Spain 2025: dynamic growth, albeit slightly lower than in 2024

As we approach the end of a good year from a macroeconomic perspective, 2025 is expected to be another buoyant year for the Spanish economy thanks to a growing role of private domestic demand.

2024 recap: a good starting point

The year that we are about to leave behind is proving to be a good one from a macroeconomic perspective, in a context still marked by high interest rates and with inflation steadily declining throughout the year.

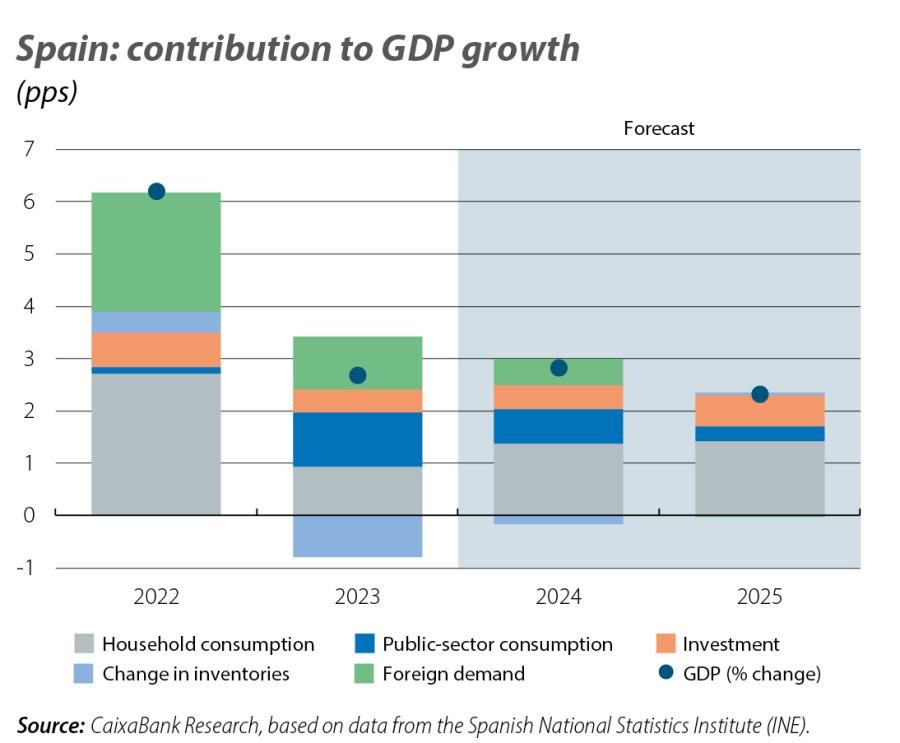

Overall, we expect GDP in 2024 to grow by around 2.8% relative to 2023, which is more than 1 percentage point higher than the rate expected at the beginning of the year.1 Nearly half of the positive surprise comes from a better-than-anticipated performance by the foreign sector, driven by tourism and non-tourism services. The other half is explained, in equal parts, by higher-than-expected growth in household consumption, which has begun to enjoy a revival in 2024, and in public consumption.

In addition, the incorporation of the Q3 GDP figure, which was published after our forecasts were produced and turned out to be better than expected, poses upside risks to our 2.8% growth forecast for 2024.

In short, we can conclude that 2024 has been better than anticipated, putting the economy in a strong position from a macroeconomic perspective to begin 2025.

- 1The upward revisions in the GDP series explain a much smaller portion of the surprise.

2025 outlook: the growth drivers of the Spanish economy

For 2025, we expect the economy to moderate its growth rate slightly to 2.3%. This is nevertheless a high rate and well above the 1.3% expected for the euro area. The Q3 GDP figure introduces some upward risks for this forecast, as it does for that of 2024.

What are the drivers that will sustain this solid growth? In this article we highlight the five main elements.

Firstly, it should be noted that households are expected to continue recovering purchasing power; remuneration per wage earner will increase slightly above inflation (which itself will be slightly above 2%). Combined with the reduction of interest rates, the solid financial position of households and the end of the inflationary pressures, this will enable a slight acceleration in private consumption.

Secondly, tourism will continue to be a key growth driver: the sector’s contribution to GDP growth in 2025 will be between 0.4 and 0.5 pps, below that of 2023 and 2024 but still a significant figure.

Thirdly, demographics will continue to act as a tailwind. Over the past two years, the population has grown by approximately 1% year-on-year, largely due to the arrival of one million immigrants. This flow has increased and rejuvenated the labour force. Projections indicate that the population will continue to grow in the coming years at a rate of around 1%. However, the housing market could prove to be a bottleneck for immigration flows, although it could also contribute to greater flows if increased activity in the real estate sector attracts more labour.

Fourthly, the labour market will continue to be a driver of growth: we expect an average net creation of just over 400,000 jobs in 2025 and a slight fall in the unemployment rate, elements that will allow more wealth to be created and will bolster household consumption.

Finally, investment has room for growth in a context in which lower rates could stimulate sectors related to investment in equipment, where the boost provided by NGEU funds will also play a role and where investment in housing has room to grow. On the other hand, a more modest contribution from public consumption is expected with the reintroduction of the European fiscal rules, as this will impose a degree of restraint in the growth of public spending.

What will change between 2024 and 2025?

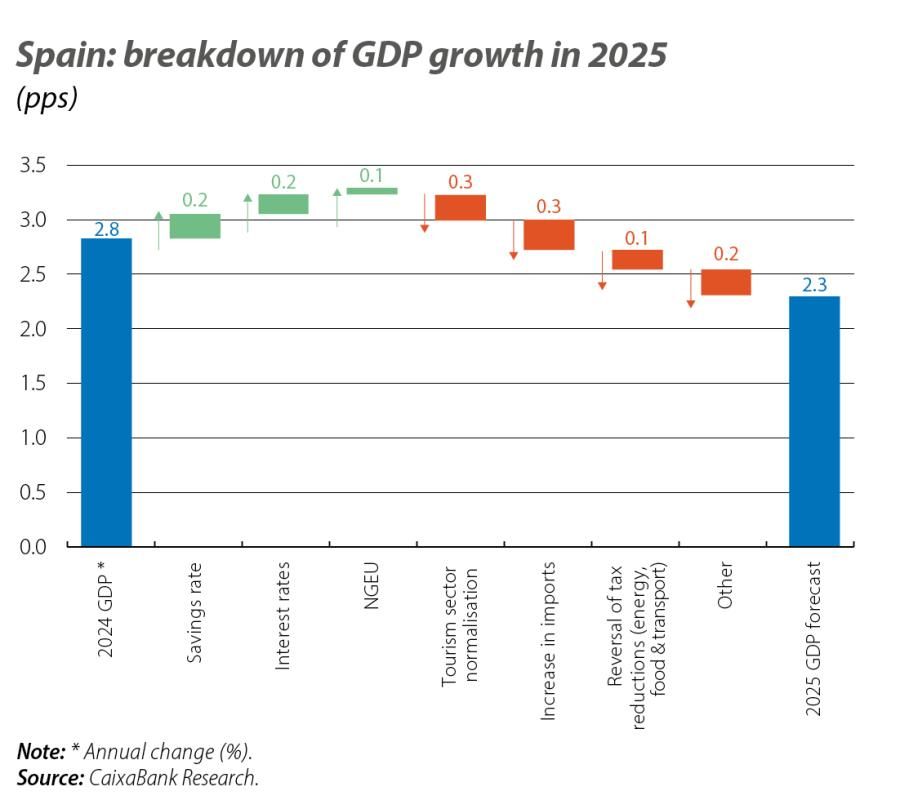

To conclude the article, we analyse which elements of the macroeconomic scenario vary in 2025 compared to 2024, which helps us understand why we expect growth to slow by about half a point in 2025. This is thus a different exercise to what was discussed in the previous section, given that here we are talking about differential factors in 2025 relative to the previous year.

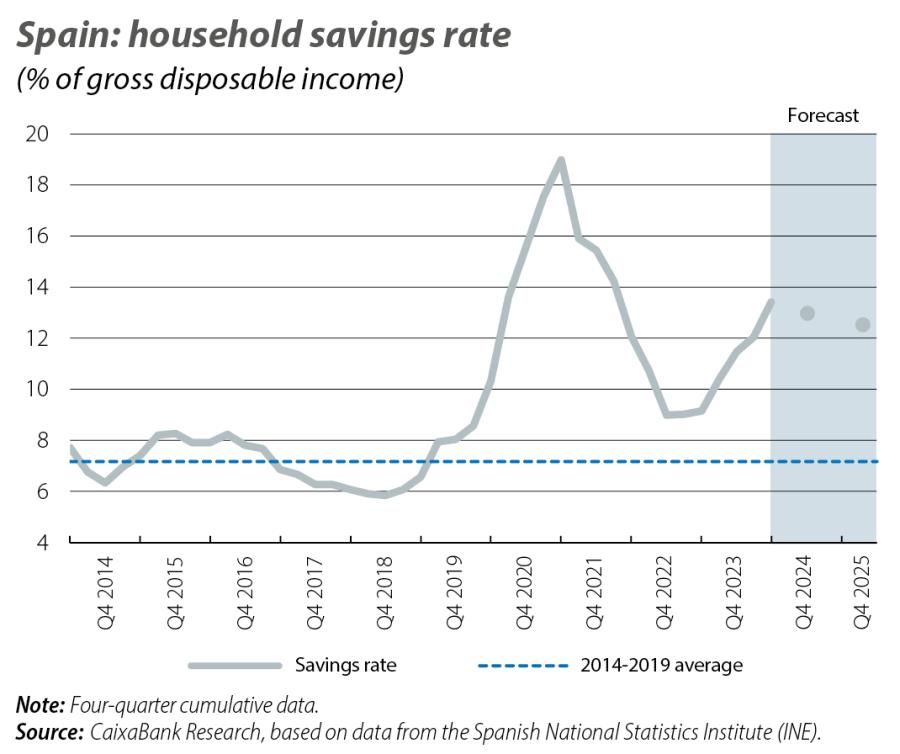

In the second chart we present the main supporting factors which, due to a better performance in 2025 than in 2024, will allow GDP growth to accelerate in 2025 compared to 2024. Firstly, we must mention the household savings rate: we estimate that in 2024 it will be around 13% of gross disposable income, driven by the buoyancy of income growth and the incentives for savings derived from high rates. In 2025, we expect to see a relatively gentle reduction in this savings rate as interest rates fall and confidence improves, and this will allow for increased consumption, boosting GDP growth by 20 basis points.2

A second differential factor for higher growth is the impact of the interest rate cuts. Our forecast is that the ECB will continue along its path of rate cuts in 2025, with four reductions of 25 bps each.3 Although rates will be lower in 2025 than in 2024, it should be recalled that there is a time lag for a reduction in rates to be passed on to the economy. These delays explain why, although we expect lower rates on average in 2025 than in 2024, the positive impact of the reduction of interest rates on GDP growth will be relatively modest in 2025 and similar in magnitude to that of the savings rate.

- 2To understand this calculation, it must be borne in mind that the savings rate captures the level of savings relative to gross disposable income, and gross disposable income itself is 60% of nominal GDP. Therefore, a 0.5-pp reduction in the savings rate, as we anticipate for 2025, would theoretically lead to an increase in GDP growth of around 0.3 points through increased consumption. Taking into account that 30% of consumption is carried out by means of imports, we arrive at an impact on GDP growth of 0.2 pps.

- 3See the article «Monetary policy in 2025: time for easing» in this same Dossier.

Thirdly, we must highlight the impact of the NGEU funds. Some investments financed with these funds that were expected for 2024 will end up materialising in 2025, and this will contribute between 10 and 20 basis points of additional growth next year.

However, there are other factors that will act in the opposite direction. Firstly, we expect tourism to make a significant contribution to growth in 2025, but we estimate that this contribution will be 30 basis points lower than in 2024. We can expect to see a normalisation of the sector’s growth rate, given the high levels already reached, although it will continue to enjoy a boom and there are significant support factors that will enable it to grow.4 Secondly, the contribution of the foreign sector will be more modest than in 2024, partly due to an increase in imports amid stronger domestic demand. Finally, the withdrawal of the tax reductions on energy and food and the discounts on transport will also have a small downward impact on growth, via the upward effect on the inflation of these items. However, the inflation dynamics will be positive on aggregate: we expect core inflation (which excludes energy and food) to go from 2.7% in 2024 to around 2% in 2025.

As for the risks surrounding this scenario, if the savings rate were to decline faster or to reach a lower level than anticipated, this would entail an upside risk for GDP growth through higher consumption growth. Counteracting this, the materialisation of adverse geopolitical risks, such as a tariff spiral or an escalation of the conflict in the Middle East that raises energy prices, would have a material negative impact on growth.5

In short, 2025 is expected to be another buoyant year for the Spanish economy thanks to a growing role of private domestic demand.