The factors behind the rise in euro area inflation

Inflation has surged in early 2021, but most of the factors driving it are of a technical and temporary nature and should not affect the ECB’s monetary policy stance.

- Inflation has surged in early 2021, but most of the factors driving it are of a technical and temporary nature and should not affect the ECB’s monetary policy stance.

- However, there are some risks that could cause the inflationary pressures to persist, such as bottlenecks in some industries and pent-up demand.

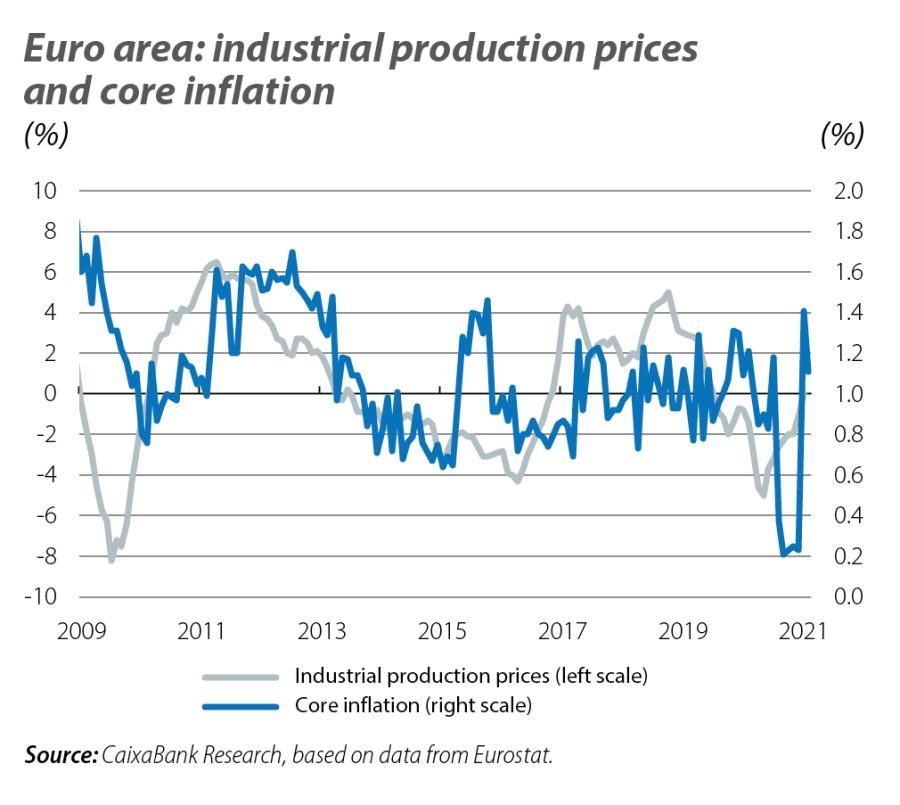

In January, the euro area’s year-on-year inflation rate suffered its biggest increase since 1997, with a change of +1.2 pps versus the previous month’s figure. This spike was not driven by prices that are usually erratic: core inflation, which excludes the most volatile components, also rose sharply and stood at 1.4%, a level not seen since 2015. However, while we are likely to see headline inflation climb above 2% at some points during 2021, this rebound is mainly due to technical and temporary factors that will have vanished by 2022.

The factors that have driven inflation up...

One key element in explaining the rise in inflation at the beginning of this year is the change in the relative weights of the various components that make up the consumer price index. Each year Eurostat assigns a weight to each component depending on the products and services that were consumed during the previous year. Thus, given the exceptional nature of 2020, there have been significant changes in the relative weights of several components. For example, in 2021, the combined weight of the transportation, catering and package holiday components has fallen by more than 5 pps, while that of food and rents has risen by almost 4 pps. The impact of these changes is significant: if the composition had remained unchanged, inflation in January would have been 3 decimal points lower. In other words, the change in the composition of the index could explain 25% of the rise in inflation.

Another factor that has pushed up inflation is the VAT rise in Germany. Following the outbreak of COVID-19, several euro area states, including Germany, temporarily cut VAT as part of their fiscal stimulus packages, which drove down inflation from mid-2020. In January, with the return of VAT to pre-pandemic levels, the year-on-year inflation rate undid the movement observed in the second half of 2020 and the impact was significant: it is estimated that this factor explains around 0.4 pps of the rise in the euro area’s headline inflation rate in January.1 However, this factor has not yet fully normalised, as the base effects resulting from last year’s VAT cut will materialise in mid-2021. Thus, during the second half of the year, the VAT effect could once again push inflation slightly up until next January, when this factor will finally fade.

A third element that drove up inflation was the delay and/or cancellation of discount sales in the retail sector in some euro area countries. January is a month usually marked by significant drops in clothing and footwear prices. However, this time the declines were more moderate: as the second chart shows, the lower month-on-month decline led to a sharp increase in inflation among these products in year-on-year terms. This is a factor that has already disappeared since February and should not push inflation up in the coming months. In January 2022, however, it is likely to push inflation down: products with the usual discounts in 2022 will be compared against products in 2021 that had been reduced by less.

- 1See ECB (2021). «Economic Bulletin. Issue 1.»

The final push to inflation was provided by the energy component, which is no longer providing a negative contribution. The oil price roller coaster, which began with the outbreak of the pandemic, led this component to register an average year-on-year inflation of –6.8% in 2020. Between January and February 2021 this rate has already moderated to –3% and we estimate that for 2021 as a whole it will be +8.6%. Moreover, year-on-year growth in energy prices could momentarily reach peaks as high as 13% (remember that the Brent oil price, now above 60 dollars, fluctuated around the 30-dollar mark between April and May 2020).

This impact of the oil price, together with the re-emergence of the base effect of VAT mid-year, makes it very likely that we will see headline inflation of around 2.5% in the second half of 2021. Although this has not happened for a sustained period since 2012, it should not affect the ECB’s course of action. After all, these factors which will drive up inflation are of a technical and temporary nature and will fade over time due to the very mechanics of the index.

...and those that could gain prominence in the future

However, over the coming months, other elements may appear that will push up inflation. These include bottlenecks in certain supply segments. Indeed, economic sentiment surveys indicate that delays in shipping are occurring and that there are pockets of shortages of intermediate materials, resulting in production cost overruns that could lead to rises in inflation in the coming months. Furthermore, the inflationary effect of these bottlenecks could be exacerbated by the release of pent-up demand among a large part of the population, having accumulated savings as a result of their consumption being held back by the restrictions on mobility and activity. While these pressures could add background noise to the ECB’s meetings, they should not alter its course of action: they are also factors of a temporary nature and should fade

as supply and demand gradually return to normal.

However, there is one more element that could add uncertainty and volatility: the availability of data itself. Where it is not possible to gather information on the price of a particular component (as is currently the case, since some products or services cannot be sold), national statistics institutes manually assign the price which they believe the product or service in question should have. In January and February, 13% of the price index’s components have had their values manually assigned in this way (18% in the case of core inflation). Thus, when it is eventually possible to gather information on the price of these products in the future, there is a risk of significant price variations.

When the storm of the pandemic has passed and the recovery is on track, all these elements will have dissipated and inflation is likely to remain contained. Between 2015 and 2019, the economic literature devoted much attention to understanding why we did not observe higher inflation rates consistent with the pace of economic growth. Much of this phenomenon was put down to structural elements (e.g. globalisation, or a lower pass-through of a tightened labour market to wages and prices). For now, the ECB considers that these elements will prevail in the medium and long term, but the jury is still out. As we see in an article of the Dossier of this same Monthly Report,2 there are arguments that indicate otherwise.

- 2See the article «Waiting for inflation» in the Dossier of this report.