The summer brings economic recovery in Portugal, despite the pandemic

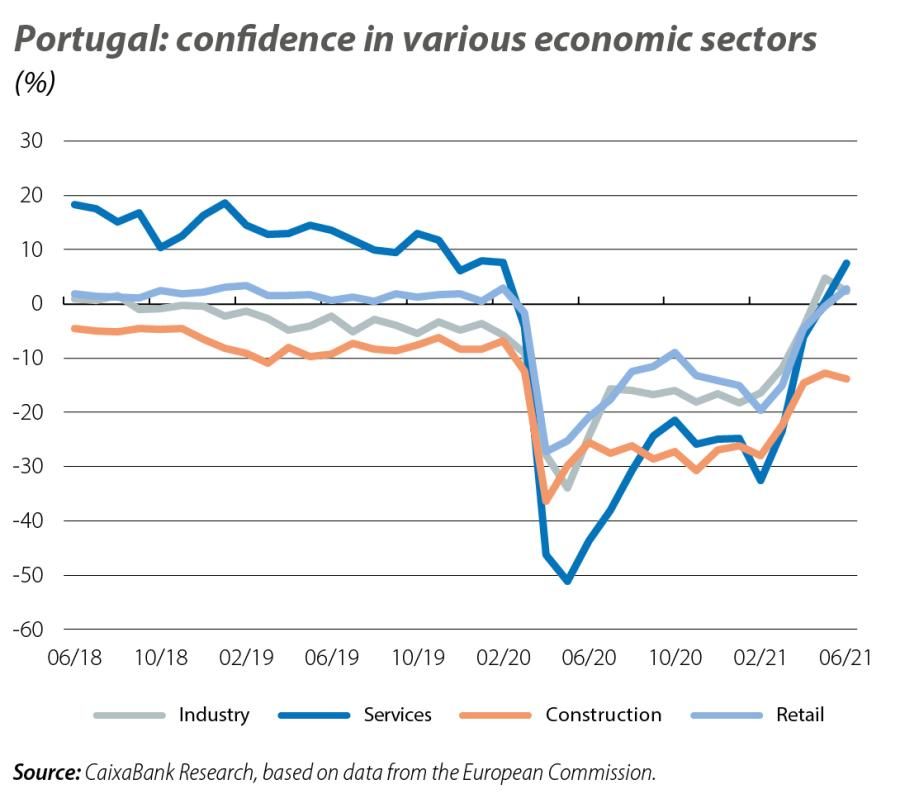

In the penultimate week of June, the daily economic activity indicator, which compiles information relating to the various sectors (e.g. road traffic, payment card usage, electricity consumption, etc.) stood 4% above the level of the end of 2020 and indicated a recovery in economic activity on the order of 7% compared to Q1 2021. Similarly, turnover in services and in industry have registered significant recoveries in the first two months of Q2. Notably, in May, retail sales were already above the level of January 2020. Confidence has also recovered rapidly in all sectors, benefiting from the easing of lockdowns and progress in the vaccination roll-out. It is plausible that economic activity in Q2 has benefited from increased consumption associated with greater household savings during the lockdown. It should be recalled that in Q1, the savings rate increased to 14.3% of disposable income, the highest level in the series, which leads us to believe that in the rest of the year household spending will rise and will reflect the gradual reversal of the previously accumulated savings.

In contrast with the recovery in economic activity in the closing stages of Q2, Q3 began marked by the increase in infections, which in some parts of the country (specifically in Lisbon) is causing the lifting of restrictions to be postponed. This could lead to less decisive growth in Q3 and Q4, albeit without jeopardising the recovery in economic activity. It should not be forgotten that, despite the rise in new infections and the increased presence of more transmissible variants, the incidence of deaths remains low and the vaccination roll-out is progressing at a faster rate than in the rest of the EU (more than 50% of the population has already received at least one dose and 30% already have both doses), suggesting that new periods of strict lockdown could be avoided.

The employed population increased slightly in May (+13,800 people versus the previous month), the fourth consecutive month with a positive (albeit not very significant) quarter-on-quarter change. Compared to pre-pandemic levels, there are still some 21,800 fewer jobs. The unemployment rate, meanwhile, crept up in May to reach 7.2% (7.0% in April). The importance of the employment support measures is clear: if the 299,281 people on simplified lay-off in May were to become unemployed, and the rest of the variables were to remain constant, then the unemployment rate would reach around 13% in May. Despite the relatively benign behaviour of unemployment to date, we maintain the expectation that unemployment will deteriorate towards the end of the year.

In particular, the consolidated general government deficit stood at 6.1% of GDP up to May (–4.2% in the same period of 2020 and –0.7% in May 2019). The year-on-year deterioration in the deficit can be explained by the decline in incomes and the rise in expenditure. In particular, among the latter, pandemic-related expenditures have played a significant role: it is estimated that COVID-related measures with an impact on the budget balance are equivalent to 3.1% of GDP up to May. However, the weight of these measures as a percentage of GDP is expected to decline between now and the end of the year, in line with the gradual improvement in economic activity and the progressive withdrawal of restrictions as normality returns. That said, there is still uncertainty over precisely what impact the new restrictions, as well as the prolongation and/or creation of new measures to support the economy, will have on the public accounts. In this context, public debt reached 129.8% of GDP in May. Although high, this figure is nonetheless 3.8 pps below that of the end of 2020.

In Q1, house prices grew more moderately than in the previous quarter, but valuations remain strong (+1.6% quarter-on-quarter and +5.2% year-on-year). In the same period, some 43,757 homes were sold (+0.5% year-on-year) and the value of properties sold increased by 2.5% year-on-year, placing the average price based on sales at 158,300 euros (+2.0% year-on-year, a more moderate increase than in the previous quarter, but nonetheless an indication that the market remains resilient). Meanwhile, the evolution of the Condifencial Imobiliário price index suggests that in Q2 the trend of market appreciation will continue.

The balance of financial risks is dominated by elements such as the high levels of indebtedness, the risk of a deterioration in the financial conditions, the banking sector's exposure to public debt, and the risk of a reduction in the value of real estate assets used as collateral in mortgages. In turn, the pandemic could create problems with respect to firms’ creditworthiness and could lead to an increase in defaults. In short, the banking sector is facing pressure in terms of profitability, with low interest rates, competition from other players and the likely increase in defaults. The data for Q1, however, do not yet reflect this increase in defaults, with an NPL ratio of 4.6%, –0.3 pps compared to the end of 2020. However, this value could increase in the future once the moratoria are brought to an end, particularly among those businesses and sectors hardest hit by the pandemic. Indeed, moratoria continue to account for a considerable portion of the stock of credit, at 11.7%, and even more so in the case of loans to businesses (30.4%).