Portugal: the economy stagnated in the second quarter

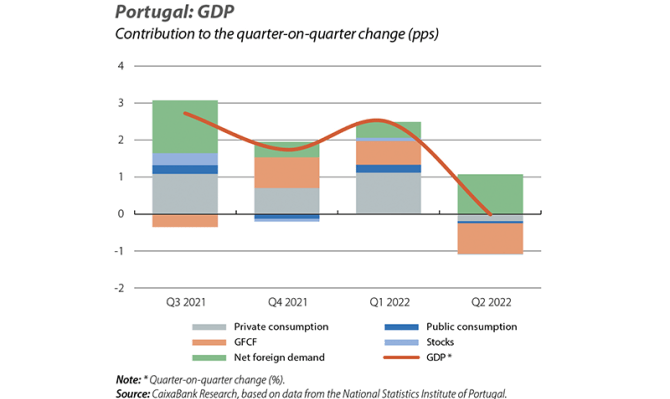

According to the second estimate made by the National Statistics Institute, in Q2 GDP remained unchanged. This places the year-on-year rate of change at 7.1%, 1.1% above the level of Q4 2019: the strength of exports offset the poor performance of domestic demand. Foreign demand contributed +1.1 pps to growth in the quarter, thanks to the 4.7% increase in exports, and this offset the negative contribution from domestic demand resulting from the contraction of 0.3% in consumption and of 4.4% in investment. However, the data available for Q3 suggest a much slower growth rate, so the average GDP growth in 2022 will be lower than we expected (6.6%), albeit still above 6%. In particular, the coincident indicator slowed to 6.4% in July, 3 decimal points below June; the daily economic activity indicator slowed to 3.5% year-on-year, 2 pps less than in July; and the sentiment indicators fell in August in virtually all sectors. In addition, the outlook for 2023 has deteriorated and the economy is facing risks arising from the tensions in the European energy markets, which will put upward pressure on prices and negatively impact consumption and production costs. At the same time, demand will also be held back by the interest rate hikes being introduced to combat inflation, although the savings accumulated by households during the lockdowns represent a significant source of support.

This was driven by the fall in inflation in the energy component (24% year-on-year, 7.2 pps less than in July), due to the correction of the price of Brent oil in the month. However, several factors suggest that the high inflation could last longer than previously anticipated, and this could lead to an upward revision of our current forecast (average inflation of 7.1% in 2022). Thus, the more rapid rise in food prices, the price increases announced by energy providers and the continued rise in persistent inflation all point to a scenario with higher than expected inflation.

In Q2, the population in employment remained practically unchanged compared to Q1, but the year-on-year rate of change slowed sharply (1.9% versus 4.7% in Q1). This was due to the base effect when compared with the strong rebound in Q2 2021, when the restrictions related to the pandemic were lifted. On the other hand, the unemployment rate fell to 5.7% (5.9% in Q1 and 6.7% in Q2 2021), indicating a shortage of labour in various sectors. However, there is a high degree of uncertainty and the risks may worsen in the coming months, given the energy crisis, rising interest rates, the ongoing conflict in Ukraine and the slowdown we are beginning to see in economic activity across the euro area.

The number of guests at hotel establishments was 6.3% higher than in the same month of 2019, with the number of overnight stays at hotels reaching 4.8% higher and the number of non-resident tourists 2% higher. The major European source markets registered positive growth, although the most noteworthy figures came from the excellent recovery in the number of tourists from the US. The appreciation of the dollar against the euro, coupled with the fact that Portugal is the European destination with the cheapest air connections with the US, ought to continue to sustain this trend.

In the first seven months of the year, the government balance stood at 0.3% of GDP, a substantial improvement compared to the negative balances of a year ago (–5.8% of GDP) and even compared to 2019 (–0.4% of GDP). Not only have revenues shown significant growth (16% year-on-year), but spending is growing very slowly (0.3%) thanks to the pattern of interest payments. It is worth noting that, despite the rise in official interest rates, the Portuguese government’s financing costs are not expected to rise significantly, as the Treasury continues to replace debt with much higher interest rates than it is currently managing to secure in the markets (the annual rollover of the stock of debt is around 8%). Thus, we estimate that the increase in yields will have only a moderate impact on the debt burden, of between 10 and 35 million euros this year.

Growth in the stock of loans decelerated in July to 2.1% year-on-year, compared to 2.7% in June. In cumulative terms in the first seven months of the year, the growth in new lending moderated (13.7% versus the same period in 2021, compared to growth of 16.8% to June). In the case of housing credit, the number of new loans increased by 12.7% year-on-year (16.3% to June), possibly affected by the rising interest rates and heightened uncertainty. In this regard, the interest rate on new housing loans increased by 1.1 pp to 1.9% in July, the highest value since August 2016. Although the interest rate on new loans is far from the highs of 2008

(in excess of 5%), the context of uncertainty, inflationary pressures and rising house prices will dent the demand for housing credit.