The Spanish economy remains steadfast in the face of the onslaught from the new wave of infections

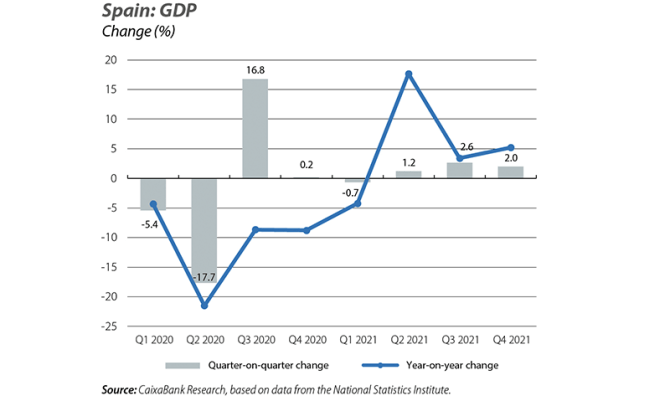

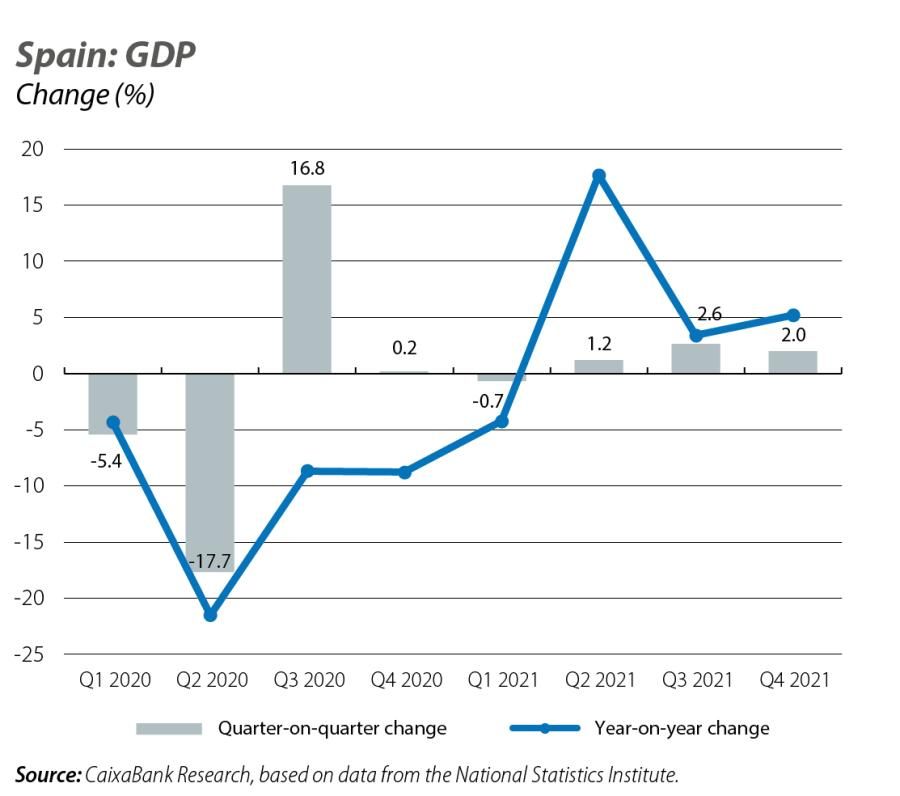

Economic activity grew by 2.0% quarter-on-quarter in Q4 2021, down from the previous quarter (2.6%), but above CaixaBank Research’s forecast (1.4%). In year-on-year terms the growth stood at 5.2%, placing GDP 4.0% below the pre-pandemic level (Q4 2019). By component of demand, the strong quarterly increase is explained by the growth in investment and exports. Specifically, investment grew by 4.9% quarter-on-quarter, driven mostly by investment in equipment. The change in inventories also made a significant positive contribution, potentially reflecting companies’ preference to accumulate inventories as a way to deal with the supply chain difficulties. Exports, meanwhile, grew by a significant 6.5%, thanks to the very strong performance of services (33%). This places them just 5.1% below the level of Q4 2019, compared to 42.8% just two quarters ago. The recovery of the tourism sector is no doubt closely linked to the good performance of this component. In contrast, private consumption disappointed, registering a drop of 1.2% on a quarter-on-quarter basis, weighed down by the epidemiological context and high inflation. The strength of the GDP figure for Q4 2021 is likely to lead us to revise up our 2022 GDP growth forecast, which currently stands at 5.5%.

The number of infections in Spain moderated slightly during the last week, although it still remains very high, at 3,195 infections per 100,000 inhabitants in 14 days (at this rate, every 14 days 3.2% of the population gets infected). Despite the high infection rate, and thanks to the extensive reach of the vaccines among the population (91% of the population over 5 years of age has received a full dose and 81% of the population over 50 has received a booster dose), the pressure on hospitals remains below that of previous waves. For instance, the number of COVID patients in ICU beds this January was 28% and 51% below the November 2020 and February 2021 figures, respectively. The stabilisation of the infection rate, the contained levels of pressure on the health system and the progress in the booster dose campaign suggest that it will be possible to overcome the sixth wave without having to resort to sweeping restrictive measures. Thus, while it will certainly have some effect on economic activity – whether through heightened uncertainty, limitations on international mobility flows or higher levels of absenteeism due to sick leave – the impact will be moderate. Furthermore, it should not lead to a decline in GDP in Q1 of the year, and the revival of the economic recovery process should be rapid as soon as the epidemiological situation shows clear signs of improvement.

In particular, the manufacturing PMI for January remained at 56.2 points, the same figure as the prior month and well above the no-change threshold (50 points). The CaixaBank consumption indicator, meanwhile, showed year-on-year growth of around 13% during the first three weeks of January, exceeding the year-on-year change of December 2021 (9.5%). Finally, social security affiliation increased in January in seasonally adjusted terms by 71,948 people.

According to the LFS, employment ended 2021 with an increase of 841,000 people, the number of unemployed people fell by 616,000 and the unemployment rate dropped to 13.3% from the 16.1% at the end of 2020. This intense recovery has allowed the labour market to exceed the pre-pandemic figures: there are now 218,000 more people in work and 88,000 fewer unemployed than in Q4 2019. Focusing on the data for Q4 2021, the results were positive, although they confirm a slight deceleration. In seasonally adjusted terms, the quarterly growth in employment moderated to 1.2% from 1.3% in Q3 2021, and the number of hours worked rose at a year-on-year rate of 2.5%, compared to 5.1% in the previous quarter. This poor result in the number of hours worked is partly due to the increase in the number of employed people who did not work in the week in question, being 2.6% higher than the previous year.

Headline inflation stood at 6.0% in January (6.5% in December), according to the National Statistics Institute’s flash indicator. This marks a slowdown in the rising trend of recent months, although it remains at historically high levels. This moderation is due to the base effect of the electricity price rally of January 2021. Inflation is expected to pick up again in February, as this effect is undone. Core inflation, meanwhile, continued to climb and reached 2.4% (2.1% in December). This rise suggests that the high inflation is spreading to the other components of the consumer price index. As an example, the inflation data split by CPI component for the month of December – the latest available at this level of detail – show that inflation is above 2% in 55% of the components that make up the index, and above 5% in 23% of them. In September, these percentages were 30% and 12%, respectively (see the Focus on «The second-round effects of the inflationary shock» in this same Monthly Report).

For the year to date to November, the current account balance showed a surplus of 9,735 million euros. This is 16.9% more than in the same period of 2020, but still a far cry from the figures for 2019 (24,425 million). The improvement in the current account balance is mainly explained by the surplus in the tourism balance, which rose by 114% year-on-year to 18,173 million, although it remained well below the figure for 2019 (44,524 million). In contrast, the trade deficit increased by 68.7% year-on-year to 20,836 million. The increase in the deficit is due to a sharp deterioration in the energy deficit of 59% year-on-year, bringing it to 24,441 million. This reflects the increase in the prices of oil and gas, which has been slightly offset by a small improvement in the surplus of the non-energy component (18.9% year-on-year, bringing it to 3,575 million).