The good health of Spanish agrifood exports

Activity in Spain’s agrifood sector is increasing at a faster rate than across the economy as a whole and the outlook for the 2024-2025 campaign is encouraging. Exports are holding up well in the adverse environment of recent years and the food price rally has begun to slow, although the cumulative increase since 2019 remains significant.

Spain’s agrifood sector exports are faring well in the challenging environment of recent years, marked by adverse weather conditions, trade tensions and rising costs. The growth in volume recorded in the first half of 2024 has truncated two years of declines. This was largely thanks to buoyant sales of fruit, legumes and vegetables, which have outweighed the deterioration in meat exports that have failed to recover the exceptional levels previously recorded despite China having overcome the impact of African Swine Fever. The sector is thus consolidating its position as the main driver of Spain’s exports of goods and is upholding the country’s position among the main exporting powers of agricultural products worldwide. Among the factors that explain this strength, besides the sector’s proven competitiveness it also has a highly diversified range of export destinations, which makes the sector very resilient to potential shocks.

The Spanish agrifood sector holds a leading position at the global level

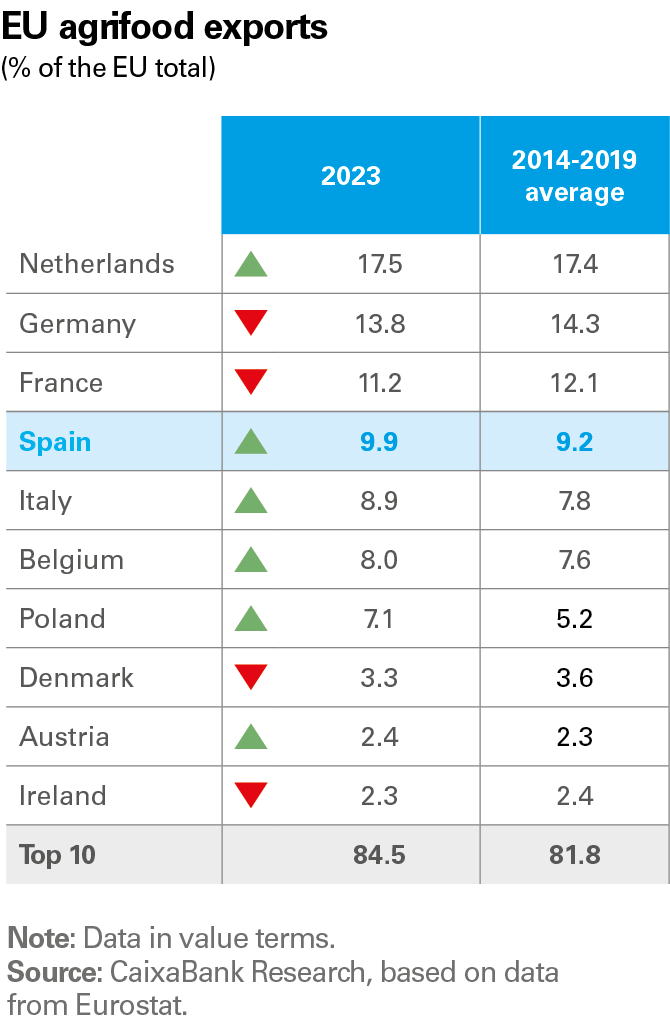

Spain’s agrifood sector is heavily geared towards exports.5 In 2023 it exported approximately 34.4 million tons, valued at 69.6 billion euros, which represents 19.4% and 18.1% of all exported goods, respectively. Spain is a major exporting power in these products: within the EU, it is the fourth largest exporting economy in terms of value, behind the Netherlands, Germany and France.

- 5Includes tariff categories 01-24 of the TARIC system.

Despite the challenging environment of recent years, Spain remains a major exporting power in agrifood products, at both the European and the global level

Spain is an exporting power of agrifood products

Globally, Spain ranked eighth in 2022 (in value terms, based on the latest available data from the WTO) in the ranking of countries that export agricultural products, with a share of 3.2%. This is well over the 1.7% share of the total exports of all Spanish goods. Despite a slight fall (0.1 pp) versus 2014-2019, Spain has upheld its position in the ranking: within the top 10 in the world, only Canada, Indonesia and Brazil have increased their export share, while among European countries Spain has evolved better than Germany, France and the Netherlands, which are the continent’s top-ranking countries.

How have Spanish agrifood exports performed recently?

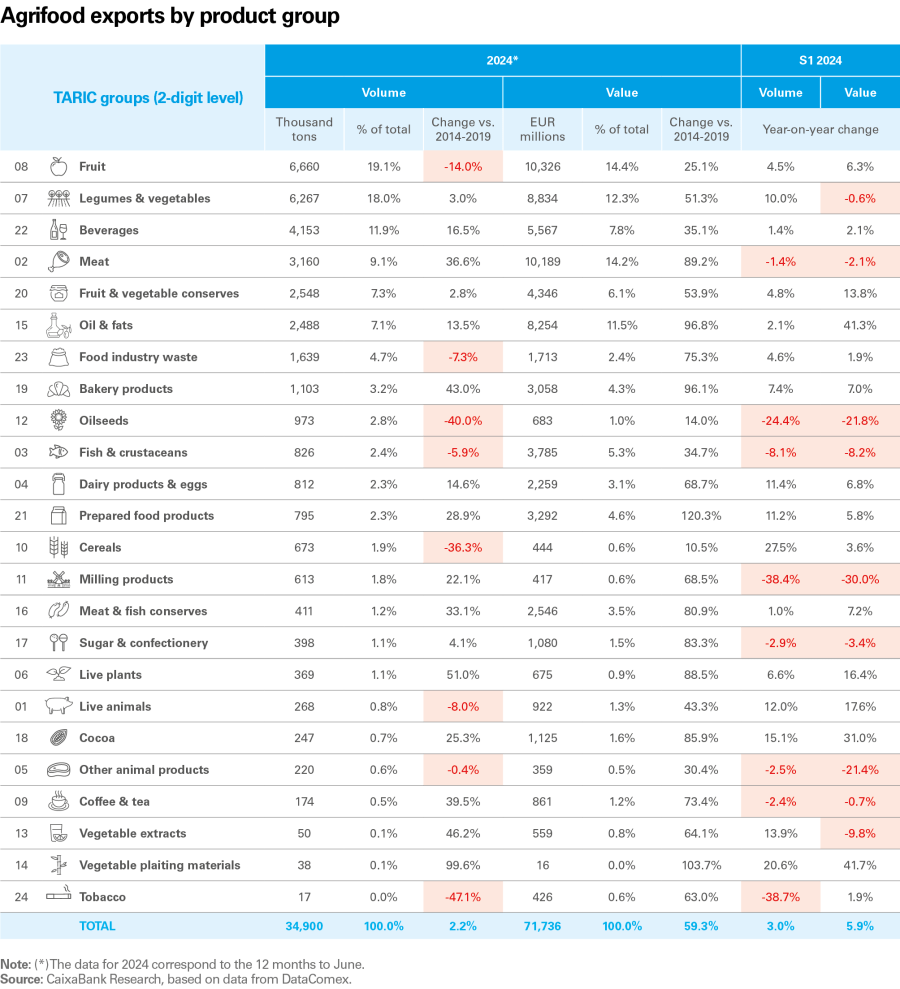

After two consecutive years of setbacks (–5.0% in 2022 and –8.9% in 2023), in which the adverse environment held back production and, consequently, export volumes, in S1 2024 Spanish agrifood exports grew by 3.0% year-on-year, reaching 34.9 million tons (in the 12 months to June). The value of exports grew by 5.9% in S1 2024, up from the 3.5% recorded in 2023, placing them at 71.7 billion euros in annualised terms. These figures are even more striking when contrasted with the decrease in total exports of goods, both in volume (–2.1%) and in terms of value (–2.4%). Compared to the pre-pandemic period, exports in volume terms are just 2.2% above the average figure for 2014-2019. In value terms, however, they are almost 60% higher, due to the rise in prices that most agrifood products have been registering in international markets.

Spanish exports rebounded in 2024, in both value and volume terms

What products have contributed to the growth of Spanish agrifood exports?

In the first semester of 2024, exports in value terms have recorded significant growth across all agrifood product groups due to the rise in prices experienced in recent years. All product groups exceed the average export value recorded during the period 2014-2019, although there is significant variation: while exports of oils and meats have almost doubled, in the case of fruits the increase is 25%.

In order to analyse the evolution of exports eliminating the effect of the price increases, given the inflationary context of recent years, we have focused on examining exports in terms of volume. In S1 2024, the vast majority of the 24 agrifood product groups recorded positive growth rates in their export volume: only eight of them registered a reduction in this measure, representing 18.3% of the total. Of particular note is the significant growth recorded in cereal exports (27.5% in S1 2024), despite still being well below the pre-pandemic average (–36.3%). If we focus on the four main export products (fruits, vegetables, beverages and meats), which account for almost 60% of exports, these categories all recorded increases in their sales abroad in S1 2024, except for meats (–1.4%). Among them, legumes and vegetables stand out, with 10.0% year-on-year growth, far exceeding that of fruits (4.5%) and beverages (1.4%). Only fruits are below the 2014-2019 average (–14.0%).

In addition to the groups mentioned, it is also worth looking at oils and fats, given their importance to Spain’s agricultural sector. Their production was severely dented last year by the drought, which suppressed export volumes and caused them to record the biggest decline in 8 years (–14.2%). In S1 2024, there was a timid recovery in these exports, with a year-on-year growth of 2.1%, such that in annualised terms they exceeded the average level of the period 2014-2019 by 13.5%. The growth of oil exports is much greater in value terms due to the sharp increase in prices (+41.3% in S1 2024 and +96.8% relative to the 2014-2019 average).

In the following chart we show how the main product groups have contributed to the growth of agrifood exports between the average of the period 2014-2019 and 2024 (cumulative data to June). In this period, exports of oils, beverages and, above all, meat have recorded significant growth. On the other hand, food industry waste and, most notably, fruits have made a negative contribution to total export growth. Thus, although fruits remain Spain's biggest export in the sector, their share of the total has fallen 4 pps, to the benefit of beverages and meat.

Which products have contributed to the growth of Spanish agrifood exports in recent years?

At a more disaggregated level (four-digit TARIC groups), the main products exported by volume are citrus fruits, wine and pig meat, as well as olive oil. All of them performed poorly in 2023, with widespread declines, especially in the cases of citrus fruits and olive oil. This trend has reversed in the first half of 2024, as shown in the chart below, except for in the case of pig meat (–2.4% in S1 2024) due to the fall in exports to China (–22.8% in S1 2024). Despite this recent poor performance, only this product exceeds the average level of exports of the period 2014-2019, and by far.

Oils, beverages and meats have spurred on food exports in recent years, counteracting the sharp decline in exports of fruits

Spanish agrifood exports are increasingly diversified in terms of destination markets, with Europe at the helm

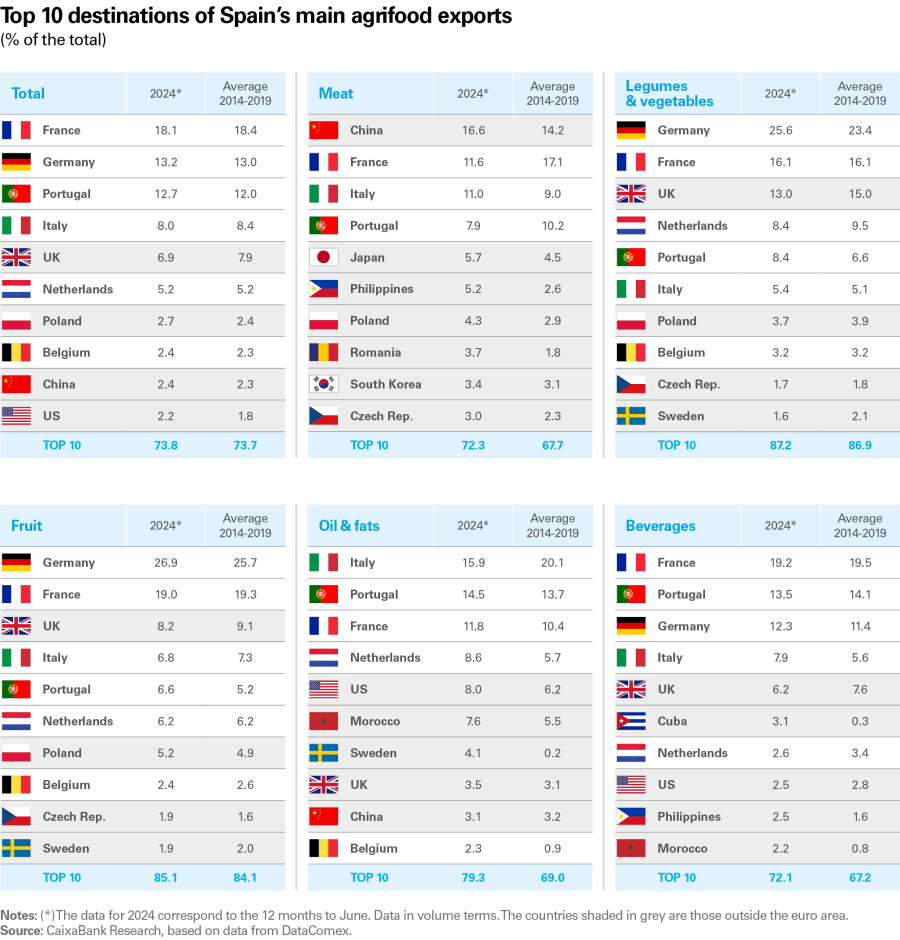

Spain sells agrifood products to virtually every country in the world, although euro area countries are the top destinations, receiving almost two thirds of the total, with France and Germany being the top destinations (18.1% and 13.2%, respectively).

This concentration in the euro area in global terms has remained fairly stable in recent years, although it varies depending on the products exported. For instance, euro area countries receive over 70% of the exports of milling products, food industry waste, fruits, dairy products and eggs, and legumes; on the other hand, in the case of beverages, oils and, above all, meat, the percentages are below average. Meat is also the only one of the large groups of agrifood products in which the country’s dependency on the euro area has reduced relative to the pre-pandemic period (mainly due to the role of China, afflicted by swine fever in recent years).

The euro area is the main destination, but Spanish agrifood exports are showing increasing geographical diversification

Beyond this dependence on the euro markets, what can we say about the geographical diversification of agrifood exports? To answer this question, we calculated the Herfindahl index, which takes the market shares of the various different destinations and measures the degree of concentration/diversification of exports (the lower the index, the greater the diversity of destinations). If we look at the evolution of this index excluding euro area countries, we see that, in recent years, not only has there been a high diversification of export destinations, but it has also increased: excluding the euro area, the Herfindahl index fell 9.5% in 2023 versus the average of 2014-2019.

As shown in the following charts, the buoyancy of exports to China, the United States and some euro area partners, especially Portugal, contrasts with the collapse in sales to the United Kingdom, which have been heavily affected by Brexit. Consequently, the United Kingdom has lost prominence as a destination for our sales, reducing its share by 1.1 points compared to the 2014-2019 average, while this decline has been offset by increases to Portugal and the US. Still, the UK remains our top export destination outside the euro area.

In recent years, the sharp decline in agrifood exports to the UK has been offset by the strength of other destinations, such as Portugal, China and the US

Which destinations have contributed to the growth of Spanish agrifood exports in recent years?

In the case of exports to China, following the extraordinary growth recorded in 2019 and 2020 (above 43% on average and mainly driven by pig meat),6 the growth rate has moderated in recent years: in S1 2024 they grew 4.9% year-on-year, surpassing the pre-pandemic average by 7.5%. It is clear that much of the upturn in exports to China was a short-term phenomenon and that this is now normalising, as the country gradually recovers its pig livestock and its domestic production capacity. In any case, exports of pig meat now exceed the 2014-2019 average by 33%. This is because, despite the recent declines, sales to China are still higher than the pre-pandemic records, as well as the fact that exports to other destinations have also grown.

- 6After domestic production in China was severely dented by African Swine Fever (ASF), Spanish exports to the Asian giant increased fivefold between 2018 and 2020, exceeding 47% of total exports in the latter year. For more information, see the article «Spanish pork is thriving», included in the Agrifood Sector Report 2021.

The EU-China trade tensions and their potential impact on pig meat exports make it advisable to forge stronger relationship with alternative destinations, such as Japan and South Korea

However, another problem has recently emerged, stemming from the EU-China trade war involving tariffs imposed by Europe on Chinese electric vehicles and the ensuing response from the Chinese authorities.7 These trade tensions could intensify the trend of declining pig meat exports to China observed in recent years and may raise the need to redirect sales towards alternative destinations. In this regard, in recent years other Asian markets where we enjoy a privileged competitive position, such as Japan and South Korea, have gained prominence. Between 2014-2019 and 2024 (trailing 12 months to June), these two countries registered growth rates of 75.1% and 51.2%, respectively, coming to account for 8.9% and 4.7% of exports, compared to 6.7% and 4.1% prior to the pandemic.8

- 7Following the investigation opened in October 2023, the European Commission decided to raise tariffs on Chinese electric vehicles to a maximum of 48.1%. In response, in June 2024 China’s Ministry of Trade announced an anti-dumping investigation into imports of pigs from the EU. This measure could particularly affect Spain, given that it is the main exporter of pig meat to China, accounting for 295,000 tons in 2023 (36% of all Spanish agrifood exports to China).

- 8Higher-value cuts are being redirected towards these markets, while China is reinforcing its role as a destination for lower-value cuts and spoils, which are highly sought-after in Chinese culture.

Asian markets are gaining relevance: exports to Japan and South Korea show significant growth

Spanish agrifood exports are less dependent on the euro area than those of our competitors

Compared to the main nearby agrifood exporting countries, Spain is somewhere in the middle of the ranking in terms of the euro area’s importance as a destination for agrifood exports. In addition, while in the case of Spain the euro area’s share has remained fairly stable in recent years at around 63%, in other countries it has increased, except in Italy, which allocated just 52% of its agrifood exports to the euro area in 2023 (54.7% on average in 2014-2019).

Spain’s agrifood exports are less dependent on the euro area and are generally more geographically diversified

Spain’s agrifood exports to outside the euro area are highly diversified in terms of destinations, giving them greater resilience

If we exclusively consider destinations outside the euro area, the diversification of Spanish agrifood exports as a whole is greater than in the case of our competitors. Specifically, if we exclude the euro area, Spain is the country with the lowest Herfindahl index as a measure of the concentration of agrifood export destinations. If we analyse in a little more detail the exports of the main products to destinations outside the euro area (see the chart above and right), we see that Spain has a greater geographical concentration in its sales abroad in the case of meat (due to the importance of China) and, especially, in legumes and vegetables (the United Kingdom receives almost half of the sales of Spanish legumes and vegetables destined for outside the euro area). In contrast, in beverages (where wine plays a key role) Spain enjoys a greater diversification of destinations compared to other European countries, such as France or Italy. Finally, in fruits and oils, Spain occupies an intermediate position in terms of the diversification of its destinations, similar to that of other European countries. Greater geographical diversification generally makes exports more resilient as they are less dependent on idiosyncratic shocks that a particular country or region may suffer, given that it is easier for sales to be redirected towards other destinations.