E-commerce in Portugal during the pandemic: a buffer for the fall in consumption?

Did online trade mitigate the fall in household consumption in Portugal? Were (are) Portuguese businesses ready to do business in this way? Have consumers’ habits changed? Can e-commerce continue to gain ground from traditional retail?

There is a certain consensus that, during the COVID-19 crisis, we have witnessed an expansion of e-commerce and a portion of what households previously spent in physical shops has shifted online. In this article we will take a closer look at the case of Portugal,1 posing the following questions: did online trade mitigate the fall in household consumption? Were (are) Portuguese businesses ready to do business in this way? Have consumers’ habits changed? Can e-commerce continue to gain ground from traditional retail?

Going back to 2020, it is clear that the pandemic, the various lockdowns and mobility restrictions, the deterioration of the labour market and the uncertainty over households’ future incomes led to a fall in household consumption (–5.8% compared to 2019, at constant prices). In fact, food purchases were the only component of consumption not to register a decline (in fact, they increased by 4.7%). More detailed data, from physical shops and transactions (surveys and in situ purchases), confirm the signals emanating from the national accounts. In particular, in Portugal’s first lockdown (from 18 March to 3 May 2020), the number of credit or debit cards registering transactions fell by 11% year-on-year,2 followed by a drop of –5% during the second lockdown (15 January to 17 March 2021). Moreover, focusing only on those cards which registered transactions, they also suffered a decline in the number of payments made.

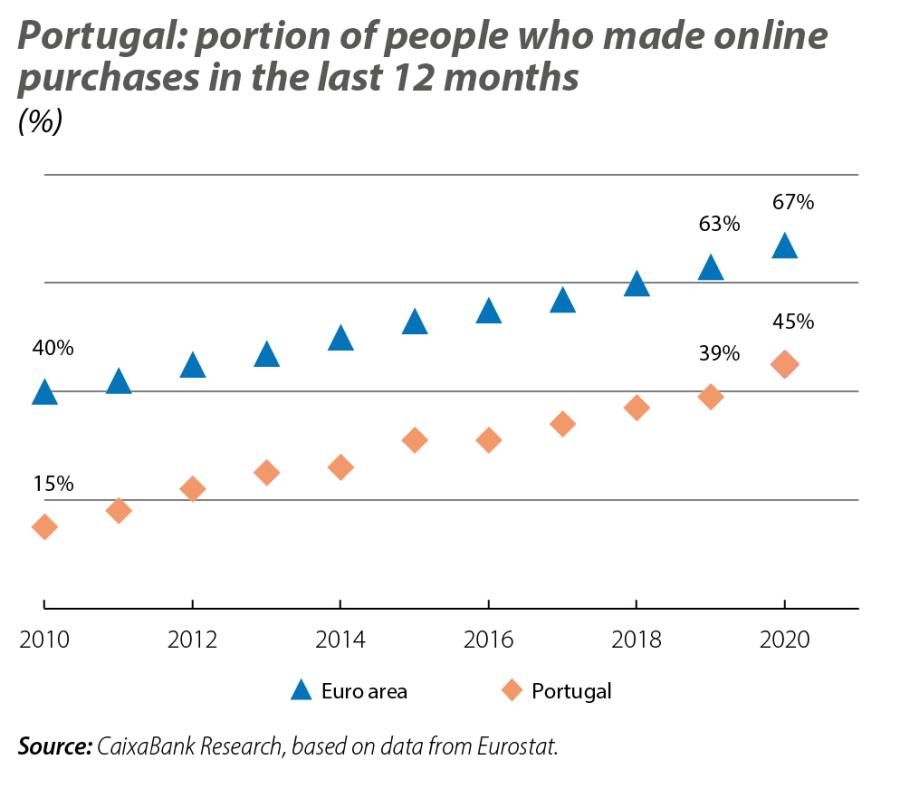

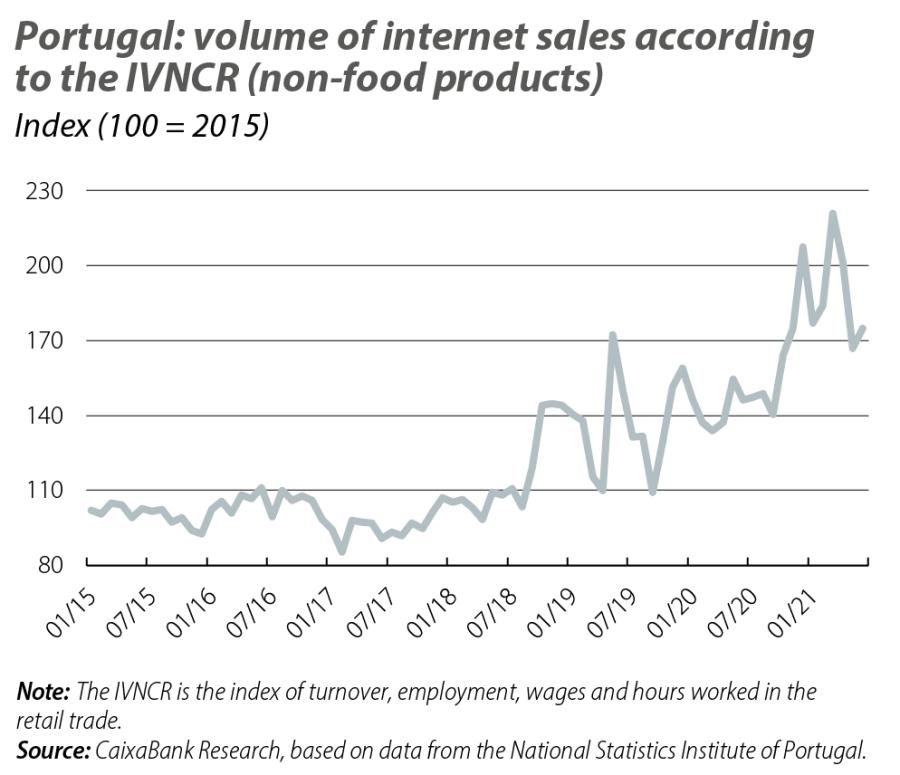

These figures attest to the reduction in face-to-face purchases (with the exception of the consumption of essential food products) and consumers’ desire to maintain social distancing. This is also confirmed by data from Eurostat: in Portugal, the percentage of people aged between 16 and 74 who made online purchases of goods and services in the last 12 months rose to 45% in 2020 (39% in 2019), well above the growth trend of the past. According to information from SIBS (Portugal’s main payment service provider),3 the number of online transactions increased, as did their relative weight in the total volume of purchases made, especially during periods when a state of emergency was declared: for instance, in February 2021 the number of online purchases represented 19% of the total (10% in February 2020). Finally, the retail trade index published by Portugal’s National Statistics Institute4 reflects a marked increase in remote sales (those made by mail order, internet or other means) for non-food products, with peaks in December 2020 and March 2021. All of this makes it patently clear that, on the demand side, there was a significant growth in online trade in goods and services. What about supply?

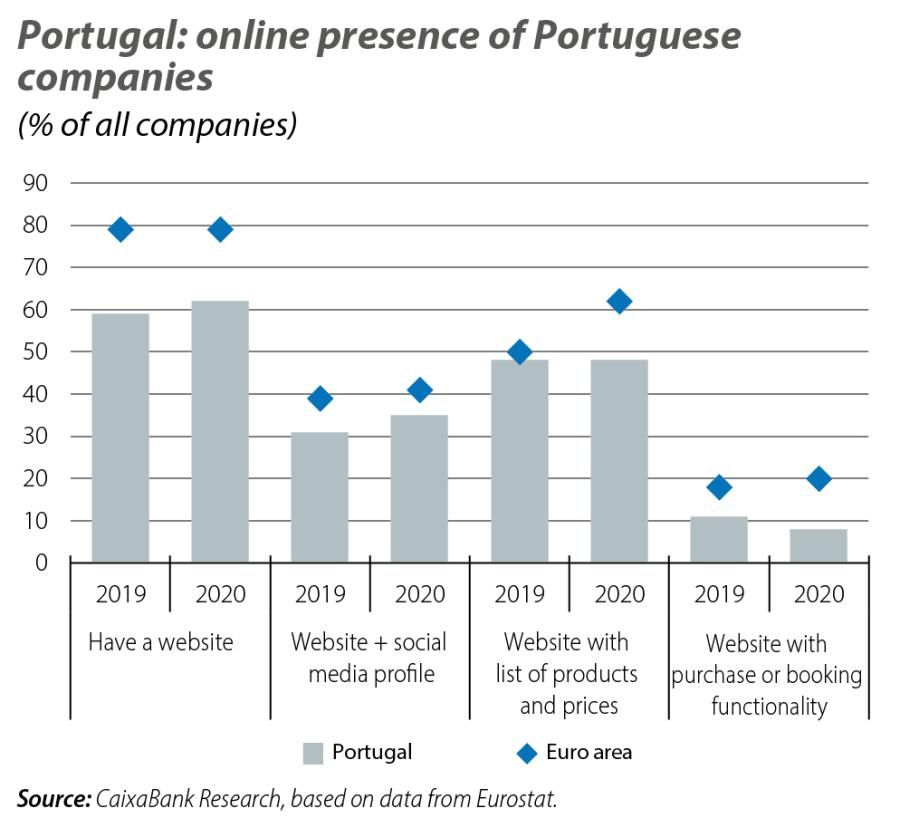

First of all, we must quantify the online presence of Portuguese businesses. According to Eurostat data, Portugal has a comparatively low number of businesses with a website through which products can be ordered or booked: 8% compared to 20% of businesses across the euro area. However, the infrastructure that will enable online sales to grow already exists and is expanding: the number of Portuguese firms5 with a website rose from 59% in 2019 to 62% in 2020.

On the other hand, according to an ACEPI study,6 half of Portuguese businesses have a presence in online marketplaces (digital buyer and seller platforms such as Amazon, Dott or OLX). This may help us to understand the low figures discussed above: the Portuguese business world is mainly made up of small businesses, and if they use marketplaces they do not need large sums of capital or a major upfront investment to conduct e-commerce.

ACEPI estimates indicate a 21% increase in B2C e-commerce,7 bringing the total to 7.4 billion euros in 2020 (3.6% of GDP).8 However, the data do not allow us to specify what portion of this increase is derived from «traditional» consumption shifting online and what portion is «new» consumption generated by electronic means. In any case, the figures are significant and suggest that, in the absence of e-commerce, the collapse in aggregate household consumption during the pandemic would have been far more severe.

The benefits of e-commerce are well known. For businesses, it provides access to new markets and enables new business models to be developed. E-commerce boosts business productivity and exports gain greater importance as a source of income.9 For consumers, they benefit from the ability to buy without having to leave their homes, in addition to the ease of comparing prices and having access to a range of differentiated products which they would not have in nearby shops. In this regard, it is important to note that the ability to compare prices and product characteristics helps to improve market efficiency. On the other hand, e-commerce also presents challenges. For businesses, these include stock logistics and management, marketing, access to high-quality telecommunications and adapting to new ways of interacting with customers. For consumers, they must be digitally literate and have greater knowledge about how to protect themselves in the online world. For states, the challenges lie in having suitable taxation frameworks and legislation to protect the economic players involved in online trades.

Following the boost to e-commerce provided by the pandemic, the lockdowns and teleworking (because of the ease of receiving orders at home), businesses and consumers can be expected to continue to make greater use this channel. Its growth will also be facilitated by generational substitution, as more consumers feel at home in the digital world. However, face-to-face trade will continue to play an important role. The potential of e-commerce is not the same in all sectors.10 In addition, a purchase is a contract between two parties and, especially in high-cost transactions, human contact is important in order to convey confidence, both in the initial exchange and also in resolving potential post-sale problems. Similarly, personal interaction in the purchase process is intrinsically important for many people, at least for certain items. E-commerce has certainly come to stay and is set to continue to grow. As part of their omni-channel strategy, businesses cannot fail to be present in the online market. Faced with the challenge of balancing retail trade in physical shops with online retail, one attractive option is the so-called ROPO strategy (Research Online & Purchase Offline). In addition, in the interaction between online and offline retail, the role of physical shops can be two-fold. On the one hand, flagship or concept stores better represent a brand’s product range and offer a distinctive shopping experience. On the other hand, the shop also functions as a logistics centre, where consumers can collect and return the items they have bought online, taking advantage of existing circuits.

- 10. For example, in 2020, only 10% of Portuguese people who bought online indicated that they had bought medicines. See source in note 6.

- 1. For the case of Spain, see the Dossier «Consumption during the pandemic: a cross section by generation» in the MR05/2021, also available at www.caixabankresearch.com

- 2. SIBS (March 2021). «365 days of pandemic – Report on the changes of Portuguese consumer habits». SIBS Analytics.

- 3. Bank of Portugal Economic Bulletin, May 2021.

- 4. IVNCR: index of turnover, employment, wages and hours worked in the retail trade. June 2021.

- 5. Companies with more than 10 employees and excluding the financial sector.

- 6. ACEPI (2020 edition). «Economia Digital em Portugal». Associação Economia Digital/IDC.

- 7. Business to Consumer.

- 8. Current prices.

- 9. See T. Kinda (2019). «E-commerce as a Potential New Engine for Growth in Asia». IMF Working Paper.

- 10. For example, in 2020, only 10% of Portuguese people who bought online indicated that they had bought medicines. See source in note 6.