The Spanish economy confirms the good tone in Q3

GDP growth once again beat expectations in Q3 and the labour market and the PMIs kick off Q4 on a good footing.

GDP growth once again beat expectations in Q3

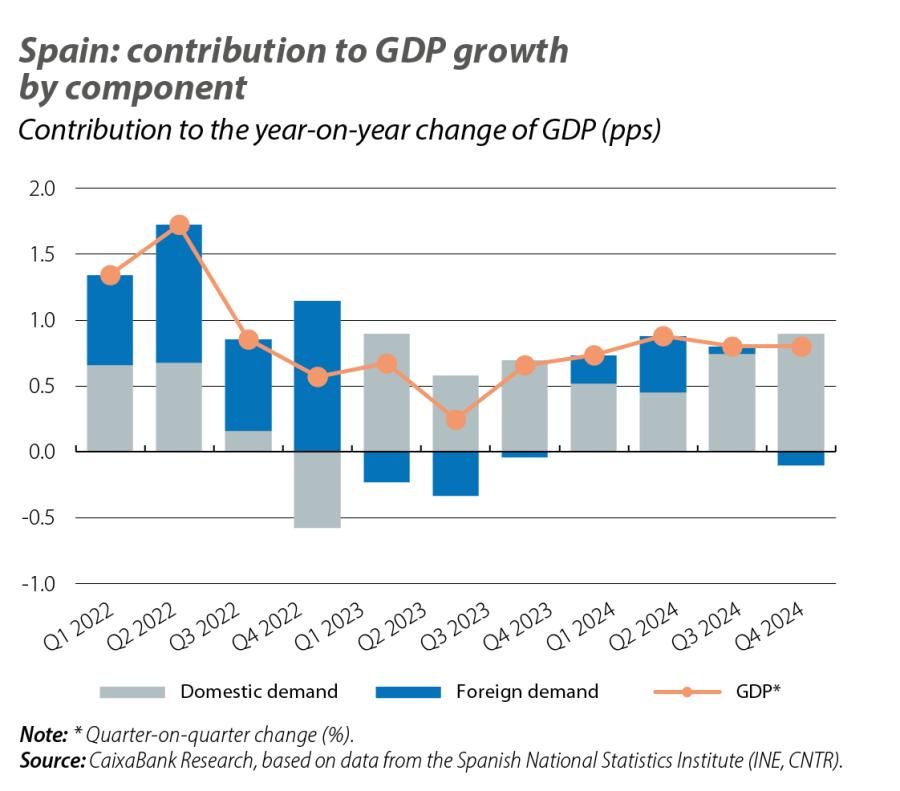

Specifically, GDP grew by 0.8% quarter-on-quarter, the same rate as in Q2 2024, and substantially above both the euro area average (0.4% quarter-on-quarter) and our forecast. In year-on-year terms, the growth rate accelerated to 3.4% from 3.2% in the previous quarter. This better-than-expected GDP growth figure for Q3 2024 introduces upside risks to our GDP growth forecast for 2024 as a whole, which is currently 2.8%. Following this advance, the Spanish economy stands 6.6% above pre-pandemic levels, compared to a 4.6% increase in the euro area.

GDP growth was driven by private and public consumption, while foreign demand became less relevant and investment failed to take off

In particular, private consumption posted a quarter-on-quarter growth rate of 1.1%, outpacing GDP, in line with the previous quarter. On the other hand, investment disappointed with a quarter-on-quarter decline of 0.9%. This was a result of the stagnation in capital investment, weighed down by the 4.2% quarter-on-quarter contraction in investment in transport, as well as by the fall in construction investment of 1.7% quarter-on-quarter. Public consumption, meanwhile, served as an important supporting factor, recording quarter-on-quarter growth of 2.2%, 1.6 pps above the figure for Q2. This growth in public consumption was higher than expected and largely explains the gap versus our forecast. Finally, foreign demand subtracted 10 basis points from quarter-on-quarter GDP growth. This was due to the fact that the increase in exports, which was a significant 0.9% quarter-on-quarter, fell short of the 1.2% growth in imports, driven by domestic demand.

The labour market and the PMIs kick off Q4 on a good footing

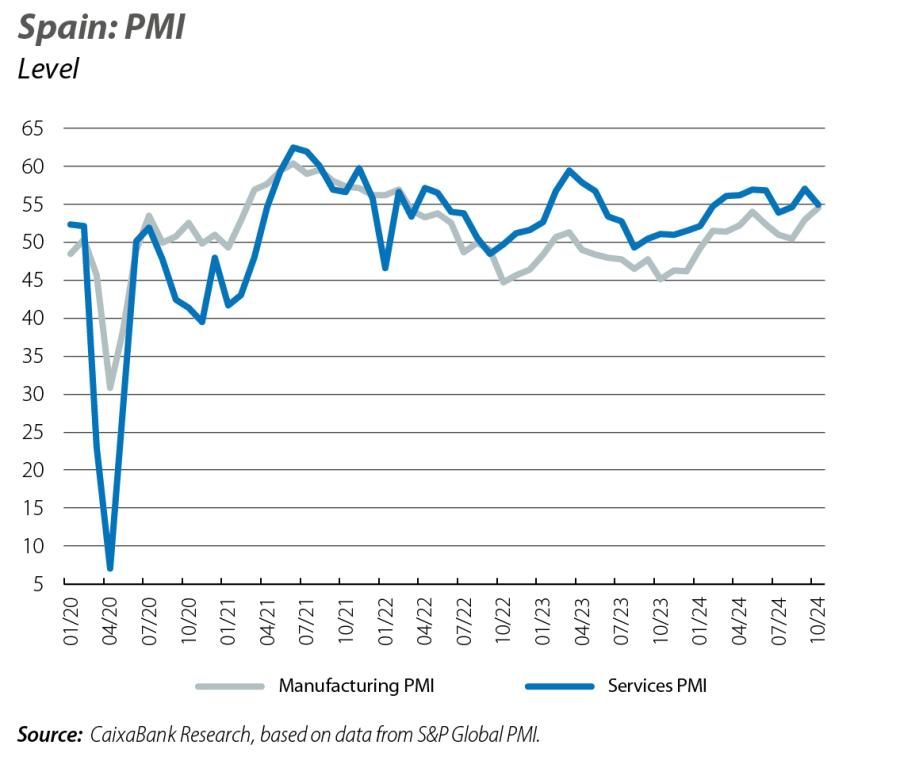

In the labour market, job creation is gaining momentum and social security affiliation grew in October by 134,307 workers compared to the previous month – a rate of 0.63% – driven mostly by the services sector. This increase was much greater than usual for a month of October: both last year and in the average of that month during the period 2014-2019, the increase was 0.45%. The total number of registered workers has thus risen to 21.33 million workers, which is 514,856 more than a year ago. In seasonally adjusted terms, employment posted a monthly increase of 67,772 registered workers, which is the biggest increase since March and well above the monthly average for Q3 (+18,000). Meanwhile, the sentiment indicators continue to show dynamism after finishing Q3 on a strong note, especially in the case of manufacturing: in October, the PMI for this sector stood at 54.5 points, well within expansive territory (above the 50-point threshold) and surpassing the figure for September (53 points), as well as the average for Q3 (51.5). Finally, the services PMI lost some ground, although it remained well within expansive territory, standing at 54.9 points in October (55.2 on average in Q3 and 57 in September). Leaving these statistics to one side, at the end of October the storm that battered much of the province of Valencia caused great human and economic devastation in the area. The destruction caused by the cold drop will take a toll on GDP growth in Q4, and although limited at the aggregate level, the impact will be significant in the affected area.

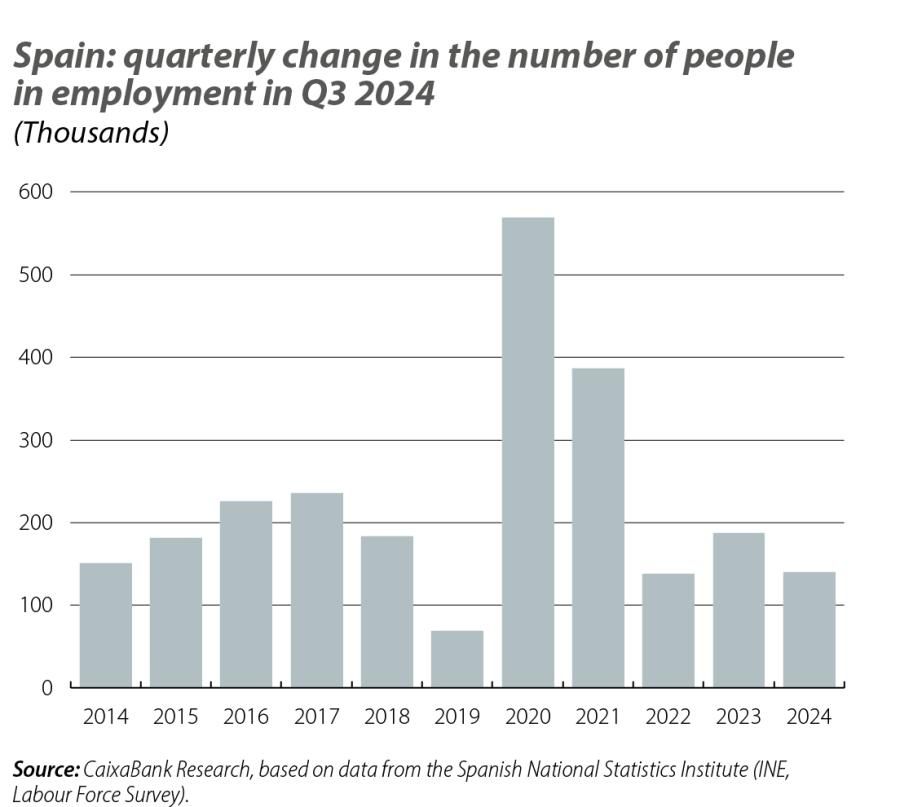

Employment performed well in Q3

The Labour Force Survey confirmed that the Spanish economy continued to create jobs at a steady pace in Q3, with seasonally adjusted growth of 0.4% quarter-on-quarter, the same rate as in the previous quarter. In addition, unemployment fell by 1,200 people in Q3 2024, compared to an increase of 86,000 in the same quarter of 2023. Thus, the unemployment rate dropped to 11.2% from the 11.3% it stood at in Q2 2024, 0.7 pps lower than the rate of a year ago (11.9%).

Also of note is the moderation in the growth rate of the labour force, which has gone from a year-on-year rate of 1.6% in Q2 to 1.0%, the smallest increase since Q3 2022. This slowdown comes from both Spaniards and foreigners, although the latter continue to grow at a much faster rate than the former (4.7% year-on-year versus 0.3%, respectively).

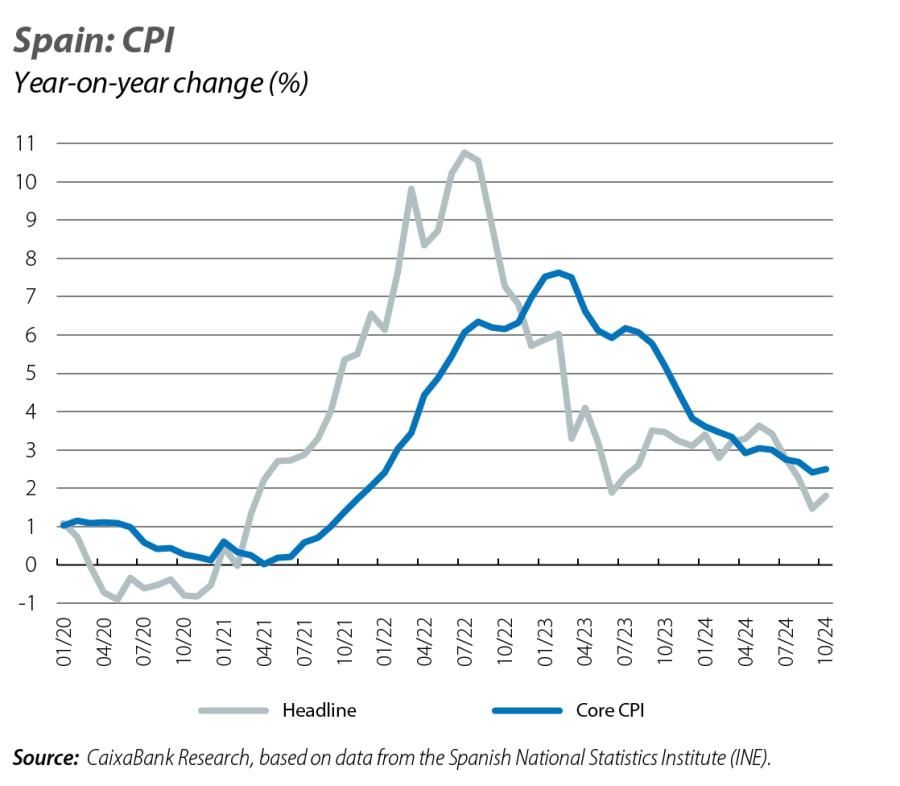

Inflation rebounded 0.3 pps to 1.8%

Inflation rebounded 0.3 pps to 1.8%, mainly due to higher fuel prices and also, albeit to a lesser extent, to higher electricity and gas prices, which fell in October in 2023. Over the coming months, the likely increase in electricity prices, according to the futures markets, coupled with the second VAT rise on food in December could give some continuity to the upturn in inflation observed this month, although we expect the increase to be moderate in any case.

The tourism sector closed the summer season with excellent records

Hotel overnight stays rose by 3.8% year-on-year in September, driven by international tourists, which grew by 4.7% year-on-year, while those of resident tourists fell by 2.2% year-on-year. This figure is somewhat below the average growth of overnight stays so far this year (5.2%), which is consistent with tourism growth that remains robust but which is stronger in the low season than in the high season, as the seasonality of the sector continues to moderate. It should be noted that the sector continues to break records for the year to date. Indeed, between January and September we received 73.9 million international tourists, some 7.4 million more than in the same period last year.

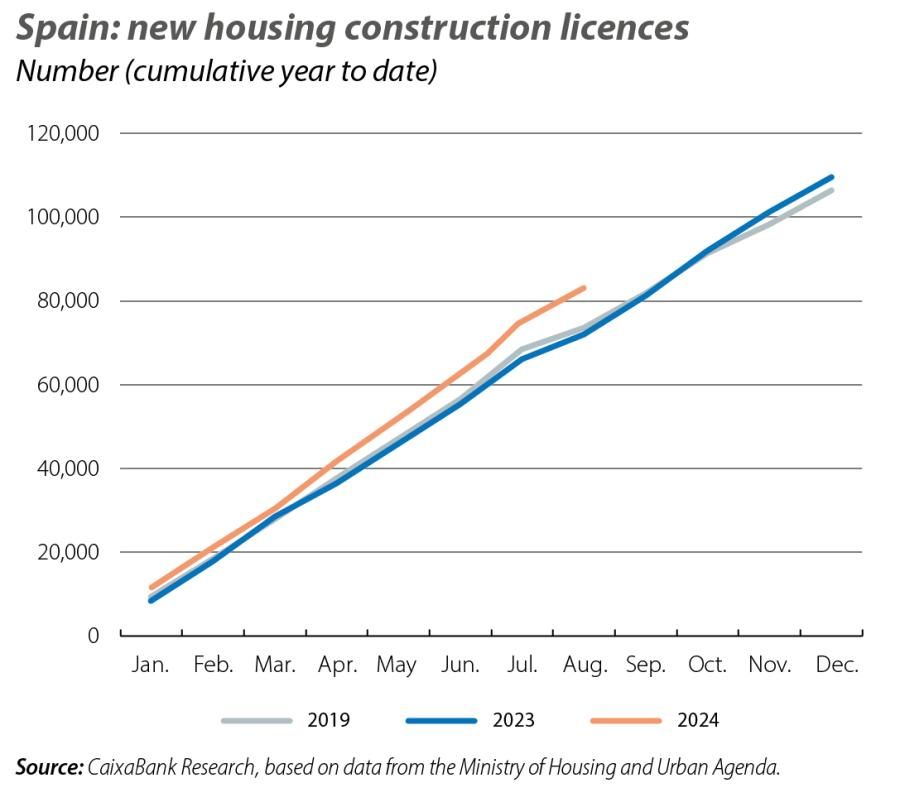

The demand for housing remains strong, while supply shows incipient signs of recovery

The number of sales in the first eight months of the year decreased by 1.0% year-on-year. Despite this slight decline, home sales remain high from a historical perspective (579,000 in the last 12 months, compared to 505,000 in 2019) and new homes are showing particularly strong growth (+7.7% year-on-year in the year to date). The housing supply remains limited and below net household creation, which is applying upward pressure on home prices. The number of new construction licences has increased by 16.4% year-on-year in the first eight months of the year, reaching 121,000 in the last 12 months, and we expect this figure to continue to steadily rise.