Snapshot of the catering sector in Spain: from bars to Michelin stars

The strong growth of the tourism sector in recent years, together with new consumer habits following the pandemic, has led to an extraordinary recovery of the Spanish restaurant sector, both in terms of job creation and turnover. It has also gained considerable international recognition and prestige, while at the same time playing a fundamental role in our country as a promoter of social and territorial cohesion.

The catering sector contributes 3.9% of the Spanish economy’s overall gross value added (GVA) and is a key branch of the economy, as it constitutes 7% of all businesses, it employs 7% of all workers and it receives 9% of the annual turnover of the services sector.15 The strong growth of the tourism sector in 2022 and especially in 2023, together with new consumer habits and a significantly increased preference for leisure and entertainment since the pandemic, have led to an extraordinary recovery of Spain’s catering sector in terms of both job creation and turnover. Also, in recent years it has managed to obtain significant international recognition and prestige, while playing a fundamental role in our country as a promoter of social and territorial cohesion.

- 15. The GVA data are an internal estimate based on the data from the National Accounts for Hotels and Restaurants and the distribution of the turnover between Accommodation and Catering per the Structural Enterprise Statistics for the services sector (2022). The data on active companies come from the 2023 business demographics statistics from the Spanish National Statistics Institute’s Central Business Register (CBR).

The catering sector is made up of around 232,000 companies, representing approximately 7% of all the companies that were active in Spain in 2023. In terms of establishments, there are some 264,000 in total, mostly bars and cafés (62%), which exceed the combined total of the other two categories, namely restaurants (31%) and catering services (7%). Most of these businesses are managed by private individuals: 63% of businesses in the sector are owned by individuals, compared to 57% in the economy as a whole. In terms of the number of employees, it is dominated by micro-enterprises: 96% of enterprises have fewer than 10 employees, slightly above the average for the whole economy, while those with more than 250 employees account for just 0.1% of the total. Even so, the role of these large companies is by no means negligible: the large catering chains present in our country contribute 17% of the sector’s GVA and provide 14% of its employment.16

- 16. The data on GVA by business size come from Eurostat’s Structural Business Statistics (2019).

Composition of businesses in the catering sector

The catering sector is dominated by micro-enterprises, bars and cafés, although it is experiencing a shift towards larger-sized companies and other types of catering establishments, such as catering companies

In the last decade there has been a certain consolidation of businesses, with the number of companies decreasing by 10% between 2013 and 2023, a trend that has accelerated as a result of the pandemic (since 2019, the number has fallen by 8%). However, this process is not widespread, but rather is concentrated in drinking establishments (the number of bar and café companies has fallen by 19%), which tend, on average, to be smaller businesses (98% of them are micro-enterprises). On the contrary, the number of companies in the rest of the catering sectors has increased, especially in the case of companies offering catering services (25% in the last decade). This trend is a reflection of the new consumption habits and current lifestyles, as well as of the continuous professionalisation of the catering services sector itself.

The annual turnover of the sector amounted to around 230,000 euros per company in 2022 (compared to 207,000 euros in 2019). Nevertheless, these revenues are not evenly distributed among the different types of establishments: restaurants have the highest income levels on average (436,000 euros per company per year) and have also seen the biggest income growth (18% since 2019). They are followed by catering services (364,000 euros, –8% since 2019) and, trailing far behind, bars and cafés (127,000 euros, +6% since 2019).17 The increase in turnover for the sector as a whole is not only due to a price effect, but also a composition effect, since there has been a fall in the number of companies in the sector with the lowest income (bars and cafés, as noted above) and an increase in all the other categories, which on average are larger in size.

The monthly turnover indicators show that revenues in the catering sector experienced significant growth in 2023 (+9.7%) and in Q1 2024 (+7.4% year-on-year), largely thanks to the performance of the tourism sector. Also, according to the consumption indicator produced using internal CaixaBank data on card payments, which is available on the Real-Time Economy portal,18 expenditure on catering with Spanish cards grew by 7.3% year-on-year between January and May in 2024. On the other hand, spending on catering with foreign cards grew by 23.5% year-on-year in the first 5 months of 2024. The granularity of the data on card payments in catering establishments allows us to corroborate the key role that the full recovery of international tourism has played in the sector’s turnover, since, according to our estimates, around 30% of establishments are highly dependent on tourism spending and 10% of them on international tourists in particular.19

- 17. The turnover data for 2022 have been obtained from the Structural Enterprise Statistics for the services sector, provided by the National Statistics Institute (INE).

- 18. The CaixaBank Research consumption indicator tracks the pattern of consumption in Spain, based on duly anonymised internal data on spending carried out with cards issued by CaixaBank, spending recorded on CaixaBank POS terminals and cash withdrawals at CaixaBank ATMs.

- 19. An establishment is considered to be dependent on tourism if the expenditure of domestic or foreign tourists represents at least 33% of its total annual turnover. For an analysis of recent patterns in expenditure on catering using internal data, see the article «An exceptional year for the catering sector in Spain», published in the Monthly Report of April 2024.

CaixaBank Consumption Indicator. Expenditure on catering

Parallel to this increase in turnover, there is also an increase in the quality of Spain’s catering services. The number of restaurants awarded with a Michelin star has increased by 43% since 2019, reaching 272 in 2024.20 In fact, Spain now has the fourth highest number of Michelin-star restaurants in the world, behind France, Italy and Germany, but it is by far the country with the biggest increased since 2019 (in Japan the number has even fallen by 20%). Although the bulk of these restaurants have a single star (representing 82% of the total), the number with the maximum distinction of 3 stars has increased in recent years (15 in 2024 compared to 11 in 2019). Moreover, the comparison with other countries reflects the fact that the Spanish haute cuisine sector has the second highest number of restaurants with the highest distinction in the world, behind only France.

- 20. The Michelin star is a prestigious award given by the Michelin restaurant guide to culinary establishments that stand out for the excellence of their cuisine and it is internationally considered as one of the highest recognitions in the catering industry. Stars are awarded based on the quality of the food, culinary creativity, culinary technique, consistency in the quality of the dishes and the overall experience offered to diners.

The revival of demand has allowed the catering sector to increase its number of registered workers to new highs, taking advantage of the surge in inbound migration in recent quarters

Michelin-star restaurants

The catering sector employed 1.4 million workers in Q1 2024 and has amassed a 15% increase in the number of workers since 2021, as a result of the sector’s reopening after the pandemic. In fact, the catering sector currently accounts for around 7% of all registered workers, compared to 6.2% in 2010, being one of the few sectors to have seen its share of Spain’s total labour market increase.

The catering sector is currently enjoying one of the most dynamic labour markets

From the point of view of the labour supply, the recent surge in migration to our country has been key. The accommodation and food services industry has been a significant source of employment for foreigners residing in Spain for decades now. In 2019, 23% of the registered workers in the accommodation and food services industry were foreigners – the highest percentage of any sector. Since then, the trend has deepened, reaching 26.2% of the total in 2023 – once again making it the sector with the highest percentage of foreign employment. Finally, it should be noted that the accommodation and food services industry is one of the sectors that has seen the biggest reduction in the temporary employment rate following the latest labour reform: in 2019, 36.7% of employees in the sector had a temporary contract (one of the highest rates) compared to 7.7% in 2023 (currently one of the the lowest of all sectors).

These signs of increasingly stable employment are also accompanied by a better-prepared labour supply. Data from the Ministry of Education show that, although the total number of people enrolled in vocational training courses related to the catering sector has been declining in recent years, proportionately speaking there is an increasing number of people enrolled in higher vocational training courses (accounting for 27% of all those enrolled in such courses related to catering in the academic year 2021-2022).

Despite this increase in higher education, the sector’s productivity, measured using GVA per employee, is modest and has been decreasing in recent years compared to the average for the economy as a whole. In fact, it also stands out as the lowest among Spain’s main service sectors. In this regard, the sector’s next steps should be aimed at encouraging greater training and the acquisition of skills among its workforce (including technical, business management and customer service skills), increasing its average business size (larger companies tend to be more productive), as well as pursuing greater technological innovation (such as order and booking management systems, automation in the kitchen and data analysis tools).

The catering sector’s next steps should be aimed at encouraging greater training and the acquisition of skills among its workforce

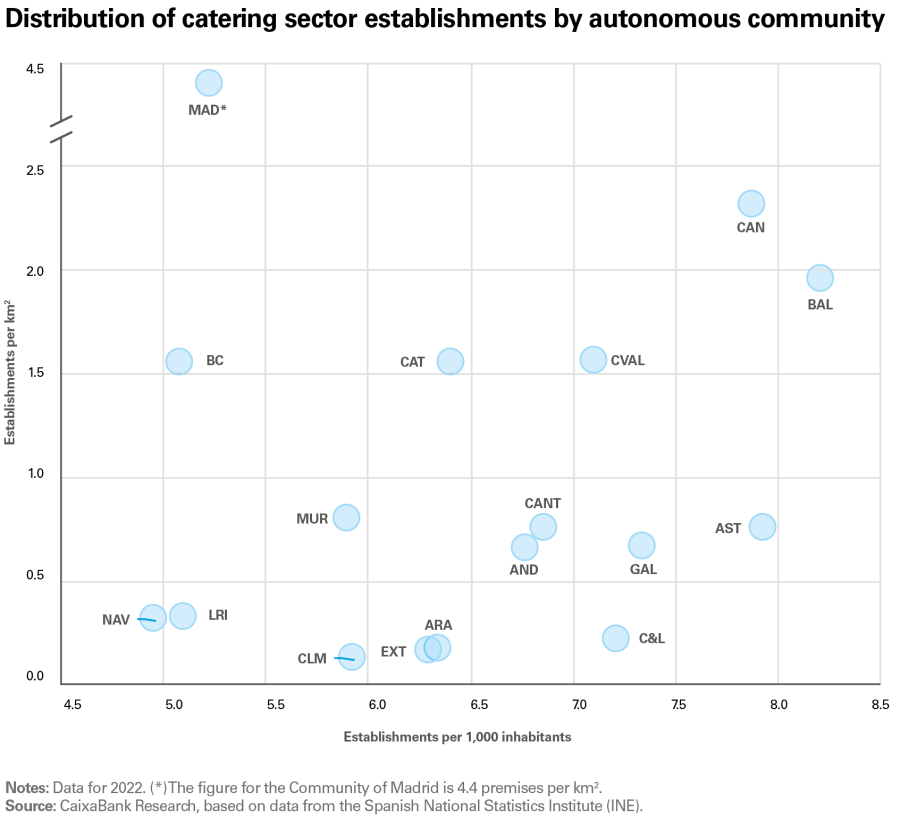

Restaurants are widespread throughout the country, although the regions that are most highly populated, dynamic and attractive for tourism (Andalusia, Catalonia, the Valencian Community and Madrid) have the largest number of companies in the sector: these four autonomous communities alone account for around 60% of the country’s catering establishments. However, if we consider the number of establishments relative to each region’s size and population, some interesting trends emerge, which are summarised in the following chart.

Firstly, in terms of territorial density, Madrid, the Canary Islands and the Balearic Islands stand out as the autonomous communities with the highest concentration of establishments, exceeding 2 per km2 (vertical axis in the chart). The case of Madrid (4.4 establishments per km2) is explained by its status as the country’s capital city and economic centre, as well as its importance as a tourist, cultural and gastronomic destination. The case of the island regions is explained by their status as hotspots for national and international tourism. On the other hand, the regions with the lowest density of establishments include the two Castile regions, Extremadura and Aragon (with fewer than 0.3 establishments per km2), as these are precisely the autonomous communities with the lowest population density in the country. Secondly, if we look at the ranking according to the number of catering establishments per 1,000 inhabitants (horizontal axis in the chart), the island regions continue to occupy prominent positions, whereas Madrid is among the lowest on the list. Others such as Asturias and Galicia also climb the ranks in this case, as regions with a long and deep-running gastronomic tradition.

In this regard, it can be said that the catering sector plays a key role in terms of territorial cohesion in Spanish society, given its significant presence throughout the country. Moreover, it is a source of local employment, it plays a key role in promoting tourism and it promotes local culture and gastronomy. It is also worth noting the importance of bars and hotel establishments for personal life and social cohesion in our country. On balance, 99.7% of Spain’s population lives in municipalities that have at least one bar. However, around 1 in 5 municipalities lack bars (specifically, 18%), although these represent just 0.30% of Spain’s population. This demonstrates the extensive presence of these establishments throughout the country, as well as their social roots. Municipalities without bars, which are mostly small, define so-called «empty Spain», highlighting their essential role in preventing depopulation and in maintaining community life.21

- 21. The data on the importance of bars as a cohesive element in society have been obtained from the report «La dimensión social de la hostelería» (The social dimension of the accommodation and food services sector), produced by the State Association of Directors and Managers in Social Services in 2022.

- 15. The GVA data are an internal estimate based on the data from the National Accounts for Hotels and Restaurants and the distribution of the turnover between Accommodation and Catering per the Structural Enterprise Statistics for the services sector (2022). The data on active companies come from the 2023 business demographics statistics from the Spanish National Statistics Institute’s Central Business Register (CBR).

- 16. The data on GVA by business size come from Eurostat’s Structural Business Statistics (2019).

- 17. The turnover data for 2022 have been obtained from the Structural Enterprise Statistics for the services sector, provided by the National Statistics Institute (INE).

- 18. The CaixaBank Research consumption indicator tracks the pattern of consumption in Spain, based on duly anonymised internal data on spending carried out with cards issued by CaixaBank, spending recorded on CaixaBank POS terminals and cash withdrawals at CaixaBank ATMs.

- 19. An establishment is considered to be dependent on tourism if the expenditure of domestic or foreign tourists represents at least 33% of its total annual turnover. For an analysis of recent patterns in expenditure on catering using internal data, see the article «An exceptional year for the catering sector in Spain», published in the Monthly Report of April 2024.

- 20. The Michelin star is a prestigious award given by the Michelin restaurant guide to culinary establishments that stand out for the excellence of their cuisine and it is internationally considered as one of the highest recognitions in the catering industry. Stars are awarded based on the quality of the food, culinary creativity, culinary technique, consistency in the quality of the dishes and the overall experience offered to diners.

- 21. The data on the importance of bars as a cohesive element in society have been obtained from the report «La dimensión social de la hostelería» (The social dimension of the accommodation and food services sector), produced by the State Association of Directors and Managers in Social Services in 2022.