Volatility returns to the financial markets

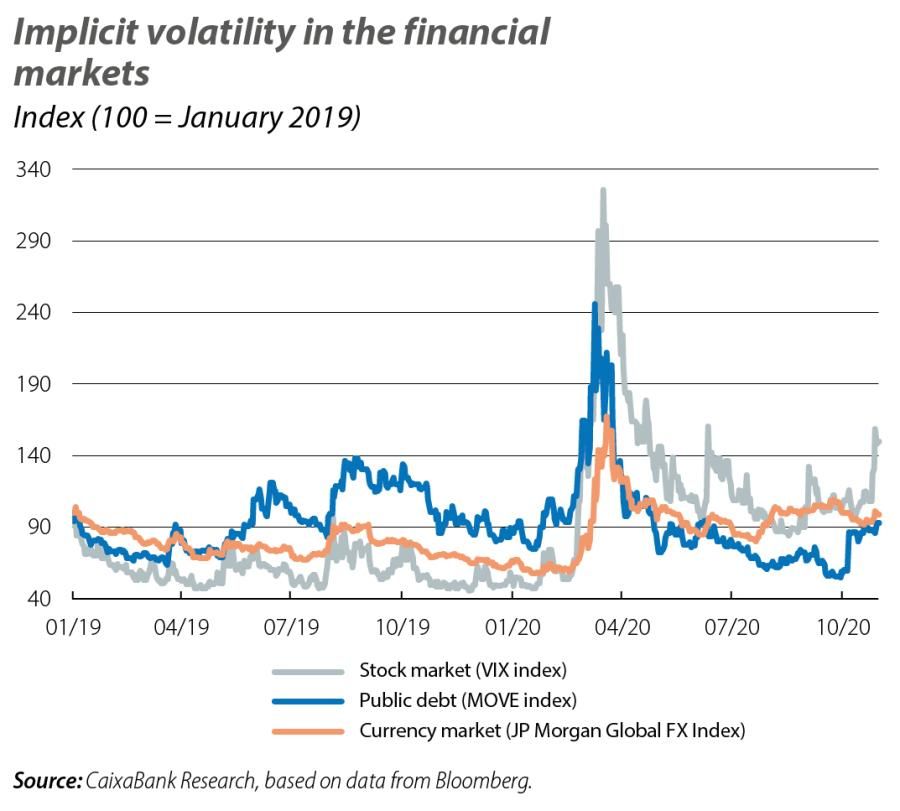

Continuing the tone set in September, in October investor sentiment continued to deteriorate with the notable spread of COVID-19 in developed countries. Market attention was focused on what new measures would be imposed to contain the pandemic, as well as the continued support from central banks (the ECB appears set to announce further stimuli in December) and the negotiations over a new fiscal package in the US Congress. Against a background of nervousness in the run-up to the US presidential election, these factors fuelled the surge in volatility in the financial markets, and particularly in the stock and commodity markets, which registered significant losses in October. Meanwhile, the increased demand for lower-risk assets hoisted up the dollar and sovereign US and German debt. In short, the reality of a volatile autumn in the financial markets is beginning to set in among investors, although the prospect of continuity of the accommodative monetary environment in the medium term will help to dampen the risk of financial stress like that suffered in March. This being the situation up until the end of October, at the cut-off date of this report there was confirmation of the Democratic victory in the US presidential election, which was followed by a change in sentiment and gains beginning to be registered in the stock markets.

In this scenario of uncertainty over the economic recovery, in October the major stock market indices added further declines to those already experienced in September. On this occasion, unlike in the previous month, the losses were more pronounced in the European stock markets (above 5% on average) due to the severity of the mobility restrictions imposed across much of the continent as well as the composition of the indices (with greater predominance of cyclical sectors). The US indices, meanwhile, registered smaller losses, partly thanks to a relative improvement in corporate earnings during Q3 this year. Specifically, and up until the cut-off date of this report, around 70% of the firms that have announced their results have managed to beat the sales and profit expectations of the analyst consensus, and many expect their revenues to improve over the coming quarters. The emerging-economy indices, meanwhile, overcame the September blip and registered gains of around 2%, driven by the Asian stock markets and favoured by the rising demand for raw materials, such as industrial metals.

Volatility also spread in the oil market due to fear of the impact that the new mobility restrictions would have on the demand for fuel over the coming months. The price of a barrel of Brent suffered its biggest monthly decline since March, bringing it to around 37 dollars. In recent weeks, forecasts by the major international energy agencies and OPEC have coincided in anticipating the slowdown in demand for crude oil in the coming quarters, a process that could be accentuated by a surge in new outbreaks of the virus. Therefore, and in order to limit the rise in downward pressure on the price of the barrel, OPEC and its allies agreed to meet at the end of this month to address their strategy for action in the current environment of excess demand.

Investors favoured flows towards safe-haven currencies (the dollar, Japanese yen and Swiss franc), taking a defensive position in view of the worsening health crisis in Europe and the deterioration of the economic outlook. In this context, the dollar appreciated against the euro and emerging currencies. Among the latter group of currencies, of particular note was the continuing depreciation of the Turkish lira which, far from achieving any sort of stability following the rate hike by Turkey’s central bank, continued to weaken to historic lows.

US and euro area sovereign debt continued to offer very low yields. However, in October the rate curves followed a different path on each side of the Atlantic. In the US, the improved economic activity and consumption data for Q3 fuelled a rise in the yield on 10-year bonds in excess of 0.80% (a five-month high), despite the lack of an agreement on a new fiscal stimulus. In the euro area, in contrast, the long-term yields on the German bund fell to the levels of six months ago in the face of the surge in the pandemic and the potential deterioration in economic growth. Nevertheless, the ECB’s message about the possible extension of its monetary stimulus measures before the end of the year somewhat dispelled investors’ pessimism. Furthermore, the risk premiums of the euro area periphery remained relatively stable, held down by an ambitious response from European policy both at the fiscal level (in October, EU Member States began drawing up their recovery plans in order to receive funds from Next Generation EU) and at the monetary level (in the year to date, the ECB has acquired both public and private debt assets worth around 920 billion euros under its PEPP and APP purchasing programmes, equivalent to 8% of the euro area’s nominal GDP in 2019).

Following the Governing Council’s meeting held last month, while the ECB did not alter its monetary policy, it did announce that it will be launching a new stimulus in December. According to Christine Lagarde, the rise in infections and the subsequent measures aimed at containing the COVID-19 pandemic are causing the economic scenario to deteriorate in Q4 2020. The monetary policy measures launched since March have been very decisive and allow the ECB to take a few weeks to properly gauge the new monetary stimulus, which will most likely be announced in December. In this regard, Lagarde’s words at the post-meeting press conference suggest that the ECB is very likely to step up its asset-purchase programmes (the so-called PEPP and APP). However, she also stressed that the entity has not ruled out the possibility of using other tools and even stated that they will study how the various tools available might complement one another.