rate to 2.2% in 2024 (1.7% in 2023) before accelerating to 2.4% in 2025. In terms of investment, our forecast is that it will begin to gain momentum with a growth rate of 2.5% in 2024, spurred on by the first interest rate cuts on the part of the ECB and by greater traction in the execution of the NGEU funds, the maximum disbursement of which is expected to take place in 2025.

The good outlook in our scenario is not limited to economic activity growth. In line with the upward revision of GDP and the good performance of employment so far this year, we have revised our forecast for the unemployment rate down to 11.6% on average in 2024 and to 11.1% in 2025 (0.2 and 0.3 pps less than in the previous scenario, respectively). This forecast is relatively moderate given that we have also revised the growth of the labour force upwards in the face of immigration flows that are still projected to be high.

On the other hand, the real estate market will continue to benefit from the low level of leverage among households at the aggregate level and the resilience of foreign demand, in addition to the robust labour market and the decline in interest rates. In this regard, we have also revised upwards our forecast for the annual number of home sales to 565,000 (15,000 more than in the previous scenario) and, above all, we have raised our forecast for the growth of home prices to 4.0% year-on-year (1.3 pps more than in the previous scenario).

As for inflation, we have revised our forecast for 2024 slightly upwards to an annual average of 3.2% (0.2 pps higher than in the previous scenario). The main factors behind this revision are a slightly worse than expected pattern of inflation in food and the rise in VAT on electricity due to the low wholesale market prices.4 On the other hand, we maintain the forecast of a decline in core inflation, which would average 2.7% year-on-year in 2024 (4.4% in 2023), although it will be marked by a degree of persistence in the case of inflation in services.

- 3See the Focus «A closer look at the increase in Spanish household savings in 2023» in the MR05/2024.

- 4In March, VAT on electricity temporarily rose to 21% (from 10%) as electricity prices in the wholesale market fell below the threshold of 45 euros/MWh. Right now, the futures markets are anticipating an increase in the wholesale price of electricity above the threshold, which would cause VAT to drop back down to the reduced rate in the summer through to January 2025.

The risks surrounding the new forecast scenario are high. On the one hand, private consumption could benefit from a somewhat faster normalisation of the savings rate than we expect, and investment could recover quicker than expected as interest rates come down. In addition, immigration flows and the growth in spending by international tourists could remain higher than anticipated. As for the downside risks, they are mainly geopolitical in nature. At the international level, a potential escalation of the conflict in the Middle East could drive up the price of oil and reverse the moderation process in inflation, with the consequent impact on economic activity. At the national level, it is important that the execution of the NGEU funds gains traction in order to support the recovery of business investment.