The Spanish economy, off to a good start to the year

The reading that emerges from the behaviour of the economic indicators suggests that the Spanish economy is gaining strength in these first few months of the year. Employment, consumption, activity in industry and services, as well as the foreign sector are all showing encouraging figures. There is just one big but: inflation, which in February continued to reflect major price tensions. Despite this, the conclusion of the analysis of the current situation is that the Spanish economy continues to withstand the challenging economic environment better than expected.

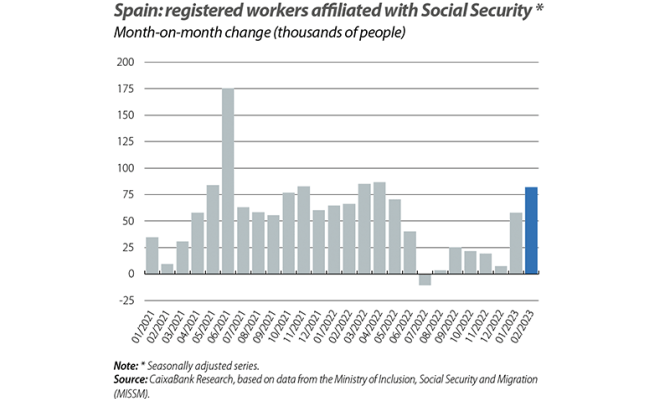

Employment once again provides a positive surprise

The February data for Social Security affiliation show that the labour market has got off to a strong start to the year. The average number of registered workers increased in February by 88,918 people, which is higher than a typical month of February (+71,000 on average in the period 2014-2019). Indeed, this is the best result in a month of February in eight years. After correcting for seasonality, the monthly growth stands at 81,808 people, the biggest increase since April last year. On the other hand, we continue to see the effects of the labour reform on the temporary employment rate, which fell to 14.2% (27.2% in December 2021).

The economic activity indicators kick off the year on a good footing

The manufacturing PMI returned to expansionary territory in February, rising above 50 points for the first time since June 2022 and reaching 50.7 points (48.4 in January). Furthermore, the counterpart indicator for the services sector advanced 4 points, to 56.7 points, placing it firmly within the expansionary zone. On the consumer side, CaixaBank Research’s consumption tracker shows that activity registered with Spanish bank cards moderated its pace of growth in February, with a year-on-year growth rate of 7% compared to 10% in January, although this is still above the rate registered in Q4 2022 (6%).

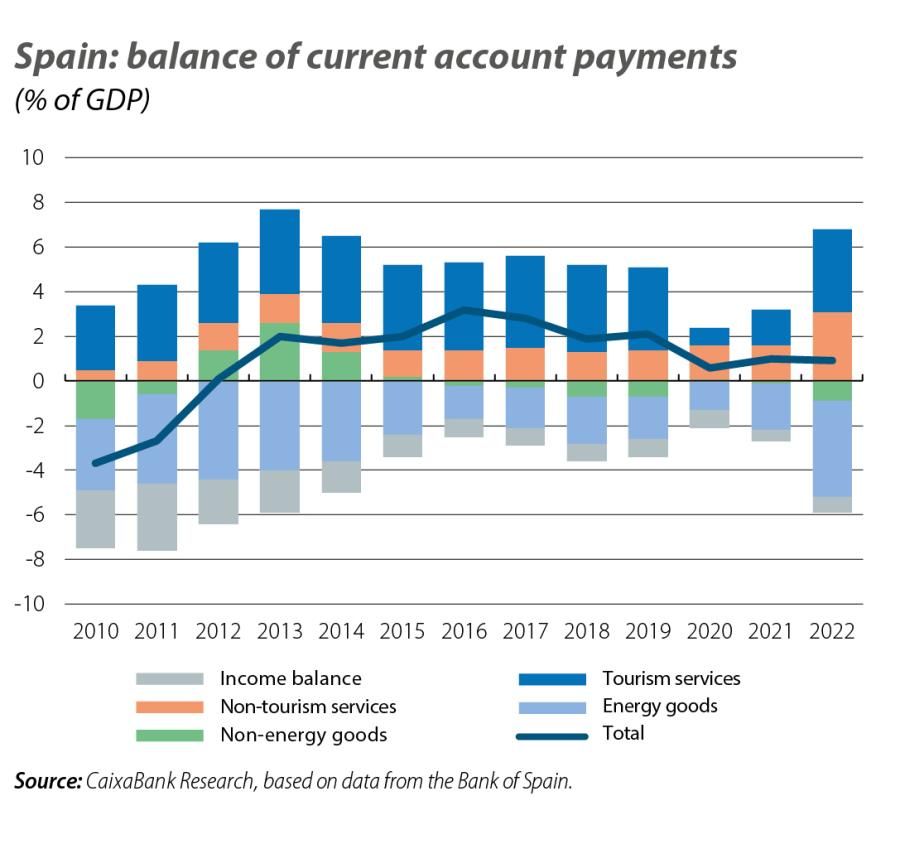

The foreign sector continues to bring good news

The current account balance ended 2022 with a surplus of 0.9% of GDP, just 1 percentage point below the level of 2021. This impressive figure was achieved despite the trade deficit of energy goods standing at 4.3%, 2.2 pps more than in 2021, weighed down by the sharp rise in gas and crude oil prices during the course of the year. The trade balance of non-energy goods, meanwhile, also closed the year with a deficit (–0.9%), although in the closing months of the year it registered a surplus thanks to the recovery in exports in real terms and the containment of imports. On the services side, the balance of non-tourism services reached a surplus of 3.1% of GDP (1.6% in 2021), the highest in the historical series. Finally, the balance of tourism services registered a surplus of 3.7% of GDP, thus recovering the levels of 2019. This figure was reached thanks to the lower spending of Spaniards abroad (1.4% of GDP in 2022 vs. 2.0% in 2019), which offset the fact that the income generated by international tourists in Spain was still below pre-COVID levels (5.3% of GDP in 2022 vs. 5.7% in 2019).

However, the latest data on international tourist arrivals confirm that tourism activity improved over the course of last year and that the start of 2023 is looking highly buoyant. The number of international tourists visiting Spain reached 4.1 million in January, which is just 1.2% below the figure for January 2019 and represents a year-on-year increase of 66.8%. By country of origin, tourists from the EU stand out, registering an all-time high for a month of January with 2.7 million tourist arrivals, 9.1% more than in January 2019. Also, the number of arrivals of American tourists has been very high, reaching 6.0% above the figure for January 2019. In contrast, British tourism remains relatively weak, with 8.1% fewer arrivals than in the same month of 2019.

The inflation rally continued in February

According to the CPI flash indicator, headline inflation rose in February for the second consecutive month, standing at 6.1%, 2 percentage points above the previous month. On the other hand, core inflation (which excludes energy and unprocessed food) rose once again, reaching 7.7%, also 2 percentage points above the figure for the month of January. That said, the monthly change reflected a significant growth rate for a month of February (+0.7% in February 2023 vs. 0.0% on average in the same month during the period 2017-2019), signalling that price tensions remain considerably high. In the absence of the breakdown by component, the National Statistics Institute noted that the main drivers of inflation were the increase in electricity prices, although they most likely continued to register a significant drop in year-on-year terms (–40.8% in January), and a new rise in food and beverage prices (+14.6% in January); while the moderation in the price of fuels helped to contain the advance of the CPI.

Home prices closed 2022 up, although their growth rate continues to moderate

The price of housing grew by 0.5% quarter-on-quarter in the final quarter of last year, thus overcoming the stagnation of Q3 (+0.0%). With this figure, the year-on-year rate stood at 3.3% at the year end, albeit with a declining trend over the course of the year (in Q1 it stood at 6.7%). In terms of housing demand, the signs of cooling are increasingly evident. In December, the first year-on-year decrease in the number of sales was recorded, according to the National Statistics Institute (–10.2%). Nevertheless, in 2022 as a whole there were some 650,000 sales (+14.7%), the highest figure since 2007. Thus, last year was one of significant growth in activity in the real estate market, but in recent months it has begun to show signs of slowing down.