The unprecedented impact of the COVID-19 crisis in Q2 overshadows the gradual recovery in Q3

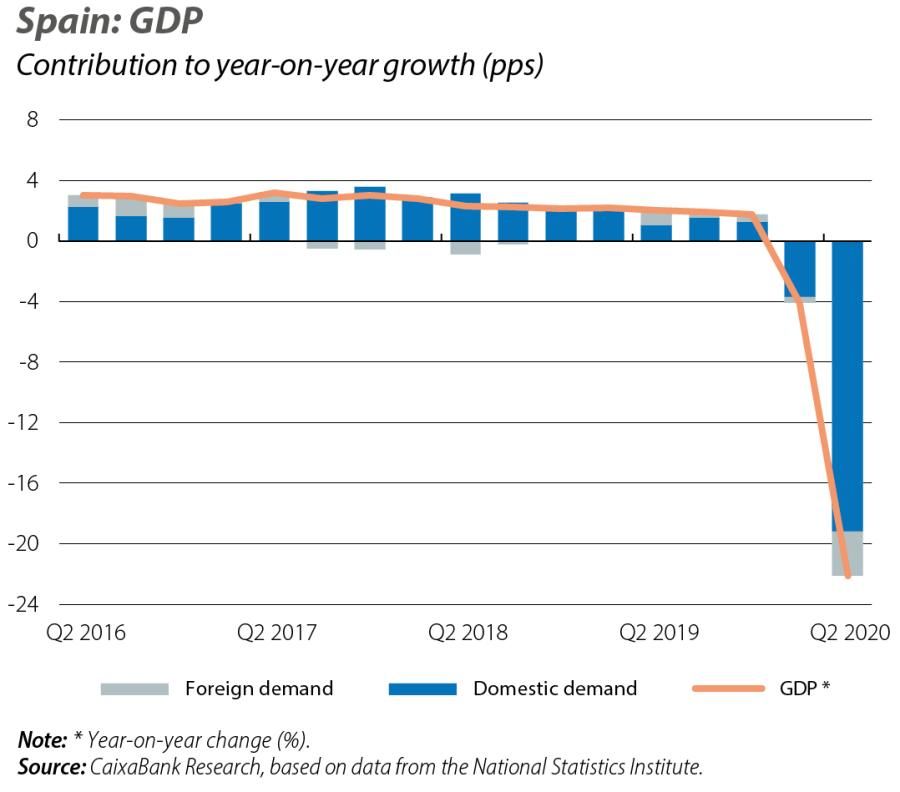

GDP fell by 18.5% quarter-on-quarter (22.1% year-on-year), the biggest drop since 1995 (the second biggest was in the previous quarter, of 5.2% quarter-on-quarter) due to the strict lockdown measures in place during much of Q2 2020. In particular, the collapse in private consumption and investment, of 21.2% and 22.3% quarter-on-quarter, could not be offset by the rise in public consumption (0.4% quarter-on-quarter) and the contribution of domestic demand to growth was as low as –19.2 pps. In addition, exports fell by more than imports (33.5% and 28.8% quarter-on-quarter, respectively), resulting in the contribution of external demand to growth dropping to a negative balance of 2.9 pps. The sharp decline in exports was led by the fall in service exports, amounting to 55.4% quarter-on-quarter, largely driven by the severe crisis that the tourism sector is facing.

In recent weeks, there has been an increase in the number of confirmed COVID-19 cases in Spain (around 10,000 cases at the end of August). Despite this increase, most cases are asymptomatic and less severe, so hospital capacity is far from suffering the stress endured in the spring, and the number of deaths remains low and well below those of March and April. To the extent that the new outbreaks of the virus remain localised and are dealt with using limited measures, the economy should experience a notable rebound in growth in Q3 2020 thanks to the lifting of restrictions on activity. That said, the recovery will remain incomplete as long as there is no vaccine, and given the scale of the declines it may take years for the pre-crisis levels of activity to be recovered.

In July, the manufacturing PMI index rose to 53.5 points (49.0 in June), placing it in expansionary territory (above the 50-point threshold). The counterpart indicator for the services sector also remained in expansionary territory (51.9 points) slightly above the figure for the previous month (50.2 points). The retail trade index, meanwhile, rose in July by a moderate 1.1% compared to June. In year-on-year terms, the retail trade index was still in negative territory (–9.9% versus July 2019), although it has at least left the double-digit declines of recent months behind. Based on data for August, the total amount of card spending on CaixaBank POS terminals and cash withdrawals shows a 6.8% year-on-year decline during the first three weeks of the month, a 5.3-pp improvement over the figure for July. This improvement almost entirely reflects the recovery in domestic spending, which increased by 3.9% year-on-year (+8.2 pps). In contrast, spending by foreign visitors registered a 58.8% year-on-year fall in the first three weeks of August, a very similar figure to that of July (see our tracker at www.caixabankresearch.com for real-time monitoring).

According to data from the LFS, employment fell by 1.07 million people in Q2 2020. The number of actual working hours, meanwhile, decreased by 22.6% quarter-on-quarter, much greater than the drop in employment and more in line with the fall in GDP. Furthermore, due to the lockdown 16.3% of people in employment worked from home in Q2 2020, a far higher percentage than in 2019 (4.8%). The increase in the number of unemployed people was much more contained (+55,000 in Q2 2020), since the vast majority of individuals who were without work but willing to work became classified as inactive, as they were unable to actively seek employment. Thus, the unemployment rate stood at 15.3% in Q2 2020 (+0.9 pps compared to Q1 2020). The developments in the labour market in Q3 paint a somewhat more positive picture with a partial recovery, particularly in sectors such as retail, catering and hospitality. Social Security data show that in July the average number of affiliated people increased by 161,000 to 18.8 million, while registered unemployment fell by 90.000 people to 3.8 million. Despite this improvement, both levels are worse than those recorded in July 2019 (–3.8% and +25%, respectively). In addition, the number of people receiving benefits under ERTE furlough schemes decreased significantly during July and August. As of mid-August, there were some 850,000 people receiving benefits under such schemes, around one million less than at the end of June and well below the peak in April (3.4 million).

The current account balance stood at 18 billion in May 2020, a sharp decline compared to the level of May 2019. By component, the fall in energy prices helped to boost the energy balance up by 6.1 billion euros compared to May 2019. The rest of the sub-balances showed slight progress, but neither these nor the improvement in the energy balance were sufficient to offset the deterioration in tourism. The fall in tourism reduced the tourism services surplus by 11.9 billion in May, and this was the main factor behind the deterioration of the current account balance, even before the summer season. Moreover, the drastic reduction in foreign tourism in summer will exacerbate the deterioration of the tourism balance and will continue to erode the total current account balance.

The unprecedented state action to help people, workers and businesses during this pandemic is having an impact on the public accounts. State expenditure already increased by +23.7% year-on-year on a cumulative basis between January and June, while revenues reduced by 14.4% year-on-year (cumulative amount up to June) due to the reduction in economic activity. As a result, the government deficit stood at 4.4% of GDP in January-June, 3.6 pps higher than in June 2019. This deterioration is expected to continue and, for the year as a whole, the deficit is expected to reach around 13.5% of GDP. In any case, the EU programmes (it has been confirmed that Spain will receive 21.3 billion euros this year) will help to cover the financing needs, and the cost of debt remains low, aided by the ECB’s accommodative monetary policy.