The evolution of the pandemic will continue to set the pace of the global economy

Omicron variant complicates the start of the year and affects the scenario for the whole of 2022

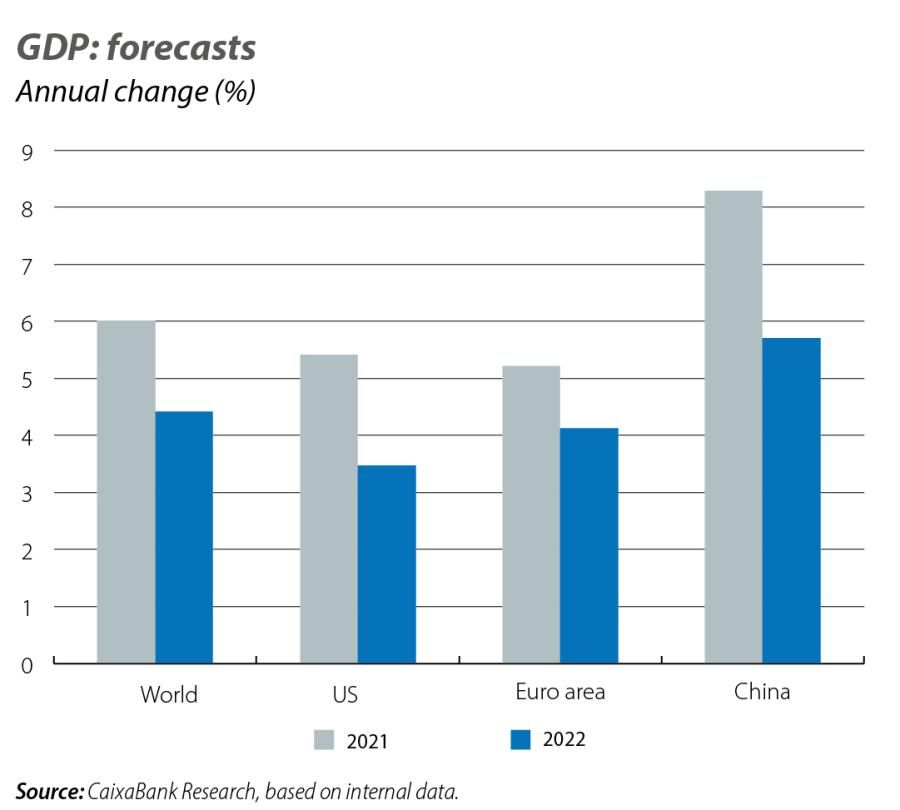

Just when we thought the worst was behind us, the rapid spread of the Omicron variant reminds us that the pandemic is far from being under control. All the indicators suggest there will be a slowdown in economic activity in Q1 2022, both in developed and emerging economies. This weak start to the year may mean that the slowdown we expect for 2022 may be even more pronounced than we estimated at the close of this report. The global outlook is therefore once again conditioned by the evolution of the pandemic, although progress in the vaccinations, the availability of antiretroviral drugs and economic agents’ adaptation to operating in a context with restrictions and high uncertainty could soften the impact that any measures taken in the event of further outbreaks may have on growth.

The bottlenecks will persist over the coming months

The deterioration in the pandemic will prolong the global supply chain problems, at least in the short term, as China continues to pursue a zero-COVID policy. Indeed, freight costs are back on the rise and we will have to wait and see to what extent this upward pressure on prices is offset by the reduced pressure from demand in a context of economic slowdown. We see a high risk that the fall in inflation will be slower than expected in the early months of the year, especially in advanced economies, but we continue to anticipate a correction from spring onwards.

US

Inflation will drive the economic agenda in 2022

The US is also experiencing a resurgence of the pandemic, and while the restrictions are not being tightened for the time being (unlike in the euro area), it still poses a potential risk to growth. Another element to keep a close eye on is inflation, which is rising sharply. In particular, the rise in inflation expectations explains the Fed’s clearly hawkish attitude, despite the risks that the pandemic poses for the growth outlook (see the Financial Markets section). Furthermore, besides the rising cost of inputs in the face of the persistent bottlenecks, the cost of labour is also on the rise. In this regard, the activity rate is still below its pre-pandemic level, which is partly attributable to changes in the behaviour of workers during the pandemic, resulting in a record number of job vacancies in excess of 10 million.

Workers could be increasing their bargaining power

To illustrate this shift, in a recent survey by Gallup, 68% of workers approved of unions, the highest percentage in the last 57 years. This increased «class awareness» in a context of a clear imbalance in the labour market explains why attractive wages are being demanded in order to return to or remain in job positions. Furthermore, those jobs are expected to guarantee workers’ purchasing power in the current context of rising prices (inflation stood at 6.8% in November, a 40-year high). We will have to wait and see to what extent the rise in inflation ends up affecting consumers’ purchasing power, as for the time being they are still financing this spending with their pent-up savings. However, this «buffer» has now been largely used up: the savings rate has gone from almost 20% of disposable income in January to 6.9% in November, slightly below the pre-pandemic average.

Biden’s new fiscal plan, run aground

In this context, Joe Biden’s 1.75-trillion-dollar Build Back Better fiscal plan, focusing on higher social spending and climate measures, stalled in the Senate in the face of a lack of support from Democratic Senator Joe Manchin. This rejection raises serious doubts over whether the plan’s economic measures can be approved in their current form.

EURO AREA

The spread of the Omicron variant forces a tightening of restrictions

The steady progress of the vaccinations has not prevented a worrying resurgence of the virus, forcing authorities to impose strict restrictions in a context marked by the persistence of global supply problems. Germany is the source of the greatest doubts, not only because of the strict measures imposed to contain the virus but also due to its high exposure to the bottlenecks: around 90% of the country’s manufacturing sector acknowledged suffering supply problems in October, compared to just over 50% in the euro area on average. Furthermore, at the European level there is a possibility that some of the projects included in the national recovery plans drawn up within the NGEU framework will need to be postponed due to a lack of materials. Thus, the risks to growth in Q1 2022 are clearly skewed to the downside.

Meanwhile, the risks affecting short-term inflation are skewed to the upside

In addition to the inflationary pressures generated by the bottlenecks, electricity prices are still on the rise driven by the sharp rally in gas prices, which have increased seven-fold since January and continue to break records. This pattern is due to the fact that gas inventories were at historically low levels at the onset of winter, at the same time as geopolitical tensions with Russia increased (Russia supplies 30% of Europe’s gas) as a result of Germany halting the certification process for the Nord Stream 2 pipeline. However, the pressure on inflation should subside after the spring as the global bottlenecks are resolved, given that, unlike in the US, wages in the euro area are contained. On the one hand, this is due to the fact that collective labour agreements in Europe span longer periods of time and include ceilings on the indexing mechanisms that are used. On the other hand, the temporary employment adjustment mechanisms have prevented job losses but at the cost of limiting workers’ ability to demand better wages as the economy has reopened. As a result, the year-on-year growth negotiated in wages fell to an all-time low in Q3. We therefore believe that the inflation rally will be temporary and we anticipate a gradual decline from the current highs (4.9% in November-December). However, we will have to keep a close eye on developments in wages in a context in which some countries are beginning to note problems in finding labour.

EMERGING ECONOMIES

In China, a significant slowdown is expected in 2022

The zero-COVID policy, the energy constraints and the problems in the country’s residential sector are some of the biggest challenges the economy will face in 2022. In this regard, the measures taken to correct the excesses of the residential sector (which accounts for over 12% of China’s GDP), which restrict developers’ ability to borrow, already explained the sector’s marked correction experienced during 2021, and this trend will continue in 2022 (see the Focus «China’s real estate sector: no room for indifference» in this same Monthly Report). The need for these measures is justified in the face of Evergrande’s failure to pay two coupons in early December, which has led Fitch to cut its rating to RD (Restricted Default).

The outlook for the country’s foreign sector is brighter

The outlook for the country’s foreign sector is brighter, bolstered by the Regional Comprehensive Economic Partnership (RCEP) which came into force on 1 January 2022. This is the world’s largest free-trade agreement, signed by China and 14 other Asia-Pacific economies (India withdrew in 2019): it accounts for some 30% of the world’s population and GDP. In any case, it should be recalled that both fiscal and monetary policy have sufficient room to act in the event of a greater than expected deterioration in economic activity.

Other emerging economies are facing 2022 with a mixed outlook

Other emerging economies are facing 2022 with a mixed outlook, partly conditioned by their vulnerability to the foreign sector. The outlook is generally better for the Asian economies, while for Russia (2.5% vs. 3.8% in 2021) and above all Brazil (0.8 % vs. 5.3%) we anticipate a substantial slowdown, partly as a consequence of the interest-rate hikes initiated in early 2021 to contain inflation. Mexico will also experience a substantial slowdown in 2022 (3.0% vs. 6.2%) due to the negative impact on investment of the nationalist rhetoric of López Obrador’s government and the interest-rate hikes expected to occur once the Fed initiates its own rates hikes. Thus, the risks affecting the outlook for emerging economies are skewed to the downside. The main risk factor lies in the normalisation of monetary policy in advanced economies, especially in the US, because of the instability this could generate in certain countries. Indeed, some may even be forced to choose between sustaining growth and avoiding capital outflows (see the Focus «Emerging Markets monetary policy: tough times ahead» in this same Monthly Report). Among the most vulnerable ones are Brazil, Egypt, Argentina, South Africa and Turkey. In fact, Turkey has been dominating the headlines in recent weeks due to the sharp depreciation of the lira and the unorthodox measures taken to control this movement (see the Financial Markets section).