A geopolitical outlook

In his first six weeks in the White House, President Trump has succeeded in disrupting the world order repeatedly. On the trade policy front, uncertainty will cloud the economic outlook in the short and medium term, and the risk of protectionist escalation is high.

A new geopolitical order...

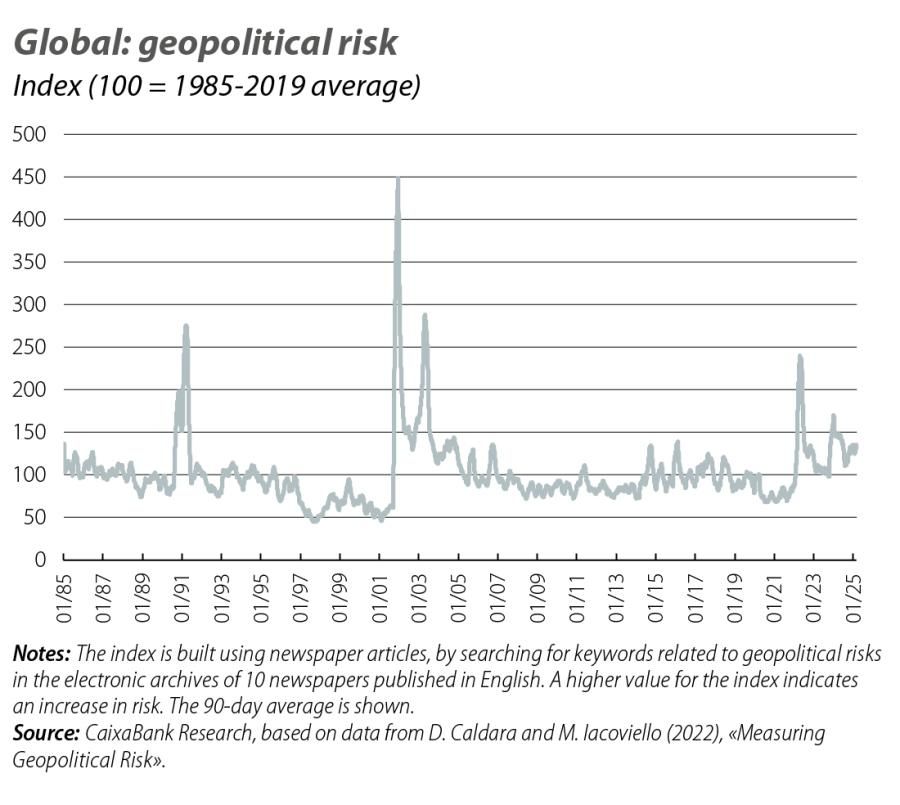

The last few weeks have inescapably been marked by geopolitics. In his first six weeks in the White House, President Trump has succeeded in disrupting the world order repeatedly. Therefore, we can expect four years of a more unilateralist, transactional and confrontational US administration. On the geopolitical front, it appears that the mantra «peace through strength» is being applied to the letter. Just days after a controversial proposal for the Israeli-Palestinian conflict, the Trump administration has left its European allies scrambling to show a united front, after the unilateral start of negotiations on Ukraine’s future with Russia without the presence of President Zelensky himself. After an historic vote at the United Nations condemning Moscow’s actions and backing Ukraine’s territorial integrity, where the US has voted against the motion, alongside Russia, Iran and North Korea. The climax of this dizzying sequence of events came during President Zelensky’s visit to the White House, which ended in a diplomatic conflict and the announcement of the suspension of US military aid. The emergency meetings taking place between European leaders highlight what a delicate moment this is for the continent. Part of the European response will come in the form of increased defence spending, although there are still question marks over what format it will take and how it will be funded, as well as regarding what the EU’s position will be in the new geopolitical balance.

... and a new trade disorder

On the trade policy front, tariff hikes have been approved on imports entering the US from China (+10 pps at the start of February, +10 pps at the start of March), from Canada and Mexico (25% with the exception of imports of energy goods from Canada, 10%), and on aluminium and steel globally (up to 25%), while tariffs on the EU have not yet been announced. That said, President Trump has indicated that there will be tariff hikes soon and has ordered the preparation of reciprocal measures, which would include tariff differentials as well as potentially non-tariff barriers. Between official announcements and night-time tweets, it is clear that the uncertainty surrounding trade policies will cloud the economic outlook in the short and medium term, with a high risk of a global protectionist escalation.

A turbulent start of the year with effects on confidence already emerging

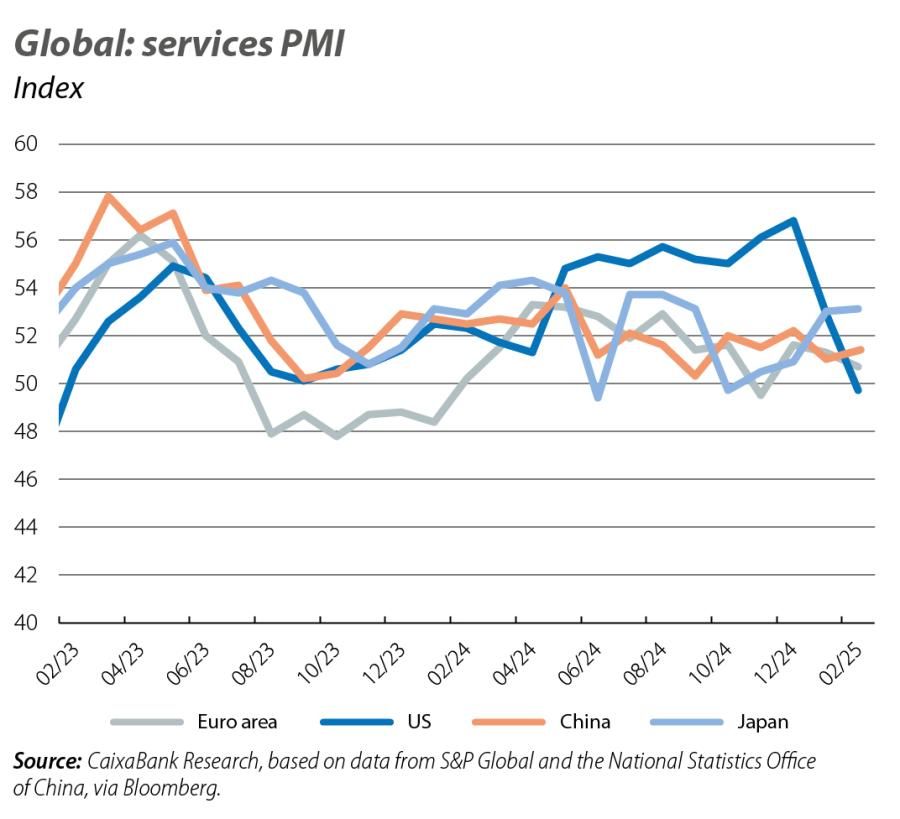

In January, the composite PMI for global activity stood at 51.8 points, 0.8 points below its level at the 2024 year end, with widespread declines recorded on the services side, which have been only partially offset by a slight improvement in manufacturing activity. In February, these trends continued in the US and the euro area, as orders accelerated in some industries, possibly in anticipation of an escalation of tarrifs. Of particular note was the sharp slowdown in the services PMIs in the US, which went from 56.8 points in December to 49.7 in February, marking the lowest level in two years. The deterioration in business confidence is attributed to the decline in activity and in new orders, which have been affected by the heightened uncertainty, the cuts in federal spending and the prospect of higher inflation. This deterioration in confidence levels is also evident in consumer confidence surveys in the US. In addition, the decline in the ISM manufacturing index (from 50.9 to 50.3 points), with sharp swings in the components of new orders (down) and prices (up), indicates that the recovery of recent months may be at risk of reversing, with the emergence of a trade war.

The euro area, between Germany’s electoral hangover and mixed data in Q1

Following the victory of Friedrich Merz’s CDU/CSU, negotiations for a grand coalition between the CDU and the SPD are expected to begin, with major challenges ahead. These include the reform of the «debt brake», without which the increase in infrastructure investment and defence spending will be limited. Meanwhile, the Ifo economic sentiment index remained unchanged in February, at around 85 points, well below the 100-point threshold that denotes growth around the historical average. In the euro area, the economic sentiment index rose to 96.3 points (vs. 95.3 previously), thanks to improvements in Germany and France. On the other hand, the unemployment rate remained at 6.2% in January, despite the fact that some indicators, such as the employment component of the PMIs, point to a slowdown in the labour market.

Acceleration of growth in Asia at the end of 2024 and the beginning of 2025

Japan’s GDP grew by 0.7% quarter-on-quarter in Q4 2024 (vs. 0.4% in Q3), with the foreign sector being the main driver of growth. For the year as a whole, the Japanese economy grew by just 0.1% (vs. 1.5% in 2023). Nevertheless, the latest GDP and inflation data could bolster the Bank of Japan’s confidence to raise interest rates in the coming months, particularly if they are accompanied by wage increases during the annual spring negotiations between big Japanese firms and unions. In India, the economy grew by 6.5% in 2024 (vs. 7.7% in 2023) and the breakdown by component reveals that private consumption remained the main source of support for the economy in Q4. On the other hand, the acceleration of public spending should continue throughout this year, with an intensification of the support from fiscal policy and a monetary policy placing greater emphasis on supporting growth. In China, the PMIs signal an acceleration of the economy in February relative to the previous month. While the support from fiscal policy and the recovery of the real estate sector could support the Asian giant’s economy, the tariff escalation remains a major downside risk.

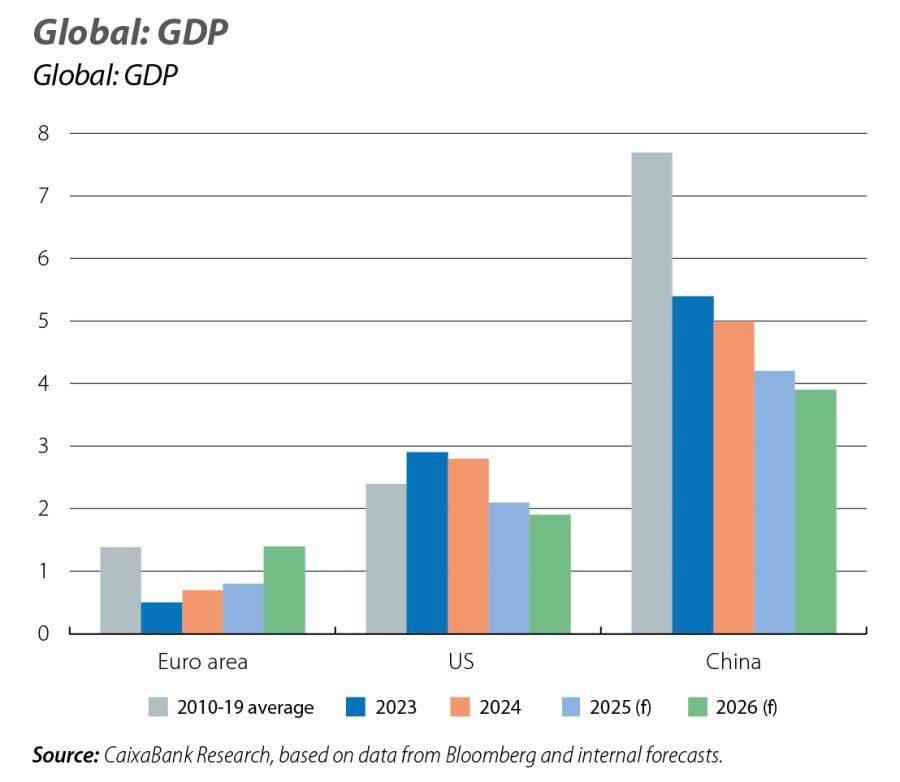

New forecasts for 2025-2026: between inertia, tariffs and more inflation

Faced with a horizon of high economic and geopolitical uncertainty, we have reviewed our global growth forecasts (for further details, see the Focus «Trump’s policies, the main question mark surrounding the global economic outlook»). In the euro area, we have revised downwards the forecasts for both 2025 (0.8% vs. 1.3% previously) and 2026 (1.4% vs. 1.8% previously). In the US and China, the upward revisions are mainly explained by the stronger than expected GDP data in the second half of 2024, and the negative impact of relatively contained tariff hikes has been incorporated. Overall, we expect a more inflationary environment, mainly in advanced economies. In this context, we have revised upwards our inflation forecasts for the US, to 3.1% in 2025 (+1 pp) and to 2.7% in 2026 (+0.7 pps). In the euro area, the latest data reinforce the disinflationary dynamics observed in recent months, with the decline of inflation in services being particularly pronounced (falling to 3.7%, its lowest level in 10 months).