Spain’s economic activity remains buoyant

The Spanish economy continues to show greater buoyancy than had been expected at the start of the year, thanks above all to the momentum of the tertiary sector, especially tourism-related activities, as well as the strength of job creation. Over the coming quarters supporting factors will emerge, such as a less restrictive monetary policy, an easing of inflationary tensions and an expected acceleration in the execution of the European NGEU funds.

The Spanish economy continues to show greater buoyancy than had been expected at the start of the year, thanks above all to the momentum of the tertiary sector, especially tourism-related activities, as well as the strength of job creation. In addition, over the coming quarters supporting factors will emerge, such as a less restrictive monetary policy, an easing of inflationary tensions and an expected acceleration in the execution of the European NGEU funds.

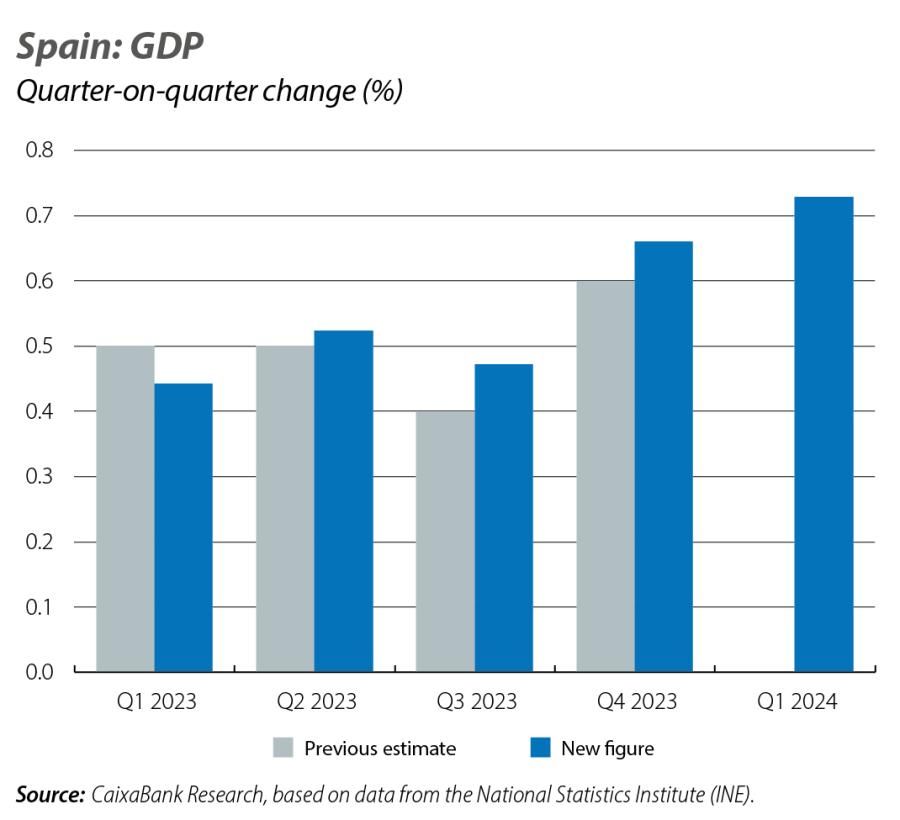

The surprising GDP growth figure for Q1 2024 (0.7% quarter-on-quarter, a rate that far exceeds that of the euro area), combined with the vigour observed in the indicators available for Q2 (PMI, employment, consumption, etc.), confirms the good tone of the Spanish economy. We must also consider the positive impact that the upward revision of GDP growth in the last three quarters of 2023 will have on growth in 2024. All this leads us to raise our growth forecast for the current year by 0.5 points to 2.4% (see the Focus «New economic outlook: Spain’s economy once again surpasses expectations» in this same report).

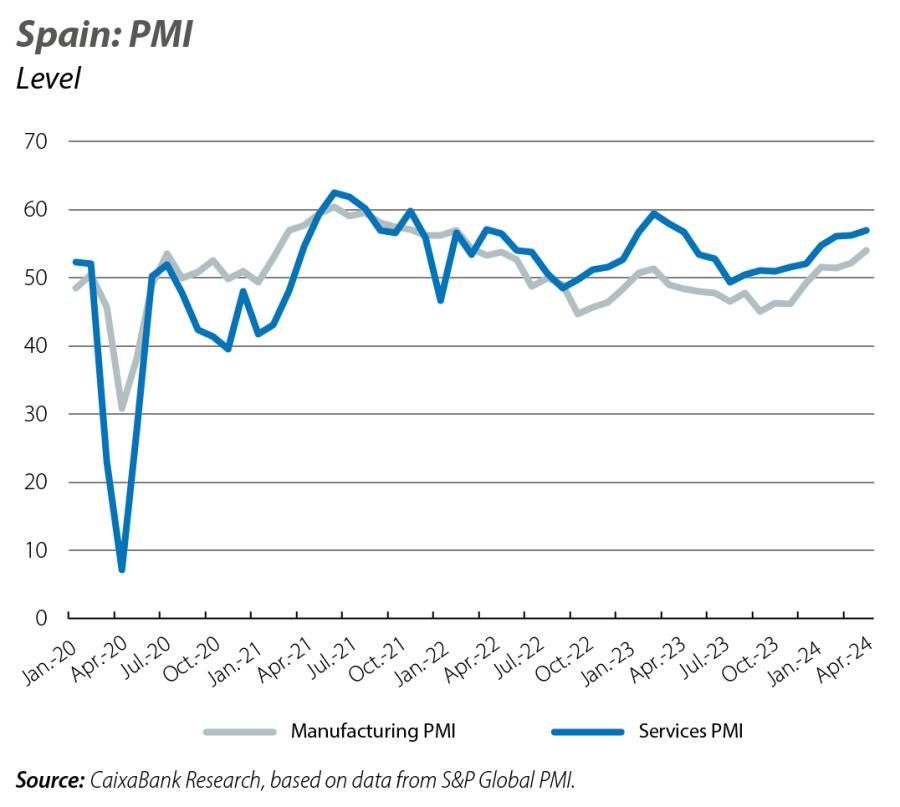

The indicators available for Q2 offer positive signals and indicate that the economy continues to grow at a steady pace. The PMI business climate survey for the services sector stood at 56.9 points in May (56.2 in April), which is well above the level that marks expansion (50 points) and marks a peak since April 2023. Within the tertiary sector, the exceptional performance of tourism continues to stand out: in April, 7.83 million tourists arrived, which is 8.3% more than in April last year, and they spent 9.565 billion euros, the highest figure in the series in that month, hinting at a new record year for the sector. As for the manufacturing sector, its revival is consolidated, with its PMI standing within expansionary territory for the fourth consecutive month, reaching 54 points, which is 1.8 points more than the previous month and the highest level since March 2022.

The consumption-related indicators also offer positive signals. On the one hand, the retail trade index in real terms, corrected for seasonal and calendar effects and excluding service stations, grew by 0.8% month-on-month in April, compared to an average monthly fall of 0.2% in Q1. Also, according to the CaixaBank Consumer Indicator, Spanish bank card usage recovered in May, following the cooling of the previous month. Specifically, it grew by 4.4% year-on-year (with data up until the 21st), exceeding the 3.2% recorded in April and similar to the pace of Q1 (4.3%).

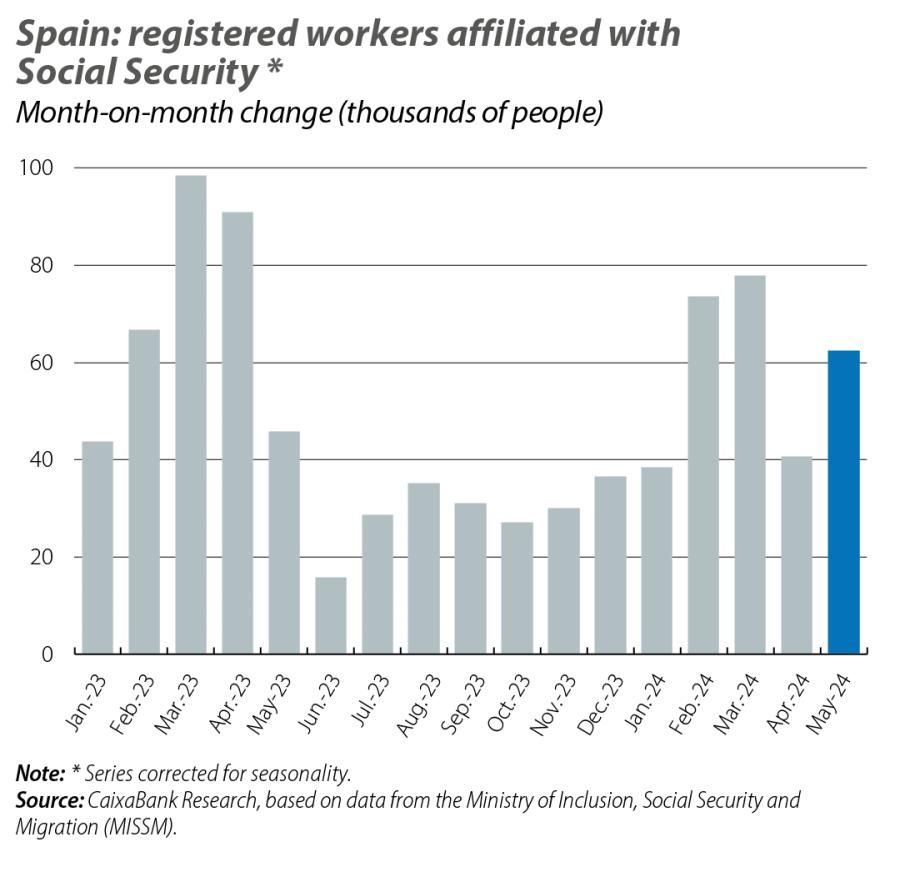

The number of registered workers increased by 220,289 people in May, improving on the figure for May last year (200,411) and the pre-pandemic average for the same month (213,582 in the period 2014-2019), and bringing the total number of registered workers to over 21.3 million. With seasonally adjusted data, employment increased in the month by 62,505 workers, in line with the monthly average for Q1 (63,242); in Q2 to date, the quarter-on-quarter growth in the number of registered workers remains at 0.7%.

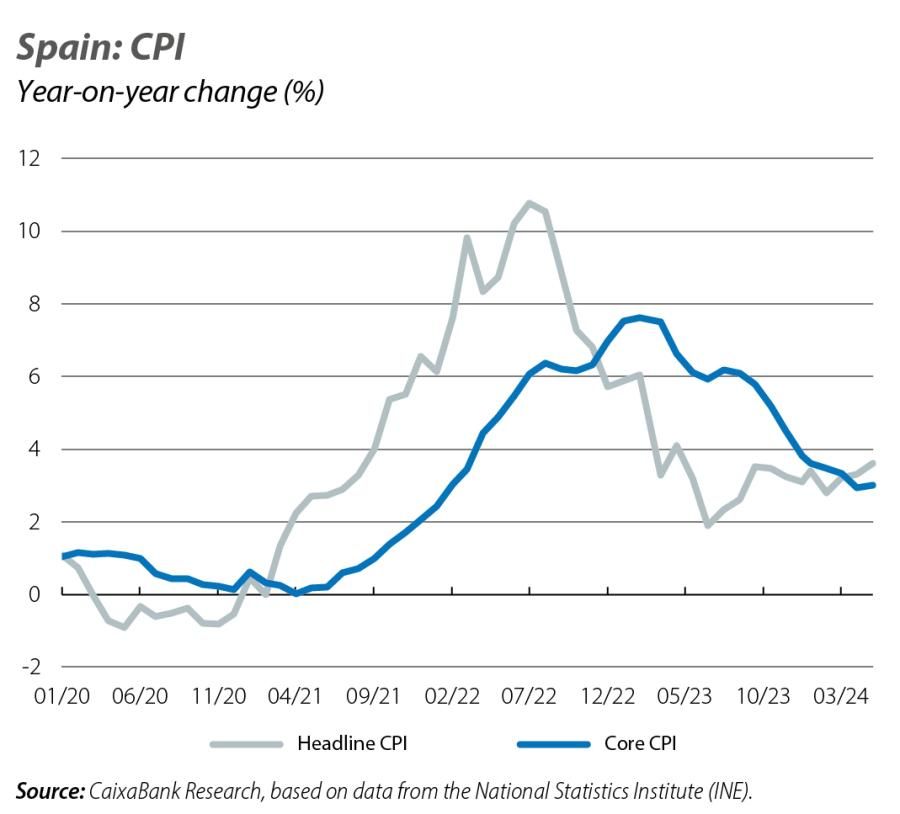

According to the CPI flash indicator published by the National Statistics Institute (INE), headline inflation increased in May for the third consecutive month, climbing 10 pps to 3.6%, which is the highest rate since April 2023. This rebound is due to the rise in electricity and fuel prices, which decreased to a lesser extent than in May in 2023: the upward contribution from energy is due to increases in the various taxes that apply to electricity bills. As for core inflation, which excludes energy and unprocessed food, it truncated its downward path of previous months and rose slightly to 3.0% (2.9% in April), due to a calendar effect influencing the price of services (Easter Week in 2023 was celebrated in April and this year, in March). In short, the rebound in inflation in May is due to specific factors and is within expectations, so it does not introduce any upside risks for our forecasts of a steady moderation over the coming months.

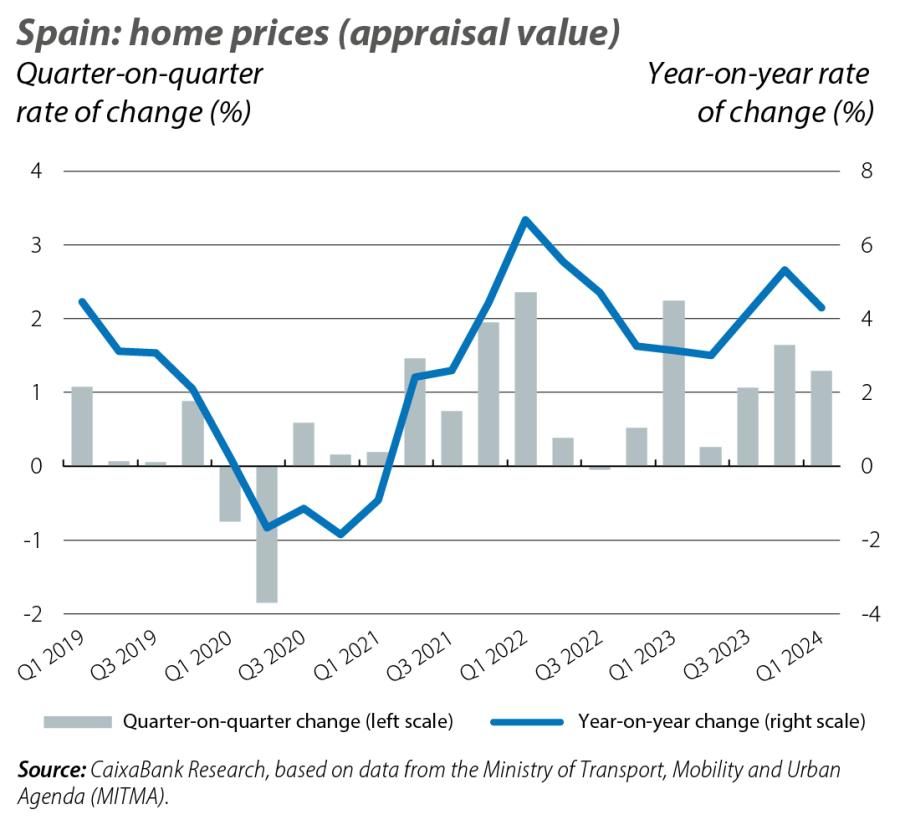

The home price index produced by the INE stood at a peak in the available series since 2007, after rebounding 2.6% quarter-on-quarter in Q1, which raises the year-on-year rate of change to 6.3% (4.2% previously). This acceleration in prices is occurring across all types of housing, although new homes are showing higher year-on-year growth rates than existing homes (10.1% versus 5.7%), reflecting a greater imbalance between supply and demand in this segment. By region, they all registered an acceleration in their year-on-year rate compared to Q4. Andalusia stands out as the market where home prices have risen the most in this early part of the year (7.9% year-on-year), compared to regions such as Castilla-La Mancha, Galicia or Asturias, where the growth rate is more moderate, at around 5%.

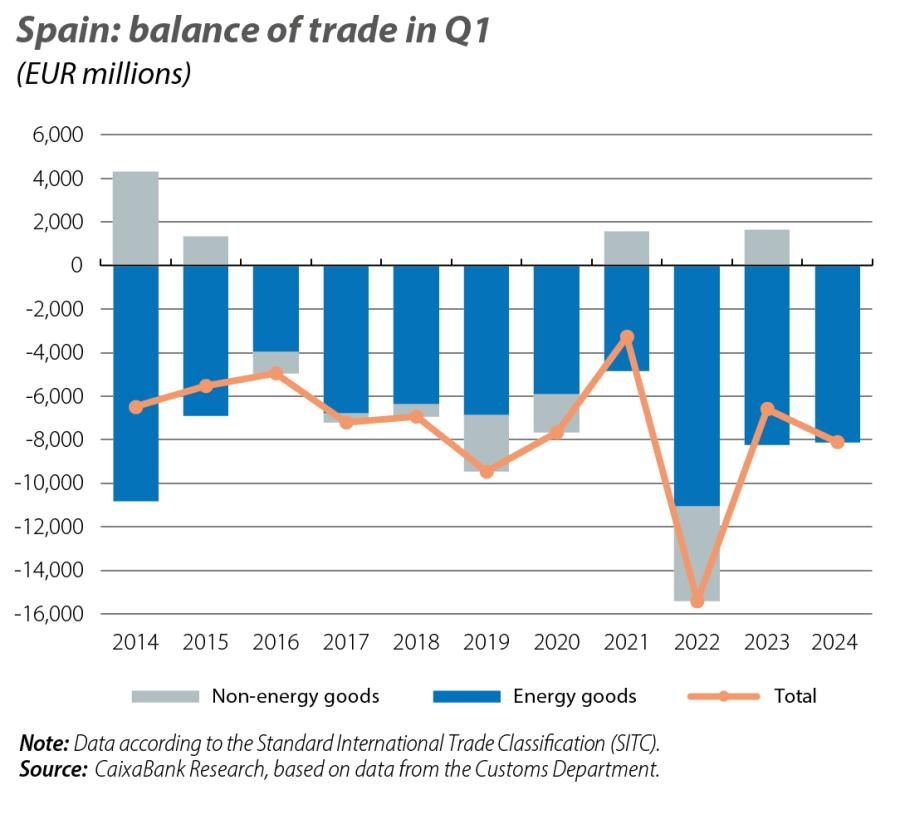

The trade deficit stood at 8.105 billion euros in Q1, surpassing the figure of a year earlier (–6.578 billion) and the average for the first quarters in the period 2014-2019 (–6.760 billion). This increase in the deficit is explained by the deterioration of the balance of non-energy goods, as the energy deficit remained fairly stable. Specifically, the balance of non-energy goods posted a surplus of 9 million euros, in contrast to the positive balance of 1.639 billion in the same period of 2023; this was due to a fall in exports, which were weighed down mainly by lower sales of medicines and organic chemicals (–7.2% year-on-year, corresponding to a 6.9% fall in volume and a 0.3% drop in prices), which was more intense than the decline in imports (–5.5%, with a 3.8% decrease in volume and a 2% decline in prices). The energy deficit, meanwhile, fell very slightly from 8.218 billion in Q1 2023 to 8.114 billion this year: exports fell by 28.2% (–21.9% in volume, with prices falling by 8.4%), which was more than imports, which fell by 15.3% (–12.3% in volume and –3.6% in terms of prices).