The Spanish agrifood sector is making headwayin a challenging context

We summarise the current situation and future outlook for the Spanish agrifood sector, as set out in the CaixaBank Research Agrifood Sector Report 2023.

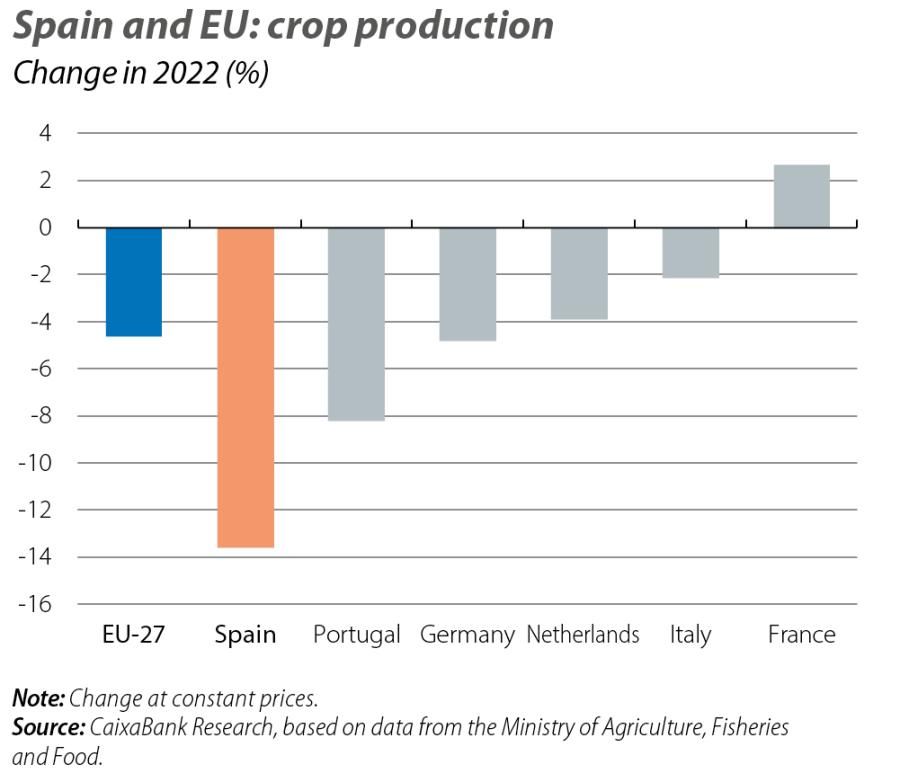

In 2022, Spanish crop production recorded a sharp drop in volume (–13.6%), curtailing the upward trend of previous years. Although the decline was widespread across all European crops and countries, Spain registered a bigger drop than the EU as a whole (–4.6%). The Spanish agrifood sector1 not only had to cope with a sharp increase in production costs, which began in 2021 with the reopening of the economy after the pandemic and was accentuated with the war in Ukraine, but it has also been impacted by the prolonged drought which the Iberian peninsula continues to endure.

- 1For a more detailed analysis, see the 2023 Agrifood Sector Report.

Estimates for the 2023 harvest are once again particularly weak for our country, in contrast to a more positive trend for the EU average. Winter grain production is expected to be the hardest hit, with some 9 million tons (Mt) in 2023 (compared to 14.4 Mt in 2022 and 19.3 Mt in 2021).2 This represents a very significant fall in grain yields (over 30%), in contrast to the better performance in the case of the EU average.3 Olive oil production also fell significantly from 1,489,351 tons last season to 675,093 tons in 2022-2023, marking a 55% drop in output which drove up the price.4

- 2See Ministry of Agriculture, Fisheries and Food. «Avance de Superficies y producciones de cultivos», May 2023.

- 3See «Crop monitoring in Europe», JRC MARS Bulletin, vol. 31, nº 8, 21 August 2023.

- 4See Ministry of Agriculture, Fisheries and Food. «Avance de la situación de mercado del sector del aceite de oliva, aceituna de mesa y aceite de orujo de oliva. Campaña 2022/2023», August 2023.

Moderating production costs will help contain food price inflation

The outlook is somewhat more favourable in terms of production costs in the sector, thanks to the sharp decline in agricultural commodity and energy prices in international markets relative to last year’s record levels.5 The World Bank’s Agricultural Commodity Price Index fell by 31.5% between its peak in May 2022 and August 2023 (latest available data). Of particular note is the fact that, although Russia announced in July that it would not extend the Black Sea Grain Initiative, agricultural commodity prices in international markets have remained relatively stable since then. This is largely due to the slowdown in global economic activity, especially in China, the redirecting of the international trade in commodities from other producers, as well as a very positive outlook for global agricultural production next year.

- 5The recent rise in oil prices, if it ends up being more persistent than expected, could limit the reduction in energy costs.

This global drop in prices is beginning to be reflected in the prices paid by farmers in Spain. The costs of agricultural inputs fell by 11.2% between August 2022 (when they peaked) and May 2023 (latest available data), especially energy (–42.3%) and fertilisers (–25.7%). Despite this decline, costs are still around 35% higher than the 2019 average.

However, the fall in the price of livestock feed, which is the biggest single component in the primary sector’s cost structure (54.4% of the total in 2022), is still very limited (–6.6% versus the peak of November 2022). Given that Spain imports around half of the grain destined for animal feed, the decline in international grain prices should help to contain the cost of feeding livestock in the coming months.

The moderation of agricultural input costs should ease inflationary pressures on the food prices paid by end consumers. In August 2023, the food CPI rose 10.1% year-on-year: while still higher than normal, this marks a considerable moderation from the peak of 15.7% registered in February 2023. This, together with the gradual recovery of household purchasing power in recent quarters, ought to boost household demand for food.

The Spanish agrifood sector remains competitive, despite the challenging conditions

One current source of concern is the impact that higher costs could have on the agrifood sector’s competitiveness. However, when we compare the evolution of Spanish agrifood exports with that of other European powers (France, Italy, Germany and the Netherlands) we see that Spain has performed relatively well.

Spanish agrifood exports in terms of value have continued to register strong growth over the last two years, supported by the high prices of most products in international markets. In terms of volume, in contrast, these exports have amassed setbacks of 5.5% in 2022 and 9.1% in 2023 (year-on-year to June), although these declines have been less pronounced than in the major European countries or in the EU as a whole (–15.1%).

Further proof of the strength of our agrifood sector is its high share of global trade and its relative good evolution over time. Based on data for 2021 (latest available from the WTO), Spain is seventh in the global ranking of exporters and fourth among European countries (behind the Netherlands, Germany and France, but ahead of Italy), accounting for 3.8% of global exports, which is a much higher share than we represent in the total trade of all goods (1.7%).

In addition, since 2010 we have improved our global market share in agrifood exports (+0.3 pps), which is a considerable feat when compared with other powers such as the US (which has seen its market share drop by 0.8 points in the same period), France (–1.2 points) or the Netherlands (–1.1 points). If we focus the analysis on the top 5 European powers, Spanish exports have grown as a portion of the total, going from 10.9% in 2010 to 16.1% in 2023 (with data up to June).

In short, Spain’s agricultural output fell sharply in 2022 and estimates suggest that it has fallen once again in 2023, due to the sharp rise in costs and the effects of climate change, one of the major challenges facing the sector. Nevertheless, despite the fall in production, agrifood exports have evolved relatively well and the sector’s competitiveness indicators do not seem to have suffered too much for the time being.