How might rising interest rates affect households’ mortgage payments?

To assess the extent to which demand for housing could be affected by the rise in interest rates, we calculate the expected trend in the theoretical mortgage burden ratio according to our current CaixaBank Research forecast scenario, recently revised following the invasion of Ukraine.

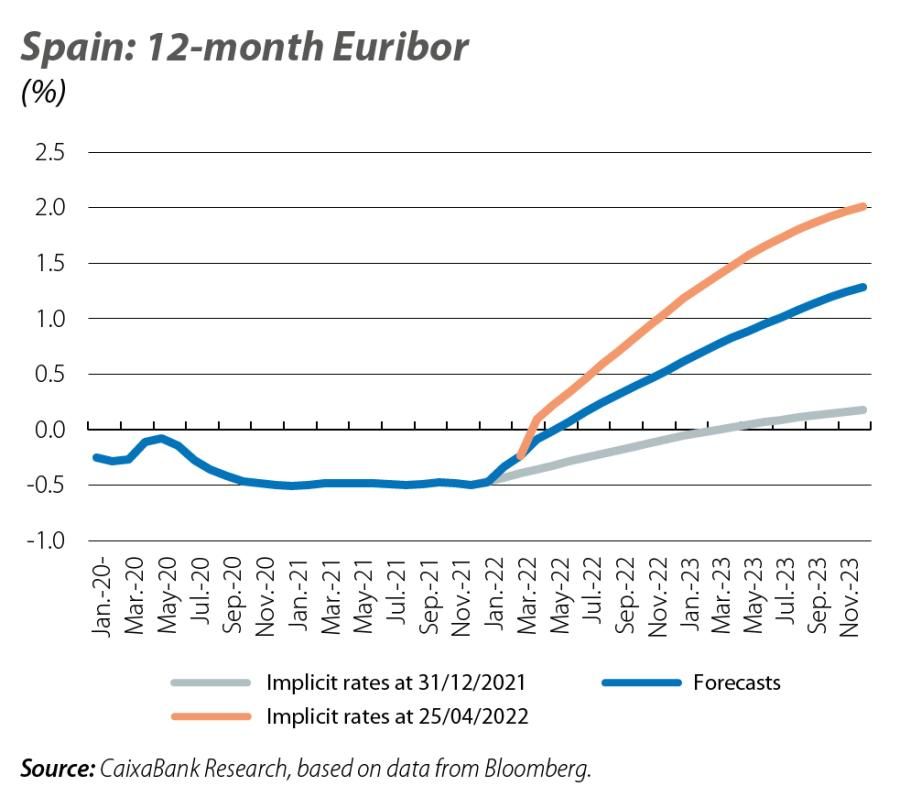

The rise in inflationary tensions in the euro area has triggered a major shift in the ECB’s monetary policy. Expectations of official interest rate hikes are already being reflected in rates in the interbank market. Indeed, in mid-April, the 12-month Euribor entered positive territory after six years below zero, marking a significant increase compared to the low levels of last year (around –0.50% on average in 2021). The financial markets are expecting this upward trend to continue in the coming months, although the increases will be gradual and it should be borne in mind that the starting point was very low (see first chart).

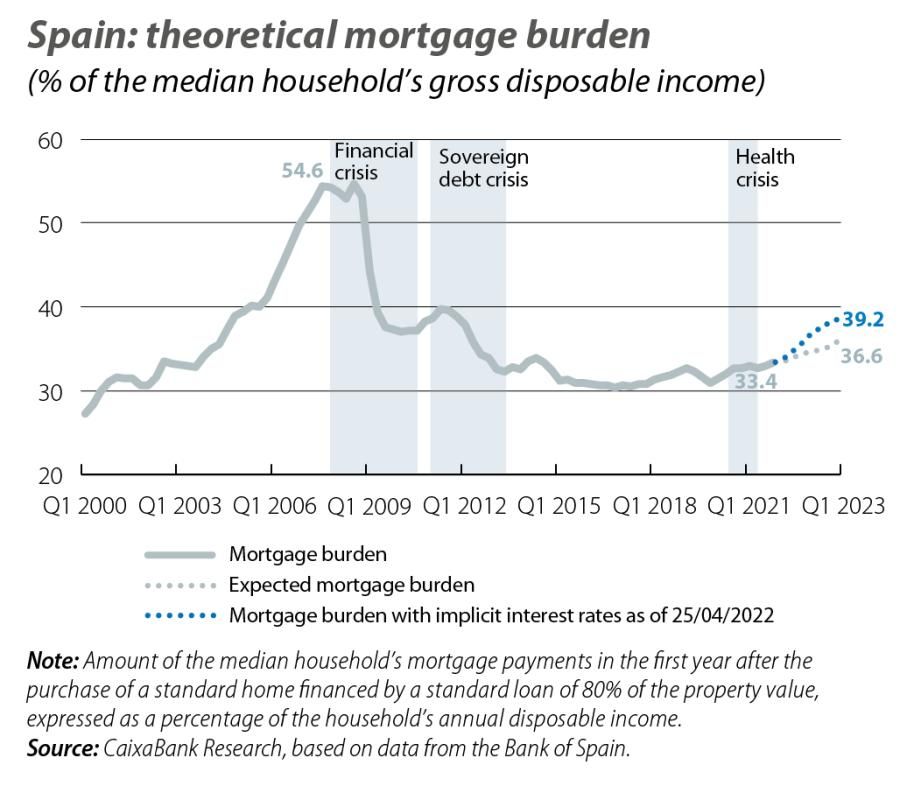

Rising interest rates could take some of the steam out of the demand for housing by increasing the cost of mortgages associated with buying a home. To assess the extent to which housing demand could be affected, we calculated the expected trend in the theoretical mortgage burden ratio,1 according to our current forecast scenario here at CaixaBank Research, which we recently revised following the invasion of Ukraine.2 The main ingredients of this ratio are the forecasts for home prices, for the gross disposable income of the median household and those of mortgage interest rates.

According to our forecasts, the rise in home prices (which we expect to reach 3.5% in 2022, partly due to rising construction costs, before returning to a more moderate growth path from 2023 onwards) will be almost entirely offset by the increase in the gross disposable income of households as a whole, given the continued strength of job creation despite the recent downward revision due to the impact of the war in Ukraine (around 300,000 jobs per year on average in 2022-2023). On the other hand, the rise in mortgage interest rates will increase the burden ratio by around 3.2 pps in 2 years (from 33.4% of household income in Q4 2021 (latest available figure) to 36.6% in Q4 2023). This is a considerable increase, although the ratio is still a far cry from the levels reached during the housing crisis. However, the financial markets are currently anticipating somewhat more aggressive action by the ECB. In particular, as of 25 April 2022, the implicit market interest rates were anticipating that the 12-month Euribor interest rate would stand at 1.06% at the end of this year and at 2.0% at the end of 2023. Thus, if we use the implicit market interest rates as of mid-April, the mortgage burden ratio shows a much steeper increase, climbing to 39.2% at the end of 2023 (see second chart).

- 1. The theoretical mortgage burden is a statistic published each quarter by the Bank of Spain which measures the percentage of income that the median household has to allocate to servicing mortgage payments in the first year after the acquisition of a standard home financed by a standard loan for 80% of the property value.

- 2. See the Focus «The war between Russia and Ukraine will slow the recovery of the Spanish economy» published in the MR04/2022.

In short, the expectation of interest rate hikes following the ECB’s shift towards a strategy of monetary policy normalisation may somewhat cool the demand for housing, by increasing the mortgage burden of the median household in the first year after buying a home. In addition, rising interest rates will also tend to increase the mortgage burden of households that have already purchased their home on mortgage credit. Nevertheless, given the increased popularity of fixed-rate mortgages (which represented more than 60% of all those contracted in 2021, compared to less than 3% between 2003 and 2007), the rise in rates will have a limited impact on households who have taken out a mortgage in recent years.3

- 3. For an analysis of the mortgage burden ratio according to the characteristics of households (income quintile, age group and mortgage contract year), see the article «The financial situation of households during the COVID-19 crisis: this time it is different», published in the Real Estate Sector Report for the first half of 2022 (content available in Spanish).