The relevance of tourism in Portugal’s national accounts and foreign balance

The Portuguese tourism sector is making headlines, with its exuberant statistics and optimism surrounding its future outlook. In this article we present the key figures of the tourism sector and their impact on the macroeconomic accounts.

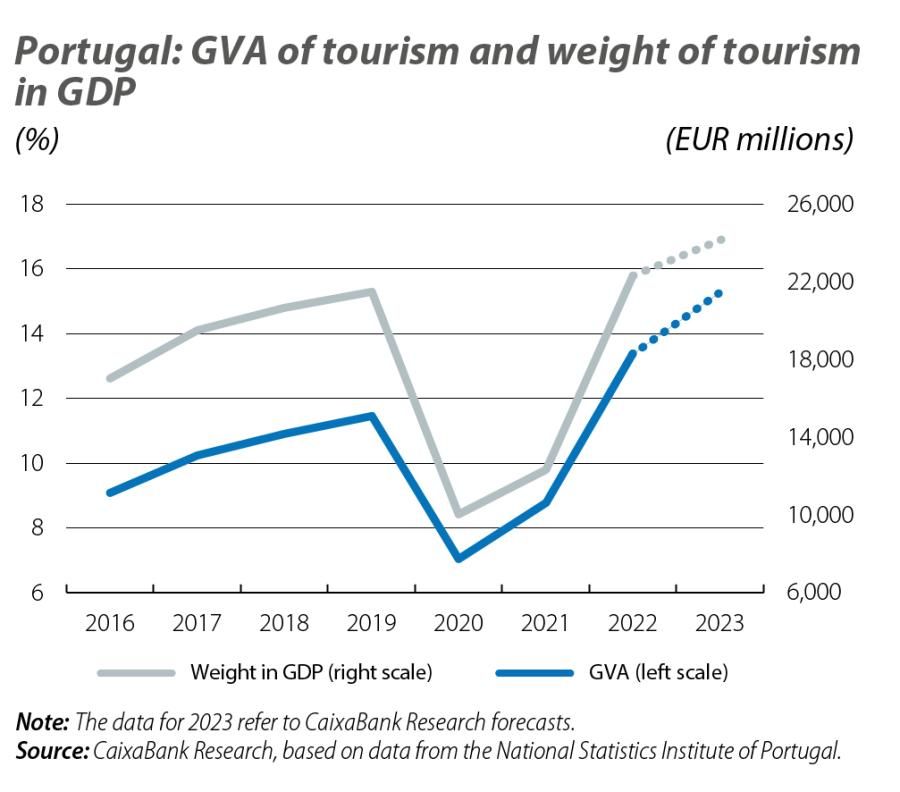

Portugal benefits from distinctive competitive factors which have provided a boost to the sector, especially over the last decade. In fact, Portugal holds 16th position in the ranking of the most competitive countries in terms of tourism and it enjoys a particularly strong position in the categories of Tourist Service Infrastructure (2nd position), Safety and Security (11th) and Health and Hygiene (14th).1 The sector’s relative importance can serve to oil the cogs of the Portuguese economy, although it also acted as a headwind during the pandemic, when the collapse in tourism activity was responsible for two-thirds of the contraction in GDP in 2020; in other words, of the 8.3% decline in GDP, 5.5 pps were due to the drop in tourism. As can be seen in the table, the 49% collapse in tourism spending2 resulted in the aforementioned fall in GDP, reducing the relative weight of tourism in the country’s GDP to 8.4%. In April 2020, the proportion of hotel establishments that were either shut or empty reached a shocking 88.5%. This highlights the particular risks of this sector, as it is exposed to factors often beyond the government’s control: pandemics, acts of terrorism, natural disasters, climate change, etc. Fortunately, the recovery was equally as rapid as the decline: in 2022 tourism revenues, measured according to the Satellite Accounts, had rallied by 79% (to more than 37 billion euros) and were responsible for 68% of the growth in GDP.

- 1. See the World Economic Forum study, «Travel and Tourism Development Index», 2021 edition, which includes 117 countries.

- 2. Refers to tourism consumption in the economic territory per the Tourism Satellite Accounts, which encompass incoming tourism (non-resident visitors), domestic tourism consumption (resident visitors travelling within the country, as well as the internal consumption made by visitors residing in the country during tourist trips abroad – an internal consumption component of outgoing tourism), and the various other components of tourism consumption that are not disaggregated by type of tourism and visitor. The rest of the components also include products where the corresponding expenditure is the responsibility of general government institutions, but where consumption occurs at the individual level.

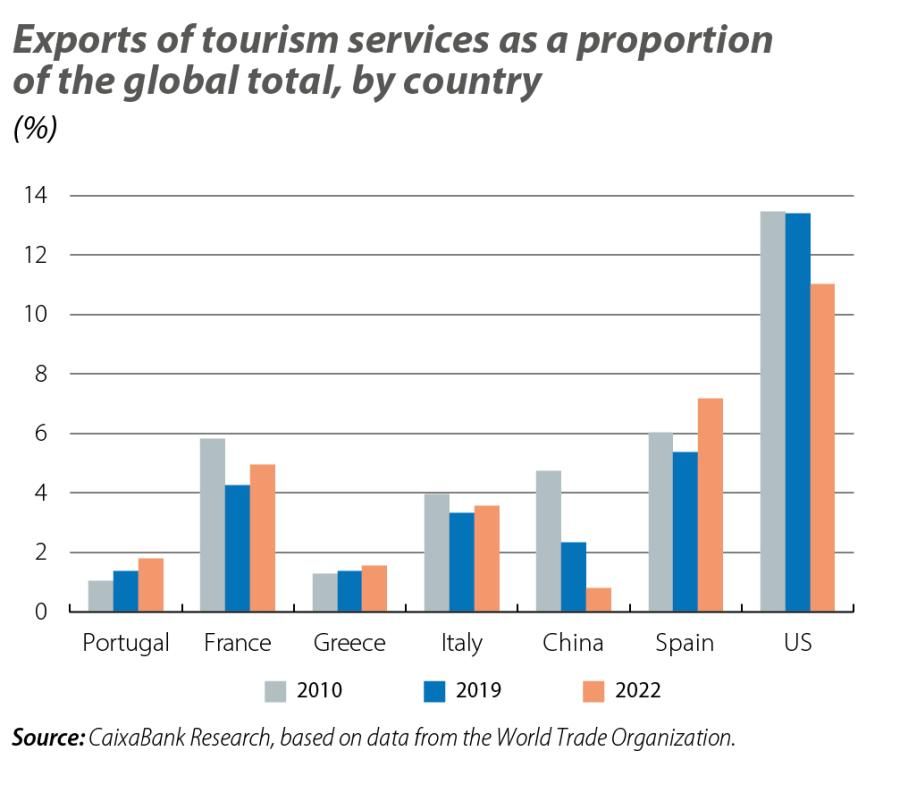

On the other hand, exports of tourism services have enjoyed an impressive trajectory. Data from the World Trade Organization (see second chart) show that, contrary to what happened in other European countries with a strong tourism sector, such as France and Italy, Portugal has been increasing its share of the global tourism market, almost doubling it between 2010 and 2022 (from 1% to 1.8% of the world total).

Another way to measure the sector’s performance is using data on visitor arrivals, in this case from the post-pandemic period. Globally, international tourist arrivals in 2022 and Q1 2023 were still below 2019 levels (–34% and –20%, respectively); however, in Portugal these levels have already been surpassed in the current year (+14% in Q1 2023 compared to Q1 2019). This means that, even in a context of decreasing activity, Portugal grew in both absolute terms (number of visitors) and relative terms (market share).

The third chart clearly illustrates the support which tourism provides for the foreign accounts: between 2013 and 2019, the current account balance recorded surpluses, but without the contribution of the tourism balance these would have been deficits. Since 2020, these balances have once again been in deficit due to the impact of COVID, but in 2022 the current account deficit would have been much greater3 had it not been for the contribution of the tourism surplus (as a result of the energy crisis and the resulting import prices of energy commodities). The tourism balance has contributed almost 70% of the surplus in the balance of services in the last year.

- 3. 18.7 billion euros, or around 8% of the GDP of that year.

What impact can we expect to see in 2023 in the national accounts? Our outlook is that the global number of tourists this year will exceed that of 2019 by 9%. Using econometric models that relate these forecasts with tourism exports, tourism GVA and GDP, we reach a value of 16.9% (i.e. the expected weight of tourism in GDP in 2023, see last chart). In other words, the direct and indirect weight of tourism in Portuguese GDP will increase by another 1.1 pps compared to 2022; a value very similar to that estimated by the WTTC4 (16.8%), which even projects that this figure will increase to over 20% by 2033 (21.1%).

- 4. World Travel & Tourism Council.

Portugal’s ability to continue to attract tourists will depend on the sum of the skills of the sector’s entrepreneurs and business leaders, together with the favourable context which the state must provide – in terms of efforts made to promote the country’s destinations and providing adequate infrastructure. It is important to try to reduce seasonality and increase territorial diversity, as well as to develop the sector in a careful and balanced way, since the sustainability of destinations is also an aspect that is increasingly valued by tourists when planning their trips.

- 1. See the World Economic Forum study, «Travel and Tourism Development Index», 2021 edition, which includes 117 countries.

- 2. Refers to tourism consumption in the economic territory per the Tourism Satellite Accounts, which encompass incoming tourism (non-resident visitors), domestic tourism consumption (resident visitors travelling within the country, as well as the internal consumption made by visitors residing in the country during tourist trips abroad – an internal consumption component of outgoing tourism), and the various other components of tourism consumption that are not disaggregated by type of tourism and visitor. The rest of the components also include products where the corresponding expenditure is the responsibility of general government institutions, but where consumption occurs at the individual level.

- 3. 18.7 billion euros, or around 8% of the GDP of that year.

- 4. World Travel & Tourism Council.