Political decisions will shape the international economy

The surge in uncertainty and the tariff hikes introduce downside risks to global growth, as well as upside risks to US inflation, while the impact on prices for the rest of the world is much more uncertain.

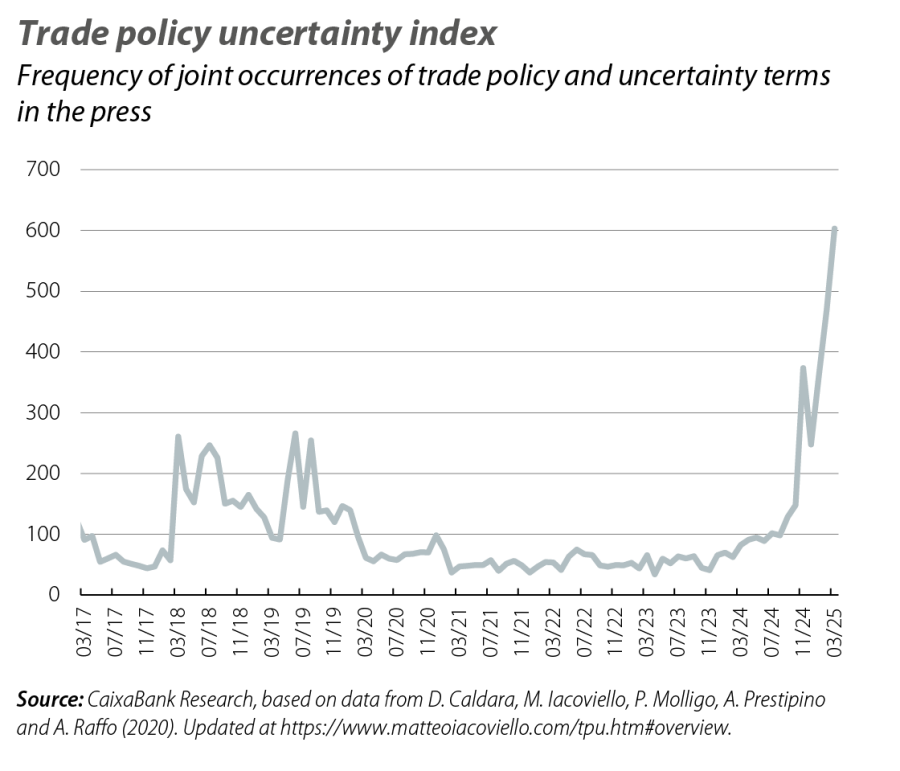

In the last month, we have witnessed a surge in uncertainty (see the Financial Markets - Economic Outlook section). Unlike what we have experienced in the last three years, we are now beginning to look with caution at the impact the Trump administration’s policies could have on volatility. The latest – and most disruptive – such episode was the tariffs announced on so-called «Liberation Day» which, if applied, would end up raising the average tariff on US imports from 3% to around 25%, their highest level in over a century. For the moment, since 5 April a universal tariff of 10% has been in force and Trump has left the additional increases on hold for 90 days, with the exception of China, with which he has entered into an intense protectionist escalation. We are thus entering a new phase, with negotiations that could lead to tariffs lower than those initially announced or, in a worst-case scenario, retaliation that would increase the risks of a trade war. For now, the surge in uncertainty and the tariff hikes introduce downside risks to global growth, as well as upside risks to US inflation, while the impact on prices for the rest of the world is much more uncertain.

The three majority parties of the outgoing parliament (CDU/CSU, SPD and the Greens), which held well over two thirds of the seats, reached an agreement to amend the constitution and loosen restrictions around the well-known debt brake. This rule, introduced in 2009, established that the structural budget deficit should not exceed 0.35% of GDP and has only been put on hold once, during the COVID pandemic. With this agreement, an Infrastructure Investment Fund amounting to 500 billion euros (12% of 2024 GDP) has been approved for the next 12 years, it has been decided to raise defence spending to 3.5% of GDP (2.1% currently) and, at the same time, defence spending exceeding 1% of GDP will not count towards the debt brake limit. In addition, the European Commission has announced its ReArm Europe plan, with which it plans to bolster the continent’s military capabilities and which has been allocated a budget of some 800 billion euros (4.5% of 2024 GDP) over the next four years. To this end, private investment in the defence industry will be encouraged, Member States will be given more leeway to increase their defence spending through the temporary easing of EU fiscal limits and the Security Action for Europe (SAFE) instrument will be created. SAFE is intended to provide loans to Member States and will be allocated 150 billion euros, much of which could come from loans already approved under the NGEU funds that have not been requested by countries.

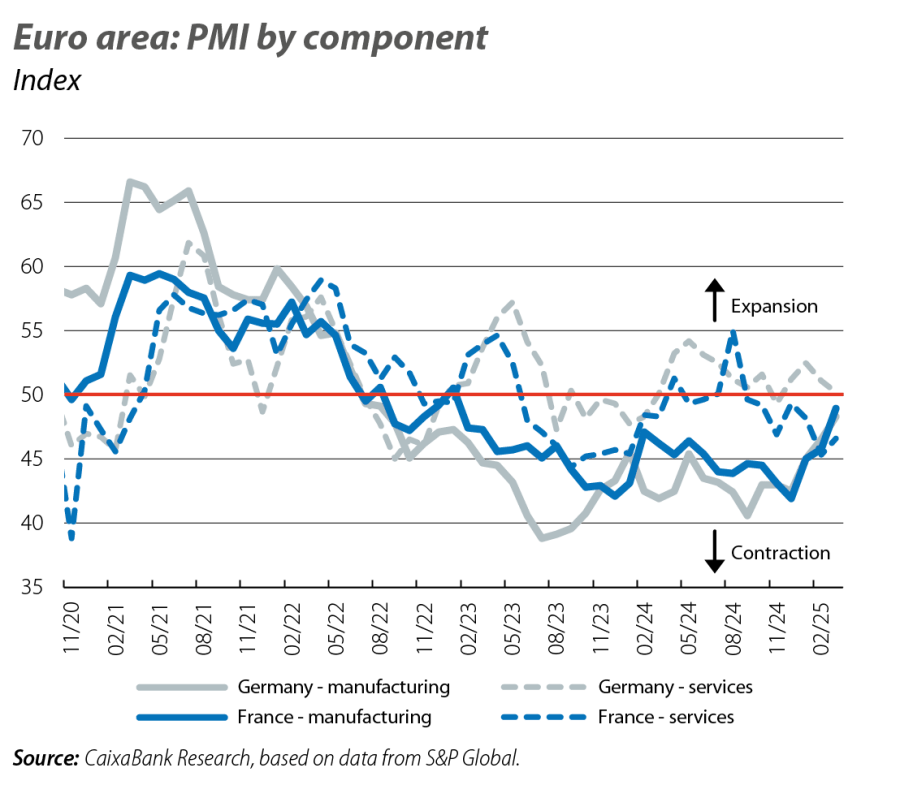

The sheer volume of the measures announced will support growth, particularly in 2026 and 2027. However, caution must be exercised, not only because the increase in trade protectionism would limit the magnitude of the fiscal boost announced, but also because certain details are yet to be clarified, including how the increase in defence spending in the EU will be carried out, the timetable for implementing Germany’s Infrastructure Investment Fund, as well as what the fiscal multiplier of these measures is expected to be. The experience with NGEU funds (see the Dossier «The transformative capacity of NGEU and other fiscal stimulus plans» in the MR03/2025) shows the difficulties involved in implementing such vast investment projects. For the moment, the business opinion indicators improved amid expectations of this fiscal stimulus, but they have not yet captured the possible impact of the latest tariffs announced by Trump. In fact, in March, Germany’s ZEW Indicator of Economic Sentiment recorded its biggest increase in almost two years, and the Ifo business confidence indicator reached its highest levels since the summer of 2024 (+1.4 points, to 86.7); meanwhile, the composite PMI for the euro area rose to 50.4, marking the third consecutive month above the 50-point threshold that indicates positive growth, thanks to the manufacturing sector.

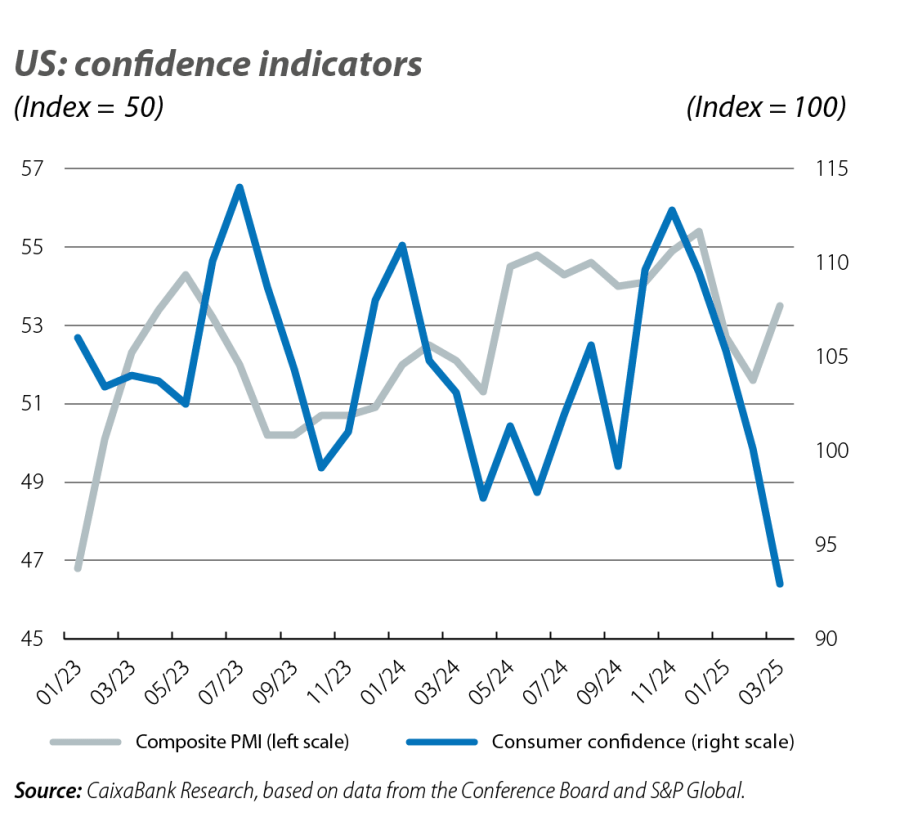

The continuous tightening and loosening of tariffs and the cuts in government spending have fuelled fears – especially after «Liberation Day» – that the economy could experience a sharper than expected slowdown. Consumer confidence has been the first indicator to reflect this increase in uncertainty, as households fear a deterioration in the labour market and a rebound in inflation due to the trade protectionist policies. Thus, the index produced by the Conference Board has been declining all year and, in March, stood at its lowest level since January 2021. However, the business climate and opinion indicators, which hint at a slight moderation in activity in Q1 2025, still remain at levels compatible with positive but modest growth. In fact, in March, the composite PMI increased significantly (+1.9 points, to 53.5) and the services ISM indicator managed to stay above the 50-point threshold (50.8 vs. 53.5), while the ISM indicator for manufacturing was at levels that suggest a practical stagnation (49.0 vs. 50.3).

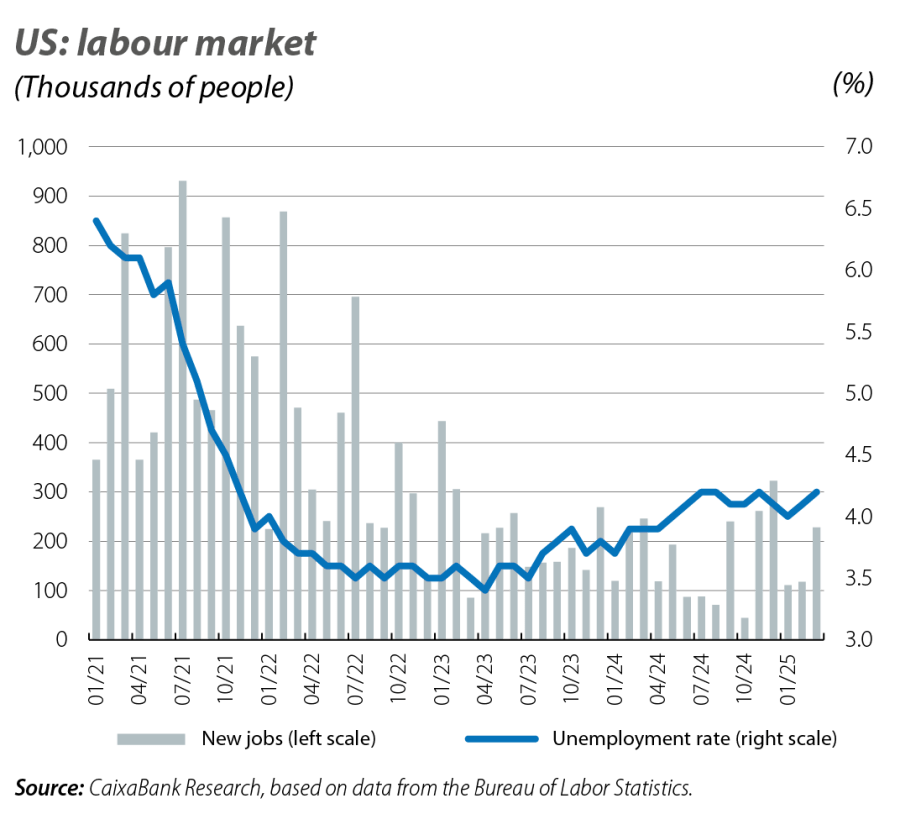

In March, 228,000 non-agricultural jobs were created, the unemployment rate increased just 0.1 pp to 4.2%, and redundancies were at a low of 1.0% of total employment. These figures reveals that the impact of the measures adopted by DOGE, which have resulted in a cumulative loss of around 14,000 federal jobs between February and March, is quite small, for now. This is because the public sector accounts for only 15% of all non-agricultural employment, and this figure falls to a mere 1.8% in the case of federal employment.

In February, both headline and core US inflation fell for the first time in five months and were down 0.2 pps, to 2.8% and 3.1%, respectively. Despite the encouraging data, the risks to inflation remain concentrated to the upside due to the current context of deteriorating trade tensions. In fact, in its March macroeconomic outlook, the Fed revised inflation upwards precisely because of the impact of the tariffs and the heightened uncertainty. Thus, the Fed has pushed back the date when inflation is expected to return to its 2.0% target to 2027. Meanwhile, in the euro area, inflation resumed its path of moderation: in March, headline inflation declined 0.1 pp to 2.2%, while the core index fell 0.2 pps to 2.4%, thanks to the continued decline of inflation in services (3.4% vs. 3.7%), and it is now at its lowest level since June 2022. In addition, the ECB revised its 2025 inflation estimate modestly upwards, but kept its forecast for the next two years unchanged.

At its annual meeting of the Two Sessions, the Chinese government once again set a growth target of around 5% and, in order to achieve this, will pursue a «moderately expansive» fiscal policy, still heavily focused on supply-side measures. However, the bilateral protectionist escalation with the US has raised concerns about the Chinese economy (exports to the US account for around 3% of its GDP).