How the NGEU funds are going in Spain: bread for today and hope for tomorrow

To date, Spain has already complied with 70% of the reforms set out in the Plan, but only with 15% of the investments, partly because of the Plan’s very nature, which places more emphasis on the reforms in the first few years, and partly due to some initial delays in the implementation.

The NGEU implementation period is entering its final two years. The programme began in 2021 and we have until August 2026 to achieve all the milestones and commit all the investments, including those financed with loans.1

Remember that the NGEU plan for Spain consists of 80 billion euros of non-repayable transfers2 and up to an additional 83 billion in loans to relaunch the economy after COVID with a focus on the green transition (the destination of 40% of the investments) and the digital transformation (26%). These investments and reforms are conveyed through the Recovery Plan and its addendum, which incorporates the loans.

To date, Spain has already complied with 70% of the reforms set out in the Plan, but only with 15% of the investments, partly because of the Plan’s very nature, which places more emphasis on the reforms in the first few years, and partly due to some initial delays in the implementation.

- 1. For full details, see the articles «NGEU funds: what is the status of their implementation at the European level?» and «NGEU funds: what can we say about their impact and future challenges?» in this same Dossier.

- 2. Supplementing the European funds from the NGEU programme, Spain has also received some 12 billion in transfers from the REACT-EU programme, mainly destined for health and education programmes of the autonomous communities.

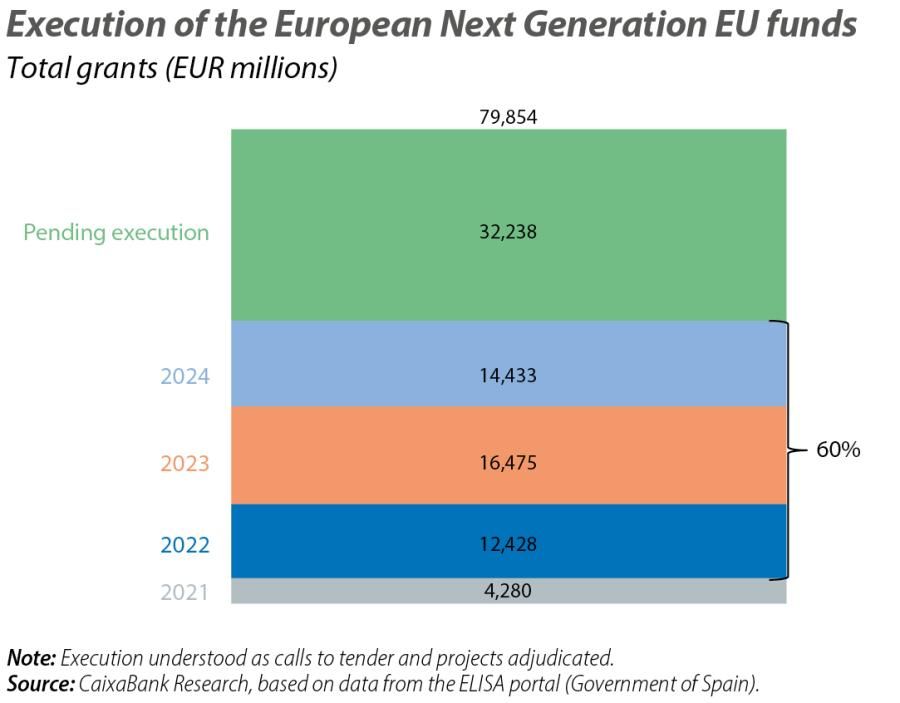

Up until December, 47.6 billion euros had been executed, comprising calls to tender and projects already adjudicated, representing 60% of the total allocation of grants under the Plan. In 2024, 14.4 billion euros was executed, slightly below the figure for 2023 (16.45 billion) and slightly higher than that of 2022 (12.4 billion).

The public-private PERTE projects (an acronym in Spanish for Strategic Projects for Economic Recovery and Transformation) have made progress with 16 billion euros executed out of a total budget of 43.6 billion. Among the biggest are the PERTE project for the connected electric vehicle (4 billion euros executed) and the PERTE project for renewable energies (4.5 billion executed).

A report by the Bank of Spain reveals that 45% of companies with projects financed by NGEU would not have undertaken such investments without the programme, and 31% would have undertaken only part of them, suggesting that the investments have a relatively high additionality.3 By component, investments related to the energy transition show the lowest degree of additionality: 39% of companies would have undertaken them without NGEU, a percentage that falls to around 20% of companies in the case of digital and R&D&i investments.

Among the key reforms, the labour reform has helped to reduce the rate of temporary employment from 27% in 2021 to 12% today and has bolstered the role of ERTE projects as an adjustment mechanism (the so-called RED mechanism). The reform of vocational training has made dual training more widespread, promoting traineeships in companies and expanding the range of studies and funding for new places.

The ICO loans and credit lines have already been activated, with the aim of helping to finance the growth of the business sector and projects that contribute to stimulating the green and digital transition, such as the green ICO programme (with an allocated budget of 22 billion euros) and the entrepreneurs ICO programme (8.15 billion). The ICO is also responsible for the deployment of loans for the construction of social and affordable housing. The banking sector must play a key role as an intermediary for a large part of these funds.

- 3. An investment is considered to create additionality if it would not have been undertaken in the absence of these European funds. See the report «Weak business investment in Spain following the pandemic: an analysis based on the Banco de España Business Activity Survey», Bank of Spain, January 2025.

When analysing the NGEU Plan by component, it is apparent that over 65% of the funds have been executed in the spheres of long-distance sustainable mobility infrastructure, urban mobility, modernisation of government administrations, digital connectivity and science, technology and innovation. However, most of the budget remains to be executed in the case of housing refurbishment, industrial policy, renewables, water resources and green hydrogen.4 By 2025, we expect around 20 billion euros in grants to be executed and that investments under the addendum financed by loans, such as the Green ICO credit line, will begin to be deployed. It will be crucial to deploy the PERTE projects that are still in their early stages, such as those related to chips (12.25 billion), the water cycle (3.055 billion) and decarbonisation (3.17 billion). The RepowerEU programme will also be pursued, with some 7 billion euros of financing for energy, of which 4.2 billion is for the renewables PERTE project.

The recovery plan in Spain focused on reforms in the first three years, and then on milestones linked to investments in the period 2024-2026. The most important outstanding milestones include: implementing low-emission zones in towns and cities, increasing the use of digital technologies in 171,000 SMEs, modernising irrigation across 160,000 hectares, renovating 285,000 homes with a minimum energy saving of 30%, building 20,000 social housing units, deploying 238,000 electric vehicles and charging points, extending 5G networks to 75% of the population, restoring 145 kilometres of degraded coastal areas and attracting foreign talent. Other important investments that should be taken into account in the future, if there is ever scope to redirect funds, include the renovation of water infrastructure to mitigate climate risks following the flooding in Valencia, increasing the housing supply and investing in artificial intelligence in coordination with Europe (in Spain’s current plan, only 538 million is allocated to AI).

- 4. According to data from AIReF’s Recovery, Transformation and Resilience Plan tracker. The total amount of the allocated funds, in billions of euros, is as follows: long-distance sustainable mobility: €6.66b, urban mobility: €6.5b, modernisation of government administrations: €4.37b, digital connectivity: €4.5b, science and technology and innovation: €4.19b, housing: €6.8b, industrial policy: €5.85b, renewables: €3.8b, water resources: €3.3b and €3.15b in green hydrogen.

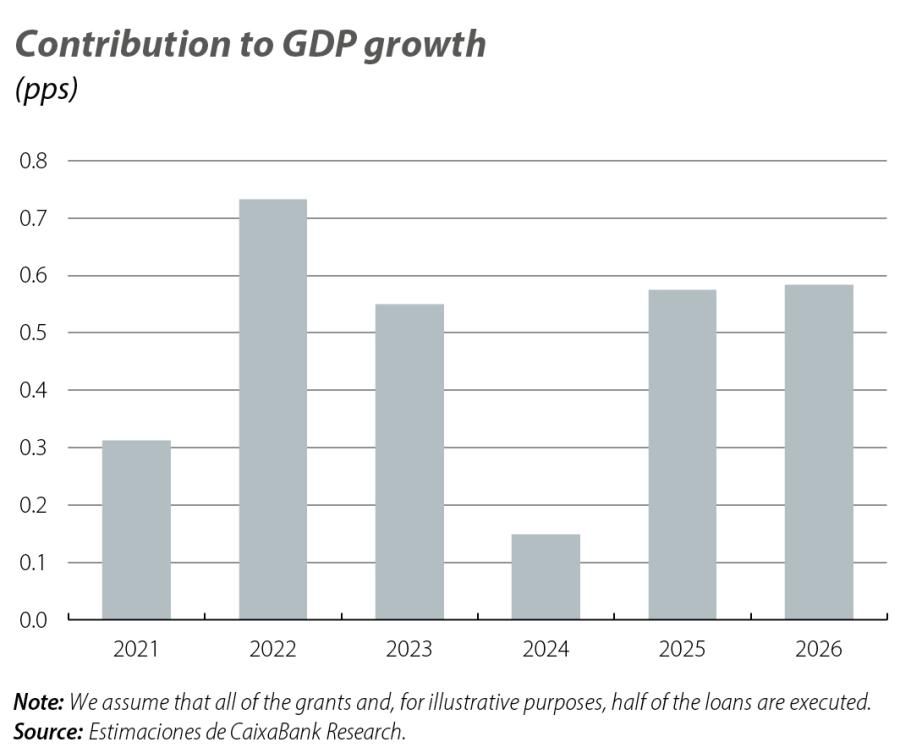

Measuring the macroeconomic impact of the NGEU funds is a complex task, as it involves making assumptions about the fiscal multiplier of the annual investments and considering whether these investments could have been undertaken by the private sector anyway. In this analysis, we focus on estimating the macroeconomic impact of the investments financed by NGEU funds (both grants and loans) and we exclude the medium-term impact of the structural reforms due to the high degree of uncertainty and complexity involved in its estimation.

It is estimated that the cumulative impact of these investments on economic activity under reasonable assumptions5 will be 2.3% of GDP in 2025 and 2.9% in 2026, thus contributing over 0.5 pps to economic growth in both years, which is more than the average contribution of 0.4 pps in the period 2021-2024. For the period 2024-2026, an economic impact of more than 2% is expected, similar to the 1.7% estimated by the ECB, provided that funds are properly channelled into productive projects.

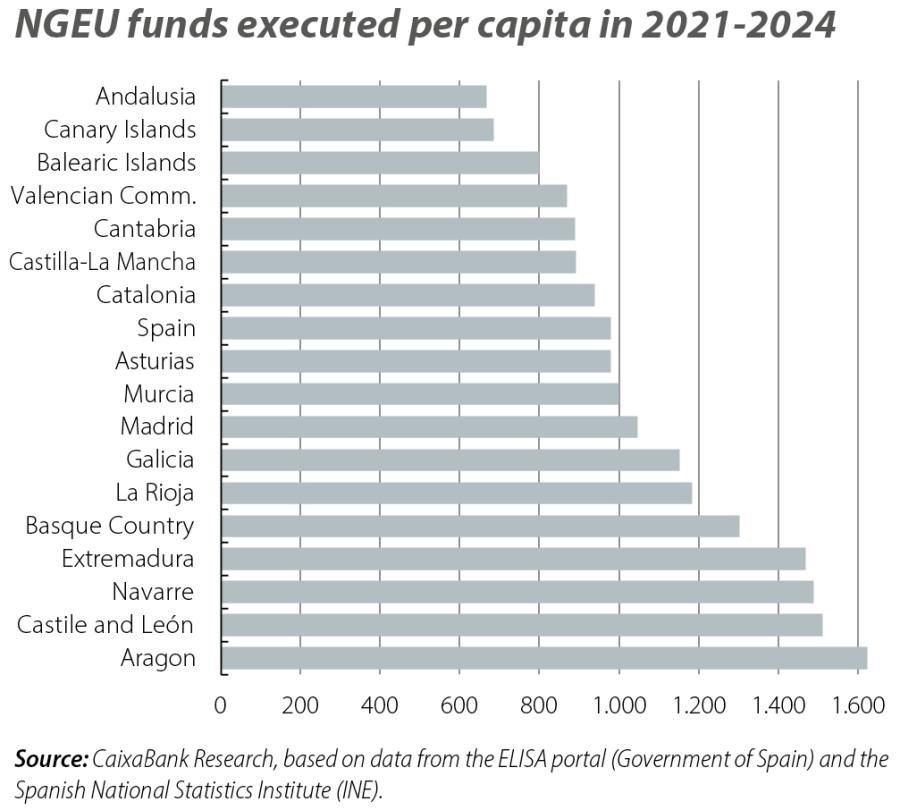

An interesting and little explored dimension is the execution of the funds by autonomous community, which affects regional convergence. Among the autonomous communities with the greatest executed expenditure per capita in 2021-2024, we find Aragon, with significant investments in renewables and the Stellantis and CATL gigafactory in Figueruelas; Castile and León, with investments in agrifood, digitalisation and SMEs; Extremadura, with investments in railway infrastructure and the construction of a lithium gigafactory in Navalmoral by Envision-AESC, and the Basque Country and Navarre, with investments in sustainable mobility and renewables.

In short, the European funds are proving to be an important driver of the Spanish economy and the moment of truth to fully execute them is approaching. This will require us to roll up our sleeves and expedite the bureaucracy. We cannot forget that there is still a long way to go and time is short: Spain has achieved 131 of the 328 milestones included in the initial plan, while 85% of the objectives linked to investments are yet to be met.6

- 5. A multiplier of 0.9 in the first year, 0.6 in the second year and decreasing to 0.2 in the fifth year after the investment. We assume that the degree of additionality is 1, such that the NGEU funds are not partially financing investments which the private sector would have undertaken anyway (crowding out), nor are they acting as a beacon for increasing private investments (crowding in). For the exercise, and for purely illustrative purposes, we assume there is a 50% take-up of the loans, consistent with the historical demand for the ICO lines of credit, although the confidence interval in this case is very wide.

- 6. In this 85% we include the objectives linked to investments that form part of the request filed by Spain in December for the fifth payment, which is currently being examined by the Commission. If they are approved, then Spain will have 75% of the objectives linked to investments remaining to be met.

- 1. For full details, see the articles «NGEU funds: what is the status of their implementation at the European level?» and «NGEU funds: what can we say about their impact and future challenges?» in this same Dossier.

- 2. Supplementing the European funds from the NGEU programme, Spain has also received some 12 billion in transfers from the REACT-EU programme, mainly destined for health and education programmes of the autonomous communities.

- 3. An investment is considered to create additionality if it would not have been undertaken in the absence of these European funds. See the report «Weak business investment in Spain following the pandemic: an analysis based on the Banco de España Business Activity Survey», Bank of Spain, January 2025.

- 4. According to data from AIReF’s Recovery, Transformation and Resilience Plan tracker. The total amount of the allocated funds, in billions of euros, is as follows: long-distance sustainable mobility: €6.66b, urban mobility: €6.5b, modernisation of government administrations: €4.37b, digital connectivity: €4.5b, science and technology and innovation: €4.19b, housing: €6.8b, industrial policy: €5.85b, renewables: €3.8b, water resources: €3.3b and €3.15b in green hydrogen.

- 5. A multiplier of 0.9 in the first year, 0.6 in the second year and decreasing to 0.2 in the fifth year after the investment. We assume that the degree of additionality is 1, such that the NGEU funds are not partially financing investments which the private sector would have undertaken anyway (crowding out), nor are they acting as a beacon for increasing private investments (crowding in). For the exercise, and for purely illustrative purposes, we assume there is a 50% take-up of the loans, consistent with the historical demand for the ICO lines of credit, although the confidence interval in this case is very wide.

- 6. In this 85% we include the objectives linked to investments that form part of the request filed by Spain in December for the fifth payment, which is currently being examined by the Commission. If they are approved, then Spain will have 75% of the objectives linked to investments remaining to be met.