Monetary policy in 2025: dialling-back time

With disinflation on track and some signs of a slowdown in economic activity and a cooling of the labour market, monetary policy is shifting gears and starting to dial back the monetary tightening of the past years: going from restrictive to neutral. The ECB and the Fed, along with other major central banks, have initiated this easing process with interest rate cuts, and they are expected to continue doing so in 2025. From there, we will seek to clarify the factors that will guide this new phase of monetary policy.

The path to neutral interest rates...

Both the Fed and the ECB have advocated a gradual approach. Although the ECB has lowered the depo rate from its peak of 4.00% down to 3.25% and the Fed has placed the fed funds rate in the 4.50%-4.75% range (vs. a peak of 5.25%-5.50%), these levels remain restrictive and the expectation is that, in a soft landing scenario, gradual rate cuts will continue in 2025.1 However, several questions remain, such as how far rates will fall, how quickly they will do so, and how their reduction will be passed on to the wider economy.

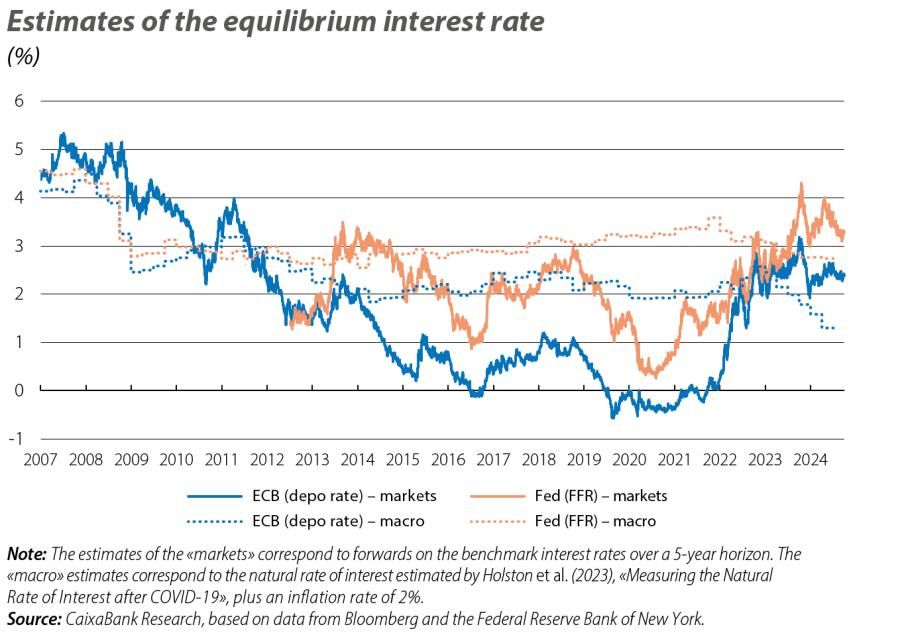

The central banks’ goal for 2025 is to bring interest rates to a level that neither stimulates nor cools the economy, but rather balances it with its potential growth. This equilibrium interest rate, also referred to as the natural or neutral rate of interest, is an unobservable and uncertain concept that guides the design of monetary policy. There are multiple ways to infer it, and we summarise two well-known approaches for the Fed and the ECB in the first chart: one based on macroeconomic models and the other on prices in the financial markets. These two options place the equilibrium interest rate in the US in the range of 2.75%-3.25%, while for the euro area it lies at 1.50%-2.50%.

- 1These rate cuts will coexist with a reduction of the central banks’ balance sheets. See the Focus «Balance sheets: the not-so-visible normalisation of monetary policy», in this same report.

The speed with which the Fed, the ECB and the other central banks undertaking a monetary easing process will lower their rates to neutral levels will depend on how quickly or slowly the soft landing scenario materialises in their economies. In the euro area, the ECB could reach neutral territory as early as 2025, given the combination of tepid growth in the region on aggregate and the expectation that inflation will settle around the 2% target in the coming quarters (a view that is reinforced by the slowdown in wages and business margins).2 In the US, our scenario is that the Fed will also reach neutral levels during the course of 2025, in order to avoid a sudden cooling of the labour market in the context of a disinflationary process which, with nuances compared to Europe, seems reasonably on track.

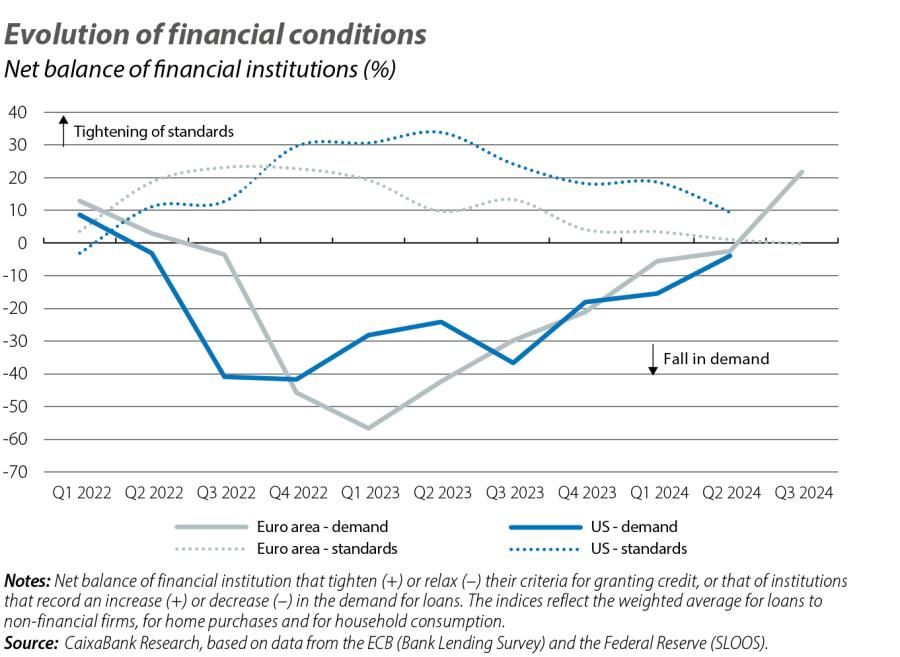

In this soft landing scenario, monetary easing will remove the burden on the economy in 2025. In fact, and as shown in the second chart, financial conditions have already been relaxed by the rate cuts (both those already implemented and those anticipated). Normally, monetary policy impacts the economy with long and variable lags (Romer and Romer [2023]3 place the maximum impact on GDP after a nine-quarter delay), so we should expect rate cuts to offer a moderate tailwind to GDP growth in 2025. However, estimates also suggest that the first positive effects are felt quickly: with highly granular data for the Spanish economy, Buda et al. (2023)4 detect that changes in interest rates have a significant impact on consumption in less than a week, on business sales in about a month and on employment in about two months.

- 2A cyclical recovery in productivity (for example, through an undoing of so-called labour hoarding) would further reinforce the decline in inflation.

- 3C.D. Romer and D.H. Romer (2023). «Does Monetary Policy Matter? The Narrative Approach after 35 Years» (nº w31170). National Bureau of Economic Research

- 4G. Buda, V. Carvalho, G. Corsetti et al. (2023), «Short and Variable Lags», CEPR Discussion Paper nº 18022.

... and risks

The last question is what risks central banks will face in the new monetary phase. The first thing they must calibrate is the speed of the cuts. On the one hand, cutting rates too cautiously could cool the economy more than desired, risking a return to the weak inflation of the previous decade. On the other hand, cutting them too quickly could compromise the inflation mandate: the central banks are in the last mile of the disinflation marathon, but they have not yet reached the finish line. The latest available data suggest that the ECB faces the first risk to a greater extent, with a loss of buoyancy already visible in the economic activity indicators, while the Fed faces the second, with an economy still growing above potential and inflation still showing some signs of resistance. In either case, the calibration of the monetary easing process will face a third ingredient: interest rates influence financial asset prices and drastic changes can lead to sharp corrections and trigger financial turbulence, as was the case during the period of rate hikes.5

The threat of further disruptions affecting the scenario must also be taken into consideration. However, the change in the monetary policy outlook in the event of a new shock, especially if it is on the supply side, should be mitigated by the fact that today the economies are starting from a position with tight financial conditions and a cooling of demand, which is radically different from the situation of 2022.

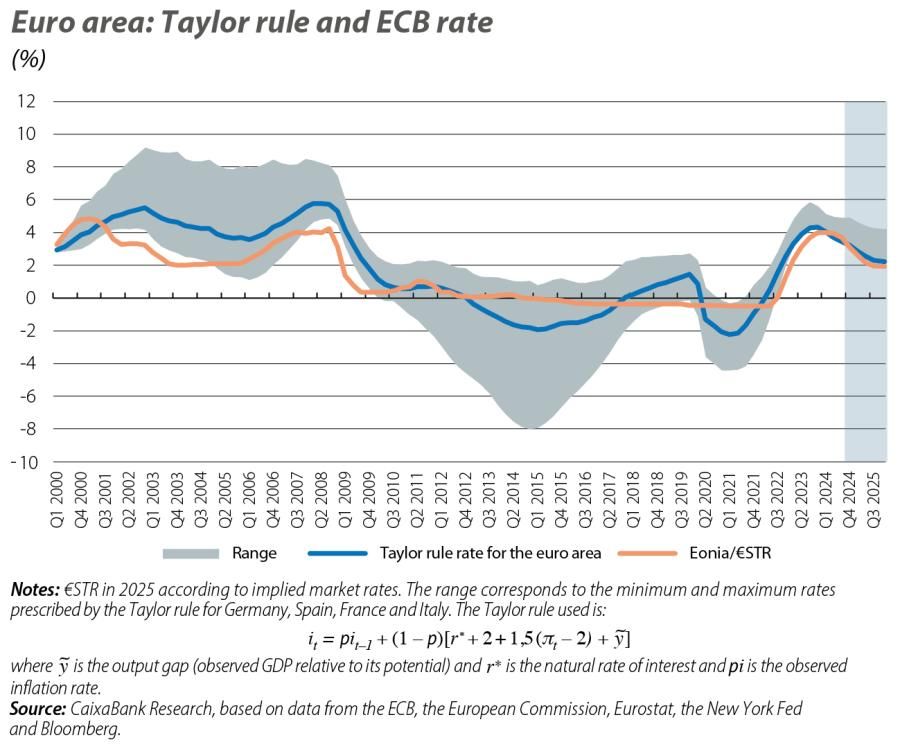

Each central bank will have to gauge idiosyncratic risks in its respective region. The ECB faces the challenge of managing the euro area’s disparities, where the strong growth of peripheral economies such as Spain (which is on track to be the fastest growing advanced economy in 2024) contrasts with the weakness shown by Germany (the only major advanced economy that is not growing in 2023-2024). This challenge makes the optimal monetary policy different for each country and means that different countries require different levels of interest rates. One way to illustrate this is with the Taylor rule.6 This guide shows how historically some euro area countries would have needed higher interest rates than those set by the ECB, while other countries, with a weaker cyclical position, would have required lower rates. As can be seen in the last chart, the range of rates indicated by the Taylor rule suggests that the challenge remains present but, for the moment, the dispersion is smaller than it was in the past.7

- 5With the collapse of Silicon Valley Bank in 2022 and the serious difficulties of NYCB in 2023.

- 6This rule gives a nominal interest rate that should be set given a particular rate of inflation, neutral rate of interest and output gap.

- 7There is lower dispersion in inflation rates compared to in previous years and, moreover, all economies are coming from a position of widespread weakness since 2020.

In the US, the big question which the Fed will have to manage will be the economic policy of the future White House administration, which could involve greater fiscal stimulus and more restrictive trade policies. The other source of risk arises from changes in the Fed’s governing board itself, given that during the next administration two of its seven members will reach the end of their terms (Kugler in 2026 and Powell in 2028) and the positions of chair (2026) and two vice chairs (Barr in 2026 and Jefferson in 2027) will be up for renewal, all of which are nominated by the US president and approved by the Senate.

In short, all the indicators suggest that 2025 will be another year in which monetary policy will play a leading role in developments in the economic and financial markets.