The EU in 2022: fiscal rules reform back on the table

The severe deterioration in the public finances as a result of the pandemic has reopened the debate about the need to reform EU fiscal rules.

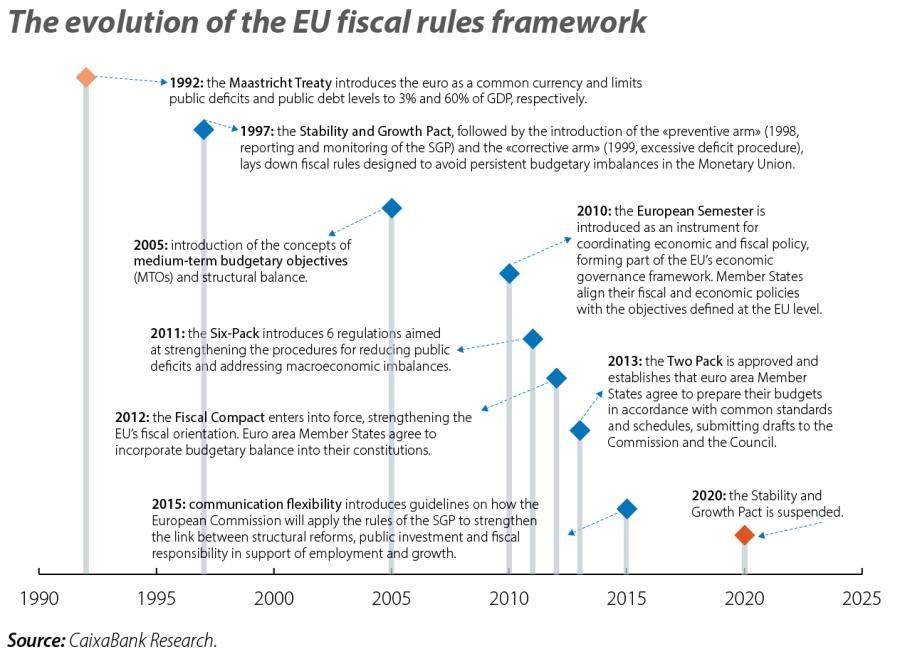

The severe deterioration in the public finances as a result of the pandemic has reopened the debate about the need to reform EU fiscal rules. The current public debt and deficit targets date back to 1992, when the Maastricht Treaty set the requirements for access to the single currency, and these were also incorporated into the Stability and Growth Pact (SGP) when it was adopted in 1997. The public debt ceiling was set at 60% of GDP (coinciding with the European average in the 1990s), a target that was expected to be met in the medium term if the public deficit ceiling was set at 3% of GDP, as nominal growth at that time was around 5.0%. That is, the SGP was approved against a backdrop of high economic growth and low levels of debt, a far cry from the present situation.

Indeed, one of the decisive moments for the SGP was the global financial crisis of 2008, which forced Brussels to adopt a set of legislative proposals known as the Six-Pack and the Two-Pack. However, these «tweaks» failed to solve the main problems of the SGP: its lack of flexibility to adapt to each Member State’s own business cycle and situation, its lack of transparency, its excessive complexity and the absence of mechanisms to ensure compliance. Even the European Commission itself recognised that these reforms aggravated the above problems by introducing new budgetary procedures and criteria that were difficult to measure in the short term.1

- 1. See the Focus «A step towards a reform of the fiscal rules in Europe?», in the MR03/2020.

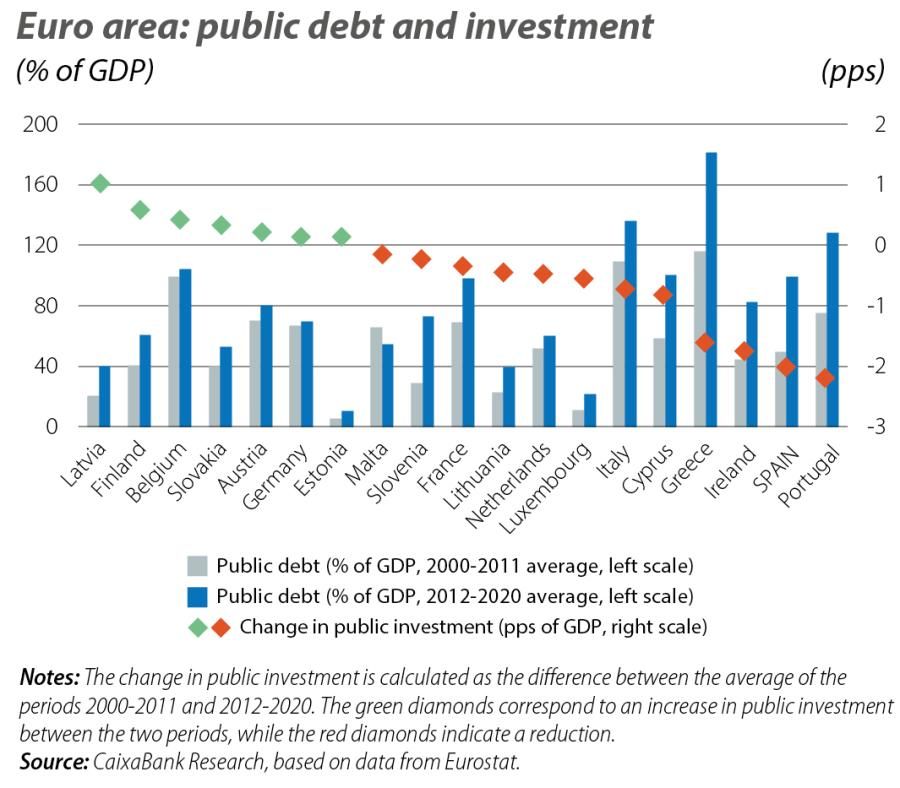

The last expansionary cycle (2014-2019) highlighted the enormous challenge that some Member States face in meeting the objectives of the SGP. Overall, Member States managed to bring their public deficit to GDP ratios down below 3.0% in 2019 (Spain and France passed by the skin of their teeth), while the primary balance (which excludes interest payments) also improved significantly in most cases, although Spain was not one of them. This improvement reduced pressure on government debt ratios, which fell over the period, although in 2019 they were still well above the 60% target in many countries (see second chart).

Even in the pre-pandemic macroeconomic context, the effort that was required of some countries to bring their debt within the limits set under the Fiscal Compact was enormous. Assuming that the long-term interest rates and the nominal GDP growth rate achieved in 2019 had remained stable, Greece would have needed to register a primary surplus of over 6.0% for 20 years; in the case of Italy and Portugal, this figure was around 3.0%, while in Spain, France and Belgium, it was around 2.0%.2 This does not seem feasible, especially given countries’ systematic failure to comply with the fiscal rules in the past. As the evolution of the structural deficits shows,3 some economies lack the tools or the political will to comply with the European recommendation to cut their structural deficit ratios by 0.5 pps per year in order to bring them closer to the established structural targets,4 even in expansionary periods (see third chart).

- 2. See the Focus «European fiscal rules: an end to the 60% limit?», in the MR03/2021.

- 3. The structural deficit is estimated to be the part of the public deficit which is not affected by the business cycle or by temporary exceptional expenditure. Effectively, it offers an estimate of the permanent (structural) imbalance in the financing of the public accounts and provides an idea of their long-term sustainability.

- 4. Brussels states that the «golden rule» of budgetary balance, with a structural deficit limit of 0.5% of potential GDP (if public debt is less than 60% of GDP, this limit is set at 1% of GDP), must be enshrined in national legislation, preferably at the constitutional level. However, this is one of the most controversial objectives. On the one hand, the concept of «structural deficit» is itself an estimate, not an observed variable. On the other hand, it is fixed in terms of potential GDP, which is another variable estimated using different methods, and this explains the differences in the potential GDP figures published for the same country by different entities such as the IMF, the European Commission and the OECD.

The COVID-19 crisis exacerbated the existing problems by making it clear that the current fiscal rules would likely be inadequate for the new reality. The exceptional nature of the situation led to the temporary suspension of the SGP (from March 2020 until, foreseeably, 2023) and revived the debate about the reform of fiscal rules. The discussion can be divided into three schools of thought: (i) those who argue that the current framework does not need reform; (ii) those who acknowledge that the fiscal rules need to be adapted, but within the current framework; and (iii) those who demand a complete overhaul of the rules and even the replacement of the numerical targets included in the European treaties. An immediate return to the rules of the Fiscal Compact could be detrimental for the euro area as it would require a very sudden and clearly unworkable fiscal adjustment, while a complete overhaul seems complicated, requiring unanimity among Member States. Thus, the option of reform within the current framework is the clear winner.

Among the potential solutions, one of the most promising is to shift the focus from rules based on the structural deficit to an expenditure-based rule. This could be easily adapted to each country’s individual macroeconomic conditions (primarily, the level of public debt) and could include exceptions which, among others, would affect public investment in order to limit the «anti-public investment» bias of the current system5 (see fourth chart). In addition, it is essential to improve the transparency of these rules, reduce their complexity and strengthen the role of institutions responsible for fiscal supervision6 by creating incentives and mechanisms to promote compliance.

- 5. The fiscal consolidation in the last expansionary cycle was largely achieved via a drastic reduction in investment, when investment contributes to medium-term growth.

- 6. These institutions include the European Fiscal Board and national fiscal supervision institutions, such as the AIReF. In this regard, a mechanism for resolving fiscal disputes between Member States and the European Commission should also be established, increasing the responsibilities of the European courts of justice.

Although adopting an expenditure-based rule adds transparency and predictability to the European fiscal framework, it is important to highlight the difficulty in naming exceptions (i.e. which items of public expenditure should be excluded from the expenditure rule and which should not?), as well as the need to set clear limits on the scope of action of the various institutions involved in the process. In the end, a reform of the fiscal rules should be capable of addressing the shortcomings already identified and should enable us to emerge from this crisis with a simple and credible mechanism for fiscal control and coordination. Such a mechanism should also give Member States a sufficiently solid architecture with which to tackle the EU’s main challenges: making Europe the first climate-neutral continent, adapting it to the digital age, reducing inequality, and mitigating the effects of population ageing... all this without jeopardising the long-term sustainability of public debt. These challenges will require significant levels of public investment, which are infeasible under the current budgetary rules, so a thorough rethink of the fiscal strategy will be key.

Furthermore, despite the pertinence of the debate on fiscal rule reform, we must not loose sight of other important elements. Let us not forget, for example, that countries must also make individual progress in carrying out the necessary structural reforms to ensure the sustainability of their public finances.7 In addition, when it comes to fiscal rules, there does not appear to be any silver bullet for easily and simultaneously achieving a simpler, more flexible and predictable application. Even so, the EU also has other heavy ammunition: the mechanisms developed during recent crises (such as the European Stability Mechanism, the SURE instrument and NGEU funds) make it possible to fine-tune the aim of the EU’s fiscal artillery. Overall, a well-established system of fiscal rules and a permanent fiscal capacity in the EU would encourage key investments during a period of ecological and digital transition, while reinforcing positive conditionality. Boosting confidence among Member States, as well as in EU institutions and rules, will be the key.

- 7. See OECD (2021). «The long game: Fiscal outlooks to 2060 underline need for structural reform».

- 1. See the Focus «A step towards a reform of the fiscal rules in Europe?», in the MR03/2020.

- 2. See the Focus «European fiscal rules: an end to the 60% limit?», in the MR03/2021.

- 3. The structural deficit is estimated to be the part of the public deficit which is not affected by the business cycle or by temporary exceptional expenditure. Effectively, it offers an estimate of the permanent (structural) imbalance in the financing of the public accounts and provides an idea of their long-term sustainability.

- 4. Brussels states that the «golden rule» of budgetary balance, with a structural deficit limit of 0.5% of potential GDP (if public debt is less than 60% of GDP, this limit is set at 1% of GDP), must be enshrined in national legislation, preferably at the constitutional level. However, this is one of the most controversial objectives. On the one hand, the concept of «structural deficit» is itself an estimate, not an observed variable. On the other hand, it is fixed in terms of potential GDP, which is another variable estimated using different methods, and this explains the differences in the potential GDP figures published for the same country by different entities such as the IMF, the European Commission and the OECD.

- 5. The fiscal consolidation in the last expansionary cycle was largely achieved via a drastic reduction in investment, when investment contributes to medium-term growth.

- 6. These institutions include the European Fiscal Board and national fiscal supervision institutions, such as the AIReF. In this regard, a mechanism for resolving fiscal disputes between Member States and the European Commission should also be established, increasing the responsibilities of the European courts of justice.

- 7. See OECD (2021). «The long game: Fiscal outlooks to 2060 underline need for structural reform».