Data and expectations set the tone in the markets

The market’s first reaction to Trump’s and the Republican party’s victory in the US election was in line with expectations that their policies would lead to higher inflation in the medium term, as well as providing a certain boost to short-term economic growth.

The market’s first reaction to Trump’s and the Republican party’s victory in the US election was in line with expectations that their policies would lead to higher inflation in the medium term, as well as providing a certain boost to short-term economic growth. Treasury yields increased throughout the curve, as did the anticipated terminal rate for the Fed in this cycle of cuts; the stock market registered gains, particularly companies more exposed to the US market; and the dollar rallied against its peers, especially the euro. This reaction, however, was corrected in various assets as the month progressed, and it contrasted with events in the euro area, where financial assets were weighed down by the news of Trump’s election.

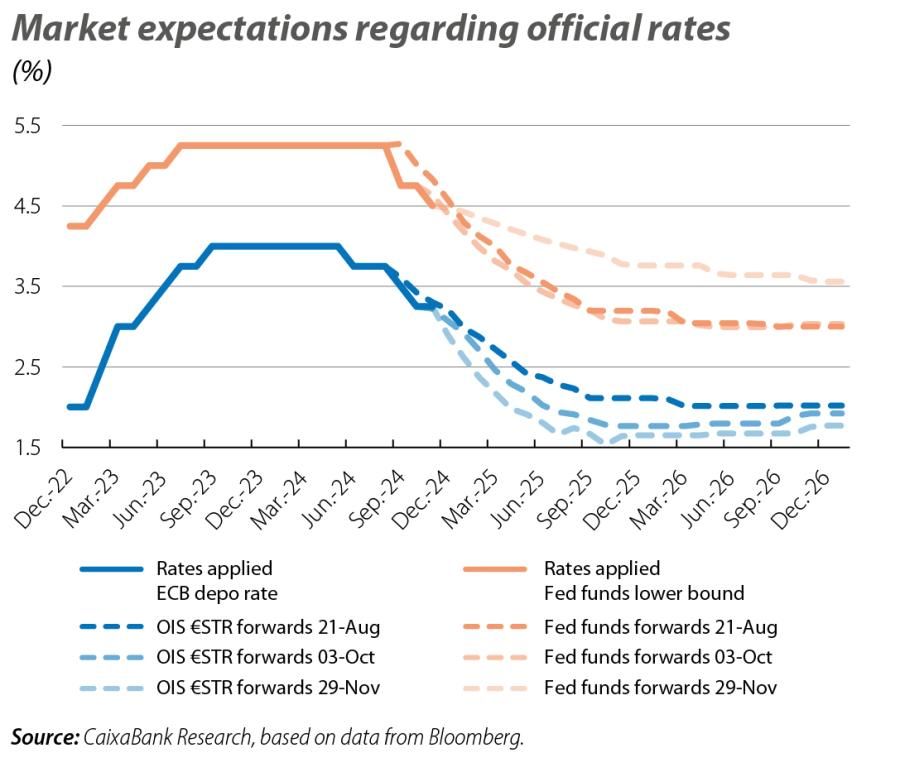

In addition to Trump’s victory, the buoyancy of the US economy led to higher expectations for the Fed’s interest rates over the coming months. Another contributing factor was the fact that various members of the Fed were in favour of gradual rate cuts and its chair, Powell, acknowledged that he did not see any need to accelerate them. Thus, although the markets continue to anticipate a 25-bp rate cut in December, they went on to expect slightly higher rates from the Fed (+20 bps) in the medium term. Expectations for the ECB remained more stable, against a backdrop of weak economic indicators and political uncertainty in the core euro area countries, and with the disinflationary process continuing as anticipated. All this reinforced expectations of another 25-bp rate cut by the ECB in December (100% probability according to the markets).

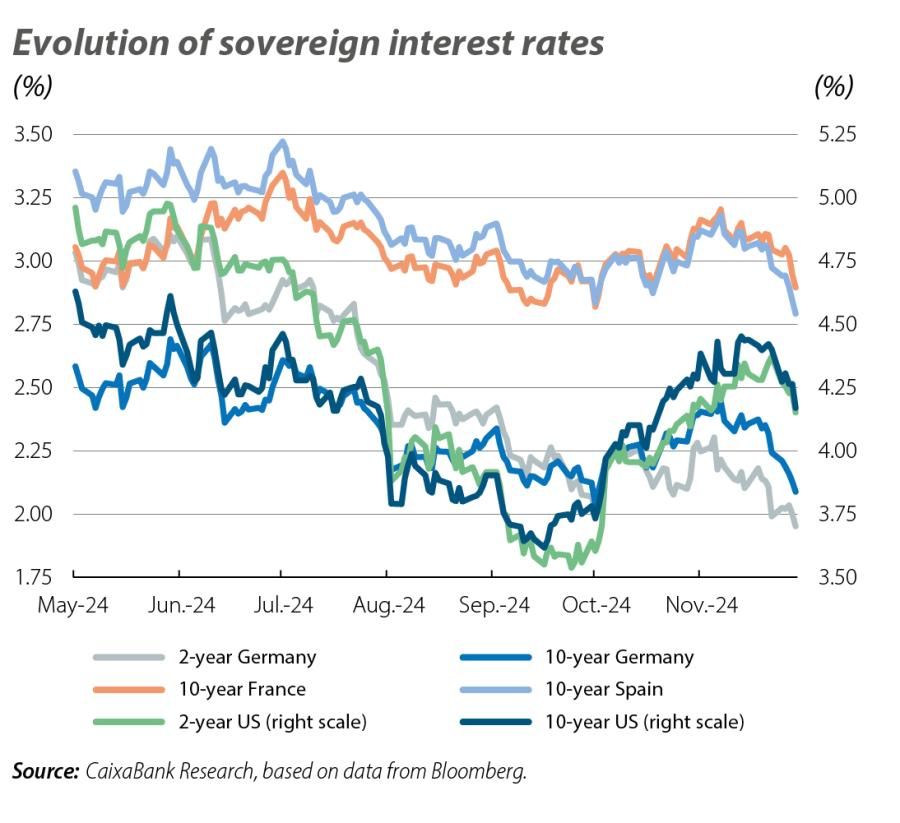

The declines in sovereign bond yields were more pronounced in the euro area, with those of German bonds falling by more than 30 bps fairly evenly throughout the length of the curve. Also of note was the spike in France’s risk premium (+10 bps and now consolidated above that of Spain), amid the government’s difficulties in approving budget cuts to correct the country’s deficit. Spain and Portugal’s risk premiums, for their part, remained relatively stable in November, while Italy’s decreased by around 10 bps. In the case of the US, the initial rebound of sovereign rates following Trump’s election victory gave way at the end of the month to a decline in treasury yields, with a flattening of the slopes of the yield curves (a movement which coincided with the proposed appointment of fund manager Scott Bessent as Treasury secretary).

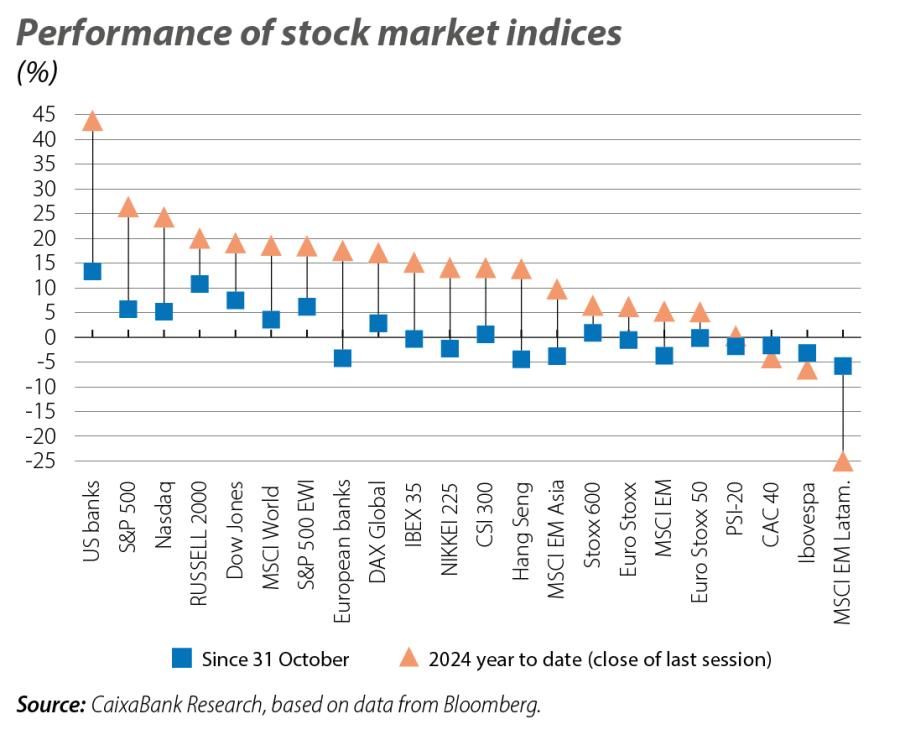

The US stock indices recorded gains, favoured by the decline in sovereign rates and the expectations of tax cuts and less regulation under the new Trump administration. The S&P 500 and Nasdaq climbed more than 5% to reach new highs, in contrast to the performance of stock markets in the rest of the world. Lower cap companies more exposed to the US market performed even better (Russell 2000 +11%) and, by sector, the banking sector benefited the most (KBW Bank Index +12%). This contrasts with Europe’s stock markets, where earnings were more moderate and the performance was more mixed depending on the country. Germany’s DAX index climbed almost 5% to reach peak levels, driven by tech firms and other non-automotive exporting companies, while France’s CAC index and Italy’s MIB recorded slight setbacks. In the middle of the spectrum, the IBEX 35 rose just over 2%.

The nominal effective exchange rate of the dollar recorded an appreciation similar to that which followed Trump’s first election win back in 2016 (around +3% since the election). A similar and opposite movement occurred in the euro (–4% since the elections). Indeed, it was one of the currencies to depreciate the most against the dollar, weighed down by the weakness of the latest economic indicators and the new US administration’s threat of tariffs (see the International Economy - Economic Outlook section). Other currencies exposed to Trump’s tariffs recorded more limited depreciations in November: the Mexican peso fell by just over 1%, the yuan around 2% and the Canadian dollar around 1%. The Brazilian real also recorded a sharp depreciation against the dollar (of more than 3% in November), weighed down by investors’ doubts surrounding the country’s fiscal policy. On the other hand, the Japanese yen appreciated against the dollar, supported by greater confidence in expectations regarding the Bank of Japan’s rate hikes.

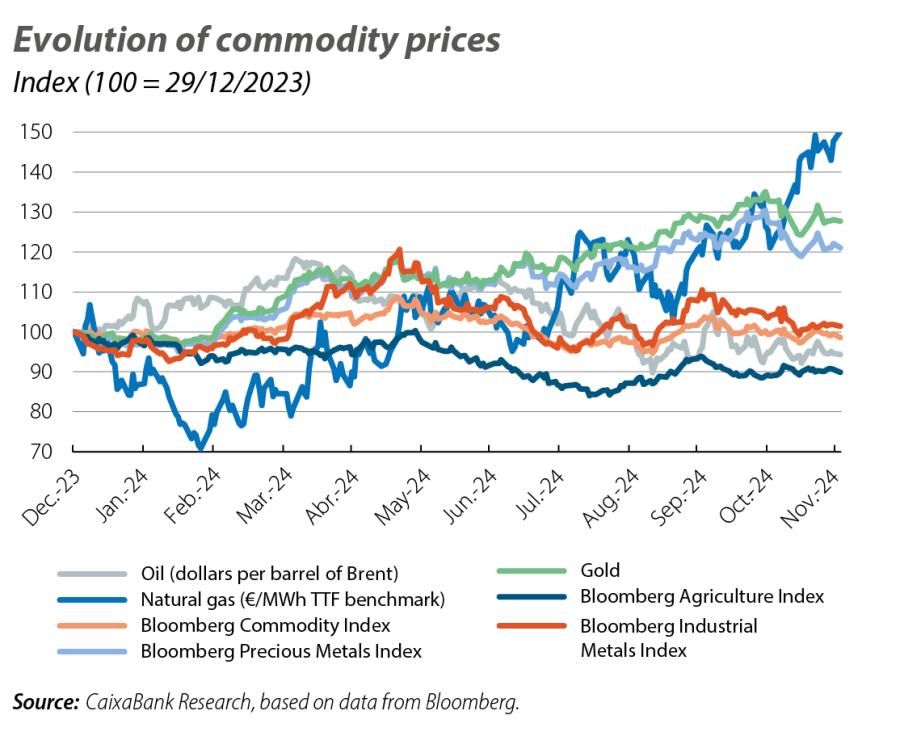

In November, the Brent barrel price fluctuated between 71 and 76 dollars, in a market subject to the prospect of OPEC+ continuing with its plan to increase production in 2025, despite the prevalence of significant risks. In addition, in November, an increase in US crude oil inventories and the strength of the dollar offset some signs of industrial recovery in China. As for natural gas, the TTF price rose from around 40 euros/MWh to around 50 euros/MWh (an increase of some +15% and marking a new peak for the year), driven by the prospect of a colder winter than that of recent years (which has also resulted in Europe’s reserves decreasing earlier, although they remain at historically high levels). In addition, the gas price was affected by the upcoming expiry on 1 January 2025 of an agreement under which Russian gas is still reaching Europe via a pipeline that passes through Ukraine.