The Portuguese economy held up well in Q3 2022

However, the latest indicators suggest that in Q4 the Portuguese economy could contract. Notably, both car sales and ATM transactions fell in September. In October, meanwhile, consumer confidence fell to a level close to that registered at the height of the pandemic, reflecting the deteriorating outlook. Similarly, sentiment indicators across all sectors show a weakening of confidence in October and a less rosy outlook for economic activity over the coming months. Incorporating this information into our forecasts leads us to anticipate a quarter-on-quarter contraction in GDP in Q4 2022, although following the strong performance in Q3 we maintain our 6.3% growth forecast for 2022 as a whole.

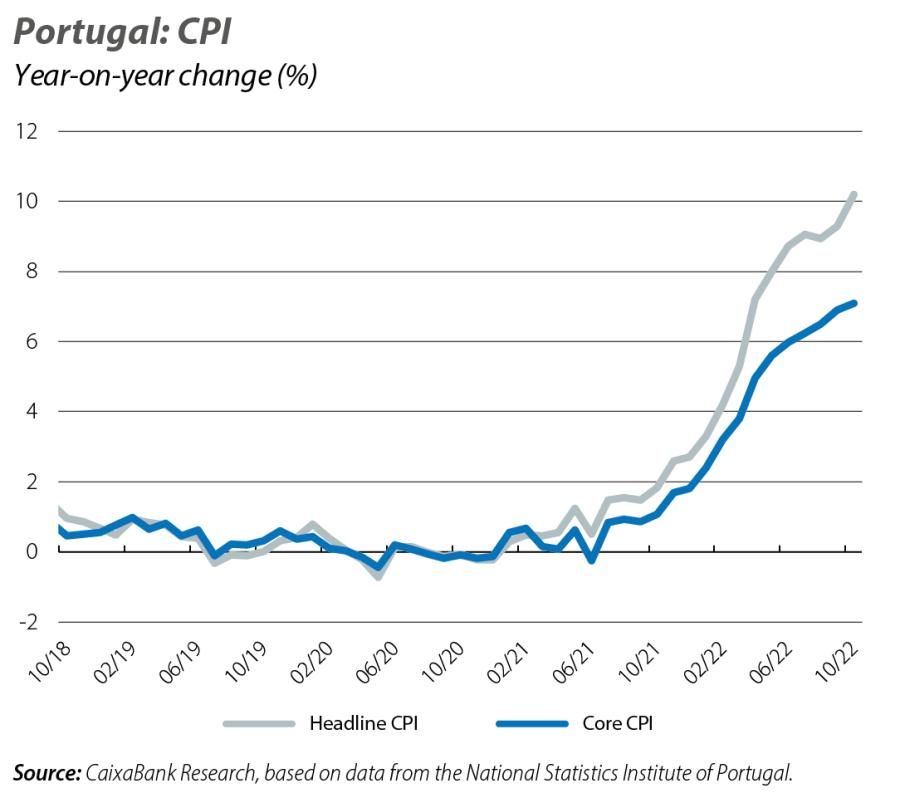

The October flash indicators suggest that inflation has risen to 10.2%, up from 9.3% in September. Unprocessed food (up 1.7% in the month) and, above all, the energy component (6.7% in the month) continue to push up prices. In the energy sphere, much of the increase is explained by the revision of regulated tariffs and prices in the electricity and natural gas markets, which came into force in October. Overall, our forecast of 7.9% average inflation in 2022 remains balanced, albeit with upside risks.

Unemployment registered in job centres rose again in September for the second consecutive month. Specifically, it increased 1.6% in the month, reaching 287,240 people unemployed. This figure nevertheless remains much lower than before the pandemic (–4.7%, or –14,000 people unemployed), but it may indicate a change in the trajectory of the labour market. This increase is largely explained by the general government civil service sector, education, health and social support activities (+1,887 people unemployed).

The housing price data measured by the National Statistics Institute’s IPH index for Q2 2022, as well as that of Confidencial Imobiliário’s residential price index, continue to indicate significant growth. However, the outlook for next year is less optimistic: rising interest rates make financing more expensive, and the sector’s expectations in terms of prices and number of transactions are about to enter negative territory. There is already a sharp slowdown in the volume of new mortgages being granted. The erosion of households’ disposable income as a result of inflation and the growing burden of interest payments will dampen demand, and this will be reflected in prices.