Excellent records in the foreign sector in 2024

The good performance of the foreign sector, especially services exports, largely explains the significant buoyancy that the Spanish economy is showing. Besides the usual strength of tourism, the strong growth of non-tourism services also stands out.

The significant buoyancy that the Spanish economy is showing, with GDP growth in 2024 reaching 3.2% and exceeding the forecasts of organisations and analysts, is largely explained by the excellent performance of the foreign sector. This sector is supported in particular by services exports, encompassing the usual strength of tourism, but also the strong growth of non-tourism services.

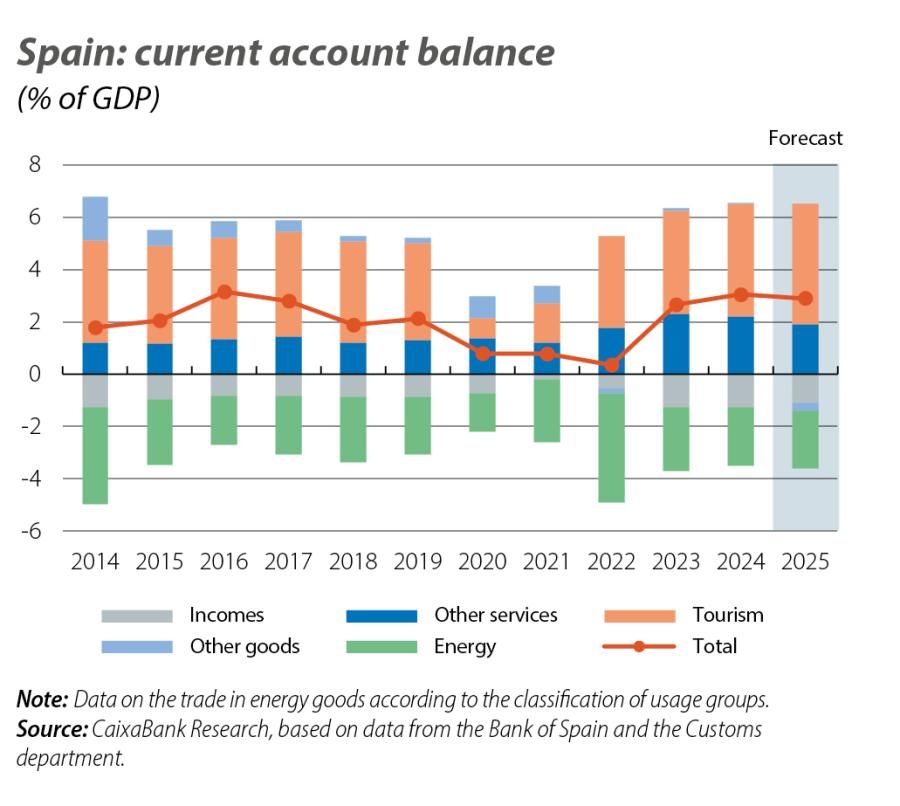

The exchange of goods, services and incomes between the Spanish economy and other countries (current account balance) recorded a surplus of 3.0% of GDP in 2024 (2.7% in the previous year), just shy of the historical peak reached in 2016 (3.1%). With the exception of the income sub-balance, for which the deficit stabilised at 1.3% of GDP,1 the rest contributed to the improvement of the current account balance, including both the slight correction of the trade deficit – in particular, the energy component, thanks to the sharp reduction in import prices – and the expansion of the surplus of services, mainly tourism.

- 1. With data up to September, the primary income deficit widened by 21.0% year-on-year, due to the higher growth in payments, especially in the case of investment income from monetary financial institutions (MFIs) and public administrations. On the other hand, the secondary income deficit fell by 8.2% year-on-year, influenced, as has been frequently the case in recent years, by the receipt of NGEU funds.

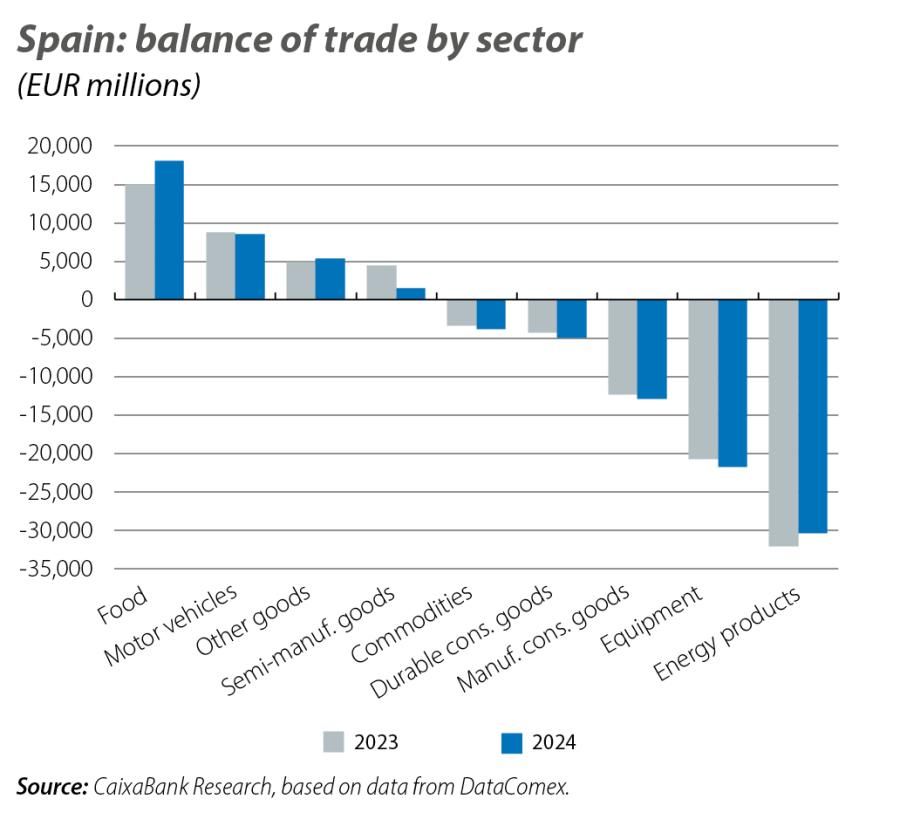

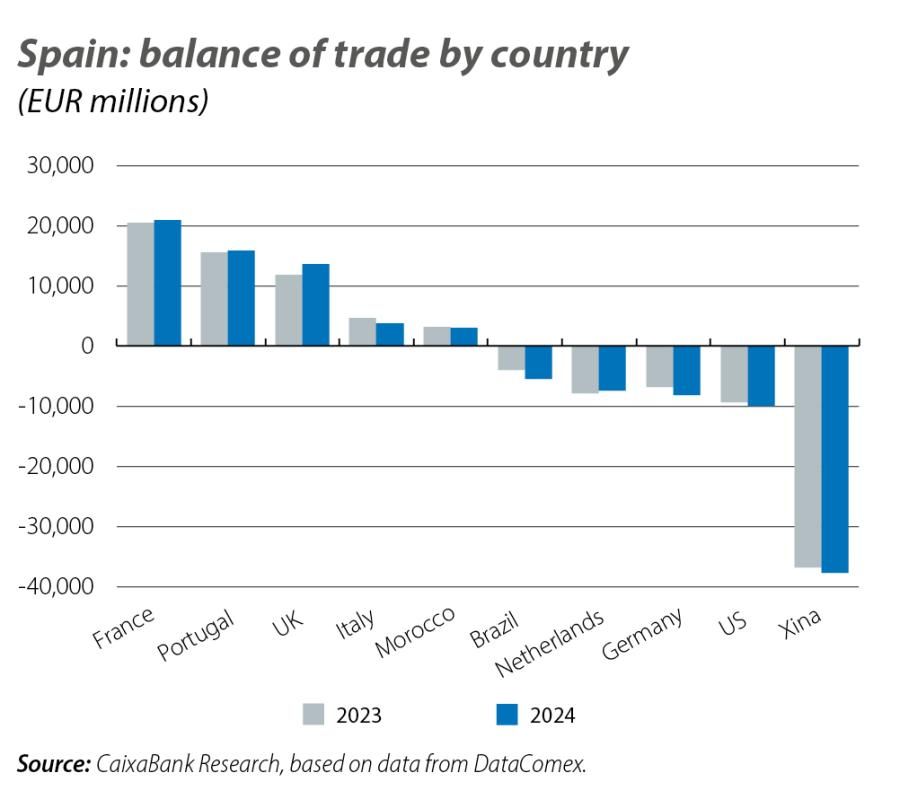

The trade deficit in terms of the balance of payments differs slightly from that recorded in terms of customs, as it includes some adjustments.2 In the absence of the year-end data for the balance of payments, we estimate that its deficit will have reduced from 2.3% of GDP in 2023 to 2.1%-2.2% in 2024. Despite the negative balance of trade in overall terms, Spain has significant surpluses with some of its main European partners – surpluses which, moreover, have increased in recent years – mostly thanks to vehicles and, above all, food (see second and third charts). In the opposite direction, the deficits have widened with Germany (the deficits in semi-manufactured and capital goods are partially offset by the surplus in food), China (capital goods and manufactured consumer goods account for 75% of the imbalance) and the US, with the energy component in this latter case causing a significant deterioration in the balance of trade in recent years.

- 2. Basically, the differences between the trade deficit in terms of customs versus balance of payments (BP) are: (i) in customs, imports are valued on a CIF basis (cost, insurance and freight price, i.e. including the amounts associated with the shipping and insurance of imports), whereas in BP terms they are valued on a FOB basis, (ii) the BP includes transactions not covered by the customs statistics (goods that do not cross the border, but do change economic ownership) and it excludes others (goods that cross the border without any change of ownership), and (iii) the BP includes estimates produced by the National Statistics Institute (INE) of illegal activities related to the international trade in goods.

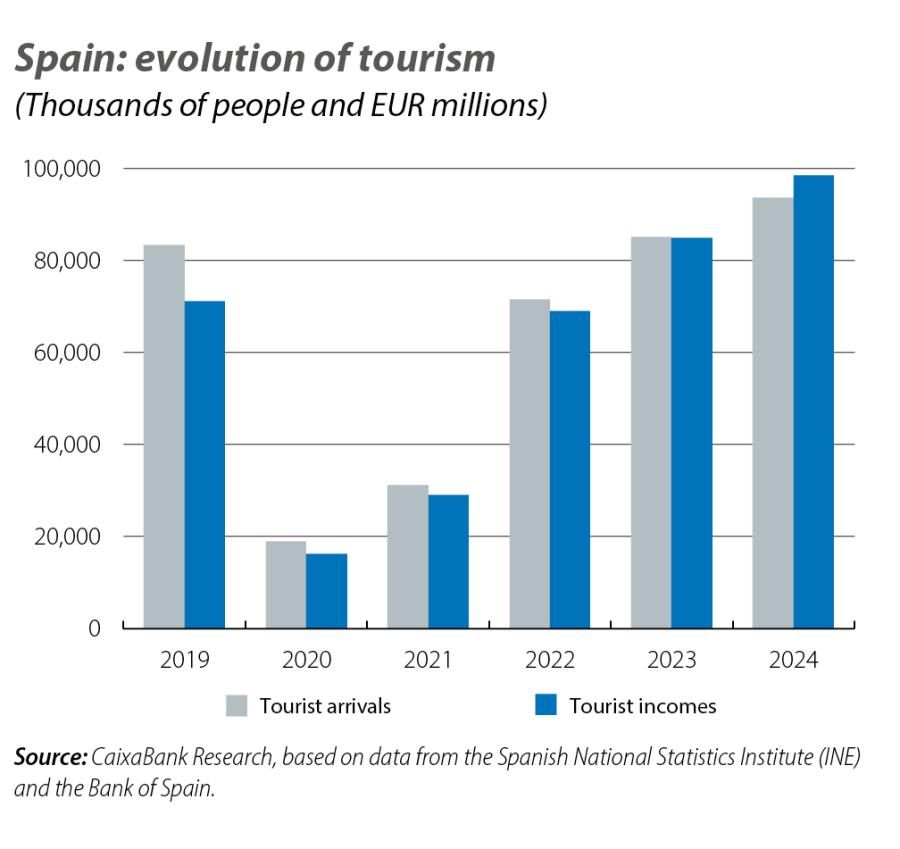

In the case of the balance of trade in services, the data for tourism in 2024 were spectacular: the surplus grew by 16.4% to reach 68.4 billion euros, a new all-time high and equivalent to 4.3% of GDP (3.9% in 2023); 93.8 million tourists arrived in our country, 10.1% more than the previous year, and tourist revenues reached 98.6 billion euros, 15.9% more; record figures in both cases. Tourist payments grew slightly less, but nevertheless at a rapid pace of 14.7%, indicating that foreign trips undertaken by Spaniards are recovering rapidly following the sudden break caused by the pandemic.3

As for the balance of non-tourism services, the available data (three first quarters of 2024) point to a slight reduction in its surplus, following the record reached the previous year (2.3% of GDP). This is explained by the extraordinary growth in imports, which doubled that of exports (18.3% year-on-year vs. 9.0%). By type of service, the positive balance accumulated up to September is widespread across most categories, except in insurance and pensions and intellectual property; compared to the previous year, the improvement in the surpluses of financial and business services contrasts with the sharp deterioration in the case of transportation.

For 2025, we expect the current account balance to continue to show a surplus, albeit a slightly smaller one than in 2024 (it will lie below 3.0% of GDP) due to a slight increase in the deficit of the balance of goods, which will be partially offset by a smaller income deficit and an increase in the surplus of services.

On the one hand, we will probably see a rebound in imports of goods, driven by the anticipated increase in domestic demand and greater pressure on import prices. The trend in exports, meanwhile, will be affected by the sluggish performance of our main trading partners in the euro area, without forgetting the potential impact of the US tariff policy, which has become one of the main sources of risk for the macroeconomic scenario this year.4 Therefore, we expect the trade deficit to increase by around 0.3 pps of GDP, to around 2.5% of GDP.

As far as tourism is concerned, we expect to see a normalisation of its growth rates, given the high levels achieved. In any event, some factors will continue to underpin its performance, such as the intense reduction of seasonality that is taking place in the sector or the recovery of real disposable income in the source countries; in addition, geopolitical uncertainty and chronic instability in the Middle East may favour Spain as a safe and stable destination.5 Thus, the tourism surplus could continue to increase by a few tenths of a percentage point of GDP, reaching 4.6%.

Finally, we expect a slight correction of the deficit in the income balance of 0.2 pps, placing it at 1.1% of GDP, as a result of the fall in interest rates.

- 3. 34.3% of tourist spending by Spaniards in 2024 (data from January to September) was carried out abroad, a percentage that already exceeds the levels of the pre-pandemic period (32.7% in 2015-2019).

- 4. For further information, see the Focuses «Exposure of the European economy to a US tariff hike» and «Impact of tariff hikes on Spanish exports to the US: which sectors could be the hardest hit?», both in the MR12/2024.

- 5. For an in-depth analysis of recent developments and the future outlook for the tourism sector, see the Tourism Sector Report S1 2025.

- 1. With data up to September, the primary income deficit widened by 21.0% year-on-year, due to the higher growth in payments, especially in the case of investment income from monetary financial institutions (MFIs) and public administrations. On the other hand, the secondary income deficit fell by 8.2% year-on-year, influenced, as has been frequently the case in recent years, by the receipt of NGEU funds.

- 2. Basically, the differences between the trade deficit in terms of customs versus balance of payments (BP) are: (i) in customs, imports are valued on a CIF basis (cost, insurance and freight price, i.e. including the amounts associated with the shipping and insurance of imports), whereas in BP terms they are valued on a FOB basis, (ii) the BP includes transactions not covered by the customs statistics (goods that do not cross the border, but do change economic ownership) and it excludes others (goods that cross the border without any change of ownership), and (iii) the BP includes estimates produced by the National Statistics Institute (INE) of illegal activities related to the international trade in goods.

- 3. 34.3% of tourist spending by Spaniards in 2024 (data from January to September) was carried out abroad, a percentage that already exceeds the levels of the pre-pandemic period (32.7% in 2015-2019).

- 4. For further information, see the Focuses «Exposure of the European economy to a US tariff hike» and «Impact of tariff hikes on Spanish exports to the US: which sectors could be the hardest hit?», both in the MR12/2024.

- 5. For an in-depth analysis of recent developments and the future outlook for the tourism sector, see the Tourism Sector Report S1 2025.